Vermont Personal Monthly Budget Worksheet

Description

How to fill out Personal Monthly Budget Worksheet?

US Legal Forms - one of the largest collections of legal documents in the United States - offers a range of legal form templates that you can download or print.

By using the website, you can discover thousands of forms for business and personal purposes, categorized by types, states, or keywords. You can find the latest types of forms like the Vermont Personal Monthly Budget Worksheet in just minutes.

If you already possess a membership, Log In and download the Vermont Personal Monthly Budget Worksheet from the US Legal Forms library. The Download button will appear on every form you view. You have access to all previously downloaded forms in the My documents section of your account.

Complete the transaction. Use your Visa, Mastercard, or PayPal account to finalize the transaction.

Select the format and download the form onto your system. Edit. Fill out, modify, print, and sign the downloaded Vermont Personal Monthly Budget Worksheet. Each template you added to your account has no expiration date and is your property forever. So, if you want to download or print another copy, just go to the My documents section and click on the form you need. Access the Vermont Personal Monthly Budget Worksheet with US Legal Forms, the most extensive collection of legal document templates. Utilize thousands of professional and state-specific templates that fulfill your business or personal needs.

- If you wish to use US Legal Forms for the first time, here are simple steps to get started.

- Ensure you have selected the correct form for your city/region.

- Click on the Preview button to review the form's content.

- Check the description of the form to make sure you have chosen the right one.

- If the form does not meet your needs, use the Search field at the top of the screen to find the one that does.

- If you are satisfied with the form, confirm your choice by clicking the Buy Now button.

- Then, select the payment plan you prefer and provide your details to register for an account.

Form popularity

FAQ

Writing a monthly budget example involves documenting your income and expenses side by side. Start with an overview of your total monthly income, and then detail each expense category with corresponding amounts. By using the Vermont Personal Monthly Budget Worksheet, you create a practical example that reflects your financial situation, allowing for easier adjustments to stay on track.

To write a personal budget example, list your income sources and the amounts you receive each month. Follow this by detailing your expenses, categorizing them into fixed and variable items. You can use a Vermont Personal Monthly Budget Worksheet to arrange this information clearly, providing a concrete sample that illustrates how to balance your income and expenses effectively.

The 3 P's of budgeting are prioritized spending, planned savings, and purposeful tracking. This concept encourages you to prioritize essential expenses, plan for savings goals, and continuously track your spending habits. Implementing the Vermont Personal Monthly Budget Worksheet aligns perfectly with these principles, offering a structured way to manage your budget effectively.

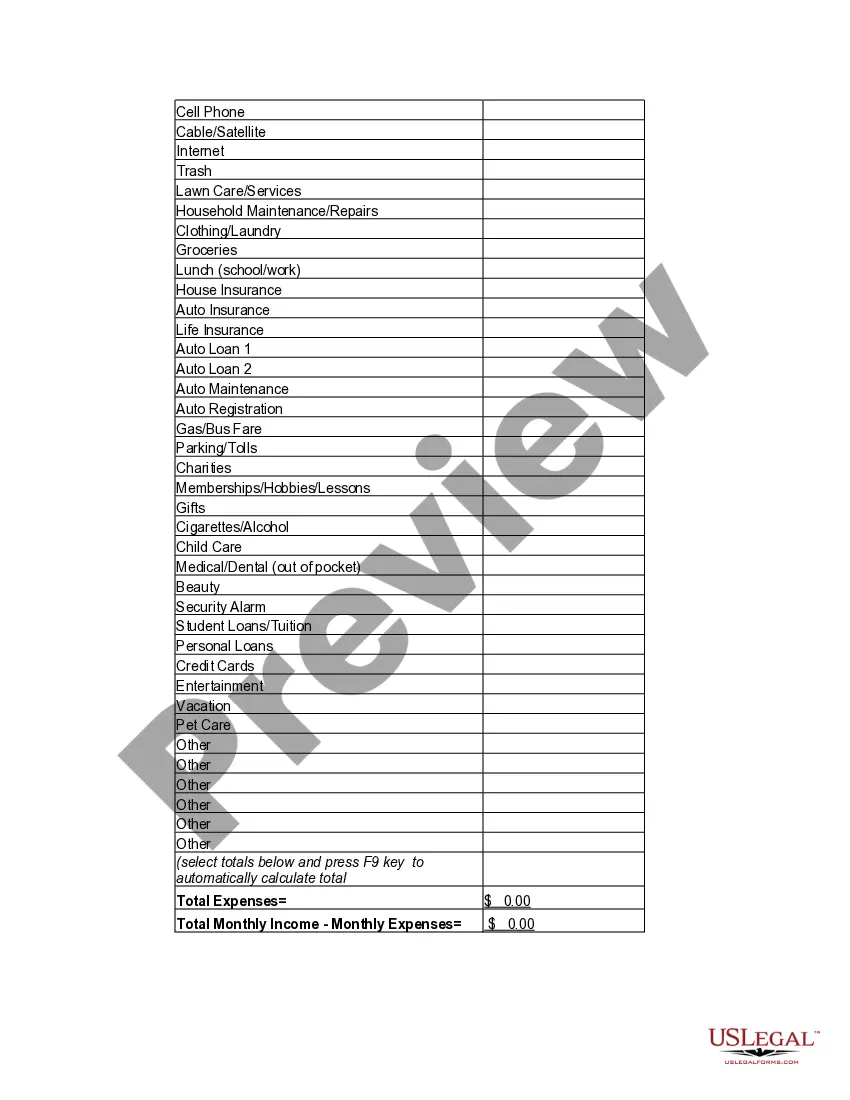

Filling out a monthly budget sheet is straightforward. Begin by entering your total income at the top of the sheet. Then, allocate specific amounts for each expense category, such as housing, food, transportation, and savings. A Vermont Personal Monthly Budget Worksheet provides designated spaces for these entries, making it easier for you to visualize your finances and adjust accordingly.

To write a personal monthly budget, start by listing your monthly income sources. Next, document your fixed and variable expenses, including necessities like rent, utilities, and groceries, and discretionary costs. After that, compare your total income with your total expenses. Utilizing a Vermont Personal Monthly Budget Worksheet can help track these figures effectively, ensuring you stay within your financial limits.

A good monthly personal budget allocates your income toward essential expenses, savings, and discretionary spending. Ideally, your budget should aim for the 50/30/20 rule, where 50% of your income goes to needs, 30% to wants, and 20% to savings. The Vermont Personal Monthly Budget Worksheet can help you set realistic targets based on your financial situation. By using this worksheet, you can ensure your budget reflects your priorities and supports your financial goals.

VT Form 114 is utilized for claiming the income sensitivity adjustment for property taxes. This adjustment can lower your property tax liability based on income levels. When you are working on your Vermont Personal Monthly Budget Worksheet, make sure to include any adjustments you qualify for, as they will significantly affect your overall budget plans.

Form 111 in Vermont is related to the income tax return. Specifically, it is the form used to apply for a tax refund for those who have overpaid during the tax year. Including any potential refunds in your Vermont Personal Monthly Budget Worksheet can provide a more accurate forecast of available funds for future expenses.

The household income for homestead declaration in Vermont includes all income from all sources for every member of the household. This total determines eligibility for tax reduction programs. Knowing your household income can significantly impact your Vermont Personal Monthly Budget Worksheet as it provides a clearer picture of your financial situation.

VT Form 113 is the Vermont Homestead Declaration form. It allows homeowners to declare their primary residence and potentially qualify for property tax benefits. Integrating this information into your Vermont Personal Monthly Budget Worksheet can ensure you capture all relevant expenses and benefits, leading to more effective budgeting.