This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Vermont Gift of Entire Interest in Literary Property

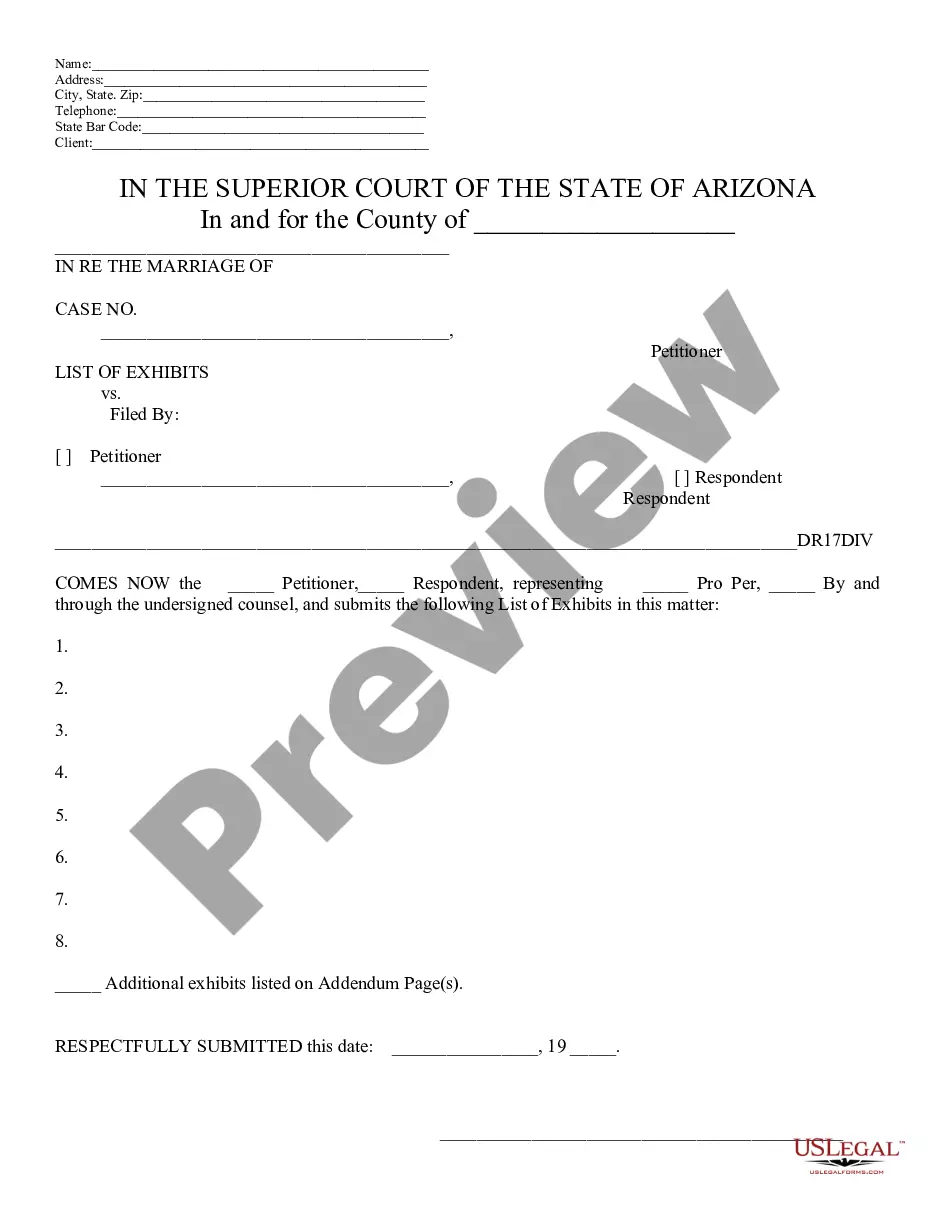

Description

How to fill out Gift Of Entire Interest In Literary Property?

If you wish to finalize, download, or print legal document templates, utilize US Legal Forms, the most extensive selection of legal forms available online.

Leverage the site’s simple and user-friendly search to locate the documents you need.

Various templates for business and personal purposes are classified by categories and states, or keywords.

Every legal document template you purchase belongs to you indefinitely.

You can access every form you acquired in your account. Click on the My documents section and select a form to print or download again. Stay competitive and download, and print the Vermont Gift of Complete Interest in Literary Property with US Legal Forms. There are thousands of professional and state-specific forms available for your business or personal requirements.

- Use US Legal Forms to obtain the Vermont Gift of Complete Interest in Literary Property with just a few clicks.

- If you are already a US Legal Forms user, sign in to your account and select the Acquire button to get the Vermont Gift of Complete Interest in Literary Property.

- You can also access forms you previously obtained in the My documents section of your account.

- For first-time users of US Legal Forms, follow the steps below.

- Step 1. Ensure you have selected the form appropriate for your area/region.

- Step 2. Use the Review option to examine the form’s details. Don’t forget to check the information.

- Step 3. If you are dissatisfied with the form, use the Search box at the top of the screen to find other versions of the legal form template.

- Step 4. Once you have found the form you need, select the Buy now button. Choose your preferred pricing plan and enter your details to sign up for an account.

- Step 5. Complete the transaction. You may use your credit card or PayPal account to finalize the payment.

- Step 6. Choose the format of the legal form and download it to your device.

- Step 7. Complete, modify, and print or sign the Vermont Gift of Complete Interest in Literary Property.

Form popularity

FAQ

The IRS can uncover unreported gifts by analyzing patterns in tax returns, reviewing financial transactions, and receiving third-party reports from banks and financial institutions. If you own a Vermont Gift of Entire Interest in Literary Property and do not report it, the IRS might discover it through various means. Accuracy is vital in your tax reporting to avoid unintended issues. Using USLegalForms can help ensure you have all required documentation ready.

Several factors can trigger a gift tax audit, including consistently high-value gifts, discrepancies in reported amounts, or unusual patterns in gifting behavior. The IRS pays attention to large transactions, particularly those related to a Vermont Gift of Entire Interest in Literary Property. Maintaining thorough and accurate documentation can help mitigate the risk of an audit. Using services like USLegalForms can assist in keeping everything organized.

Generally, the receiver of a gift does not need to report it to the IRS unless the gift generates income, such as rental income from property. For a Vermont Gift of Entire Interest in Literary Property, the recipient might have future tax obligations if they sell or earn income from it. However, typically, they are not responsible for reporting the gift itself. Always consult a tax professional for personalized advice.

The IRS knows about gifts primarily through tax returns and information reported by financial institutions. If you file a gift tax return for larger gifts, the IRS will be informed of your Vermont Gift of Entire Interest in Literary Property. Moreover, certain transactions may trigger reporting requirements. Keeping accurate records can help ensure compliance.

The annual exclusion is the amount you can gift each recipient without incurring a gift tax, which is adjusted annually. For 2023, this amount is $17,000 per recipient. This is especially relevant for high-value gifts such as a Vermont Gift of Entire Interest in Literary Property. Make sure to stay updated on this limit to maximize your gifting potential.

Yes, you can gift a piece of property, including a Vermont Gift of Entire Interest in Literary Property. However, keep in mind that specific reporting requirements exist if the gift exceeds the annual exclusion limit. It’s essential to ensure all the relevant paperwork is completed correctly. For a comprehensive solution, USLegalForms offers templates to simplify the gifting process.

If you don't report a gift to the IRS, you could face penalties and interest on any unpaid taxes. It's crucial to understand that the IRS requires you to report certain gifts, especially if they exceed the annual exclusion amount. Failing to report a Vermont Gift of Entire Interest in Literary Property could lead to complications down the line. To avoid problems, consider using a platform like USLegalForms to manage your gift documentation effectively.

Gifts of future interests in property refer to gifts that take effect at a later date rather than immediately. These can include trusts or conditional gifts that stipulate certain criteria before the recipient can access them. Understanding these types of gifts is important, especially in the context of Vermont Gift of Entire Interest in Literary Property. Uslegalforms can help clarify the requirements and implications of such gifts.

Your parents can gift you $30,000, but this may have gift tax implications. The IRS allows gifts up to a certain amount without tax, which may vary annually. If the gift exceeds the annual exclusion limit, they might need to file a gift tax return. For questions related to Vermont Gift of Entire Interest in Literary Property, uslegalforms can provide useful templates and information.

The gift tax on a $30,000 gift may depend on various factors, including the annual exclusion limit set by the IRS. In the United States, the annual exclusion for gifts is typically $15,000 per recipient. Since $30,000 exceeds this limit, the excess may be subject to gift tax unless it falls within your lifetime exemption. For complexities surrounding Vermont Gift of Entire Interest in Literary Property, consider using uslegalforms to get clear guidance.