Vermont Stock Purchase Agreement between Two Sellers and One Investor with Transfer of Title Concurrent with Execution of Agreement

Description

How to fill out Stock Purchase Agreement Between Two Sellers And One Investor With Transfer Of Title Concurrent With Execution Of Agreement?

US Legal Forms - one of the most extensive collections of legal documents in the country - provides a variety of legal record templates that you can obtain or print.

When using the site, you will find numerous forms for both business and individual purposes, organized by categories, states, or keywords. You can easily locate recent versions of forms such as the Vermont Stock Purchase Agreement among Two Sellers and One Investor with Title Transfer Concurrent with the Execution of Agreement within moments.

If you already hold a membership, Log In to obtain the Vermont Stock Purchase Agreement among Two Sellers and One Investor with Title Transfer Concurrent with the Execution of Agreement from your US Legal Forms collection. The Download option will be visible on each document you view. You can access all previously saved forms in the My documents section of your account.

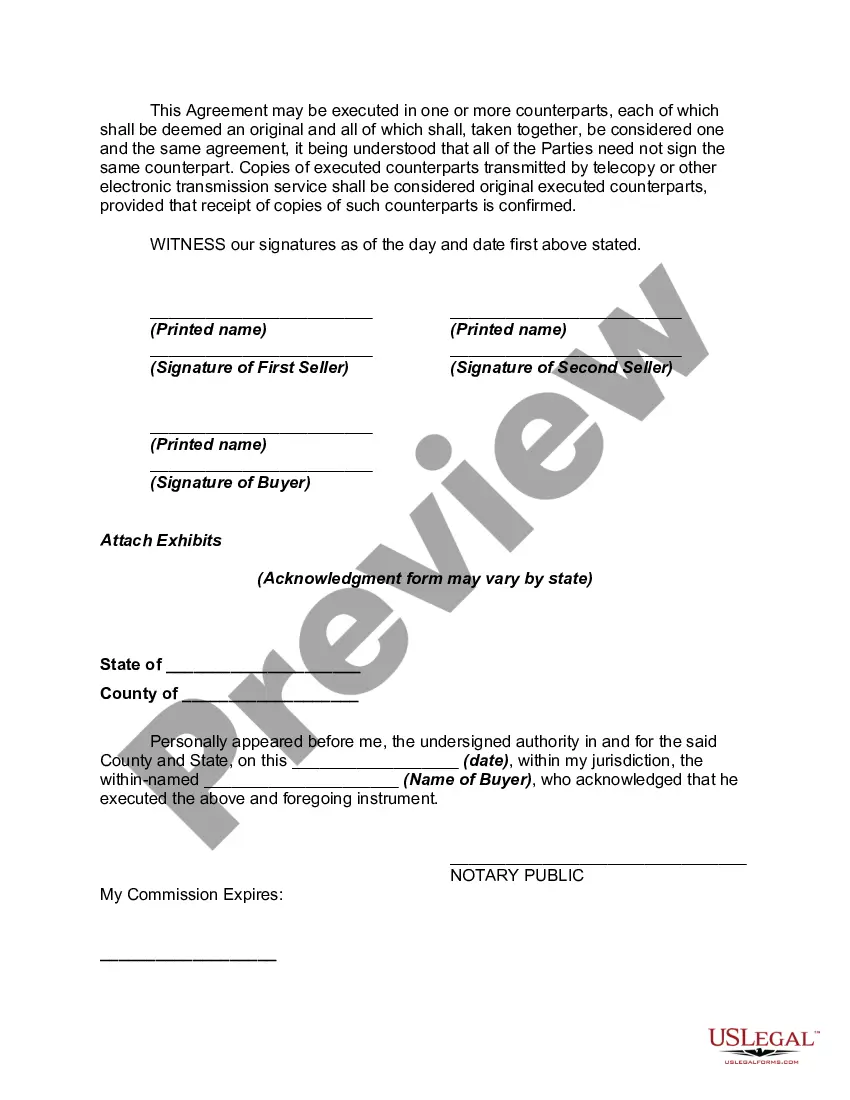

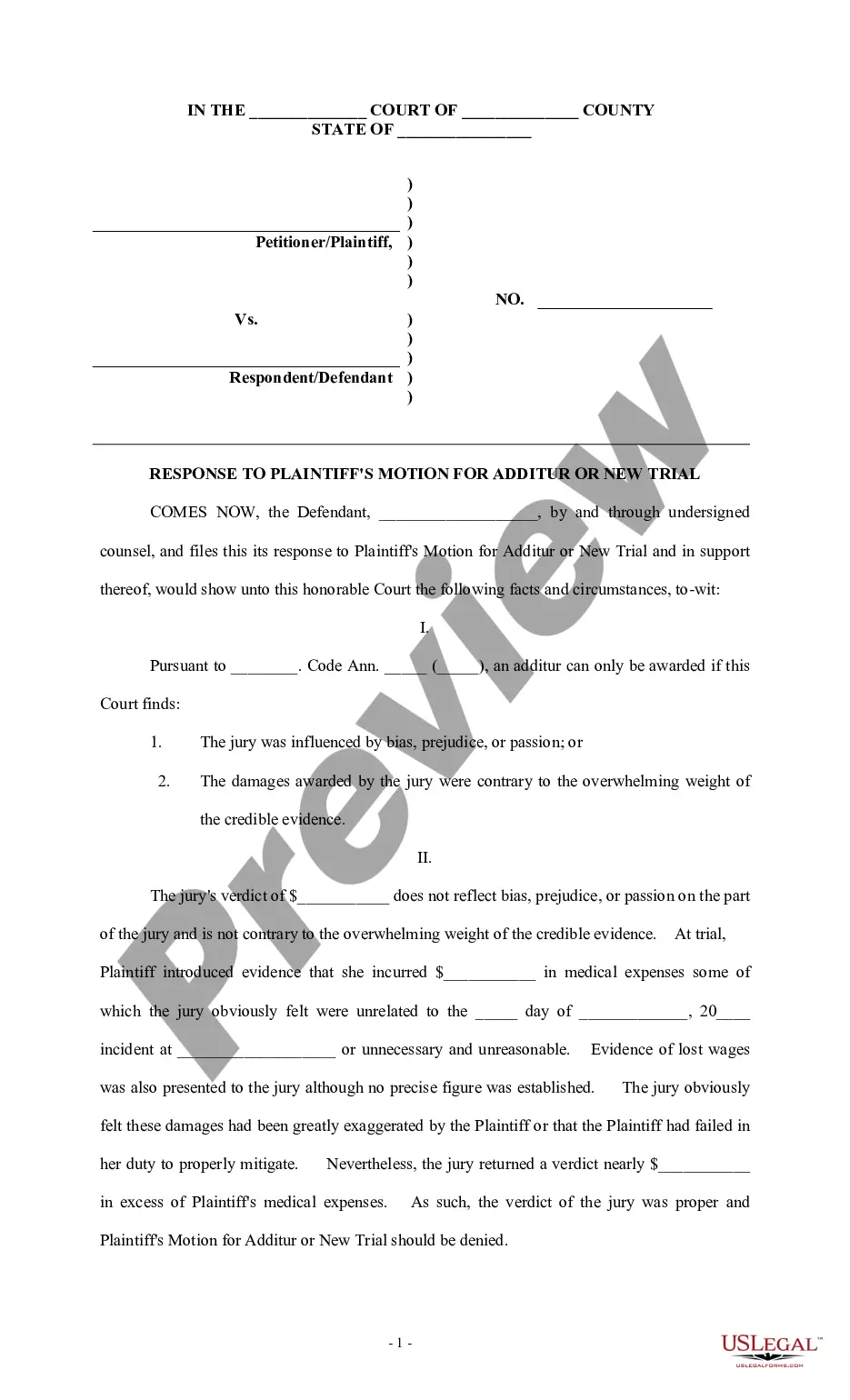

Make modifications. Fill in, edit, print, and sign the saved Vermont Stock Purchase Agreement among Two Sellers and One Investor with Title Transfer Concurrent with the Execution of Agreement.

Every template you have added to your account does not have an expiration date and is yours permanently. Therefore, if you wish to obtain or print an additional copy, simply navigate to the My documents section and click on the form you need.

Access the Vermont Stock Purchase Agreement among Two Sellers and One Investor with Title Transfer Concurrent with the Execution of Agreement through US Legal Forms, one of the most comprehensive collections of legal document templates. Utilize numerous professional and state-specific templates to meet your business or personal needs and requirements.

- If you are using US Legal Forms for the first time, follow these simple steps to get started.

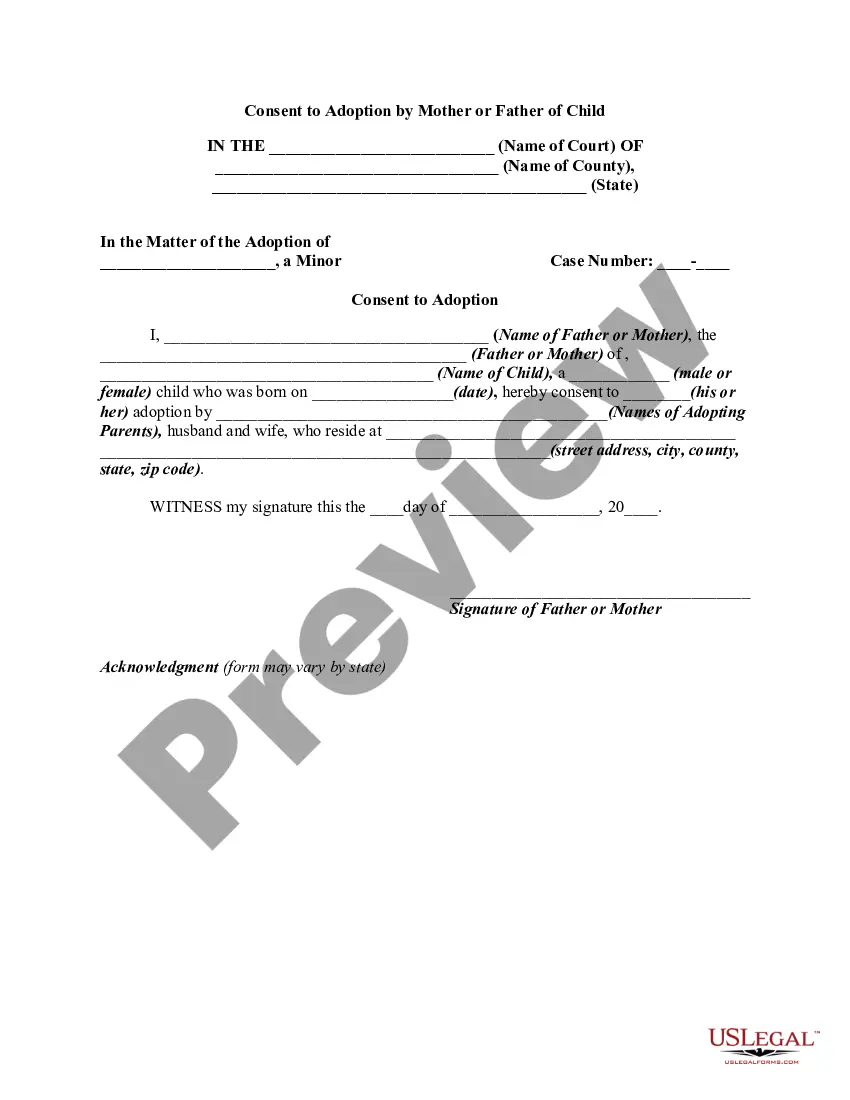

- Make sure you have selected the correct form for your area/region. Click on the Preview button to review the form's content. Check the form summary to ensure you have chosen the right form.

- If the form does not meet your requirements, utilize the Search area at the top of the screen to find one that does.

- Once you are satisfied with the form, confirm your selection by clicking the Acquire now button. Then, select the pricing plan you prefer and provide your details to register for the account.

- Process the transaction. Use your credit card or PayPal account to complete the purchase.

- Choose the format and download the form to your device.

Form popularity

FAQ

A restricted stock purchase agreement is a type of written agreement that places restrictions on the stockholder's rights with respect to the shares being issued. The restrictions generally restrict selling, transferring, etc.

It's important to include details about the type of shares being sold in your Share Purchase Agreement because the type of share will determine the buyer's voting rights, dividend yields, and percentage of ownership in the company.

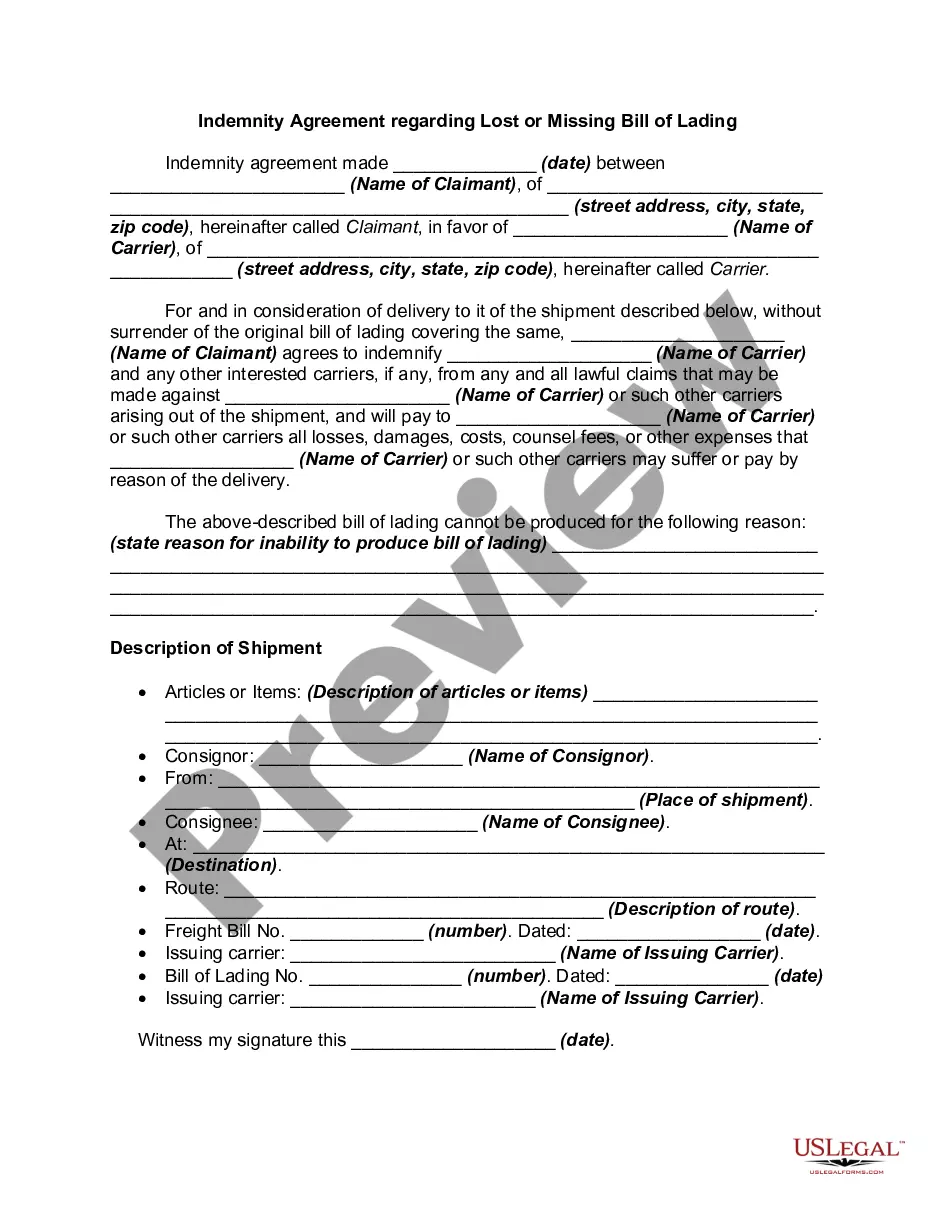

A transfer agreement is a legally binding document that conveys ownership from one person or entity to another.

Change in Ownership means any sale, disposition, transfer or issuance or series of sales, dispositions, transfers and/or issuances of shares of the capital stock by the Corporation or any holders thereof which results in any person or group of persons (as the term group is used under the Securities Exchange Act of

Transferring stocks is a straightforward process to complete.Request a Transfer of Stock Ownership form from your stockbroker or directly from the brokerage company.Write a letter with the instructions on the means of transfer to include with your Transfer of Stock Ownership form.More items...

A corporate stock transfer agreement, also known as a share purchase agreement or a stock purchase agreement, is used to sell or transfer one's shares in a company to another individual.

A Share Purchase Agreement, also called a Stock Purchase Agreement, is used to transfer the ownership of shares (also called stock) in a company from a seller to a buyer. Shares (or stock) are units of ownership in a company that are divided among shareholders (also called stockholders).

A shares transfer agreement, also known as a stock purchase agreement, is an legal document used to transfer the ownership of shares of stock. The party transferring shares could be a person or a company.

The advantage of a share purchase agreement is that the intentions of the parties are documented in a legally binding contract. There is often no need for the involvement of third parties.

A purchase contract is as legally binding as is stated in the agreement itself. A purchase agreement should stipulate acceptable reasons for a buyer backing out of a purchase. Otherwise, once it's signed, you stand to lose your earnest money deposit should you break your contract.