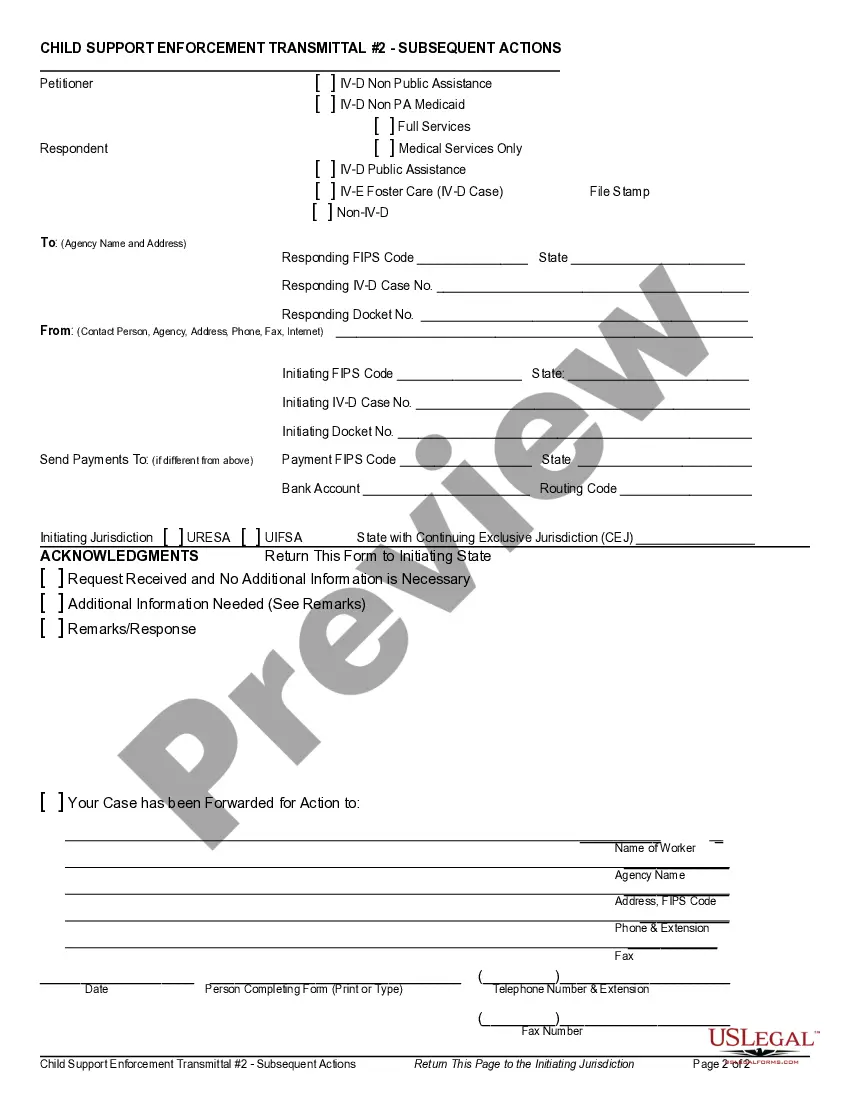

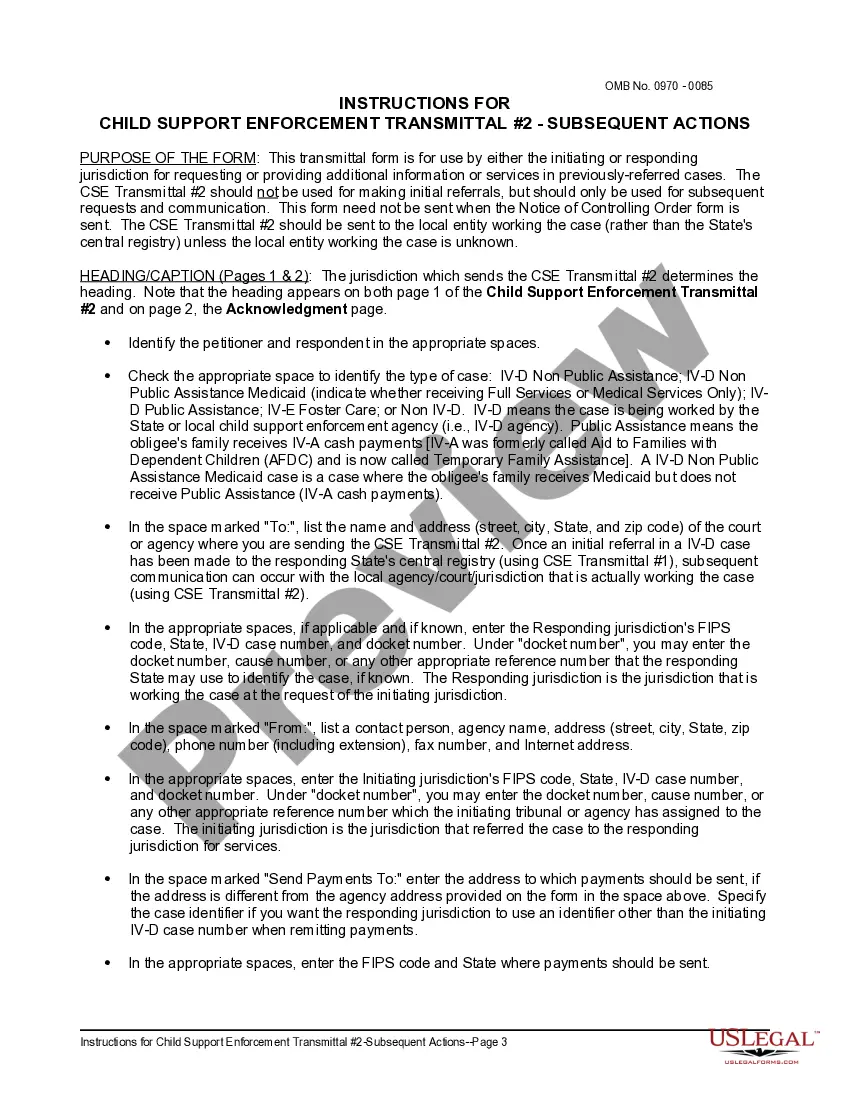

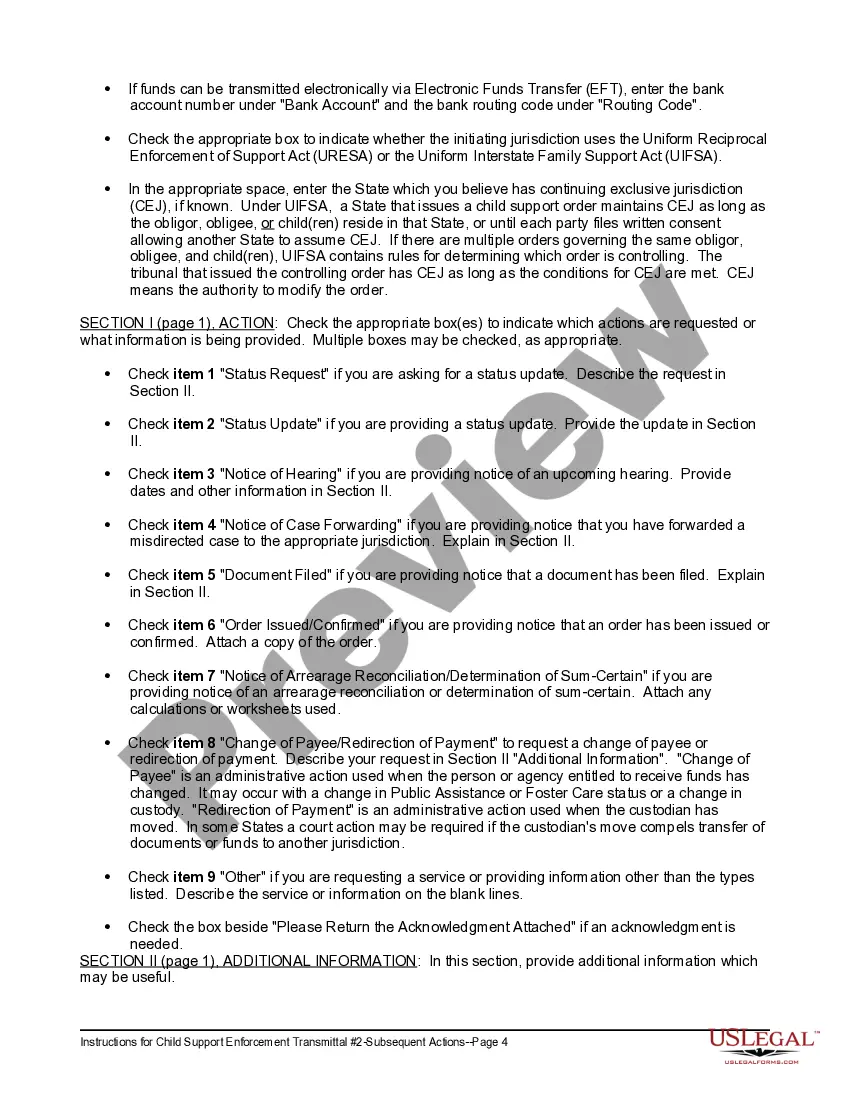

Vermont Child Support Transmittal #2 — Subsequent Actions and Instructions is an official document that serves as a means of communication between parties involved in the child support process in Vermont. This transmittal form is used to convey subsequent actions taken and provide detailed instructions regarding child support matters. This article will outline the purpose of the form and highlight some key points, using relevant keywords. The Vermont Child Support Transmittal #2 — Subsequent Actions and Instructions is primarily used by the Vermont Office of Child Support (OCS) and other relevant parties to transmit important information related to ongoing child support cases. It acts as a formal notification, ensuring that all parties involved are aware of the actions taken and the instructions to be followed for continued compliance and effective child support management. One common type of subsequent action covered by this transmittal form is the modification of an existing child support order. When a substantial change in circumstances occurs, such as a significant change in income, custody arrangements, or the child's needs, either parent can request a modification of the support order through the appropriate court. If such modification is granted, the Vermont Child Support Transmittal #2 — Subsequent Actions and Instructions will be used to communicate the updated terms and requirements to both parents. Another important situation covered by this transmittal form is the enforcement of child support orders. If a noncustodial parent fails to make the court-ordered child support payments, the custodial parent can seek enforcement through various means, such as wage garnishment, interception of tax refunds, or property liens. In such cases, the Vermont Child Support Transmittal #2 — Subsequent Actions and Instructions will be utilized to inform both parties about the enforcement actions taken and any necessary steps they need to follow. Furthermore, this document may serve as a channel for updates related to income withholding orders. Income withholding is a process through which child support payments are automatically deducted from the noncustodial parent's wages. If there are changes in employment, income withholding amounts, or any adjustments required for compliance with federal regulations, the Vermont Child Support Transmittal #2 — Subsequent Actions and Instructions will provide detailed instructions to ensure all parties are informed and in compliance. Overall, the Vermont Child Support Transmittal #2 — Subsequent Actions and Instructions is a critical communication tool in managing child support cases effectively in Vermont. It covers various subsequent actions such as modifications, enforcement, and income withholding, and provides concise instructions to ensure all parties involved in the child support process are aware of the actions taken and their obligations.

Vermont Child Support Transmittal #2 - Subsequent Actions and Instructions

Description

How to fill out Vermont Child Support Transmittal #2 - Subsequent Actions And Instructions?

Discovering the right legitimate file template can be a have difficulties. Naturally, there are a variety of layouts accessible on the Internet, but how do you find the legitimate kind you want? Use the US Legal Forms site. The assistance gives a large number of layouts, such as the Vermont Child Support Transmittal #2 - Subsequent Actions and Instructions, that can be used for business and personal requirements. Every one of the varieties are examined by specialists and meet federal and state demands.

If you are presently authorized, log in for your accounts and click on the Down load switch to get the Vermont Child Support Transmittal #2 - Subsequent Actions and Instructions. Utilize your accounts to appear with the legitimate varieties you may have bought previously. Visit the My Forms tab of the accounts and acquire an additional backup of the file you want.

If you are a whole new customer of US Legal Forms, listed below are basic recommendations so that you can adhere to:

- Very first, be sure you have selected the correct kind for your area/area. You are able to check out the form utilizing the Review switch and look at the form explanation to ensure it is the best for you.

- If the kind is not going to meet your expectations, make use of the Seach field to get the right kind.

- Once you are sure that the form is suitable, click the Purchase now switch to get the kind.

- Pick the pricing strategy you want and enter the needed details. Make your accounts and purchase an order utilizing your PayPal accounts or Visa or Mastercard.

- Opt for the data file format and download the legitimate file template for your system.

- Comprehensive, modify and print out and signal the acquired Vermont Child Support Transmittal #2 - Subsequent Actions and Instructions.

US Legal Forms may be the biggest catalogue of legitimate varieties in which you can discover numerous file layouts. Use the service to download skillfully-created documents that adhere to condition demands.

Form popularity

FAQ

§ 2650. Minors residing in the State and having reached the age of 14 years may choose their guardians, subject to the approval of the Probate Division of the Superior Court, and may appear before the court or before a Superior judge and make their choice.

The calculation takes into account what parents in Vermont ordinarily spend to raise a child. It takes into account many factors, including the income of both parents and the amount of time the child spends with each parent. If you have other children with a different parent, that will also be considered.

What is your state's statute of limitations for the collection of past-due support? A court action to obtain a judgment for child support arrears not previously reduced to a judgment must be commenced within six years after the youngest child who is the subject of a support order turns 18 years-old.

In Vermont, child support is determined by a set of guidelines established by state law. These guidelines take into account several factors, including the income of both parents, the number of children involved, and the expenses associated with caring for the child, such as health insurance and childcare costs.

After you have that number, you can calculate what each parent's share of that amount will be. Child support continues until a child turns 18 or is emancipated.

The court usually bases the child support calculation on your actual earned income. However, in some cases the court may use an imputed income. For example, a parent may decide to leave a job to stay home, or to change to a job with a lower salary.