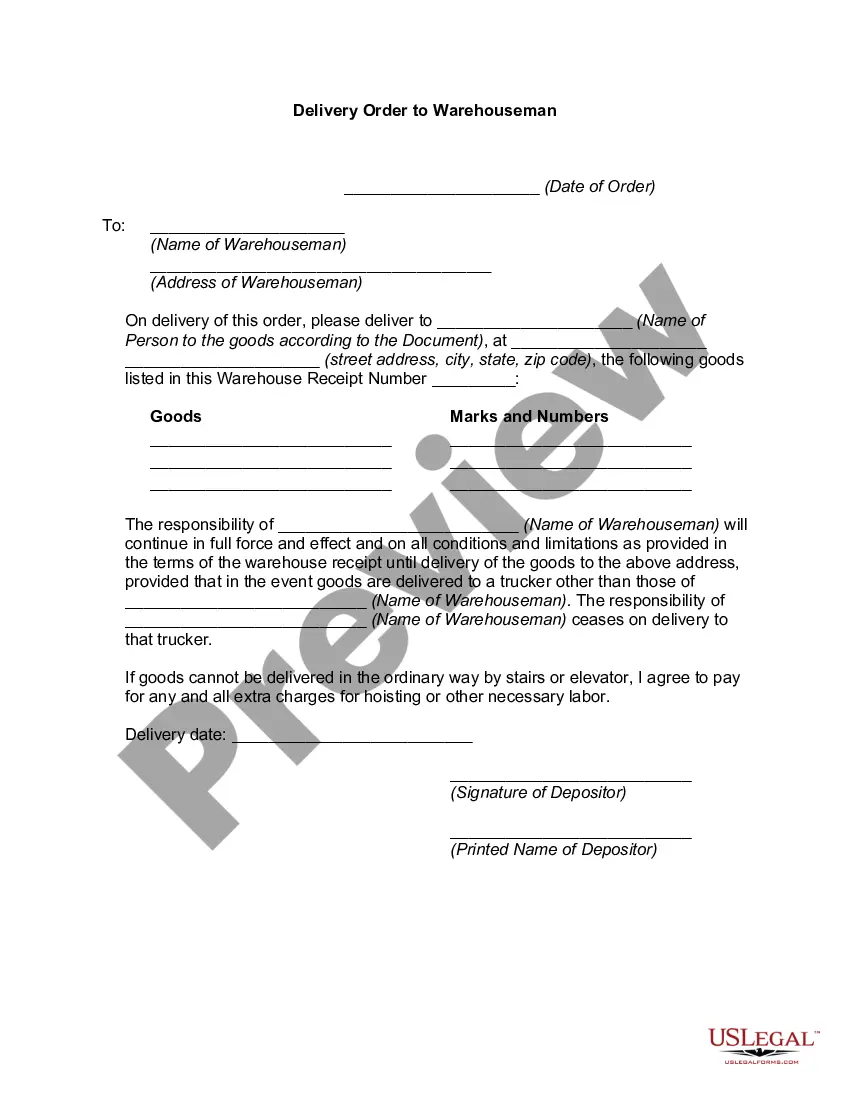

Vermont Delivery Order to Warehouseman

Description

How to fill out Delivery Order To Warehouseman?

If you desire to compile, obtain, or print legal document templates, utilize US Legal Forms, the largest assortment of legal forms, available online.

Employ the site's user-friendly and accessible search feature to locate the documents you need.

Numerous templates for business and personal purposes are categorized by types and states, or keywords.

Step 4. Once you have found the form you need, select the Acquire now button. Choose the payment plan you prefer and provide your details to register for the account.

Step 5. Process the transaction. You can use your credit card or PayPal account to complete the transaction.

- Use US Legal Forms to find the Vermont Delivery Order to Warehouseman in just a few clicks.

- If you are currently a US Legal Forms customer, Log In to your account and click the Download button to acquire the Vermont Delivery Order to Warehouseman.

- You can also access forms you previously downloaded in the My documents tab of your account.

- If you are using US Legal Forms for the first time, please refer to the instructions below.

- Step 1. Make sure you have selected the form appropriate for your area/state.

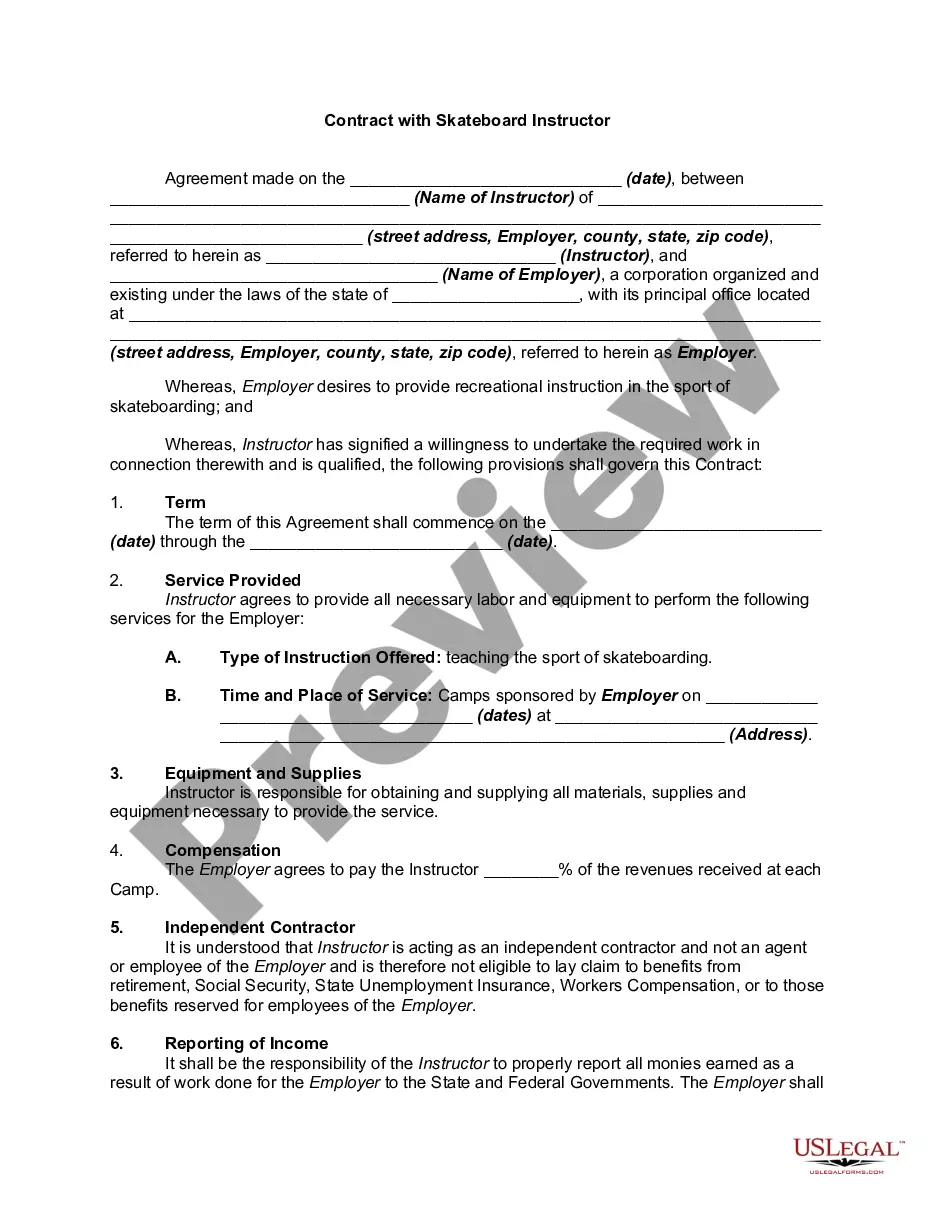

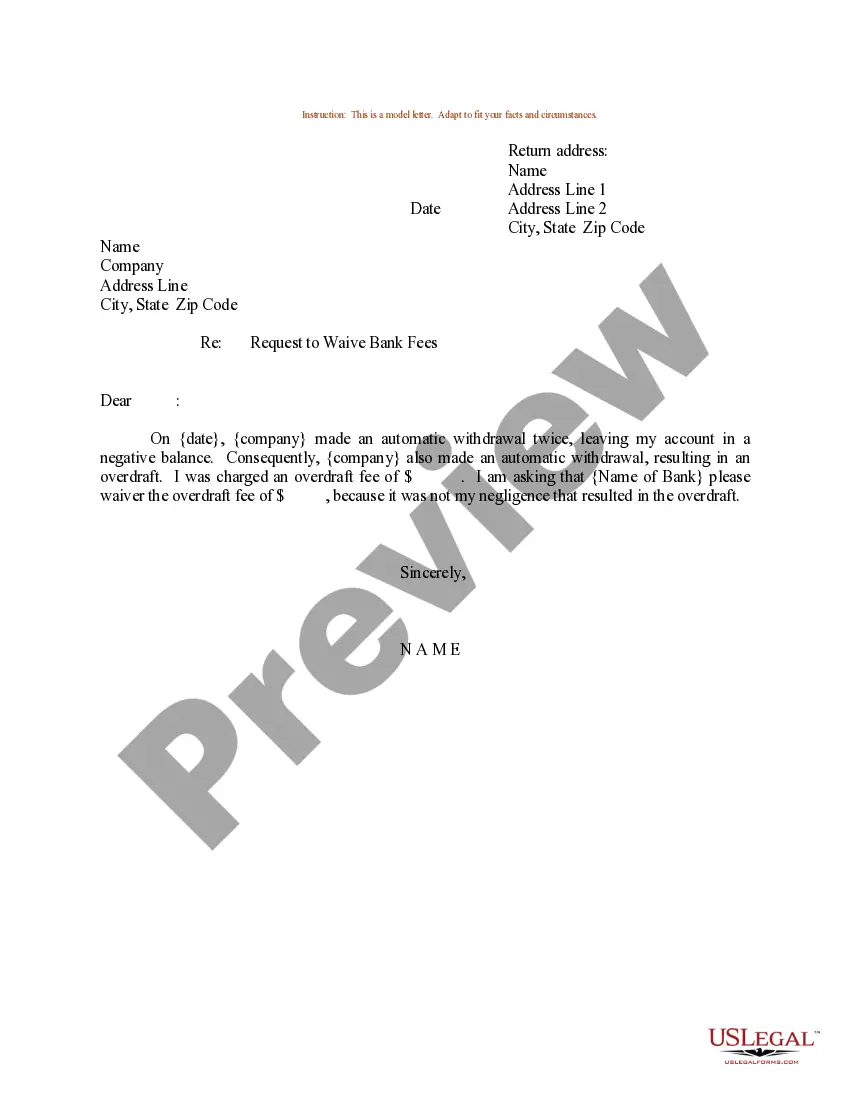

- Step 2. Use the Preview option to review the content of the form. Do not forget to read the description.

- Step 3. If you are not satisfied with the form, use the Search area at the top of the screen to find other legal form templates.

Form popularity

FAQ

The Form IN-111 in Vermont is used for reporting and collecting the property transfer tax. This form must be filed when a property is sold or transferred, ensuring compliance with state laws. Completing the IN-111 accurately is vital, particularly when managing your Vermont Delivery Order to Warehouseman.

To avoid taxes on property transfer in Vermont, you need to utilize exemptions properly. Certain transfers may be exempt under specific circumstances, such as gifts or transfers between family members. You might also consider using legal instruments, like those available on USLegalForms, to ensure correct handling of your Vermont Delivery Order to Warehouseman.

In Vermont, most services are not subject to sales tax. However, certain services related to property or specific goods may entail tax. For instance, services rendered directly related to the sale of tangible personal property can be taxable. Always consult local laws to ensure compliance when managing your Vermont Delivery Order to Warehouseman.

In Vermont, property tax rates vary by town and city. Generally, the average property tax rate hovers around 1.5% to 2% of the property's assessed value. It's important to check local regulations, as they can differ significantly. Understanding this is crucial, especially when preparing any Vermont Delivery Order to Warehouseman.