Vermont Receipt for Payment of Account

Description

How to fill out Receipt For Payment Of Account?

Are you presently inside a placement where you will need papers for possibly company or personal uses nearly every day? There are plenty of lawful document templates available on the net, but getting versions you can depend on is not simple. US Legal Forms offers a large number of form templates, such as the Vermont Receipt for Payment of Account, which can be published to satisfy federal and state specifications.

Should you be already informed about US Legal Forms website and have a free account, merely log in. Next, you may download the Vermont Receipt for Payment of Account format.

Unless you come with an bank account and want to begin using US Legal Forms, adopt these measures:

- Obtain the form you will need and make sure it is to the right area/county.

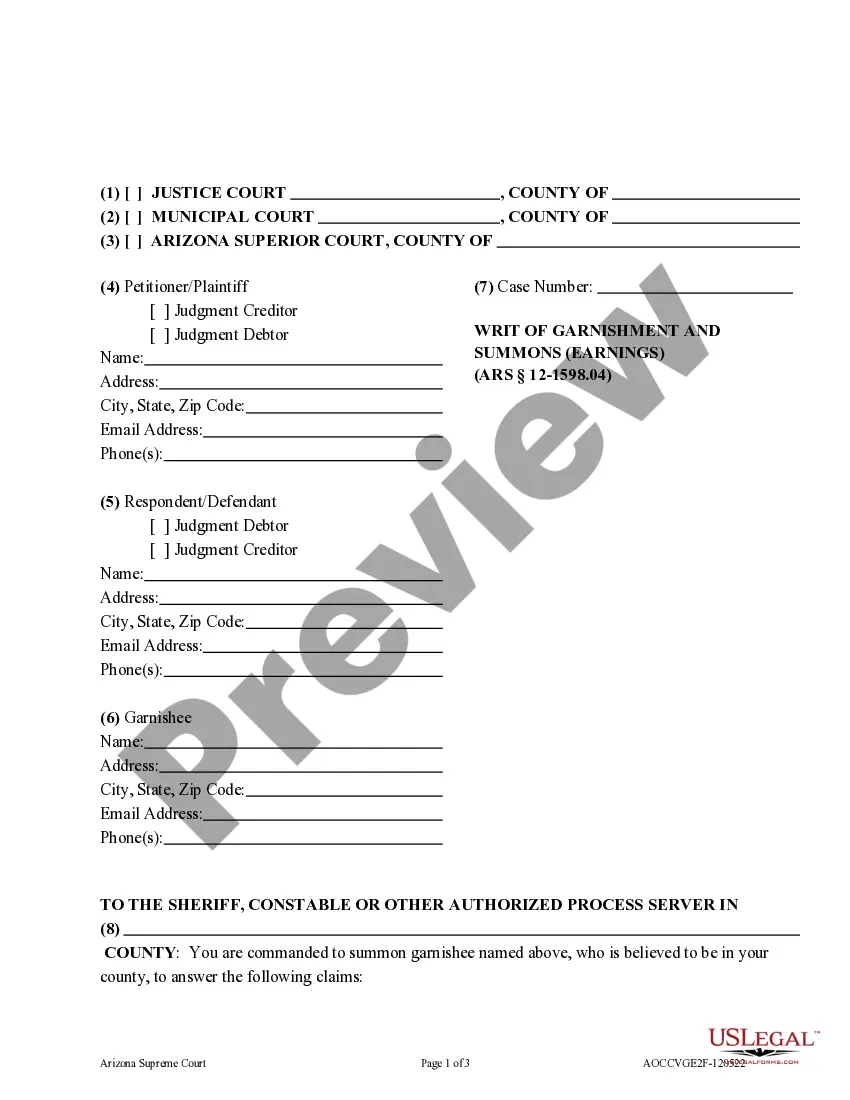

- Use the Preview button to analyze the form.

- See the explanation to ensure that you have selected the right form.

- In case the form is not what you`re trying to find, make use of the Look for industry to discover the form that suits you and specifications.

- Once you find the right form, simply click Get now.

- Opt for the prices strategy you would like, complete the specified info to create your money, and purchase your order with your PayPal or Visa or Mastercard.

- Choose a handy document file format and download your copy.

Find each of the document templates you have purchased in the My Forms food selection. You may get a more copy of Vermont Receipt for Payment of Account anytime, if possible. Just click on the needed form to download or print the document format.

Use US Legal Forms, the most comprehensive selection of lawful forms, to save time as well as stay away from blunders. The support offers appropriately manufactured lawful document templates which can be used for a selection of uses. Generate a free account on US Legal Forms and start producing your way of life a little easier.

Form popularity

FAQ

Other Ways You Can Pay Same-Day Wire ? Bank fees may apply. Check or Money Order ? Through U.S. mail. Cash ? Through a retail partner and other methods. Electronic Funds Withdrawal ? During e-filing.

Ways to Get Your. Vermont Income Tax Forms. Download fillable PDF forms from the web. Order forms online. Order forms by email. Order forms by phone. For a faster refund, e-file your taxes! For information on free e-filing and tax assistance for qualified taxpayers, visit .tax.vermont.gov.

PAYMENT METHODS ONLINE eCHECK. There is no cost to you for electronic check (eCheck) payments. ... ONLINE CREDIT OR DEBIT CARD. We accept major credit card and debit card payments. ... MAILED PAYMENTS. ... TELEPHONE PAYMENTS. ... PAY IN PERSON.

By Vermont law, property owners whose homes meet the definition of a Vermont ?homestead? must file a Homestead Declaration annually by the April due date. If eligible, you must file so that you are correctly assessed the homestead tax rate on your property.

Pay Online with myVTax Enter your account number and the routing number of your bank or financial institution into the secure online form. Be sure to double check the numbers and match them exactly as errors will result in processing delays, and additional interest and penalties may accrue.

How to Pay Taxes: 10 Ways to Pay Your Tax Bill Direct pay. Electronic Funds Withdrawal. Electronic Federal Tax Payment System. Credit and debit cards. Check or money order. Cash. Short-term payment plan. Long-term payment plan.

Pay Online You may pay your business and corporate income taxes, sales and use tax, meals and rooms tax, withholding, and miscellaneous taxes online by ACH debit or credit card.

Pay Online You may pay your business and corporate income taxes, sales and use tax, meals and rooms tax, withholding, and miscellaneous taxes online by ACH debit or credit card. If you file your return electronically you can submit your payment by Automated Clearing House (ACH) Debit.