This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Vermont Agreement between Mortgage Brokers to Find Acceptable Lender for Client

Description

How to fill out Agreement Between Mortgage Brokers To Find Acceptable Lender For Client?

Finding the right legitimate document design might be a have a problem. Needless to say, there are a variety of templates available on the net, but how can you obtain the legitimate type you require? Use the US Legal Forms website. The assistance delivers a huge number of templates, including the Vermont Agreement between Mortgage Brokers to Find Acceptable Lender for Client, that you can use for organization and private needs. All the varieties are inspected by experts and meet up with state and federal needs.

In case you are presently listed, log in to the bank account and then click the Down load key to get the Vermont Agreement between Mortgage Brokers to Find Acceptable Lender for Client. Make use of bank account to check with the legitimate varieties you may have ordered previously. Go to the My Forms tab of your respective bank account and obtain one more backup in the document you require.

In case you are a brand new user of US Legal Forms, listed below are easy directions that you should follow:

- First, ensure you have chosen the appropriate type for your area/state. You are able to look over the form utilizing the Preview key and study the form outline to make sure it is the right one for you.

- In case the type is not going to meet up with your needs, utilize the Seach industry to get the proper type.

- Once you are certain that the form is suitable, click the Get now key to get the type.

- Pick the costs program you need and enter in the essential information. Build your bank account and purchase an order making use of your PayPal bank account or Visa or Mastercard.

- Choose the file structure and download the legitimate document design to the device.

- Complete, edit and produce and signal the acquired Vermont Agreement between Mortgage Brokers to Find Acceptable Lender for Client.

US Legal Forms is definitely the most significant catalogue of legitimate varieties for which you will find various document templates. Use the company to download skillfully-created paperwork that follow condition needs.

Form popularity

FAQ

When borrowers work with a loan officer, they deal directly with the institution that will lend them money. When borrowers work with a mortgage broker, they work with a third party. The broker merely facilitates the process between the borrower and the lender.

Finance Brokers are the Agent of the Borrower Not the Lender - Elliott May.

A lender is a financial institution that makes loans directly to you. A broker does not lend money. A broker finds a lender. A broker may work with many lenders.

The main difference between a mortgage broker and lender is a broker doesn't lend you money. Instead, a mortgage broker helps you find the most suitable lender for your home purchase. A mortgage lender then provides the loan to you to buy the property.

A mortgage broker is a third party who will act on your behalf to arrange your home loan application. Instead of working directly with a bank or financial institution, a mortgage broker can work with various lenders to find the right home loan for you.

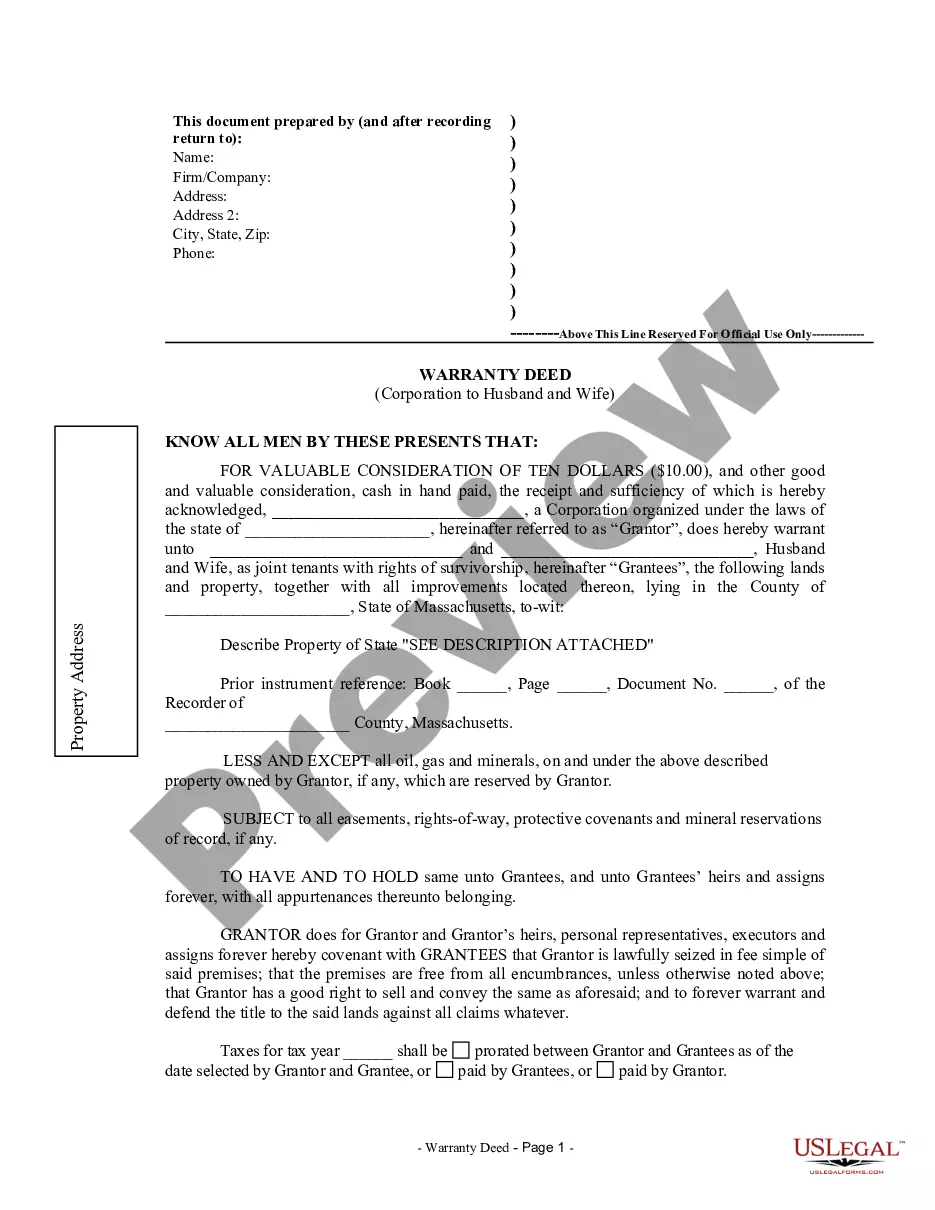

A mortgage broker agreement is a contract that outlines the terms of service and compensation, typically between a bank and a mortgage company or brokerage. Both parties sign this document before any work begins, ensuring that expectations are clear from the beginning.

10 Lead Generation Strategies for Mortgage Brokers Network. Networking is an extremely important way of finding new leads. ... Buy leads. ... Utilise social media. ... Use MLS listings. ... Get published. ... Optimise your website. ... Ask for referrals. ... Create a Google my business page.

When you're looking to buy a home, there are many people who can help you along the way. Two of the most important allies a homebuyer can have are a real estate agent, to help you find the right property, and a lender, to help you finance the purchase.