Whenever credit for personal, family, or household purposes involving a consumer is denied or the charge for the credit is increased either wholly or partly because of information obtained from a person other than a credit reporting agency bearing on the consumer's creditworthiness, credit standing, credit capacity, character, general reputation, personal characteristics, or mode of living, certain requirements must be met. The user of such information, when the adverse action is communicated to the consumer, must clearly and accurately disclose the consumer's right to make a written request for disclosure of the information. If such a request is made and is received within 60 days after the consumer learned of the adverse action, the user, within a reasonable period of time, must disclose to the consumer the nature of the information.

Vermont Notice of Increase in Charge for Credit Based on Information Received From Person Other Than Consumer Reporting Agency

Description

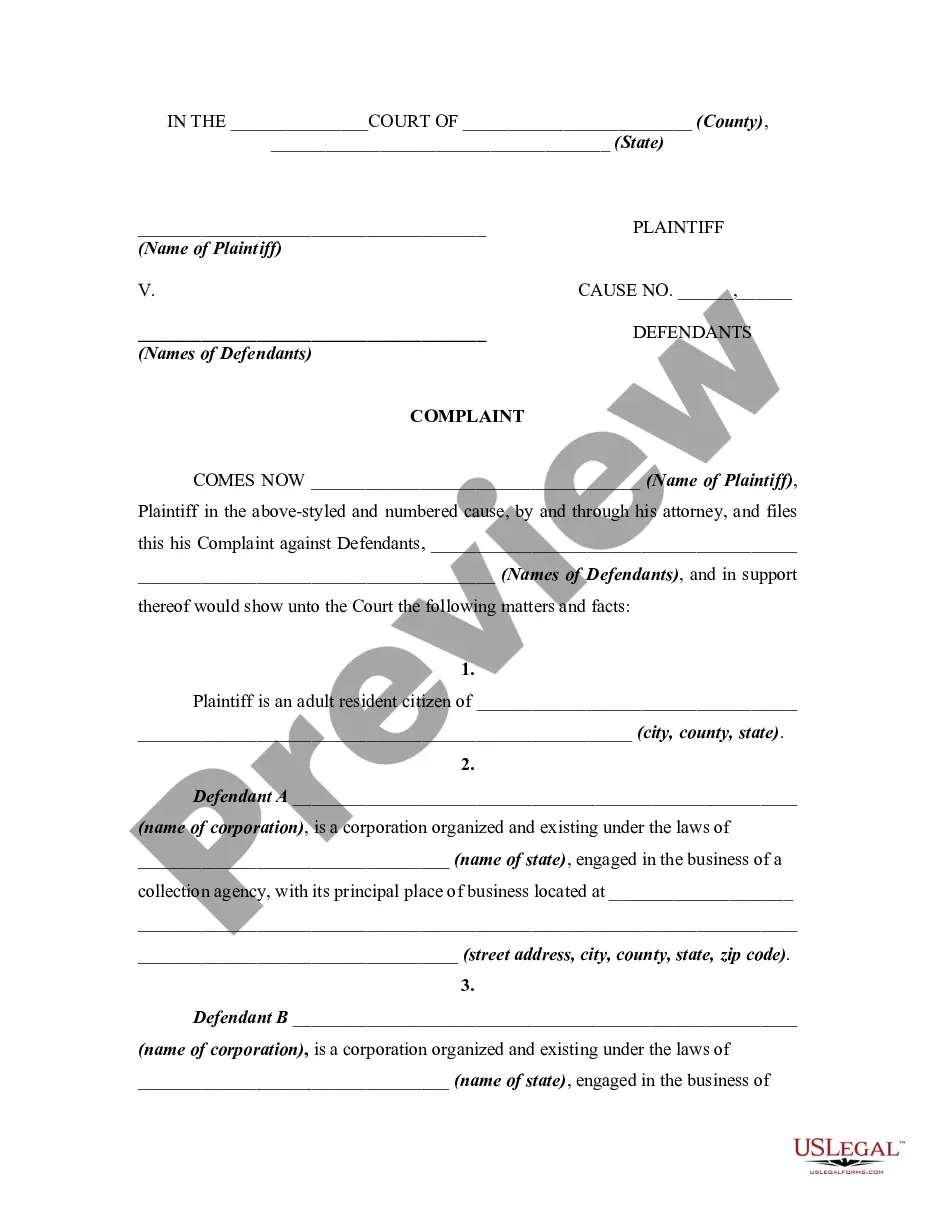

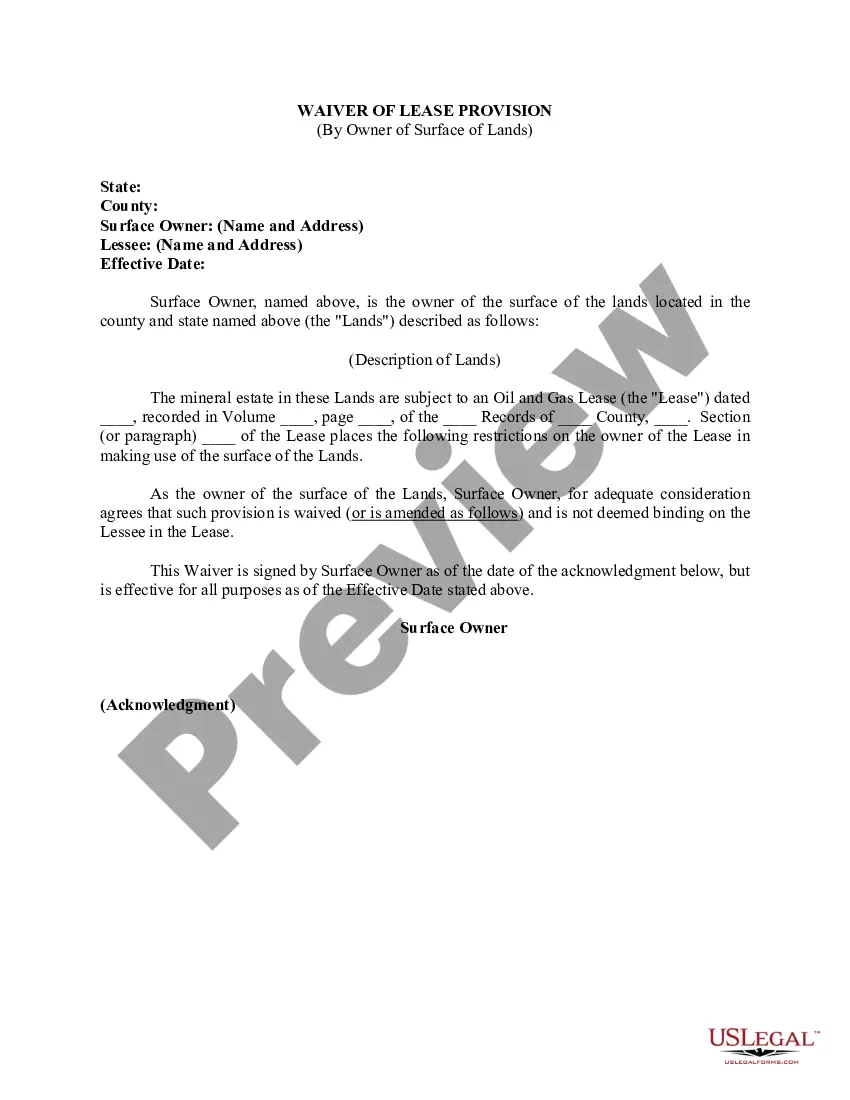

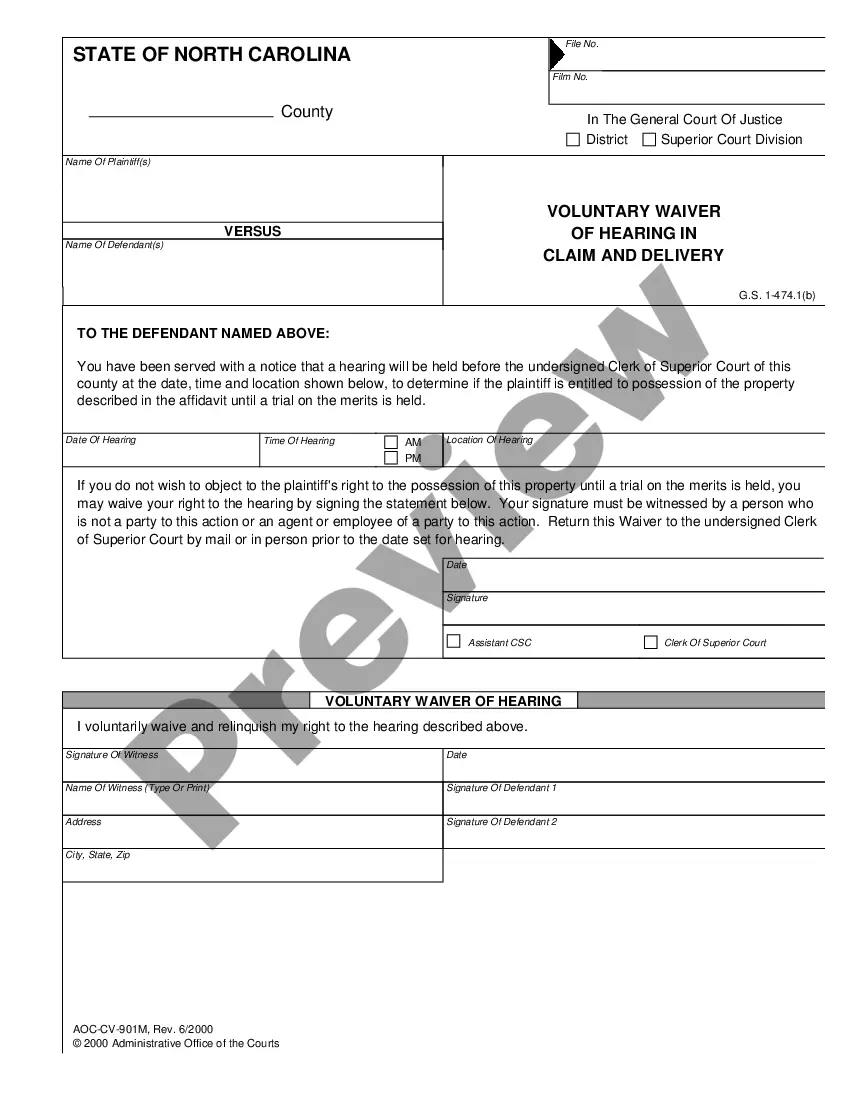

How to fill out Notice Of Increase In Charge For Credit Based On Information Received From Person Other Than Consumer Reporting Agency?

If you have to full, down load, or print out legal document layouts, use US Legal Forms, the most important assortment of legal kinds, that can be found on the Internet. Make use of the site`s simple and hassle-free search to find the files you need. A variety of layouts for organization and specific functions are sorted by groups and claims, or key phrases. Use US Legal Forms to find the Vermont Notice of Increase in Charge for Credit Based on Information Received From Person Other Than Consumer Reporting Agency in just a couple of click throughs.

In case you are currently a US Legal Forms buyer, log in to your accounts and then click the Acquire key to get the Vermont Notice of Increase in Charge for Credit Based on Information Received From Person Other Than Consumer Reporting Agency. You can also accessibility kinds you earlier downloaded inside the My Forms tab of your own accounts.

If you are using US Legal Forms the very first time, refer to the instructions under:

- Step 1. Ensure you have selected the shape to the proper city/country.

- Step 2. Utilize the Review method to examine the form`s articles. Never neglect to see the information.

- Step 3. In case you are unhappy with the develop, use the Look for area on top of the display to get other variations of the legal develop format.

- Step 4. Upon having located the shape you need, click on the Buy now key. Pick the rates plan you favor and add your credentials to sign up for the accounts.

- Step 5. Approach the financial transaction. You can use your charge card or PayPal accounts to complete the financial transaction.

- Step 6. Pick the formatting of the legal develop and down load it on the device.

- Step 7. Total, modify and print out or signal the Vermont Notice of Increase in Charge for Credit Based on Information Received From Person Other Than Consumer Reporting Agency.

Each and every legal document format you purchase is your own permanently. You have acces to every develop you downloaded with your acccount. Click the My Forms portion and choose a develop to print out or down load again.

Compete and down load, and print out the Vermont Notice of Increase in Charge for Credit Based on Information Received From Person Other Than Consumer Reporting Agency with US Legal Forms. There are thousands of professional and state-distinct kinds you can use for your personal organization or specific demands.

Form popularity

FAQ

A consumer reporting agency is any person that (1) for monetary fees, dues, or on a cooperative nonprofit basis regularly engages in whole or in part in the practice of assembling or evaluating consumer credit information, or other information on consumers, for the purpose of furnishing consumer reports to third ...

Section 628 - Properly dispose of consumer information to protect the confidentiality of the information -- go to Section 628. Section 629 - Prevents consumer reporting agencies from circumventing the law -- Section 629.

The most common type of adverse action is a denial of credit. Adverse action is defined in the Equal Credit Opportunity Act and the FCRA to include: a denial or revocation of credit. a refusal to grant credit in the amount or terms requested.

A creditor must notify the applicant of adverse action within: 30 days after receiving a complete credit application. 30 days after receiving an incomplete credit application. 30 days after taking action on an existing credit account.

Removals, demotions, and suspensions of Federal employees are ?adverse actions.?1 A removal action terminates the employment of an individual.

Even though it may sound scary, an adverse action notice aims to provide transparency into the application process and informs you of your rights if you think your application was incorrectly denied.

Under the Fair Credit Reporting Act (FCRA), potential lenders are required to provide you with an adverse action notice when they deny you credit based on information in your credit report.

This isn't an exhaustive list, but here are some common reasons you could see in your adverse action letter: Too much debt relative to your income. ... Credit score too low. ... Not enough credit history. ... Too many recent credit applications. ... High credit utilization ratio. ... Late payments. ... Too much existing credit with the lender.