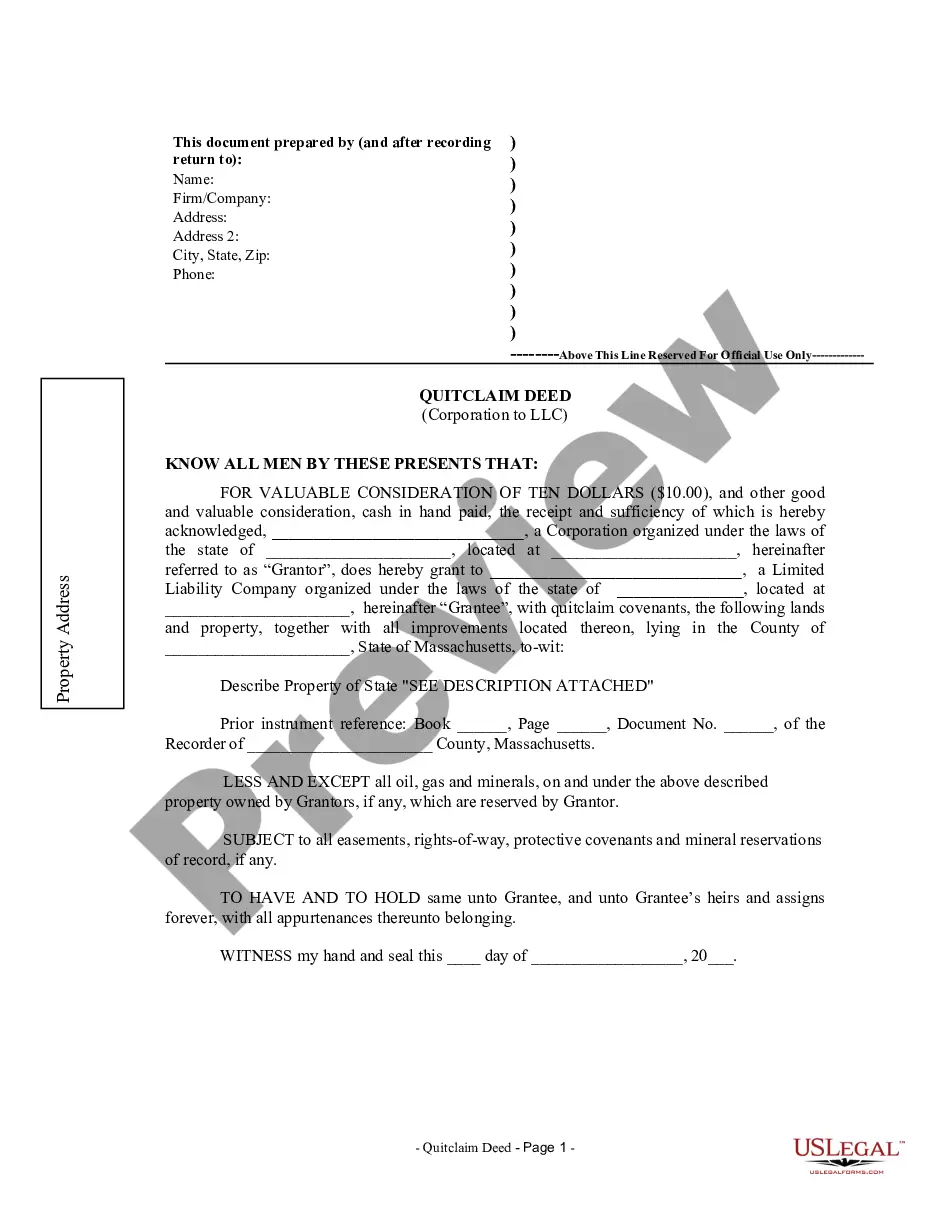

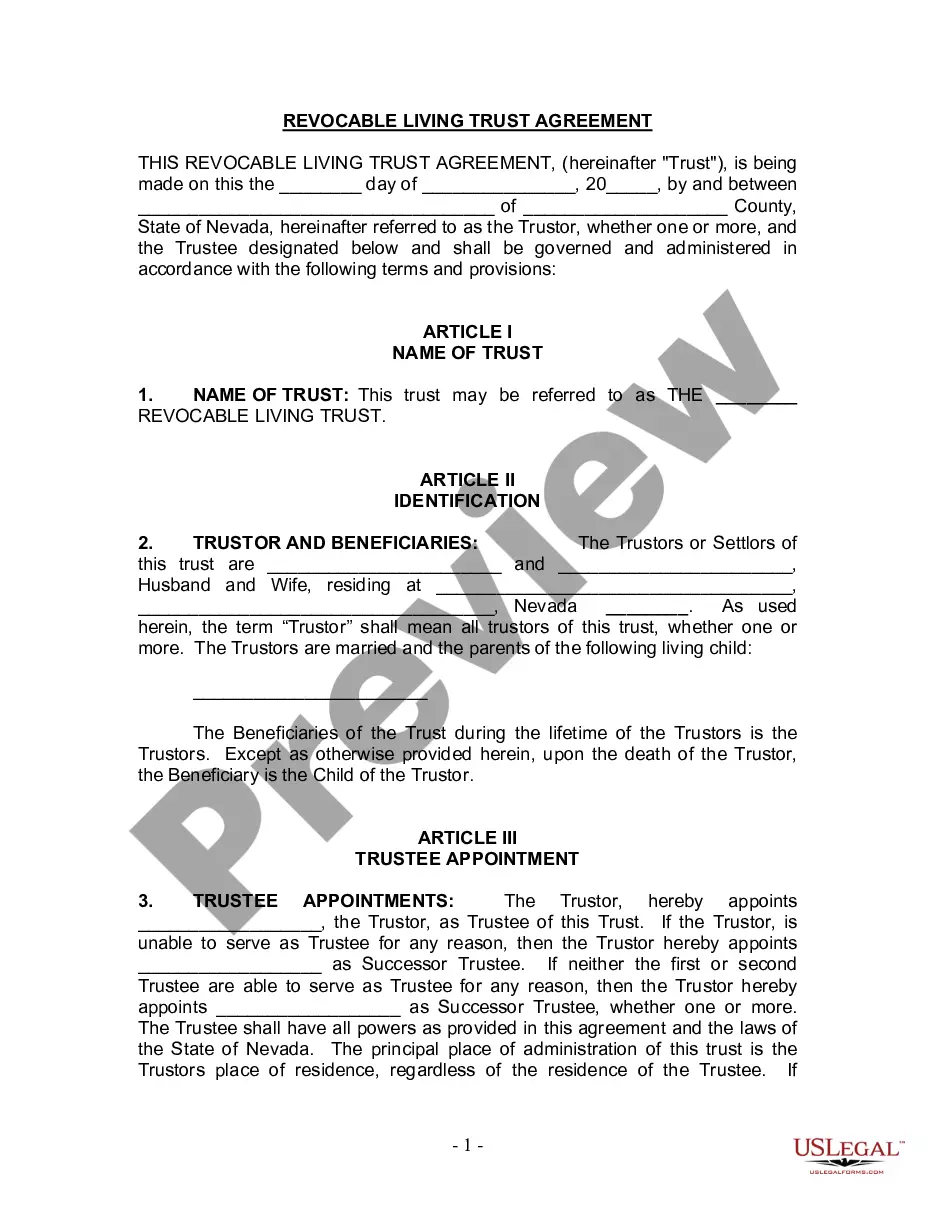

This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Vermont Bill of Sale of Customer Accounts

Description

How to fill out Bill Of Sale Of Customer Accounts?

If you wish to finalize, retrieve, or print legitimate document templates, utilize US Legal Forms, the most extensive assortment of legal forms, which are accessible online.

Leverage the website's straightforward and user-friendly search to locate the documents you need.

An assortment of templates for business and personal purposes is organized by categories and claims, or keywords.

Step 4. Once you have located the form you need, select the Get now button. Choose the pricing plan you prefer and enter your details to register for an account.

Step 5. Process the transaction. You can use your credit card or PayPal account to complete the purchase.

- Employ US Legal Forms to find the Vermont Bill of Sale for Customer Accounts in just a few clicks.

- If you are an existing US Legal Forms client, Log In to your account and click the Acquire button to obtain the Vermont Bill of Sale for Customer Accounts.

- You can also find forms you have previously acquired in the My documents section of your account.

- If you are using US Legal Forms for the first time, adhere to the following steps.

- Step 1. Ensure you have selected the form for your correct state/country.

- Step 2. Utilize the Review option to inspect the form's details. Remember to go through the summary.

- Step 3. If you are not satisfied with the form, use the Search field at the top of the screen to discover other types of your legal document format.

Form popularity

FAQ

To get a copy of your Vermont registration, you can request it directly from your local DMV office or access it through their online services. You'll need to provide your identification and vehicle information for verification. Utilizing resources available on our platform can help you obtain a Vermont Bill of Sale of Customer Accounts as part of your vehicle documentation process.

The registration loophole in Vermont refers to certain legal provisions that allow residents to register their vehicles without a physical inspection. This can simplify the process for some vehicle owners. However, it is crucial to stay updated with local regulations to ensure compliance. If you're involved in a vehicle transaction, remember that a Vermont Bill of Sale of Customer Accounts is essential for documentation.

Yes, renewing your Vermont vehicle registration online is a convenient option. You can visit the Vermont DMV website and follow the provided steps. Make sure to have your current registration details and payment information ready. If you need to complete a Vermont Bill of Sale of Customer Accounts for any changes, you can access templates and guidance through our platform.

When selling a car privately in Vermont, it is important to complete a Vermont Bill of Sale of Customer Accounts. This document serves as a legal record of the transaction. Make sure to provide the buyer with the vehicle title and ensure that all forms are signed properly. For added ease, consider using online platforms that offer templates for completing these forms.

To obtain a copy of your Vermont registration, you can visit your local DMV office or request it online through their official website. You will need to provide some identification and vehicle information. If you have questions regarding the Vermont Bill of Sale of Customer Accounts, the DMV staff can guide you through the necessary documentation.

Yes, you can walk into the Vermont DMV without an appointment. However, it is important to know that wait times may vary. To save time, consider checking the DMV website for any specific requirements. If you plan to conduct business related to the Vermont Bill of Sale of Customer Accounts, visiting in person can help clarify the process.

In Vermont, the frequency of filing sales tax returns depends on your total sales volume. Businesses may be required to file monthly, quarterly, or annually. It is crucial to stay informed about your filing schedule, as consistent compliance will help maintain the integrity of your Vermont Bill of Sale of Customer Accounts in any transaction.

To file your Vermont state taxes, you need to gather your financial documents, forms, and any necessary receipts. You can file online through the Vermont Department of Taxes website, or you can submit paper forms by mail. If you are dealing with customer accounts, utilizing a Vermont Bill of Sale of Customer Accounts can streamline your record-keeping and tax filing process.

Yes, a Vermont sales tax exemption certificate can expire if not used properly or if the business's status changes. Businesses should regularly review their certificates to ensure compliance with state laws. When executing a Vermont Bill of Sale of Customer Accounts, always check the status of exemption certificates to prevent future tax liabilities.

Vermont sales tax law requires businesses to collect a state sales tax on the sale of tangible personal property and certain services. The current sales tax rate is 6 percent, but local municipalities may impose additional taxes, which can raise the total rate. Understanding Vermont sales tax is essential when preparing a Vermont Bill of Sale of Customer Accounts, as this documentation may detail applicable sales taxes.