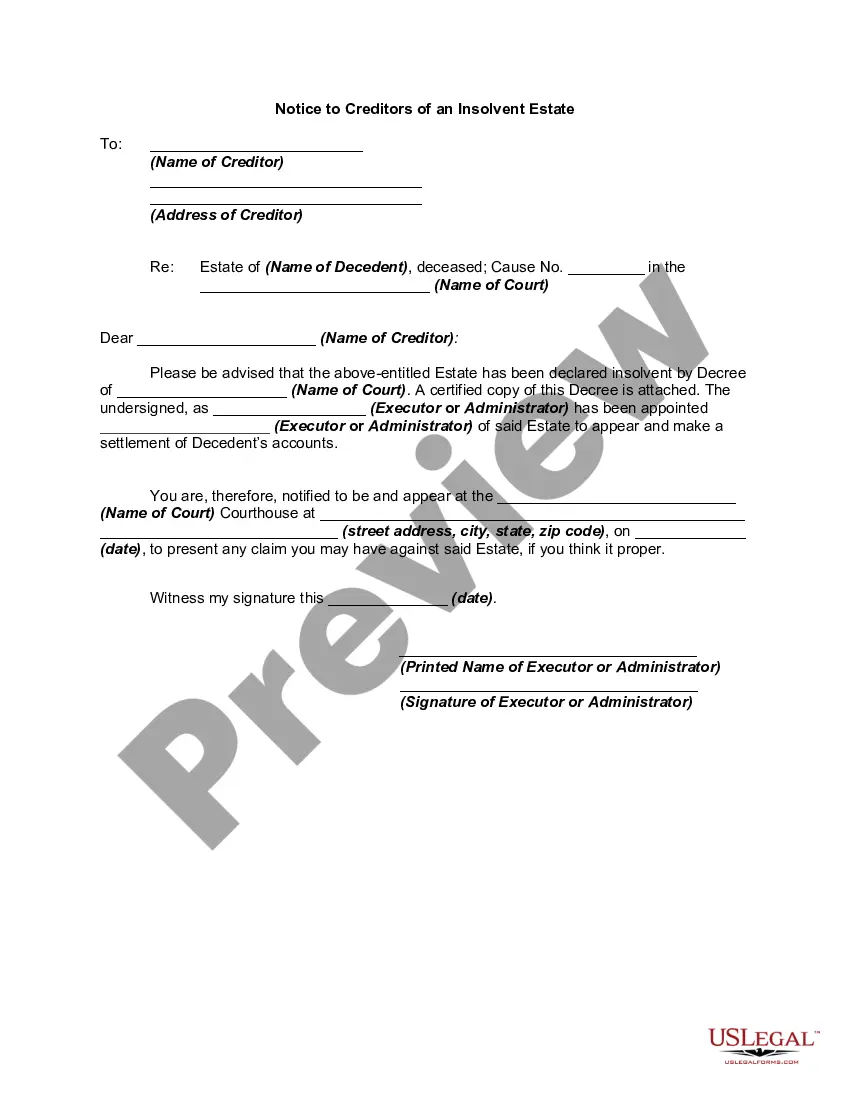

Almost every state has special statutory methods for the administration of insolvent estates. These statutes vary widely from one jurisdiction to another. Creditors of an insolvent estate generally have greater rights than creditors of solvent estates. For example, each creditor may have the right to be heard in opposition to claims of other creditors against the estate. If a creditor's opposition is successful, he or she thereby increases the amount available to pay his or her own claim.

Claims of creditors against an insolvent estate are general be paid pro rata. It is a breach of duty for a representative of an insolvent estate to prefer some creditors over others of the same class. Of course, if statutory preferences or priorities exist, payment of claims must be made accordingly.

Some jurisdictions do not have special statutory methods for the administration of insolvent estates. Some have statutory provisions only on particular phases of administration, for example, provisions prescribing the order in which debts of an insolvent estate are to be paid. Accordingly, in many cases the forms in other divisions of this title may be used, with appropriate modifications, in the administration of such an estate.

Vermont Notice to Creditors of an Insolvent Estate is a legal document that serves as a formal notification to creditors regarding the status of an insolvent estate in Vermont. When an individual passes away, their estate may be unable to cover all outstanding debts and liabilities, resulting in insolvency. In such cases, a Notice to Creditors of an Insolvent Estate is filed to inform creditors of the deceased person's inability to repay their debts fully. The purpose of this notice is to provide an opportunity for creditors to come forward, present their claims, and participate in the distribution of the estate's assets, if any. It is essential to understand that an insolvent estate may not have sufficient assets to cover all outstanding debts, and thus, creditors may only receive a portion of what is owed to them. By filing this notice, the estate's administrator or executor ensures transparency and fairness in the distribution process. Different types of Vermont Notice to Creditors of an Insolvent Estate can include: 1. Standard Notice to Creditors of an Insolvent Estate: This is the most common type of notice, where the estate's administrator or executor formally notifies creditors of the deceased individual's insolvency status and invites them to present their claims within a specific period. 2. Notice to Creditors of an Unsatisfied Judgment: In cases where the decedent owed a judgment debt that remains unpaid, a separate notice may be required to alert the creditors holding unsatisfied judgments against the insolvent estate. 3. Notice to Creditors of an Insolvent Business Estate: If the insolvent estate is a business, an additional notice specifically addressing creditors associated with the business may be required. This notice would outline the insolvency of the business estate and provide instructions on how creditors should proceed. Key phrases and keywords related to the Vermont Notice to Creditors of an Insolvent Estate: — Vermont probate la— - Insolvent estate proceedings — Creditor claimEdmontonon— - Distribution of assets — Insolvency notice requirement— - Legal notification for creditors — Estatadministrationio— - Executor or administrator duties — Creditors' right— - Unsatisfied judgments — Insolvent businesestateat— - Claims bar date — Debt repayment prioritizatio— - Estate assets and liabilities.