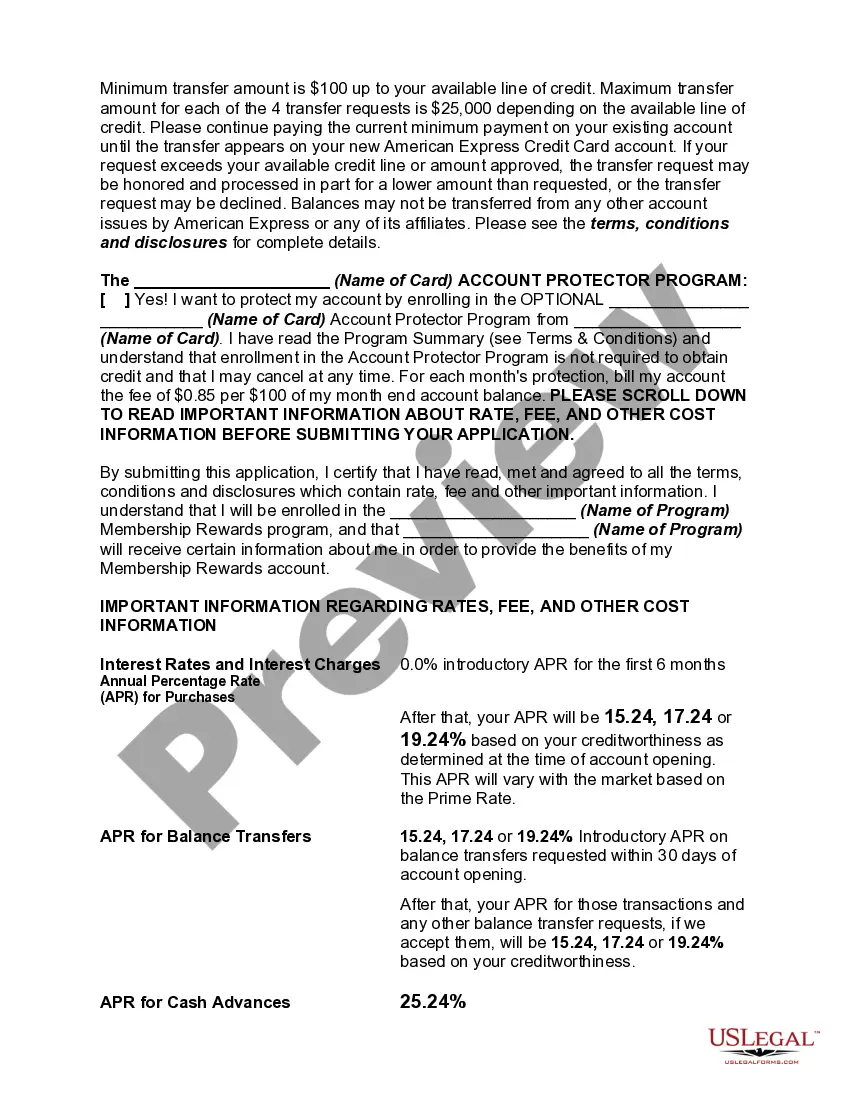

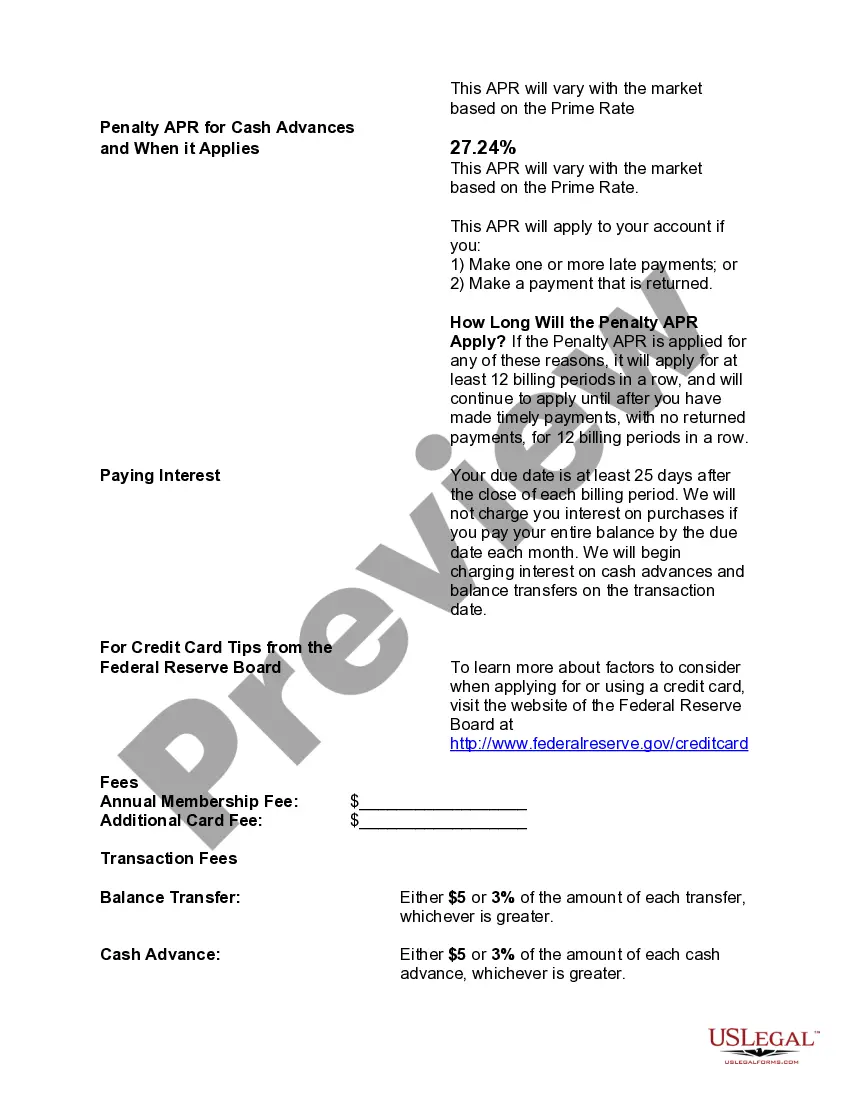

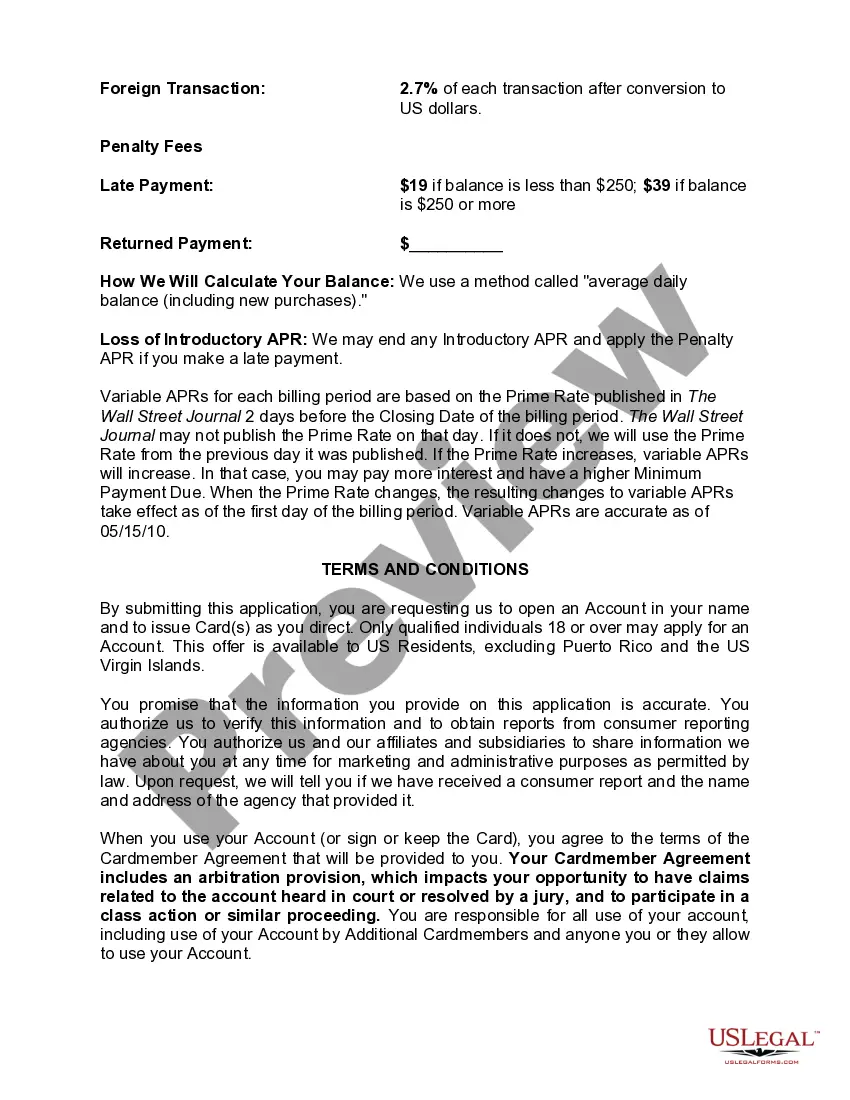

Vermont Credit Card Application with Bonus Features on Using Card: A Comprehensive Guide Introduction: If you are a resident of Vermont and you are searching for a credit card application that offers bonus features and rewards, you've come to the right place. In this article, we will walk you through the various types of credit card offers available in Vermont, highlighting their unique bonus features and benefits. Types of Vermont Credit Card Application with Bonus Features: 1. Vermont Rewards Credit Card: The Vermont Rewards Credit Card is designed to provide cardholders with exceptional rewards and benefits. By opting for this credit card, users can earn points on every purchase they make. These points can be redeemed for a wide range of rewards such as travel rewards, cashback, gift cards, and more. Some variants of the Vermont Rewards Credit Card also offer a sign-up bonus that includes a lump sum of points upon approval and additional points on meeting certain spending thresholds within the initial months. 2. Vermont Cashback Credit Card: For those who prefer cashback rewards, Vermont offers Cashback Credit Cards. By using this type of credit card, users can earn a certain percentage of their purchases as cashback. These cards typically have attractive introductory cashback offers, allowing cardholders to earn a higher percentage of cashback during the initial months of card usage. Additionally, some cards offer boosted cashback rates in specific categories such as gas, groceries, and dining. 3. Vermont Travel Credit Card: Vermont Travel Credit Cards are perfect for frequent travelers or those who wish to travel often. These cards offer bonus rewards on travel-related expenses such as flights, hotel stays, car rentals, and dining. Cardholders can accumulate travel points or miles that can be redeemed for discounted or free flights, hotel stays, and other travel perks. Many travel credit cards also provide access to exclusive airport lounges, travel insurance, and other travel-related benefits. Bonus Features and Using the Card: 1. Introductory 0% APR Period: Many Vermont credit card applications offer an introductory 0% annual percentage rate (APR) period for balance transfers and/or new purchases. This feature allows cardholders to pay off outstanding balances or make new purchases without incurring any interest charges for a specified period. It is essential to read the terms and conditions to know the length of the introductory period. 2. No Annual Fee: Several credit card options in Vermont have no annual fee. This means that cardholders can enjoy the benefits of their credit card without having to pay an annual fee for maintaining their account. However, it is crucial to review the terms and conditions of individual credit card offers as some may waive the annual fee for the first year only. 3. Fraud Protection and Security Measures: Vermont credit card applications prioritize the safety and security of their customers. Most credit cards come with advanced security features such as MV chip technology, contactless payments, and fraud protection services. These measures ensure that your transactions are secure and that you are promptly alerted in case of any suspicious activity on your account. Conclusion: Choosing the right Vermont credit card application with bonus features can significantly enhance your financial flexibility and help you make the most out of your purchases. Whether you are interested in earning rewards points, cashback, or travel benefits, it is crucial to compare multiple credit card options and their bonus features to find the one that aligns with your lifestyle and financial goals. Apply for your ideal Vermont credit card today and start reaping the benefits.

Vermont Credit Card Application with Bonus Features on Using Card

Description

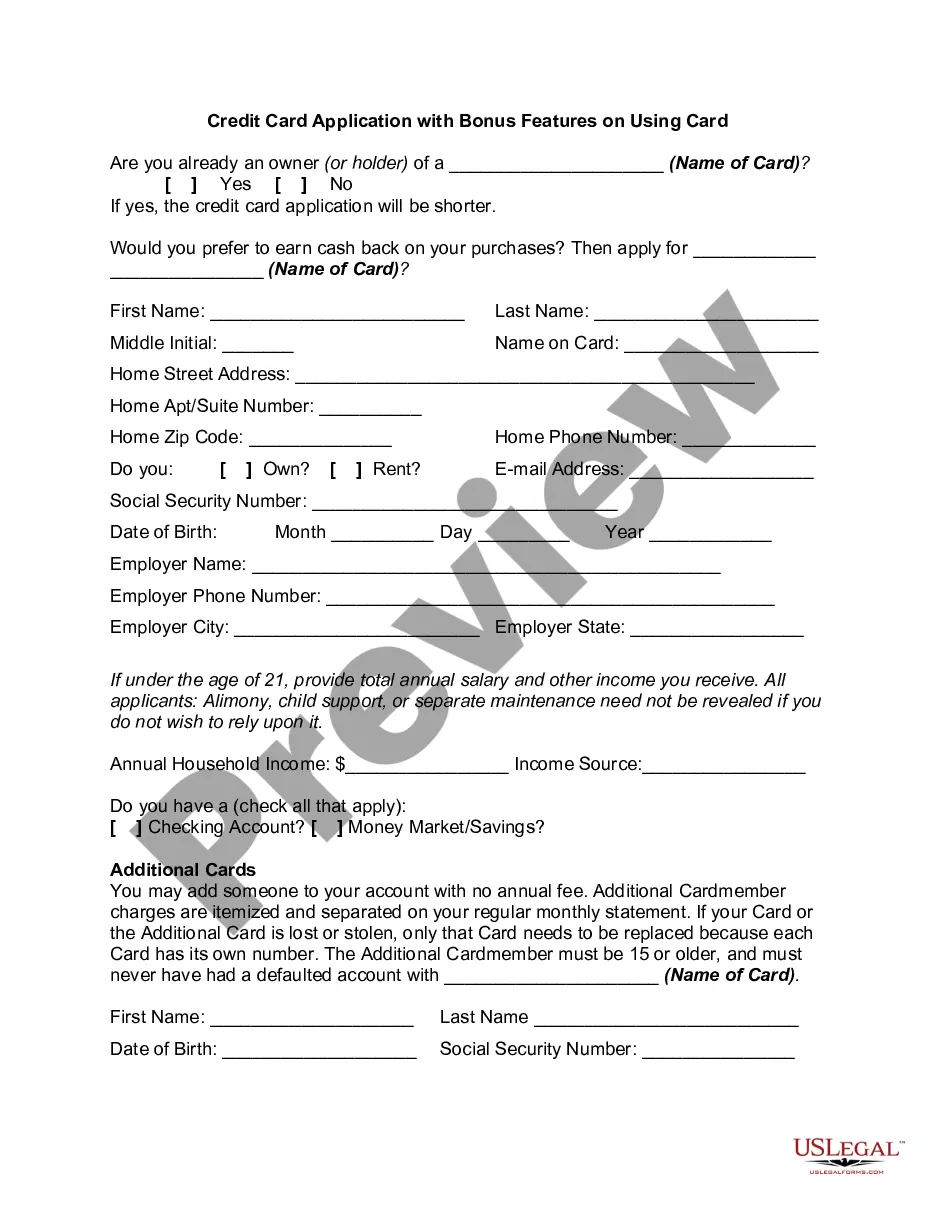

How to fill out Vermont Credit Card Application With Bonus Features On Using Card?

Choosing the right lawful papers template can be a have a problem. Of course, there are a variety of templates accessible on the Internet, but how can you find the lawful kind you require? Utilize the US Legal Forms website. The support offers a huge number of templates, like the Vermont Credit Card Application with Bonus Features on Using Card, that you can use for company and personal requires. Each of the kinds are examined by specialists and fulfill federal and state demands.

When you are previously registered, log in in your bank account and click the Download switch to obtain the Vermont Credit Card Application with Bonus Features on Using Card. Utilize your bank account to appear through the lawful kinds you have acquired in the past. Proceed to the My Forms tab of the bank account and obtain yet another version of your papers you require.

When you are a whole new user of US Legal Forms, allow me to share easy instructions that you should stick to:

- Initial, be sure you have selected the correct kind for the metropolis/county. You may look over the shape using the Review switch and browse the shape explanation to ensure it is the right one for you.

- When the kind will not fulfill your expectations, make use of the Seach area to discover the right kind.

- When you are positive that the shape would work, go through the Purchase now switch to obtain the kind.

- Choose the rates strategy you would like and type in the essential information. Build your bank account and pay money for an order using your PayPal bank account or charge card.

- Choose the file file format and acquire the lawful papers template in your product.

- Comprehensive, edit and printing and sign the attained Vermont Credit Card Application with Bonus Features on Using Card.

US Legal Forms may be the most significant local library of lawful kinds that you can discover numerous papers templates. Utilize the company to acquire skillfully-produced files that stick to condition demands.