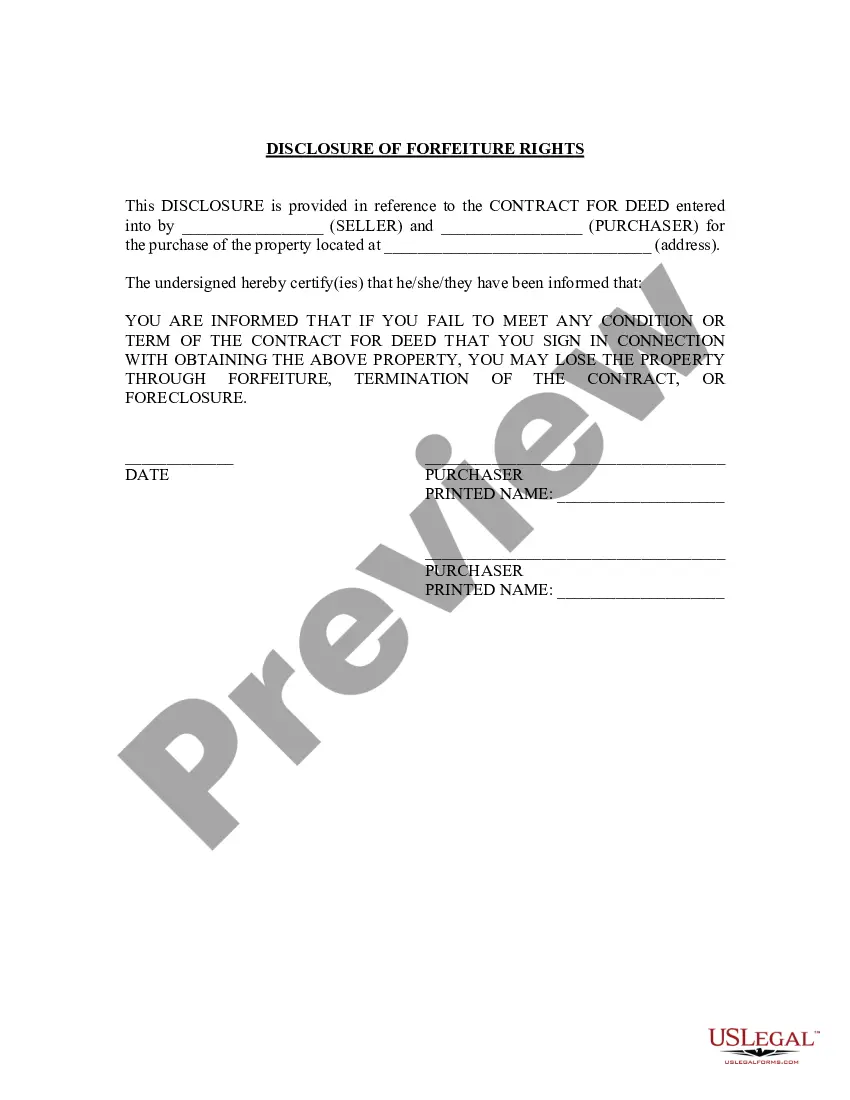

A Vermont Installment Promissory Note with Bank Deposit as Collateral is a legally binding document that outlines the terms and conditions under which a borrower agrees to repay a loan received from a lender. In this particular case, the borrower secures the loan by pledging a bank deposit as collateral. This type of promissory note provides stability and assurance to the lender in the event of default. The Vermont Installment Promissory Note with Bank Deposit as Collateral contains essential details such as the names and addresses of both the borrower and the lender, the loan amount, the interest rate, the repayment schedule, and any additional terms and conditions agreed upon. The note also specifies the consequences of default, including possible forfeiture of the pledged bank deposit. There are various types of Vermont Installment Promissory Notes with Bank Deposit as Collateral available, each tailored to specific borrowing situations. Some common variations include: 1. Personal Installment Promissory Note with Bank Deposit as Collateral: This type of note is used when an individual borrower secures a personal loan from a lender using their bank deposit as collateral. It is often used for smaller loan amounts. 2. Business Installment Promissory Note with Bank Deposit as Collateral: This version is designed for business entities looking to secure funds using a bank deposit as collateral. It offers flexibility in terms of loan amounts and repayment schedules to accommodate the varying needs of businesses. 3. Real Estate Installment Promissory Note with Bank Deposit as Collateral: For borrowers looking to finance real estate investments, this type of note allows them to pledge a bank deposit as collateral. It includes specific terms relevant to real estate transactions, such as property descriptions and additional contingencies. Regardless of the type of Vermont Installment Promissory Note with Bank Deposit as Collateral, it is crucial for both parties to thoroughly review and understand the terms and conditions before signing the document. Consulting with legal professionals may be beneficial to ensure compliance with state laws and to protect the rights and interests of the involved parties.

Vermont Installment Promissory Note with Bank Deposit as Collateral

Description

How to fill out Vermont Installment Promissory Note With Bank Deposit As Collateral?

US Legal Forms - among the largest libraries of legal forms in the USA - provides a variety of legal file web templates you may obtain or print. While using website, you will get a large number of forms for company and personal purposes, categorized by categories, suggests, or key phrases.You can get the most up-to-date types of forms just like the Vermont Installment Promissory Note with Bank Deposit as Collateral in seconds.

If you currently have a monthly subscription, log in and obtain Vermont Installment Promissory Note with Bank Deposit as Collateral from your US Legal Forms local library. The Down load switch will appear on each and every develop you see. You have access to all previously delivered electronically forms within the My Forms tab of your respective account.

If you wish to use US Legal Forms the first time, allow me to share easy guidelines to help you get started:

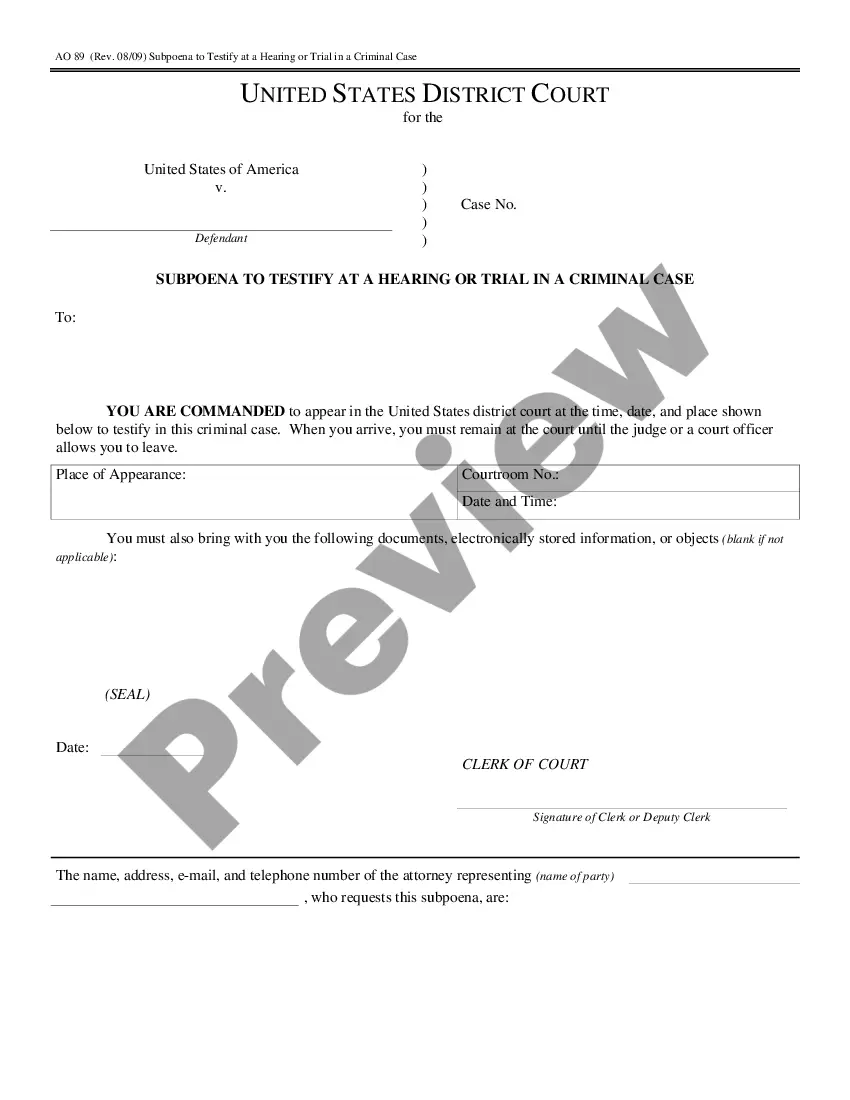

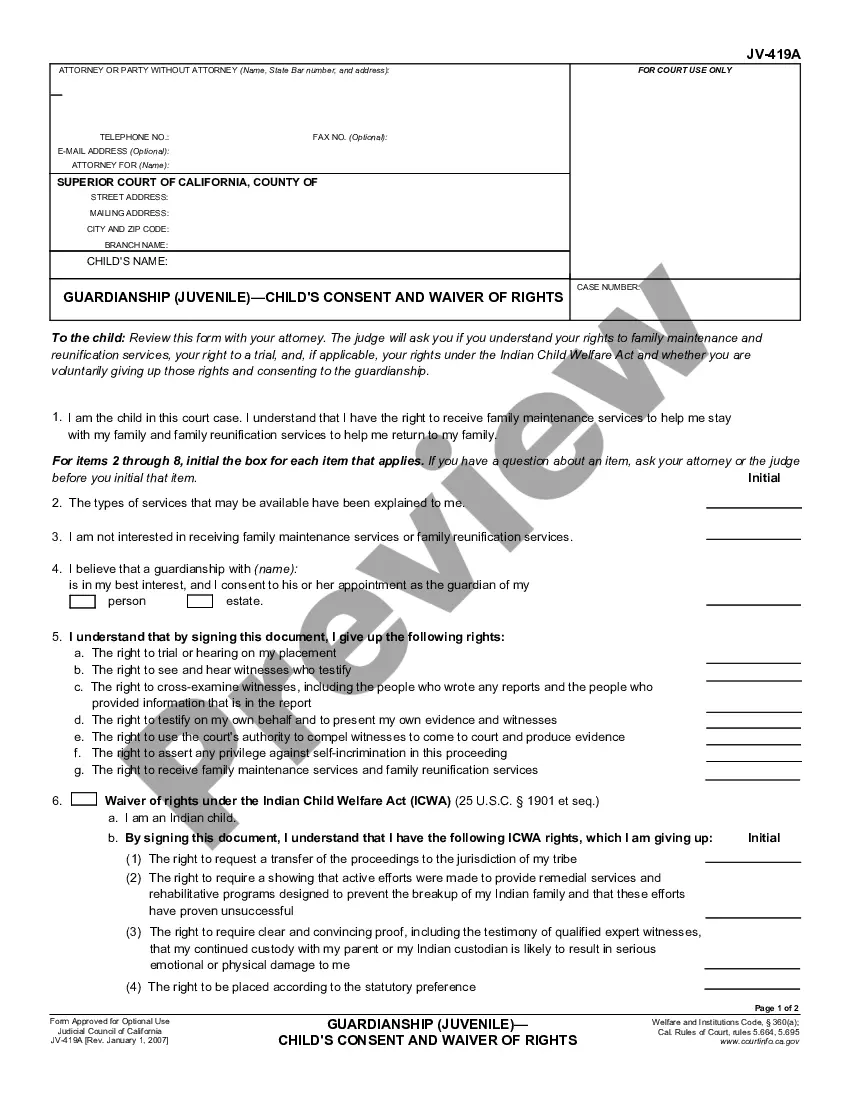

- Be sure to have selected the proper develop for your area/state. Select the Review switch to analyze the form`s information. Look at the develop description to actually have selected the correct develop.

- In case the develop does not suit your specifications, make use of the Search industry at the top of the screen to discover the one which does.

- When you are happy with the shape, verify your option by clicking on the Acquire now switch. Then, opt for the rates prepare you want and offer your references to register to have an account.

- Approach the deal. Use your charge card or PayPal account to accomplish the deal.

- Select the structure and obtain the shape on the product.

- Make alterations. Fill out, edit and print and signal the delivered electronically Vermont Installment Promissory Note with Bank Deposit as Collateral.

Every web template you put into your money does not have an expiry day which is your own forever. So, in order to obtain or print an additional version, just check out the My Forms portion and click about the develop you will need.

Get access to the Vermont Installment Promissory Note with Bank Deposit as Collateral with US Legal Forms, probably the most considerable local library of legal file web templates. Use a large number of expert and condition-distinct web templates that meet up with your business or personal demands and specifications.

Form popularity

FAQ

Financial institutions such as banks and lenders often use promissory notes when issuing real estate mortgage loans or student loans. Companies or individuals also use promissory notes when issuing or taking on personal loans or corporate loans.

If you are borrowing money from a lending institution, they will have someone on staff who creates a promissory note. However, if you need a promissory note for a personal loan or a loan between friends and family, you can contact a lawyer or financial professional to help you create a promissory note.

A bank can issue a promissory note, but so can an individual or a company or business. Anyone who lends money can do so. A promissory note isn't a contract, but you'll likely have to sign one before you take out a mortgage.

The Difference Between a Promissory Note & a Mortgage. The main difference between a promissory note and a mortgage is that a promissory note is the written agreement containing the details of the mortgage loan, whereas a mortgage is a loan that is secured by real property.

Although it's a legal document, writing a promissory note doesn't have to be difficult. There are even websites online that offer fill-in-the-blank templates, like or .

If you're signing a promissory note, make sure it includes these details:Date. The promissory note should include the date it was created at the top of the page.Amount.Loan terms.Interest rate.Collateral.Lender and borrower information.Signatures.17-Apr-2019

Although a promissory note is usually written on a computer and printed out or a pre-made form is filled out, a handwritten promissory note signed by both parties is legal and will stand up in court.

If you are borrowing money from a lending institution, they will have someone on staff who creates a promissory note. However, if you need a promissory note for a personal loan or a loan between friends and family, you can contact a lawyer or financial professional to help you create a promissory note.

In order for a promissory note to be valid and legally binding, it needs to include specific information. "A promissory note should include details including the amount loaned, the repayment schedule and whether it is secured or unsecured," says Wheeler.

In order for a promissory note to be valid and legally binding, it needs to include specific information. "A promissory note should include details including the amount loaned, the repayment schedule and whether it is secured or unsecured," says Wheeler.