A Vermont Private Annuity Agreement is a legal contract between two parties, often family members, where one party (the annuitant) transfers assets or property to another party (the obliged) in exchange for periodic annuity payments for the annuitant's lifetime. This agreement allows for the transfer of wealth to the next generation while also providing the annuitant with a stable stream of income during their retirement years. The annuity payments are typically determined based on the annuitant's life expectancy, prevailing interest rates, and the value of the transferred assets. The annuity can provide a fixed or variable stream of income, depending on the terms agreed upon in the agreement. This arrangement offers several benefits. Firstly, it allows the annuitant to effectively transfer assets outside their estate, potentially reducing estate taxes. Secondly, the annuitant can enjoy income during retirement without depending on other sources such as pensions or Social Security. Lastly, the annuitant retains control of the assets during their lifetime, providing flexibility and continued access to the transferred wealth. There are generally two types of Vermont Private Annuity Agreements: 1. Traditional Private Annuity: In this type, the annuitant transfers assets to the obliged in exchange for future annuity payments. The annuity payments are typically for the annuitant's lifetime and cease upon their death. This agreement is often used as an estate planning tool to pass assets to the next generation while minimizing estate taxes. 2. Granter Retained Annuity Trust (GREAT): A GREAT is a variation of a private annuity agreement where the annuitant transfers assets into an irrevocable trust instead of directly to the obliged. The annuitant retains the right to receive annuity payments from the trust for a specified term, after which any remaining assets pass on to the beneficiaries. This type of agreement offers additional estate planning benefits by allowing the annuitant to leverage their lifetime gift tax exemption. It is important to note that Private Annuity Agreements, including the Vermont Private Annuity Agreement, should be approached with caution. They involve complex legal and tax implications, and it is advisable to consult with an experienced attorney or financial advisor who specializes in estate planning to determine if this arrangement is suitable for your specific circumstances.

Vermont Private Annuity Agreement

Description

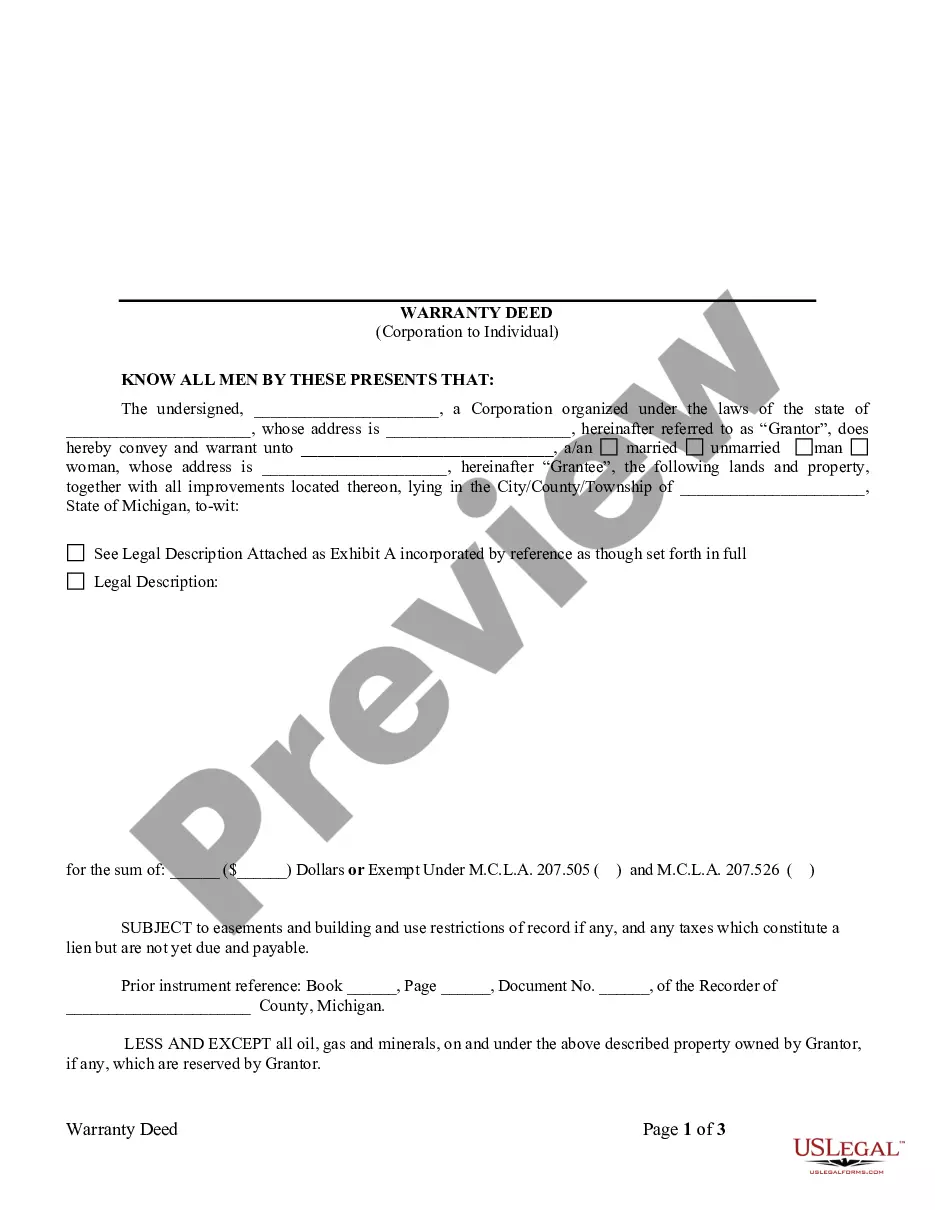

How to fill out Vermont Private Annuity Agreement?

US Legal Forms - one of many largest libraries of lawful forms in the USA - delivers a wide range of lawful papers layouts you can download or printing. Making use of the web site, you will get thousands of forms for enterprise and individual purposes, categorized by classes, states, or keywords and phrases.You will discover the newest types of forms much like the Vermont Private Annuity Agreement within minutes.

If you have a registration, log in and download Vermont Private Annuity Agreement in the US Legal Forms catalogue. The Download key will appear on every kind you look at. You get access to all in the past downloaded forms within the My Forms tab of your respective profile.

If you wish to use US Legal Forms initially, listed here are simple recommendations to help you get started out:

- Be sure you have chosen the best kind for your personal metropolis/state. Select the Review key to examine the form`s articles. See the kind description to actually have chosen the proper kind.

- In case the kind doesn`t fit your needs, utilize the Lookup area on top of the display screen to get the the one that does.

- Should you be satisfied with the shape, confirm your selection by clicking on the Acquire now key. Then, choose the prices program you prefer and give your credentials to sign up for an profile.

- Process the transaction. Use your credit card or PayPal profile to complete the transaction.

- Choose the formatting and download the shape on your product.

- Make adjustments. Complete, modify and printing and indicator the downloaded Vermont Private Annuity Agreement.

Every design you included in your bank account lacks an expiry time and is also your own forever. So, if you want to download or printing an additional copy, just proceed to the My Forms portion and click on about the kind you need.

Get access to the Vermont Private Annuity Agreement with US Legal Forms, the most substantial catalogue of lawful papers layouts. Use thousands of specialist and state-specific layouts that meet your business or individual requires and needs.

Form popularity

FAQ

natural owner of an annuity is usually a legal entity, such as a corporation, trust, or partnership. These entities can possess annuities to manage investments or assets more strategically. If you are considering options like a Vermont Private Annuity Agreement, it's crucial to understand how having a nonnatural owner may affect tax consequences and payment structures.

Typically, the annuitant must be a natural person in an annuity contract. This ensures a genuine connection and provides legal standing for an individual to receive payments as stipulated in the agreement. In the context of a Vermont Private Annuity Agreement, having a natural person as an annuitant is essential for the validity of the contract.

An annuity contract usually involves two main parties: the annuitant, who receives payments, and the issuer or insurer, who is responsible for making those payments. In a Vermont Private Annuity Agreement, additional parties may include beneficiaries or a second annuitant, adding layers to the contractual relationships. Each party plays a critical role in the overall function and purpose of the contract.

In most annuity agreements, at least one party must be a natural person, which typically refers to an individual rather than a company or organization. This requirement helps ensure that the contract has a human element, giving a clear sense of accountability and relationship. In a Vermont Private Annuity Agreement, this aspect is especially important for the implementation of agreements.

Exiting an annuity contract can be challenging, but it is not impossible. You may need to surrender the policy, which often comes with fees or penalties. Alternatively, you can explore a Vermont Private Annuity Agreement, which allows for greater flexibility in managing your retirement assets without facing excessive charges.

Annuity contracts are typically guaranteed by the issuing insurance company, which provides the financial backing for the agreed benefits. In a Vermont Private Annuity Agreement, the reliability of the guarantee can vary based on the financial strength of the company. It is recommended to assess the issuer's ratings and reviews to ensure that your investment is secure and will perform as expected.

Only licensed insurance companies and certain financial institutions can issue annuities. These entities must comply with state regulations, including those governing Vermont Private Annuity Agreements. When selecting an issuer, ensure they have a strong financial standing, as this impacts your long-term financial health and reliability of payouts.

The issuer of an annuity is often a licensed life insurance company that specializes in these financial instruments. They create and sell annuity contracts, including those associated with Vermont Private Annuity Agreements. Choosing a reputable issuer is essential, as it affects the contract's security and the benefits you'll receive over time.

Annuity contracts are generally issued by insurance companies or financial institutions authorized to provide these financial products. In the context of a Vermont Private Annuity Agreement, these issuers must adhere to state regulations, ensuring the contracts are properly structured for your needs. It is wise to engage with a qualified provider to secure a reliable contract that aligns with your financial strategy.

In a Vermont Private Annuity Agreement, the control of the annuity contract typically resides with the individual or entity that holds the contract. This control allows the owner to manage its features, including the investment options and payout terms. When considering a private annuity, it's crucial to understand the rules governing your specific agreement to ensure it meets your financial goals.

Interesting Questions

More info

Item A is made up of two individuals, Bob and Carol. Each item has two transferors, Bob and Carol. Item A is made up of four discrete transfers. Bob and Carol will receive their portion of the Basket A will consist of a sale contract, Bob's and Carol's portion of the transfer of title, Bob and Carol's portion of the transfer of ownership, and the deed of transfer. Bob and Carol will receive the property. What is the legal procedure for the sale? What is the property transfer documents that will be signed? What is the amount that they each will receive? Item Basket A. Item A is made up of four individuals, Bob and Carol. Each item has two transferors, Bob and Carol. Item A is made up of four discrete transfers. Bob and Carol will receive their portion of the A-Basket-A. Bob and Carol will receive the property. Each individual is entitled to receive the same portions, depending on what portion of the Basket-Basket is being transferred.