Contractor is performing this agreement as an independent contractor. An independent contractor is a person or business who performs services for another person under an express or implied agreement and who is not subject to the other's control, or right to control, the manner and means of performing the services. The person who hires an independent contractor is not liable to others for the acts or omissions of the independent contractor. An independent contractor is distinguished from an employee, who works regularly for an employer. The exact nature of the independent contractor's relationship with the hiring party is important since an independent contractor pays their own Social Security, income taxes without payroll deduction, has no retirement or health plan rights, and often is not entitled to worker's compensation coverage.

There are a number of factors which to consider in making the decision whether people are employees or independent contractors. No one factor is controlling, and the characterization of the relationship by the parties is also not controlling. One of the most important considerations is the degree of control exercised by the company over the work of the workers. An employer has the right to control an employee. It is important to determine whether the company had the right to direct and control the workers not only as to the results desired, but also as to the details, manner and means by which the results were accomplished. If the company had the right to supervise and control such details of the work performed, and the manner and means by which the results were to be accomplished, an employer-employee relationship would be indicated. On the other hand, the absence of supervision and control by the company would support a finding that the workers were independent contractors and not employees. Whether or not such control was exercised is not the determining factor, it is the right to control which is key.

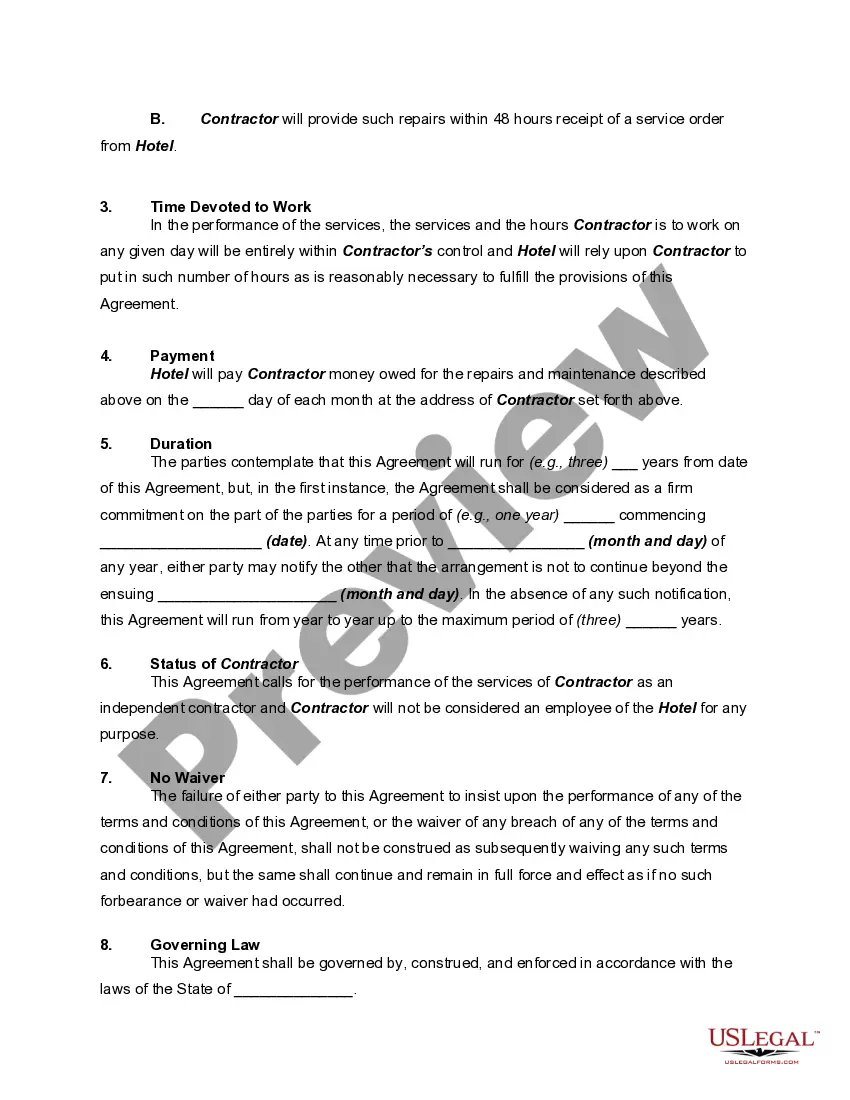

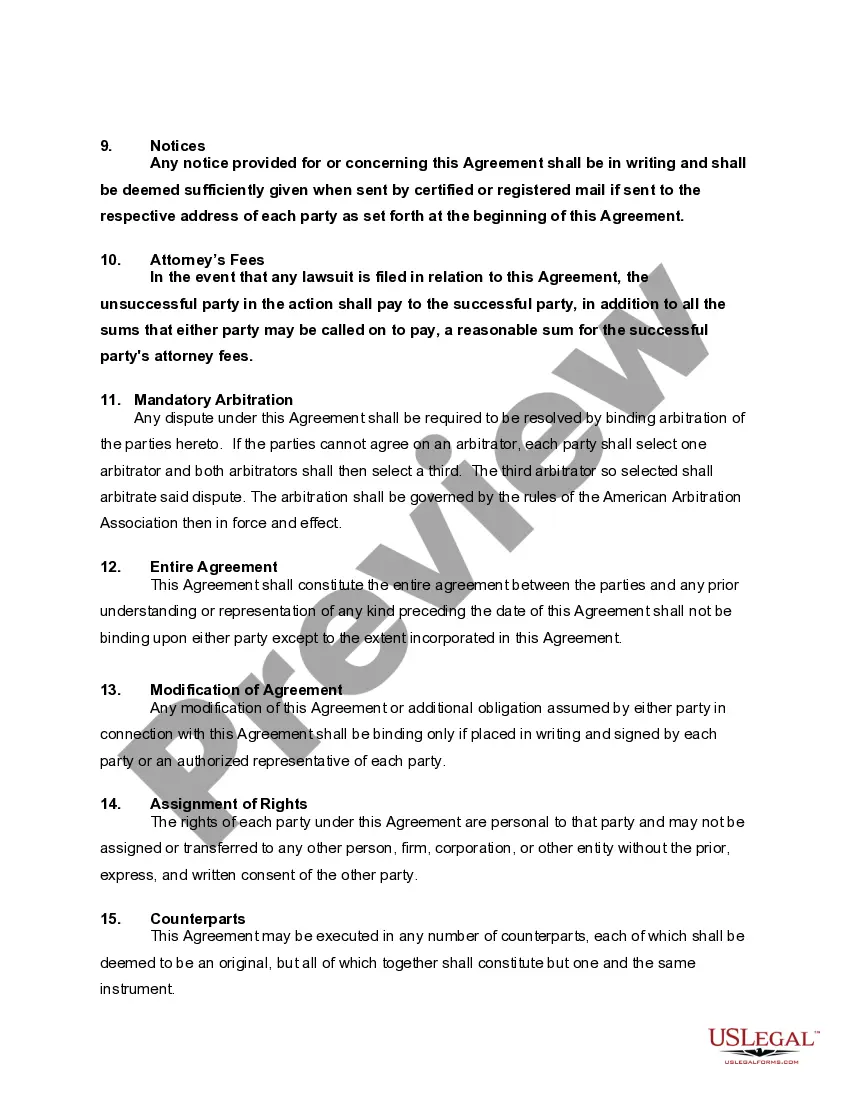

A Vermont Services Contract with Hotel to Maintain in Working Order LCD Televisions is a comprehensive agreement designed for self-employed individuals who specialize in maintaining and repairing LCD televisions in hotels. This contract outlines the terms and conditions under which the self-employed individual will provide their services to the hotel, ensuring that all LCD televisions on the premises are functioning optimally and delivering seamless entertainment experiences to hotel guests. The main purpose of this contract is to establish a clear understanding between the self-employed individual and the hotel regarding the scope of services, payment terms, responsibilities, and liabilities. By entering into this agreement, both parties can ensure a smooth and efficient operation of LCD televisions within the hotel premises, guaranteeing guest satisfaction. Here are some key aspects covered in the Vermont Services Contract with Hotel to Maintain in Working Order LCD Televisions — Self-Employed: 1. Scope of Services: This contract outlines the specific tasks and services that the self-employed individual will provide to the hotel. It may include regular maintenance, troubleshooting and repair, software updates, replacement of faulty components, and any other necessary tasks related to LCD televisions. 2. Responsibilities: The contract clearly defines the responsibilities of both parties. The hotel will be responsible for providing the necessary access to LCD televisions, power supply, and any other required resources. It may also include the responsibility to report any issues promptly. The self-employed individual is responsible for delivering the agreed-upon services with the highest level of professionalism and expertise. 3. Payment Terms: The contract details the compensation structure, payment frequency, and accepted methods of payment. It may include hourly rates, fixed fees for specific tasks, or a combination of both. 4. Term and Termination: This section specifies the duration of the contract and the procedure for termination. It may include provisions for renewal, automatic termination, or notice period required for terminating the contract. 5. Liability and Insurance: The agreement defines the liability and responsibility in case of damages or accidents related to the LCD televisions during the provision of services. It may also outline the requirements for the self-employed individual to maintain appropriate insurance coverage to protect both parties. Different types of Vermont Services Contracts with Hotels to Maintain in Working Order LCD Televisions — Self-Employed can vary depending on the specific services provided or the level of expertise required. Some contracts may focus on regular maintenance and troubleshooting, while others may include more advanced repair and replacement services. Additionally, contracts may differ in terms of the compensation structure, duration, and termination conditions to accommodate the unique needs of each hotel and self-employed professional. By using a Vermont Services Contract with Hotel to Maintain in Working Order LCD Televisions — Self-Employed, hotels can ensure that their LCD televisions receive the necessary maintenance and repairs from a qualified professional. Similarly, self-employed individuals can benefit from a well-defined agreement that outlines their responsibilities and protects their interests.