Vermont Owner Financing Contract for Land

Description

How to fill out Owner Financing Contract For Land?

Have you ever found yourself in a scenario where you require documents for both business or personal purposes nearly every day.

There are numerous legitimate document templates available online, but locating ones you can trust is challenging.

US Legal Forms offers a vast array of form templates, such as the Vermont Owner Financing Contract for Land, designed to comply with federal and state regulations.

Select a convenient document format and download your copy.

Access all the document templates you have purchased in the My documents section. You can obtain another version of the Vermont Owner Financing Contract for Land at any time if needed. Simply click the desired form to download or print the document template.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- After that, you can download the Vermont Owner Financing Contract for Land template.

- If you do not have an account and wish to start using US Legal Forms, follow these instructions.

- 1. Find the form you need and confirm it is for the correct city/county.

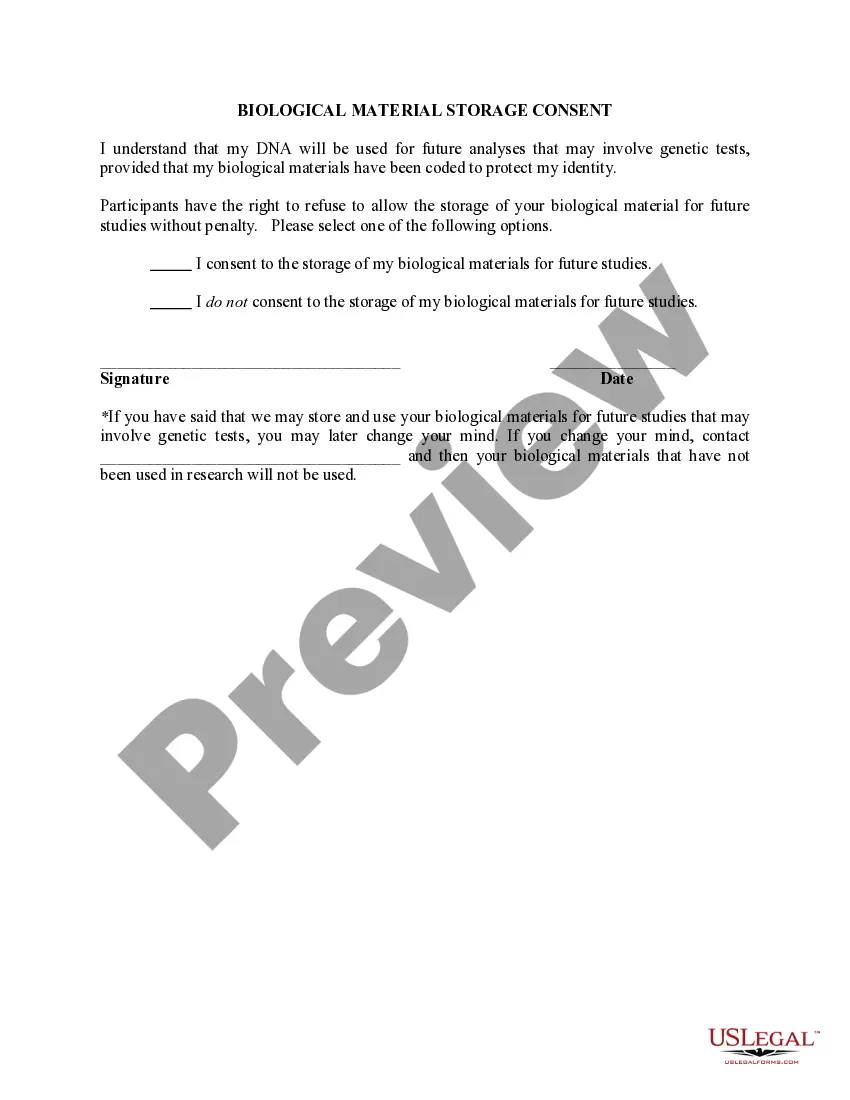

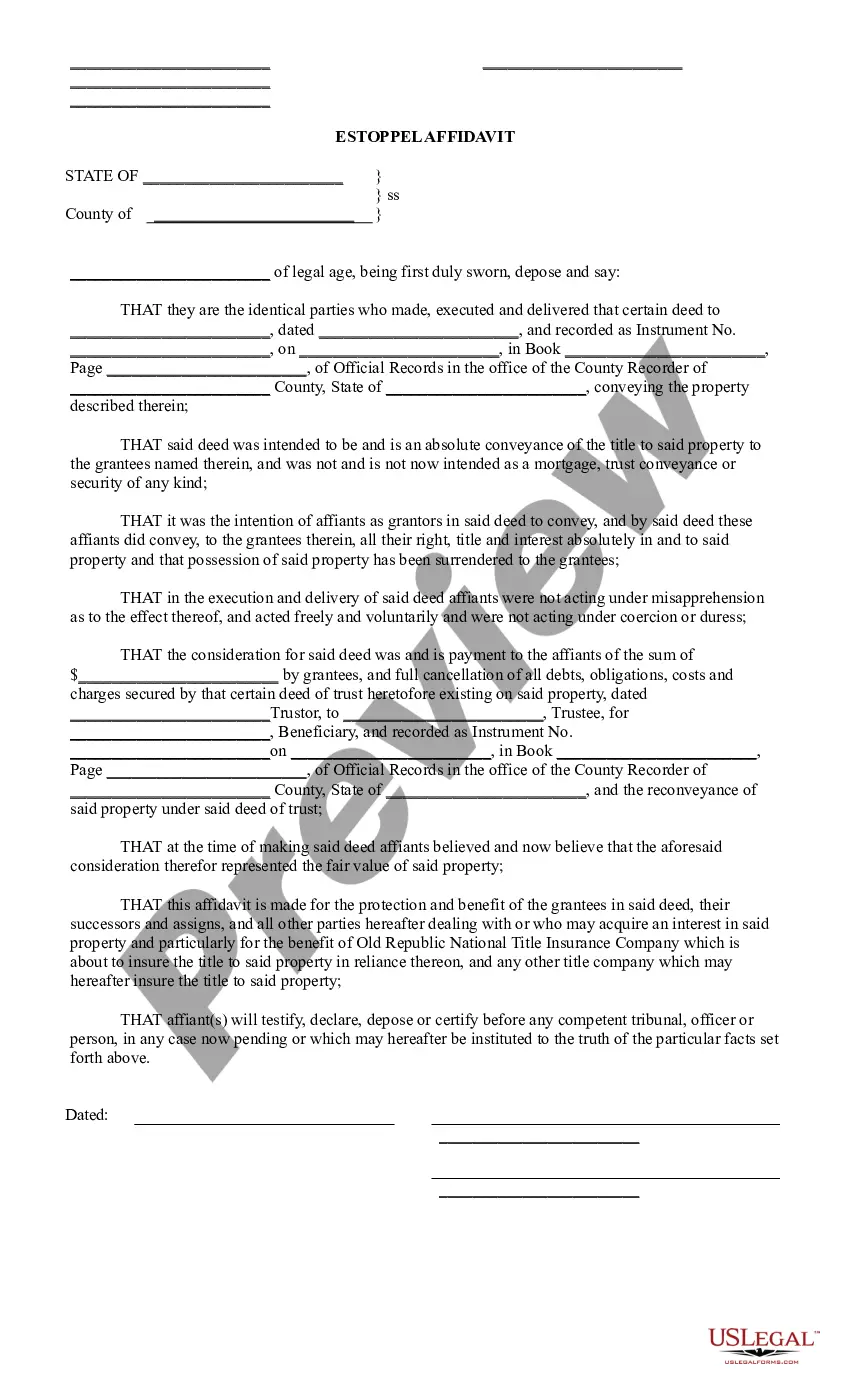

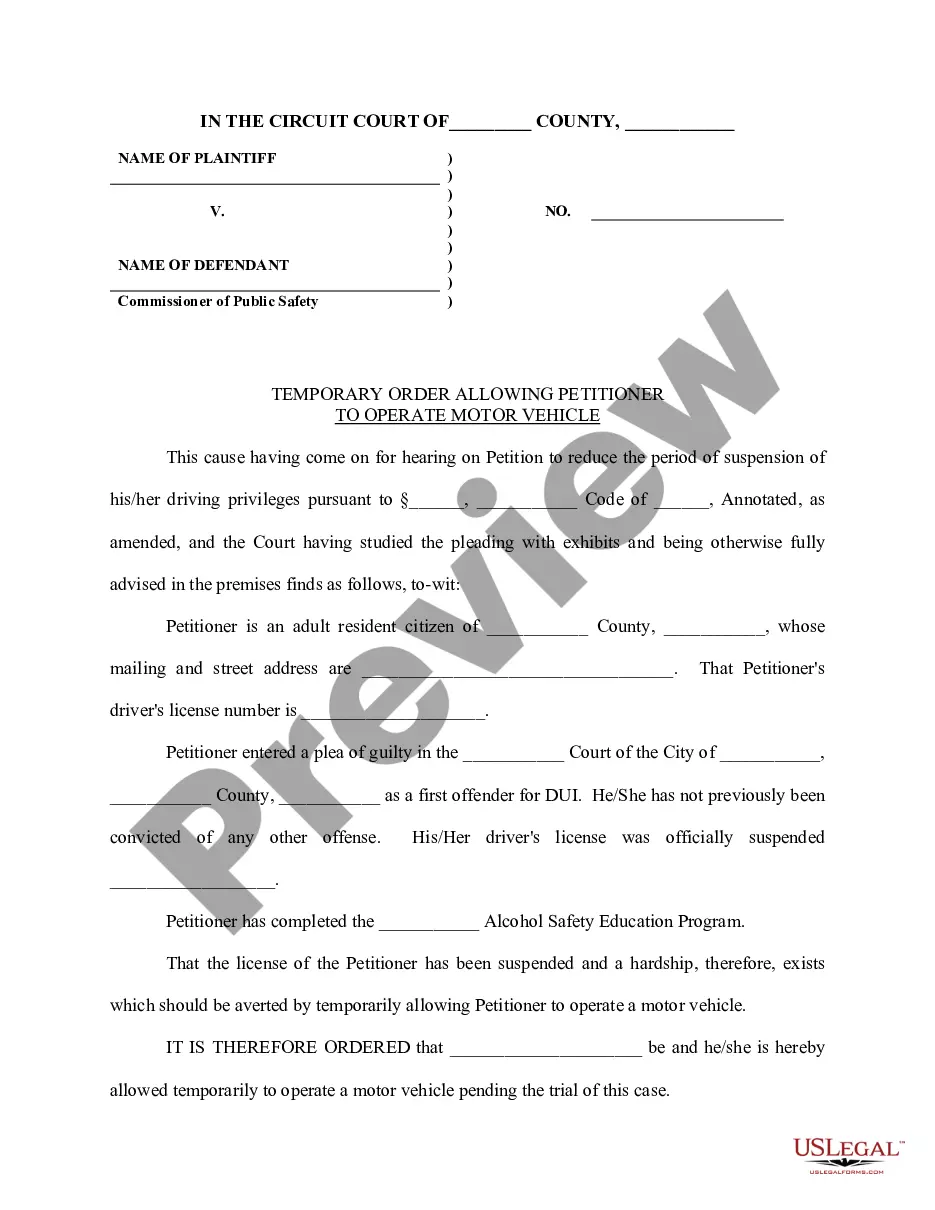

- 2. Use the Review button to evaluate the form.

- 3. Read the description to ensure you have selected the correct document.

- 4. If the form is not what you're looking for, use the Search field to find the template that meets your criteria.

- 5. Once you find the appropriate form, click on Purchase now.

- 6. Choose the payment plan you want, fill in the necessary information to create your account, and pay for the transaction using your PayPal or credit card.

Form popularity

FAQ

To obtain owner financing on land, begin by identifying sellers who are willing to offer financing options. Engage in discussions about their terms and ensure you clearly understand the payment structure. Utilizing a Vermont Owner Financing Contract for Land can help formalize the agreement, providing protection for both the buyer and seller.

Owner financing is often referred to as seller financing. This arrangement allows the seller to provide financing directly to the buyer, making the process more flexible. You can create a Vermont Owner Financing Contract for Land that outlines the terms and conditions clearly, benefiting both parties involved.

Another common term for a land contract is a 'contract for deed.' This label reflects the agreement between buyer and seller, where the buyer makes payments during a set period before obtaining the deed. In Vermont, a Vermont Owner Financing Contract for Land often serves a similar purpose, streamlining the transfer of ownership.

To secure financing for land, start by researching lenders who specialize in land purchases or owner financing options. You can compare rates and terms to find the best option for your needs. A Vermont Owner Financing Contract for Land could simplify the process by bypassing traditional loans, allowing you to negotiate terms directly with the seller.

A land contract is a specific type of agreement where the buyer pays the seller in installments until they fully own the property. Owner financing, on the other hand, involves any financing terms set between a buyer and seller directly, which could include various payment methods. Both terms often describe similar arrangements, particularly in the context of a Vermont Owner Financing Contract for Land.

Owner financing can indeed be a great idea for purchasing land, especially if you are looking for flexible payment arrangements. This method allows you to bypass traditional lending restrictions, making land acquisition more approachable. With a well-structured Vermont Owner Financing Contract for Land, both parties can safeguard their interests and enjoy a smooth transaction.

The average down payment for owner financing can vary widely. Typically, it ranges from 10% to 30% depending on the terms negotiated between the buyer and seller. In many instances, a Vermont Owner Financing Contract for Land will detail these financial expectations, allowing for clarity and mutual agreement.

While owner financing offers several advantages, it also comes with potential downsides. For instance, sellers assume the risk if the buyer defaults on the payments. Moreover, without the proper legal documentation, such as a Vermont Owner Financing Contract for Land, both parties could face complications down the line.

Owner financing can be a smart choice for many buyers, particularly in Vermont. It allows buyers to negotiate terms directly with the seller, which can lead to better payment plans. Additionally, if you have less-than-perfect credit, a Vermont Owner Financing Contract for Land may present a more accessible option compared to traditional bank loans.

Owner financing can be set up by the seller of the property, who offers financing directly to the buyer. In the case of a Vermont Owner Financing Contract for Land, the seller typically outlines the terms and works with the buyer to finalize the contract. For a smoother experience, sellers can use platforms like uslegalforms to easily draft and execute the necessary agreements.