Are you looking for comprehensive information on Vermont Financing Statement? Well, you've come to the right place! In this article, we'll provide you with a detailed description of what a Vermont Financing Statement is, along with some relevant keywords. Additionally, we'll shed light on different types of Vermont Financing Statements. Description: A Vermont Financing Statement is a legal document filed to create a public record of a security interest in personal property. It is a vital component of the Uniform Commercial Code (UCC) in Vermont, which governs commercial transactions and provides a framework for creditors to assert their rights when dealing with secured transactions. Keywords: — Vermont Financing Statement: This is the main keyword that defines the topic of this article. — UCC: The Uniform Commercial Code is a set of laws governing commercial transactions in the United States, including Vermont. — Security Interest: Refers to an interest in personal property that secures payment or performance of an obligation, typically in a loan or credit agreement. — Personal Property: Tangible or intangible property such as inventory, equipment, accounts receivable, patents, copyrights, etc., that is not considered real estate. — Creditor: A person or entity that extends a loan or credit to another party. — Secured Transaction: A transaction where a creditor has a security interest in personal property to guarantee the repayment of a debt. Types of Vermont Financing Statements: 1. Initial Financing Statement: This type of statement is filed when a creditor initiates a loan or credit agreement and seeks to establish a security interest in the debtor's personal property. It provides public notice that the creditor has a valid claim over certain assets and outlines the terms and conditions of the loan or credit. 2. Amended Financing Statement: If there are any changes or updates in the original filing, an amended financing statement is filed. It ensures that the public record remains accurate and up-to-date regarding any modifications to the security interest, such as changes in collateral or amendments to the loan agreement. 3. Termination Statement: A termination statement is filed when the debt is fully repaid, the loan is concluded, or the security interest is no longer valid. It serves to remove the security interest from public record and provides notice that the debtor has discharged their obligations. In conclusion, a Vermont Financing Statement is a crucial legal document used to establish and maintain a creditor's security interest in personal property as part of a commercial transaction. By filing this statement, both parties gain clarity and protection regarding their rights and obligations. Understanding the different types of Vermont Financing Statements can be beneficial in ensuring compliance with UCC regulations and protecting the interests of all parties involved.

Vermont Financing Statement

Description

How to fill out Vermont Financing Statement?

You can devote time online trying to find the legitimate record template which fits the federal and state demands you will need. US Legal Forms supplies a huge number of legitimate varieties that happen to be analyzed by specialists. You can actually acquire or print the Vermont Financing Statement from the support.

If you have a US Legal Forms profile, you may log in and then click the Down load switch. Afterward, you may total, edit, print, or signal the Vermont Financing Statement. Each legitimate record template you buy is the one you have forever. To get another copy of any acquired type, proceed to the My Forms tab and then click the corresponding switch.

If you work with the US Legal Forms web site initially, stick to the easy directions beneath:

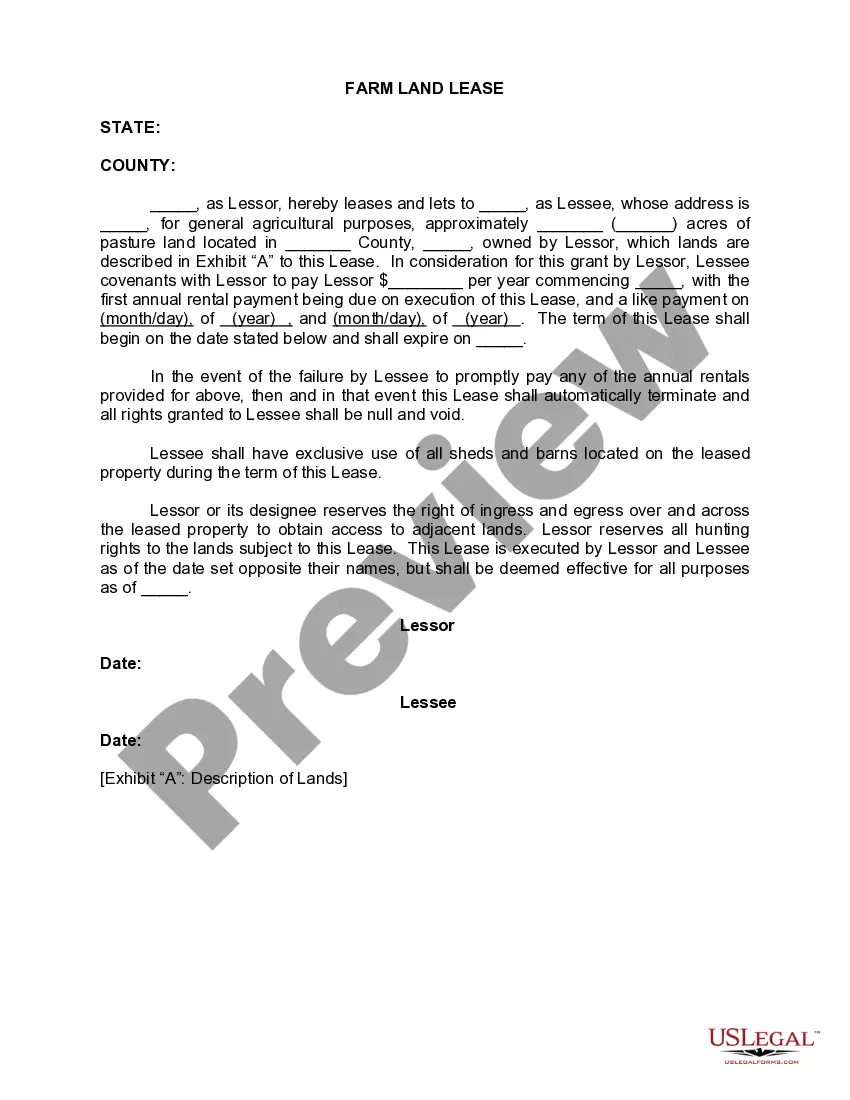

- Very first, ensure that you have selected the right record template for the state/area that you pick. Look at the type description to ensure you have picked the proper type. If accessible, make use of the Review switch to check through the record template at the same time.

- If you would like get another version of the type, make use of the Search industry to find the template that fits your needs and demands.

- Once you have located the template you want, simply click Acquire now to continue.

- Choose the costs strategy you want, enter your references, and register for an account on US Legal Forms.

- Full the deal. You should use your charge card or PayPal profile to pay for the legitimate type.

- Choose the format of the record and acquire it to the product.

- Make changes to the record if necessary. You can total, edit and signal and print Vermont Financing Statement.

Down load and print a huge number of record layouts using the US Legal Forms website, which provides the biggest variety of legitimate varieties. Use specialist and express-specific layouts to take on your small business or specific demands.