Vermont Assignment of Life Insurance Proceeds to a Funeral Director for the Purpose of Arranging a Funeral is an important legal document that allows individuals to assign their life insurance benefits directly to a funeral director in order to cover the costs associated with a funeral. This legal instrument can help ensure that funeral expenses are promptly paid without placing a financial burden on the deceased's loved ones. The process of assigning life insurance proceeds to a funeral director in Vermont involves a series of steps. First, it is crucial to understand that there are typically two types of assignments: revocable and irrevocable assignments. 1. Revocable Assignment: A revocable assignment grants the policyholder the ability to modify or cancel the assignment at their discretion. It allows the policyholder to maintain control over the remaining life insurance proceeds after the funeral expenses have been covered. Therefore, any excess funds can be provided to the designated beneficiaries or used for other purposes. 2. Irrevocable Assignment: An irrevocable assignment, on the other hand, does not allow for any changes or alterations to be made after making the assignment. Once the assignment is completed, the entire life insurance benefit is transferred to the funeral director. This type of assignment provides certainty that the funeral expenses will be fully covered. To initiate the Vermont Assignment of Life Insurance Proceeds to a Funeral Director, the individual needs to obtain the necessary forms from their respective life insurance company and carefully complete them. The forms typically require information such as the policy details, funeral director's information, and the specific amount to be assigned. Once the forms are accurately filled out, they must be signed and notarized. It is essential to carefully review the assignment provisions and ensure they comply with Vermont state laws, insurance policies, and any contractual obligations. Seeking legal advice or the assistance of an estate planning professional may be beneficial during this process to ensure all aspects are handled correctly. After completing the assignment, the policyholder should provide copies to both the funeral director and the life insurance company. Additionally, any remaining beneficiaries named in the policy should be informed about the assignment. It is important to note that the assigned life insurance proceeds can only be utilized for funeral expenses, such as burial or cremation costs, service fees, casket or urn purchases, transportation, and other related services. If the funeral expenses exceed the assigned amount, the remaining balance is typically covered by the estate of the deceased, their loved ones, or through alternative financing options. In summary, the Vermont Assignment of Life Insurance Proceeds to a Funeral Director for the Purpose of Arranging a Funeral is a legal tool that can alleviate financial burdens associated with funerals. Whether choosing a revocable or irrevocable assignment, individuals can ensure their designated funeral director receives the necessary funds promptly. By understanding the different types of assignments and completing the required paperwork accurately, individuals can navigate this process smoothly and responsibly.

Vermont Assignment of Life Insurance Proceeds to a Funeral Director for the Purpose of Arranging a Funeral

Description

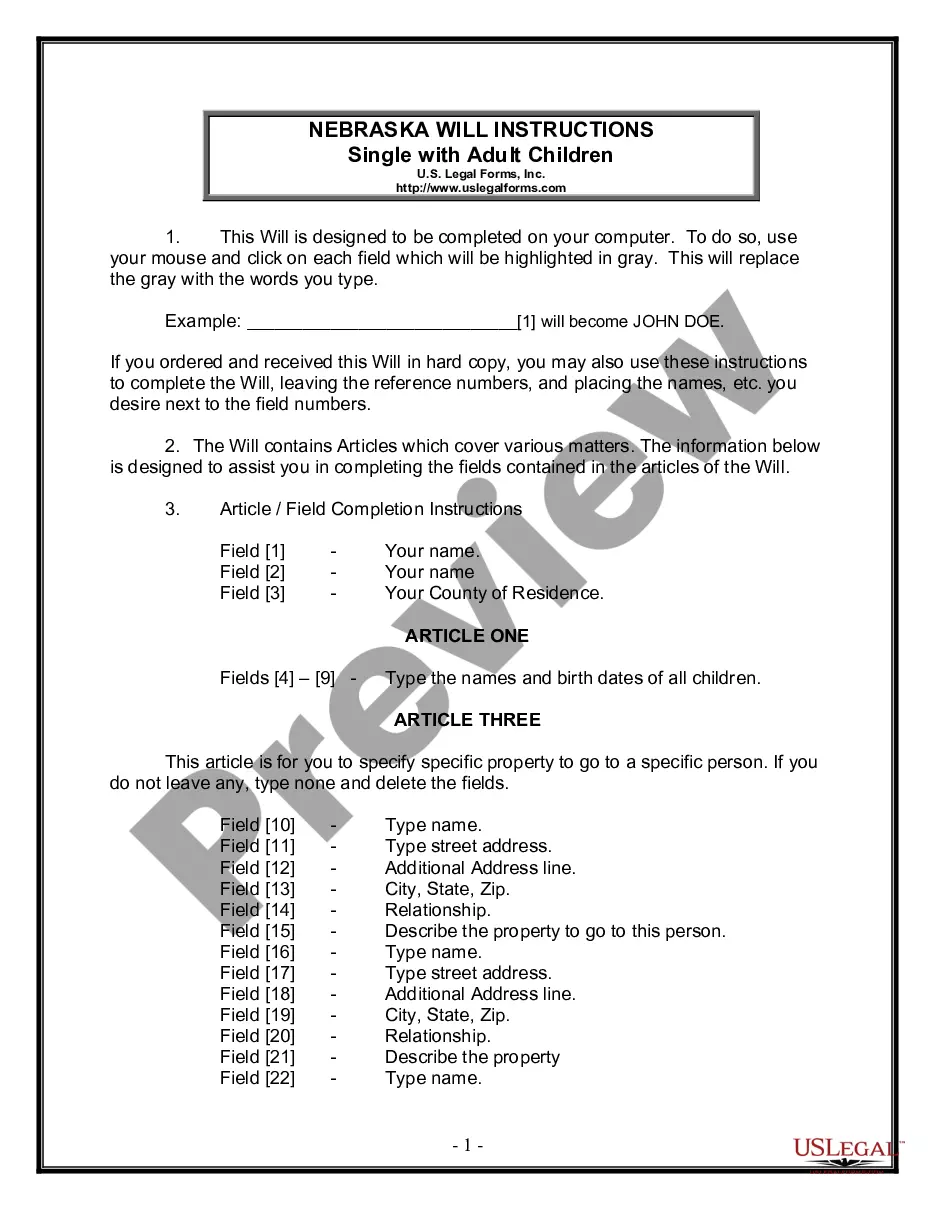

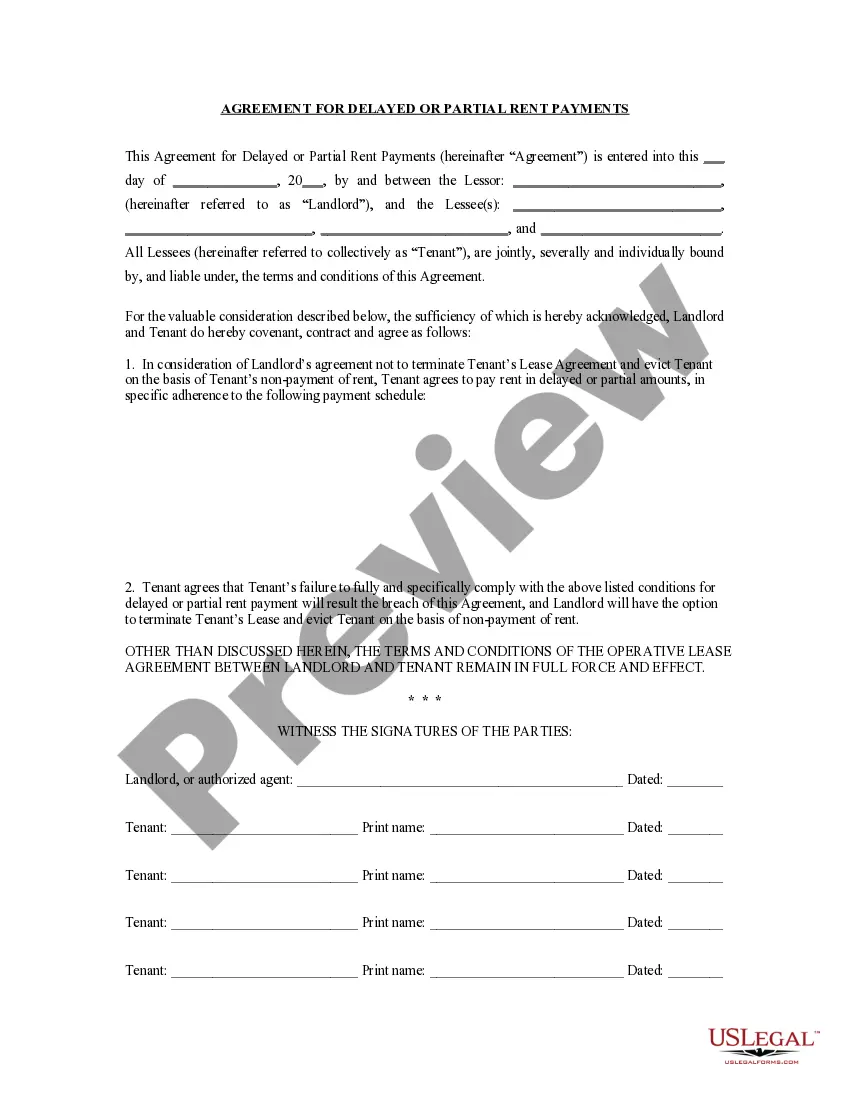

How to fill out Vermont Assignment Of Life Insurance Proceeds To A Funeral Director For The Purpose Of Arranging A Funeral?

If you need to complete, obtain, or produce authorized document themes, use US Legal Forms, the greatest variety of authorized types, which can be found online. Take advantage of the site`s simple and easy convenient lookup to obtain the files you require. Numerous themes for enterprise and specific uses are categorized by groups and claims, or keywords and phrases. Use US Legal Forms to obtain the Vermont Assignment of Life Insurance Proceeds to a Funeral Director for the Purpose of Arranging a Funeral within a handful of click throughs.

In case you are currently a US Legal Forms consumer, log in for your account and click on the Acquire switch to get the Vermont Assignment of Life Insurance Proceeds to a Funeral Director for the Purpose of Arranging a Funeral. You can also accessibility types you earlier saved from the My Forms tab of your account.

If you use US Legal Forms the first time, refer to the instructions below:

- Step 1. Be sure you have selected the form for that correct town/region.

- Step 2. Make use of the Preview solution to look through the form`s content. Do not overlook to read through the explanation.

- Step 3. In case you are unhappy with all the form, utilize the Research industry near the top of the display screen to find other types of your authorized form design.

- Step 4. When you have found the form you require, go through the Acquire now switch. Opt for the prices prepare you favor and include your references to register to have an account.

- Step 5. Process the purchase. You can use your credit card or PayPal account to complete the purchase.

- Step 6. Pick the structure of your authorized form and obtain it on the device.

- Step 7. Comprehensive, modify and produce or sign the Vermont Assignment of Life Insurance Proceeds to a Funeral Director for the Purpose of Arranging a Funeral.

Every single authorized document design you buy is your own forever. You might have acces to every single form you saved in your acccount. Select the My Forms section and choose a form to produce or obtain once again.

Be competitive and obtain, and produce the Vermont Assignment of Life Insurance Proceeds to a Funeral Director for the Purpose of Arranging a Funeral with US Legal Forms. There are thousands of specialist and state-specific types you can utilize for your enterprise or specific requires.

Form popularity

FAQ

Lump sum: The most common option is to receive the death benefit in one lump sum. You can either receive a check for the full amount or have the money wired into a bank account electronically.

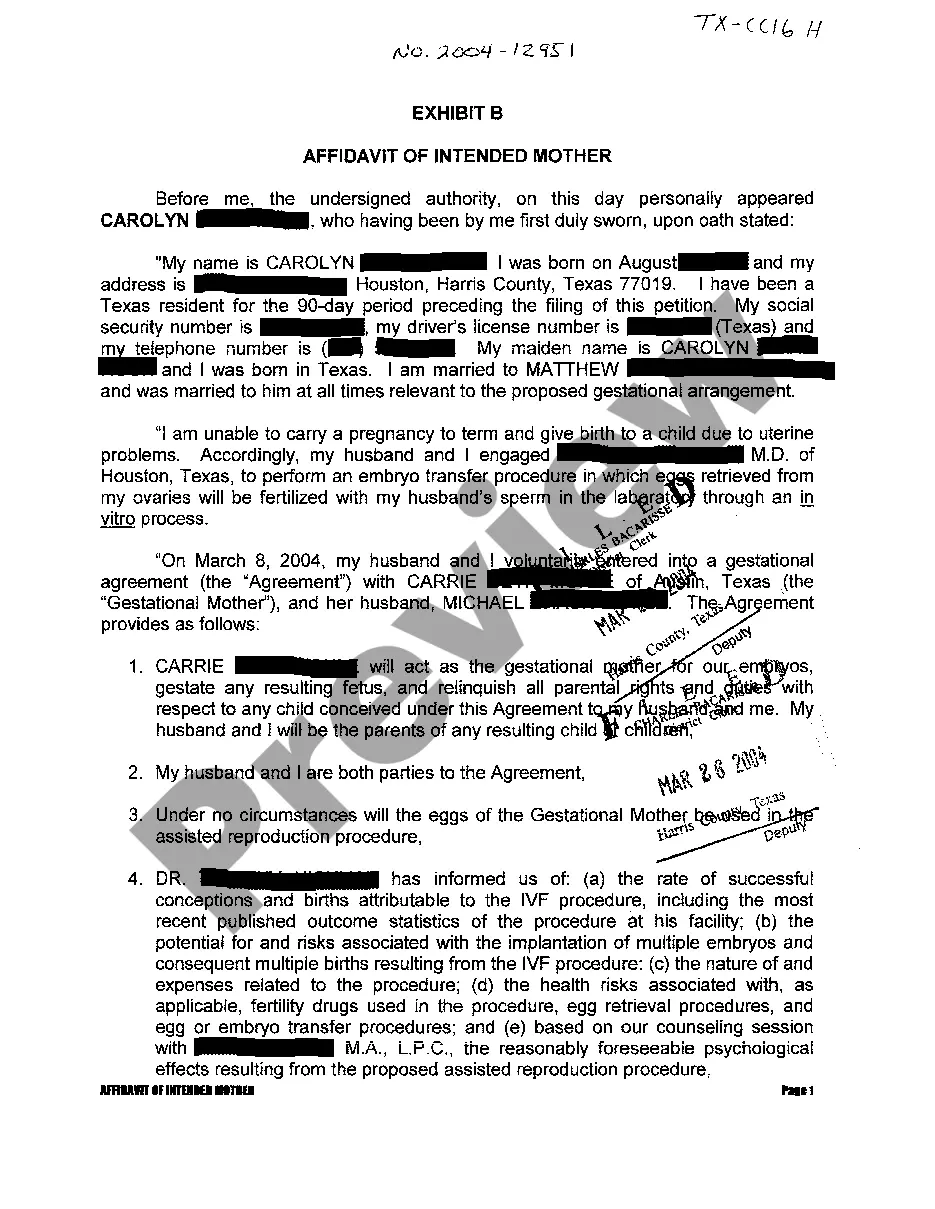

A Funeral Assignment is an agreement that is signed by a beneficiary of a life insurance policy. The beneficiary assigns all or a portion of the life insurance benefits at the Funeral Home which allows payment for funeral expenses to be made directly to the funeral home.

This type of insurance is designed specifically to cover funeral expenses when the insured person dies. The widow or partner of the policyholder can get a portion of the benefit upfront for the funeral expenses until the full benefit is processed. Funeral expenses are the costs of organizing and carrying out a funeral.

Next-of-Kin and Blood-Related Family Members Once that family member steps up and takes responsibility for both making and paying for the funeral arrangements, they sign a legal contract which obligates the funeral home to follow the instructions of that family member alone.

What is a death benefit beneficiary? In most cases, the beneficiaries of a death benefit from life insurance are your partner, children, or other close loved ones, though you can technically name any person or organization as a beneficiary.

How does collateral assignment of life insurance work? If you die before fully repaying your loan, collateral assignment will allow the lender, or "assignee," to be repaid for the outstanding loan amount using your death benefit.

Morticians and funeral arrangers (also known as funeral directors or, historically, undertakers) plan the details of a funeral. They often prepare obituaries and arrange for pallbearers and clergy services. If a burial is chosen, they schedule the opening and closing of a grave with a representative of the cemetery.

A funeral director is a person whose job is to arrange funerals.