Vermont Owner Financing Contract for Vehicle

Description

How to fill out Owner Financing Contract For Vehicle?

If you intend to compile, acquire, or produce official document templates, utilize US Legal Forms, the most extensive collection of legal forms available online.

Take advantage of the website's user-friendly and convenient search function to obtain the documentation you require.

A range of templates for business and personal use are organized by categories and jurisdictions, or keywords.

Step 4. Once you have found the form you need, click the Buy now button. Select the payment plan you prefer and enter your information to register for an account.

Step 5. Complete the transaction. You can use your credit card or PayPal account to finalize the purchase.

- Utilize US Legal Forms to access the Vermont Owner Financing Agreement for Vehicle in just a few clicks.

- If you are currently a US Legal Forms customer, sign in to your account and click the Download button to locate the Vermont Owner Financing Agreement for Vehicle.

- You may also retrieve documents you have previously purchased in the My documents section of your account.

- If this is your first time using US Legal Forms, follow the instructions below.

- Step 1. Ensure you have chosen the form for the correct city/state.

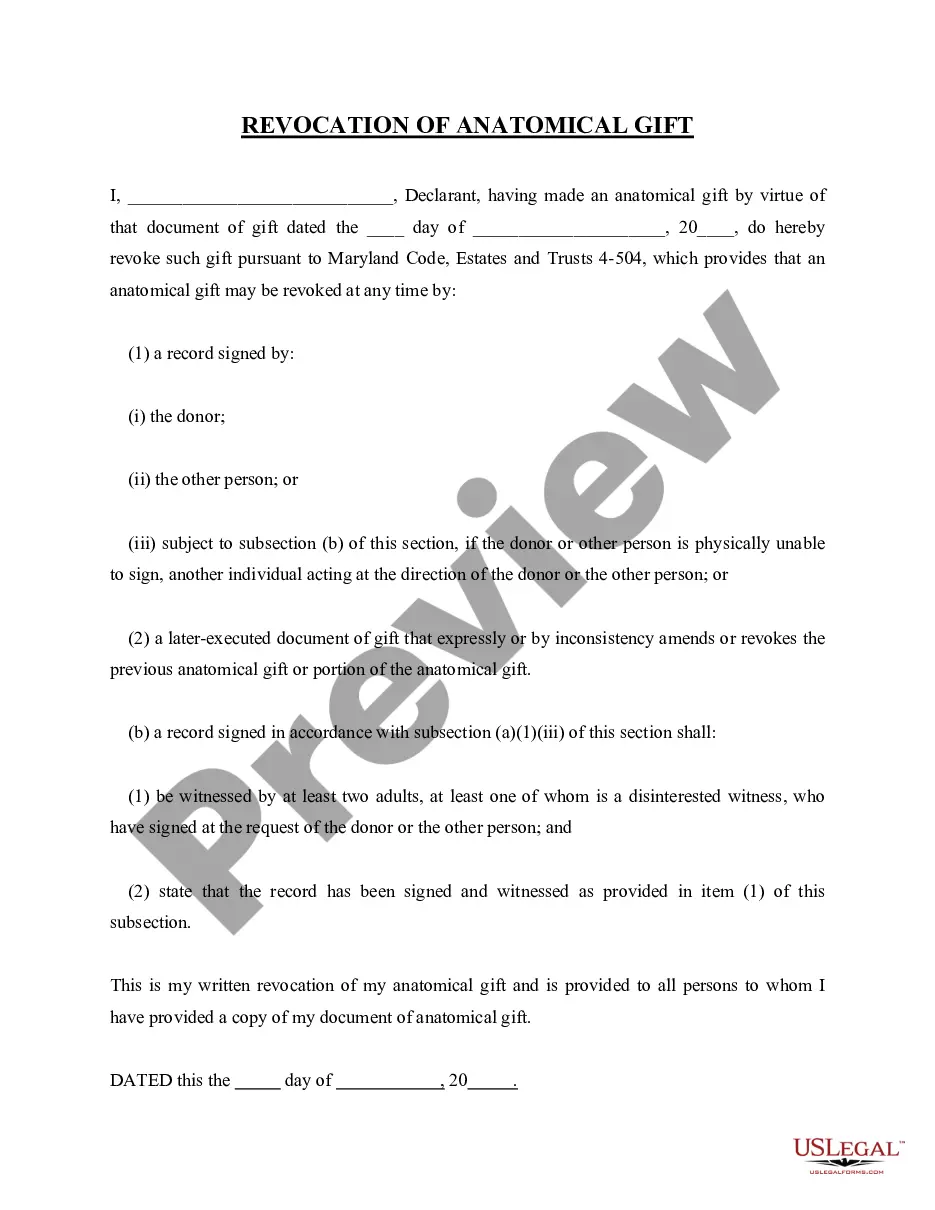

- Step 2. Use the Preview option to review the form's details. Don’t forget to read the description.

- Step 3. If you are unhappy with the form, use the Search box at the top of the screen to find other versions of the legal form template.

Form popularity

FAQ

An owner finance agreement for vehicles is a legal contract between a seller and a buyer, allowing the buyer to make payments directly to the seller. This agreement outlines the sale terms, including payment amounts, schedule, and any interest applicable. By utilizing a Vermont Owner Financing Contract for Vehicle, buyers can often bypass traditional financing institutions, benefiting from more flexible payment options. It's important to ensure that the agreement complies with state laws to protect both parties involved.

In Texas, it is generally required for both the buyer and the seller to be present when transferring a title. However, if one party cannot attend, they can provide a power of attorney to authorize someone else to act on their behalf. This process simplifies the transaction and ensures that the title transfer occurs legally. If you are considering an owner financing agreement for vehicles, understanding title transfer rules in your state is crucial.

An owner finance contract is a formal document that outlines the terms and conditions of a financing agreement between a buyer and seller. This contract specifies payment schedules, interest rates, and consequences for default. Using a Vermont Owner Financing Contract for Vehicle ensures that both parties are protected and agree on their responsibilities.

Owner financing on a vehicle works by allowing the buyer to make installment payments directly to the seller. The seller then retains the title to the vehicle until the buyer completes all payments. This approach offers flexibility in financing and may be beneficial for those who struggle to secure traditional loans, highlighted by utilizing a Vermont Owner Financing Contract for Vehicle.

In an owner financing arrangement, the seller typically retains the title until the buyer fulfills all payment obligations outlined in the Vermont Owner Financing Contract for Vehicle. This arrangement protects the seller's interest, ensuring that the vehicle cannot be sold to another party until payment is complete. Clear communication about title transfer is essential for both parties.

An owner financing contract for a vehicle is a legal agreement between the seller and buyer that allows the buyer to make payments directly to the seller instead of a financial institution. This agreement typically includes terms on payment amount, duration, and interest rate. Understanding this contract is crucial to ensure a clear ownership transfer through a Vermont Owner Financing Contract for Vehicle.

One downside of owner financing is that it often comes with higher interest rates compared to traditional loans. Additionally, the buyer may face stricter payment terms, which can lead to financial strain. It's important to approach a Vermont Owner Financing Contract for Vehicle with caution and ensure you understand all obligations.

To privately sell a car in Vermont, start by preparing the vehicle for sale and gathering necessary documents like the title and maintenance records. You should advertise your car online or in local classifieds, ensuring to highlight its best features. When you find a buyer, consider using a Vermont Owner Financing Contract for Vehicle to facilitate payments if you choose to finance the sale.

An owner finance contract for a car is an agreement that allows the buyer to make payments directly to the seller, rather than through a bank or financial institution. This type of contract usually includes terms for the payment amount, due dates, and consequences for late payments. By using a Vermont Owner Financing Contract for Vehicle, both parties can ensure the deal is legally binding and clearly outline each person's obligations.

To write a payment agreement for a car, include the buyer's and seller's names, vehicle details, payment amounts, payment schedule, and any penalties for late payments. This document should be clear about the conditions under which the vehicle may be repossessed if payments are missed. Utilizing a Vermont Owner Financing Contract for Vehicle ensures that both parties understand their rights and responsibilities.