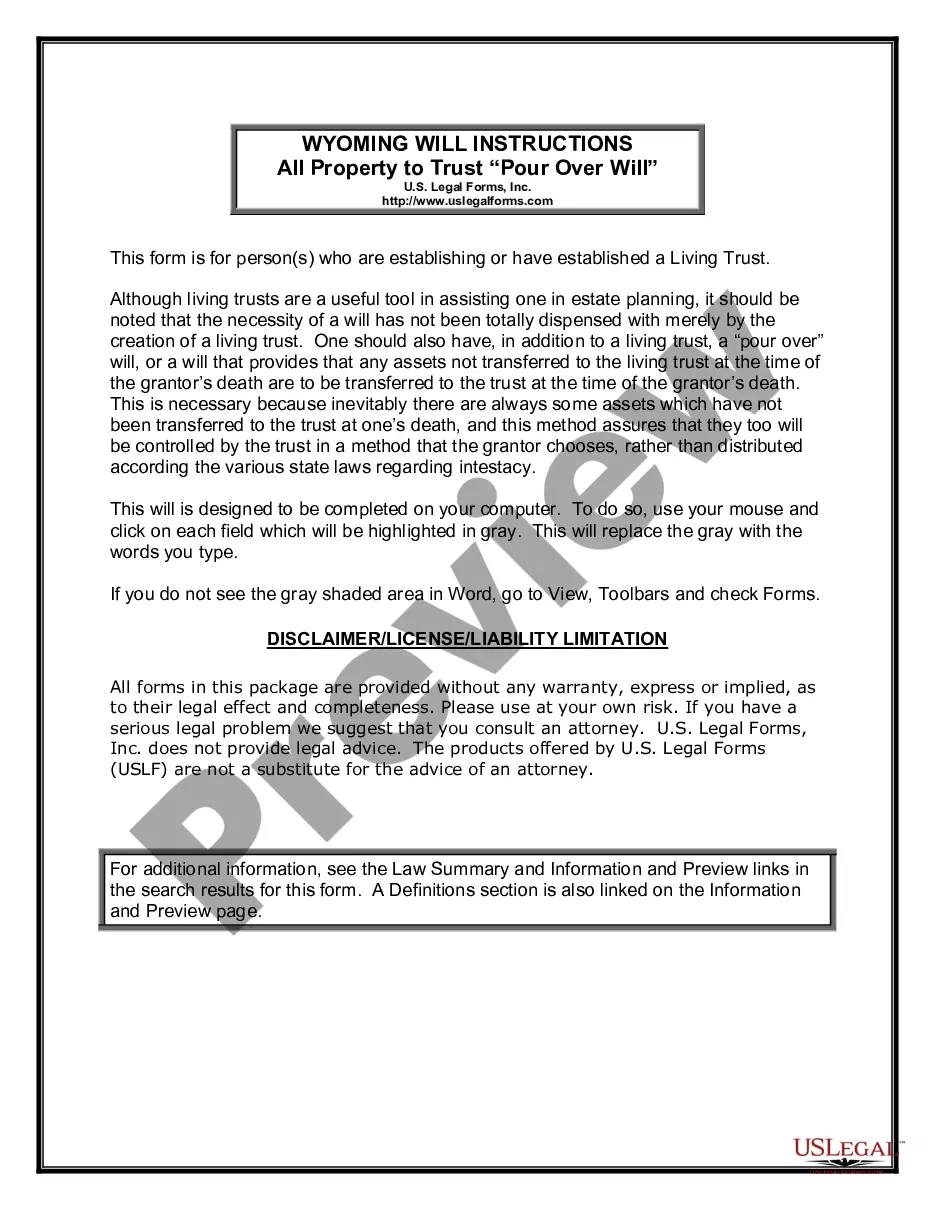

Keywords: Vermont, customer invoice, detailed description, types, billing, payment, sales, services, formatting, itemized, terms, due date, customization. Description: A Vermont customer invoice is a document issued by a business or service provider in the state of Vermont to their customers for the purpose of requesting payment for goods sold or services rendered. It serves as an official record of the transaction and outlines the details of the purchase or service, along with the amount due. Vermont customer invoices come in various types to cater to different billing needs and industries. Let's explore some common types: 1. Sales Invoice: This type of invoice is generated for customers when they purchase goods or products from a business in Vermont. Sales invoices typically include details such as the date of purchase, the itemized list of products with descriptions, quantity, unit price, and the total amount payable. 2. Service Invoice: Service-based businesses in Vermont, such as consultants, contractors, or freelancers, issue service invoices. These invoices detail the services provided, the duration or quantity of the service, hourly rates or fixed fees, and the total amount owed. 3. Recurring Invoice: For businesses that offer subscription-based services or recurring billing, recurring invoices are used. They are sent at regular intervals, such as monthly or annually, and contain the agreed-upon recurring charges for those services. 4. Proforma Invoice: A proforma invoice is a preliminary invoice issued before the completion of a transaction, mainly used for quoting prices, estimated costs, or outlining the terms of the sale. It provides an overview of the potential charges to be incurred by the customer. When generating a Vermont customer invoice, various aspects need to be considered. These include formatting, which typically involves including the business name, logo, address, contact details, and the customer's information. The invoice should also have a unique invoice number and the date of issuance. Additionally, a Vermont customer invoice requires accurate itemization of the goods or services provided, along with their corresponding prices and quantities. Subtotal, taxes, discounts, and any additional charges should be clearly mentioned, leading to the total amount payable. It is also important to include the payment terms and conditions, such as the due date, acceptable payment methods, and any late payment penalties or incentives. Many Vermont businesses customize their invoices to align with their branding, including the incorporation of specific colors, fonts, or business slogans. Customization allows the invoice to reflect the professionalism and identity of the business while maintaining clarity and adherence to relevant legal requirements. In conclusion, a Vermont customer invoice is an essential tool for businesses and service providers to facilitate smooth billing and payment processes. By utilizing different types of invoices, businesses can tailor their invoicing practices to specific industries or customers' needs, ensuring accurate and timely payment collections.

Vermont Customer Invoice

Description

How to fill out Vermont Customer Invoice?

US Legal Forms - one of the biggest libraries of lawful kinds in the USA - provides a variety of lawful document themes you may obtain or printing. Making use of the internet site, you may get a large number of kinds for company and personal uses, sorted by groups, says, or keywords.You can find the most recent types of kinds just like the Vermont Customer Invoice in seconds.

If you already have a registration, log in and obtain Vermont Customer Invoice in the US Legal Forms catalogue. The Download option can look on every single type you see. You have accessibility to all earlier delivered electronically kinds inside the My Forms tab of your profile.

If you wish to use US Legal Forms the very first time, here are basic recommendations to obtain began:

- Be sure you have picked the right type for your personal city/area. Click the Preview option to examine the form`s content material. Look at the type outline to ensure that you have chosen the right type.

- If the type does not satisfy your specifications, utilize the Research discipline near the top of the monitor to discover the one who does.

- When you are satisfied with the form, affirm your choice by clicking on the Get now option. Then, choose the rates program you like and supply your accreditations to register for an profile.

- Process the financial transaction. Use your bank card or PayPal profile to accomplish the financial transaction.

- Find the structure and obtain the form on your own gadget.

- Make alterations. Fill out, edit and printing and indication the delivered electronically Vermont Customer Invoice.

Each template you added to your money does not have an expiration date and it is yours forever. So, if you would like obtain or printing one more version, just visit the My Forms section and then click in the type you want.

Get access to the Vermont Customer Invoice with US Legal Forms, one of the most extensive catalogue of lawful document themes. Use a large number of skilled and express-certain themes that meet up with your small business or personal requirements and specifications.

Form popularity

FAQ

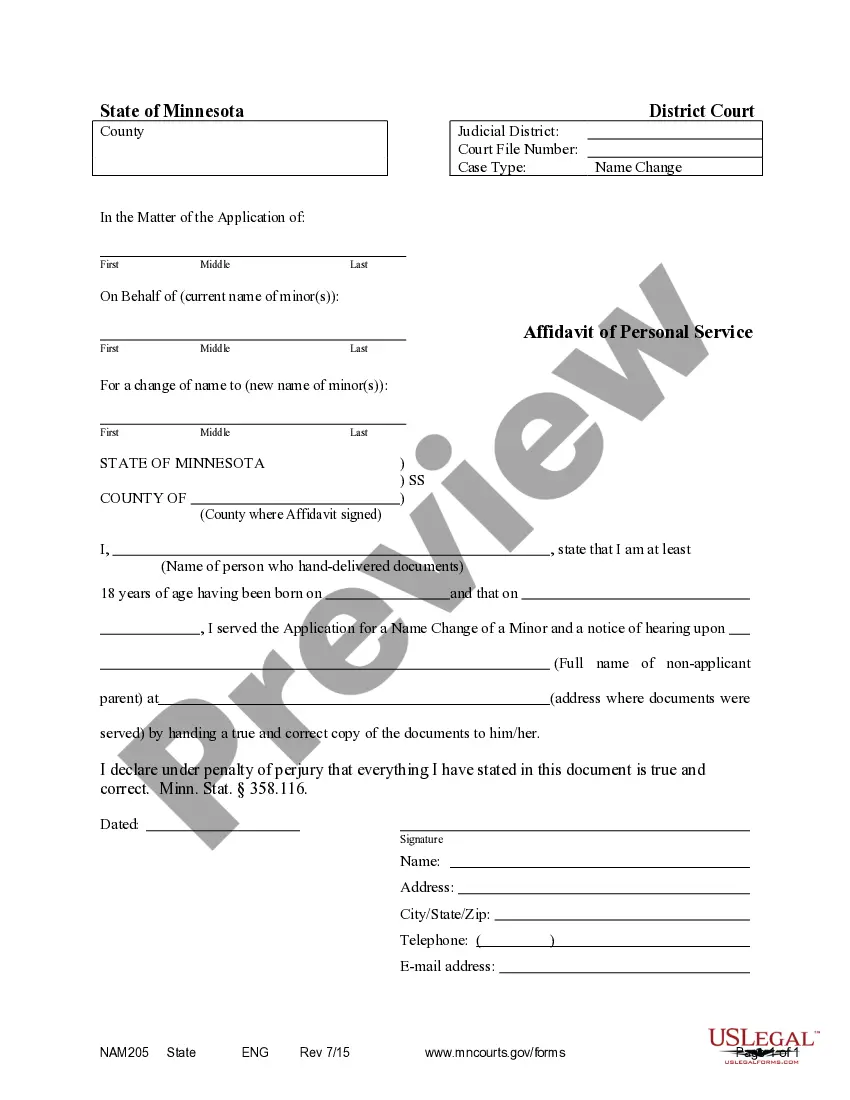

Invoices - what they must includethe company name and address of the customer you're invoicing. a clear description of what you're charging for. the date the goods or service were provided (supply date) the date of the invoice.

What to include on an invoiceThe word 'invoice' so that it stands out from quotes or estimates.A unique invoice number.Your complete information name, address and phone number.Customer's complete information name, address and phone number.Invoice date.List of products or services provided including cost.More items...

Your business's name and contact information. Your customer's billing information. A description of the goods or services rendered. A due date (so you get paid on time) Sales tax, if applicable.

However, all invoices should include five components:An invoice number.A date.Business contact information.Descriptions of goods and services.Payment terms.

How to Properly Fill Out an InvoiceCompany name, address, phone number, and email address.Customer name, address, phone number, and email address.Unique invoice number.Invoice date.The due date for payment by the customer.Line item type (service/hours/days/product/discount)Line item description.Unit price.More items...

What should be included in an invoice?1. ' Invoice'A unique invoice number.Your company name and address.The company name and address of the customer.A description of the goods/services.The date of supply.The date of the invoice.The amount of the individual goods or services to be paid.More items...?

What information should be on a Sales Invoice?a unique identification number - (Invoice Number)your company name, address and contact information.the company name and address of the customer you're invoicing.a clear description of what you're charging for.the date the goods or service were provided (supply date)More items...?

How to Fill out an Invoice Professional Invoicing ChecklistThe name and contact details of your business.The client's contact information.A unique invoice number.An itemized summary of the services provided.Specific payment terms.The invoice due date.The total amount owing on the invoice.

How to create an invoice: step-by-stepMake your invoice look professional. The first step is to put your invoice together.Clearly mark your invoice.Add company name and information.Write a description of the goods or services you're charging for.Don't forget the dates.Add up the money owed.Mention payment terms.

To make a sales invoice and get paid for your products, follow this easy guide:Add Your Company Logo.Include Contact Details.Include Customer Contact Information.Add the Date.Create a Detailed List of Goods Sold.Add the Total Cost.Add a Payment Due Date.Include Payment Terms.More items...?