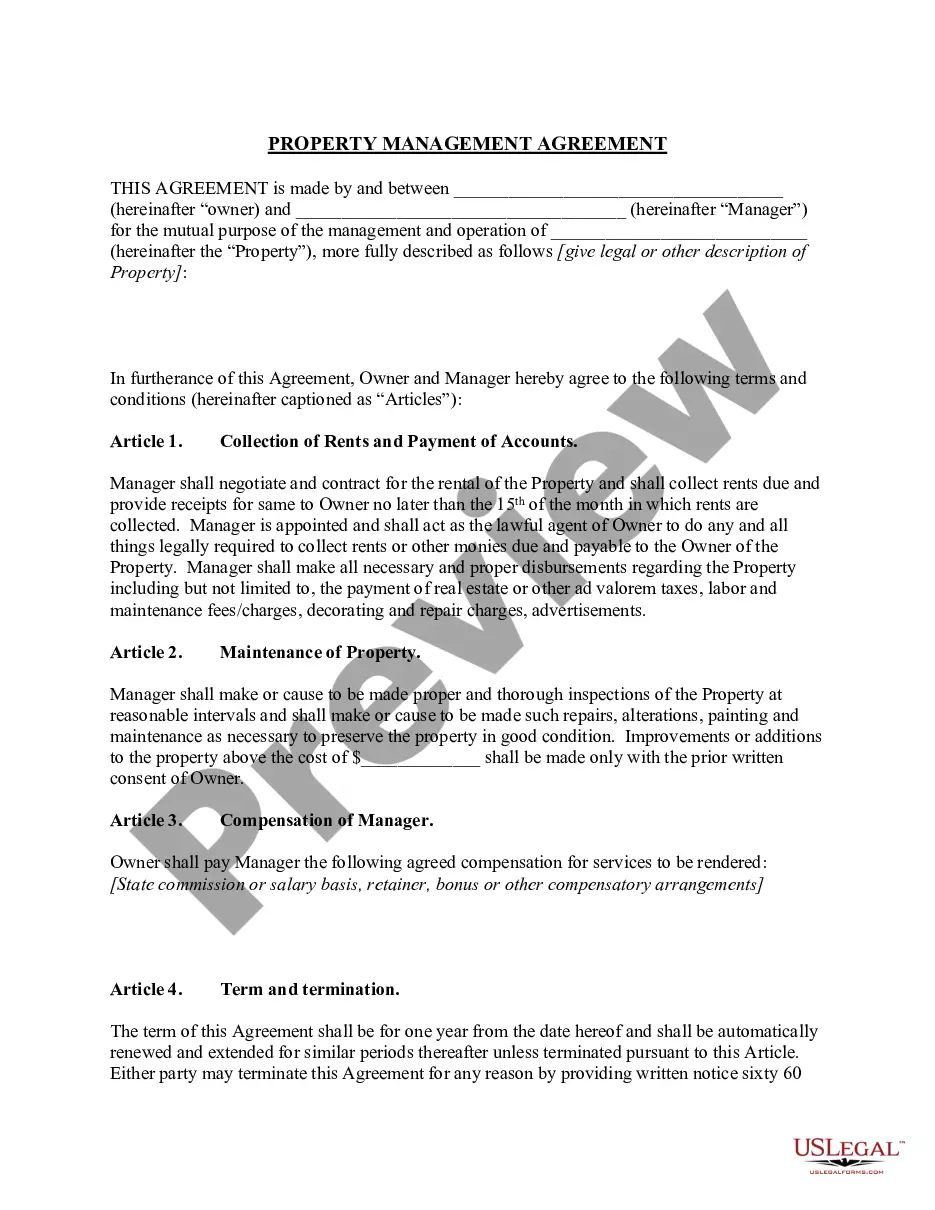

A Vermont Simple Promissory Note for Personal Loan is a legal document that outlines the terms and conditions of a loan agreement between a lender and a borrower in the state of Vermont. This document serves as evidence of a loan, and it ensures that both parties understand and agree to the terms laid out. The Vermont Simple Promissory Note for Personal Loan typically includes key details such as the names and contact information of the lender and borrower, the loan amount, the interest rate, the repayment schedule, and any late fees or penalties. It also specifies the terms of default and the consequences that may arise if the borrower fails to repay the loan as agreed. It is important to note that there may be different types or variations of the Vermont Simple Promissory Note for Personal Loan. These variations could include: 1. Secured Promissory Note: This type of promissory note includes a collateral agreement, whereby the borrower pledges an asset (such as a vehicle or property) as security for the loan. If the borrower defaults on the loan, the lender has the right to seize the collateral. 2. Unsecured Promissory Note: In contrast to a secured promissory note, an unsecured promissory note does not require collateral. This type of note relies solely on the borrower's promise to repay the loan without any additional security. 3. Demand Promissory Note: A demand promissory note allows the lender to request repayment of the loan at any time, without a specific repayment schedule. The borrower must repay the loan within a reasonable timeframe upon receiving a demand from the lender. 4. Installment Promissory Note: This type of promissory note divides the loan into equal installments, specifying the amount due, and the due dates for each payment. The borrower is required to repay the loan over a predetermined period, following the provided repayment schedule. The specific type of Vermont Simple Promissory Note for Personal Loan required may vary depending on the parties involved, the loan amount, and the terms agreed upon. It is essential for both the lender and the borrower to consult with a legal professional or seek appropriate legal advice when entering into a loan agreement to ensure that the promissory note accurately reflects their agreement and protects their rights.

Vermont Simple Promissory Note for Personal Loan

Description

How to fill out Vermont Simple Promissory Note For Personal Loan?

Have you been in the place that you need documents for possibly organization or personal functions just about every time? There are a lot of lawful file templates available on the Internet, but discovering ones you can trust is not effortless. US Legal Forms delivers a huge number of type templates, much like the Vermont Simple Promissory Note for Personal Loan, that are composed to satisfy state and federal requirements.

If you are currently familiar with US Legal Forms website and have an account, basically log in. Afterward, it is possible to obtain the Vermont Simple Promissory Note for Personal Loan format.

If you do not come with an account and wish to start using US Legal Forms, follow these steps:

- Get the type you need and ensure it is for that correct city/county.

- Make use of the Preview option to analyze the shape.

- Read the description to actually have selected the appropriate type.

- If the type is not what you are searching for, take advantage of the Look for area to obtain the type that suits you and requirements.

- Whenever you obtain the correct type, click Acquire now.

- Choose the costs plan you desire, submit the necessary info to generate your bank account, and pay for the order using your PayPal or bank card.

- Pick a practical paper format and obtain your duplicate.

Locate each of the file templates you have bought in the My Forms menu. You can obtain a additional duplicate of Vermont Simple Promissory Note for Personal Loan any time, if needed. Just go through the needed type to obtain or print the file format.

Use US Legal Forms, by far the most comprehensive collection of lawful varieties, in order to save time and stay away from blunders. The service delivers expertly manufactured lawful file templates which you can use for a variety of functions. Produce an account on US Legal Forms and initiate making your way of life a little easier.