Vermont Employment Verification Letter for Mortgage represents a crucial document required by lenders during the mortgage application process. This letter serves as proof of an individual's employment status and income stability in order to assess their ability to pay off the mortgage. It plays a crucial role in determining the applicant's loan eligibility and overall creditworthiness. The Vermont Employment Verification Letter for Mortgage typically includes essential details such as the borrower's full name, current job position, employment start date, and income information. It is necessary to mention the borrower's gross monthly income, which generally comprises base salary, overtime, commissions, bonuses, and any other additional income sources. Furthermore, it should specify the number of hours the borrower typically works per week and their regular schedule. Additionally, it is essential to describe the borrower's employment status (full-time, part-time, or self-employed) and their nature of work. Verification of a stable employment history is crucial for lenders, so the letter may include details of previous employers, job titles, and duration of employment. Lenders may request contact information for the borrower's current employer to authenticate the information provided. Different types of Vermont Employment Verification Letters for Mortgage may exist based on the specific needs of the applicant or lender. Some common variations include: 1. Standard Employment Verification Letter: This is a general letter that outlines the borrower's current job position, income, and employment history. 2. Self-Employment Verification Letter: Tailored for self-employed individuals, this letter confirms the borrower's self-employment status, business ownership, income sources, and any relevant documents such as tax returns or financial statements. 3. Seasonal Employment Verification Letter: For applicants whose income is derived from seasonal work, this letter highlights the borrower's pattern of income generation and verifies their seasonal employment status. 4. Combined Employment Verification Letter: In cases where the borrower holds multiple jobs or has additional income sources, this letter consolidates all relevant employment details into a single document. It is important to note that the specific content and format of the Vermont Employment Verification Letter for Mortgage may vary based on the lender's requirements. Therefore, it is advisable to consult the lender or mortgage professional to ensure the letter meets their guidelines and contains all necessary information.

Vermont Employment Verification Letter for Mortgage

Description

How to fill out Vermont Employment Verification Letter For Mortgage?

If you have to comprehensive, download, or print out legitimate record themes, use US Legal Forms, the largest selection of legitimate kinds, that can be found online. Take advantage of the site`s simple and practical look for to obtain the files you will need. Different themes for enterprise and person functions are sorted by groups and states, or key phrases. Use US Legal Forms to obtain the Vermont Employment Verification Letter for Mortgage in just a few clicks.

When you are currently a US Legal Forms consumer, log in to the account and click on the Obtain button to get the Vermont Employment Verification Letter for Mortgage. You may also entry kinds you earlier saved in the My Forms tab of your own account.

If you work with US Legal Forms for the first time, follow the instructions below:

- Step 1. Ensure you have selected the form for the correct area/nation.

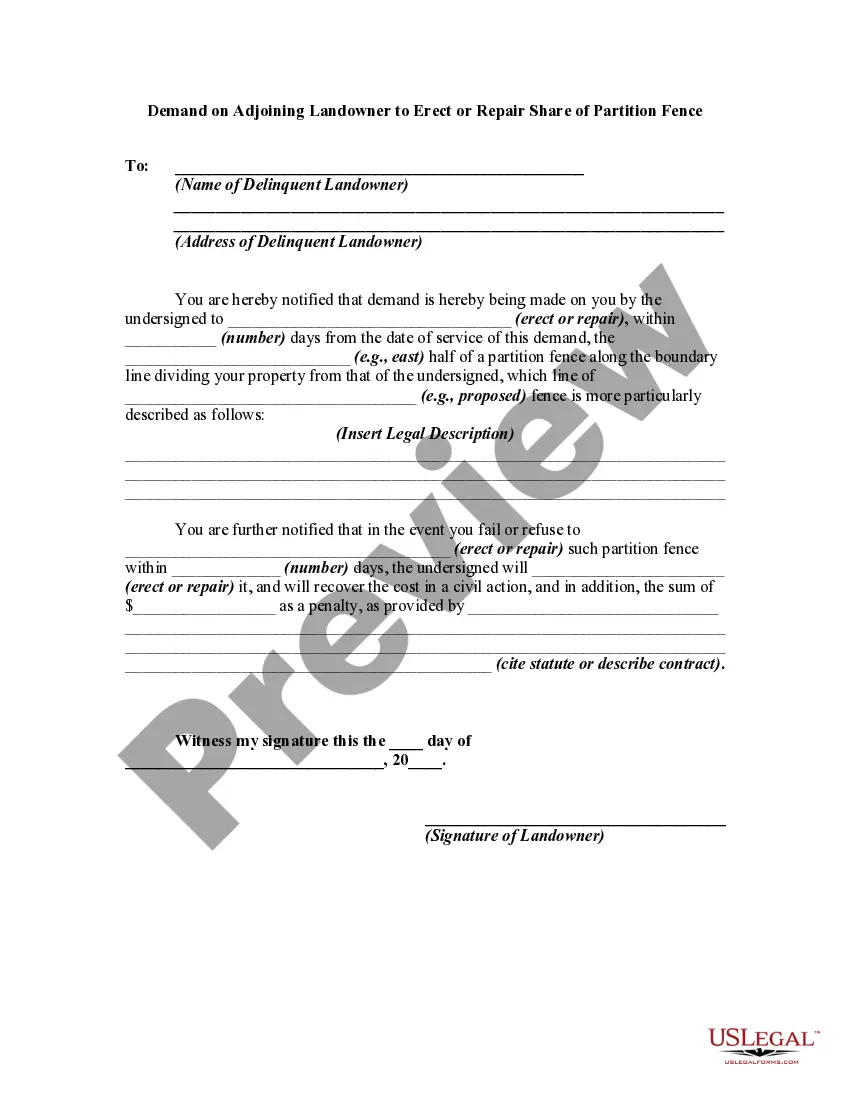

- Step 2. Use the Review choice to look over the form`s content material. Never forget to read the explanation.

- Step 3. When you are unsatisfied together with the kind, take advantage of the Search discipline towards the top of the display screen to find other variations of your legitimate kind template.

- Step 4. After you have identified the form you will need, select the Acquire now button. Opt for the pricing plan you choose and add your qualifications to sign up for an account.

- Step 5. Method the transaction. You can use your credit card or PayPal account to complete the transaction.

- Step 6. Pick the structure of your legitimate kind and download it in your gadget.

- Step 7. Total, revise and print out or sign the Vermont Employment Verification Letter for Mortgage.

Each and every legitimate record template you get is yours forever. You have acces to every single kind you saved inside your acccount. Select the My Forms area and choose a kind to print out or download once again.

Contend and download, and print out the Vermont Employment Verification Letter for Mortgage with US Legal Forms. There are thousands of skilled and condition-distinct kinds you may use to your enterprise or person requirements.

Form popularity

FAQ

VOE or Verification of Employment is a type of mortgage program where all of the verification is handled directly with the employer. If you're a salaried worker or a wage earner, this program could work for you as an alternate type of financing.

Key Takeaways. Mortgage lenders verify employment by contacting employers directly and requesting income information and related documentation. Most lenders only require verbal confirmation, but some will seek email or fax verification.

Verbal verification of employment is done with current employers just before the loan is funded to ensure employment status has not changed. It is generally completed as late as possible in the loan origination process.

There are different ways to request an employment verification letter from a current or former employer: Ask your supervisor or manager. ... Contact Human Resources. ... Get a template from the company or organization requesting the letter. ... Use an employment verification service.

Loan Applications: Financial institutions, such as banks or lending agencies, may ask for an employment verification letter when you apply for a loan, mortgage, or credit card. This letter is used to verify your income and employment stability, helping the lender assess your creditworthiness.

An employment verification letter generally includes your employer's address, the name, and address of the organization requesting the document, your name, your employment dates, your job title and salary . The document may also include your date of birth and social security number for identification purposes.

A student loan payoff letter, also called a payoff statement or loan verification letter, outlines your loan's essential details, including the balance, payoff date and estimated interest charges.

To do this, they need to be able to verify employment status and income. A letter of employment allows the mortgage lender to verify other information such as your employer information, current employment status, annual salary or if you're paid hourly, the wage rate.