A check disbursements journal is a book used to record all payments made in cash such as for accounts payable, merchandise purchases, and operating expenses.

Vermont Check Disbursements Journal

Description

How to fill out Check Disbursements Journal?

If you need to complete, download, or create official document templates, utilize US Legal Forms, the largest collection of official forms, which are accessible online.

Employ the website's simple and user-friendly search feature to locate the documents you require. Various templates for business and personal purposes are categorized by regions and states, or keywords.

Use US Legal Forms to find the Vermont Check Disbursements Journal in just a few clicks.

Every official document format you purchase is yours permanently. You can access each form you have saved in your account. Click on the My documents section and select a form to print or download again.

Complete and download, and print the Vermont Check Disbursements Journal using US Legal Forms. There are numerous professional and state-specific forms available for your business or personal needs.

- If you are a current US Legal Forms user, sign in to your account and select the Download option to acquire the Vermont Check Disbursements Journal.

- You can also access forms you have previously saved in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

- Step 1. Ensure you have selected the form for the correct area/state.

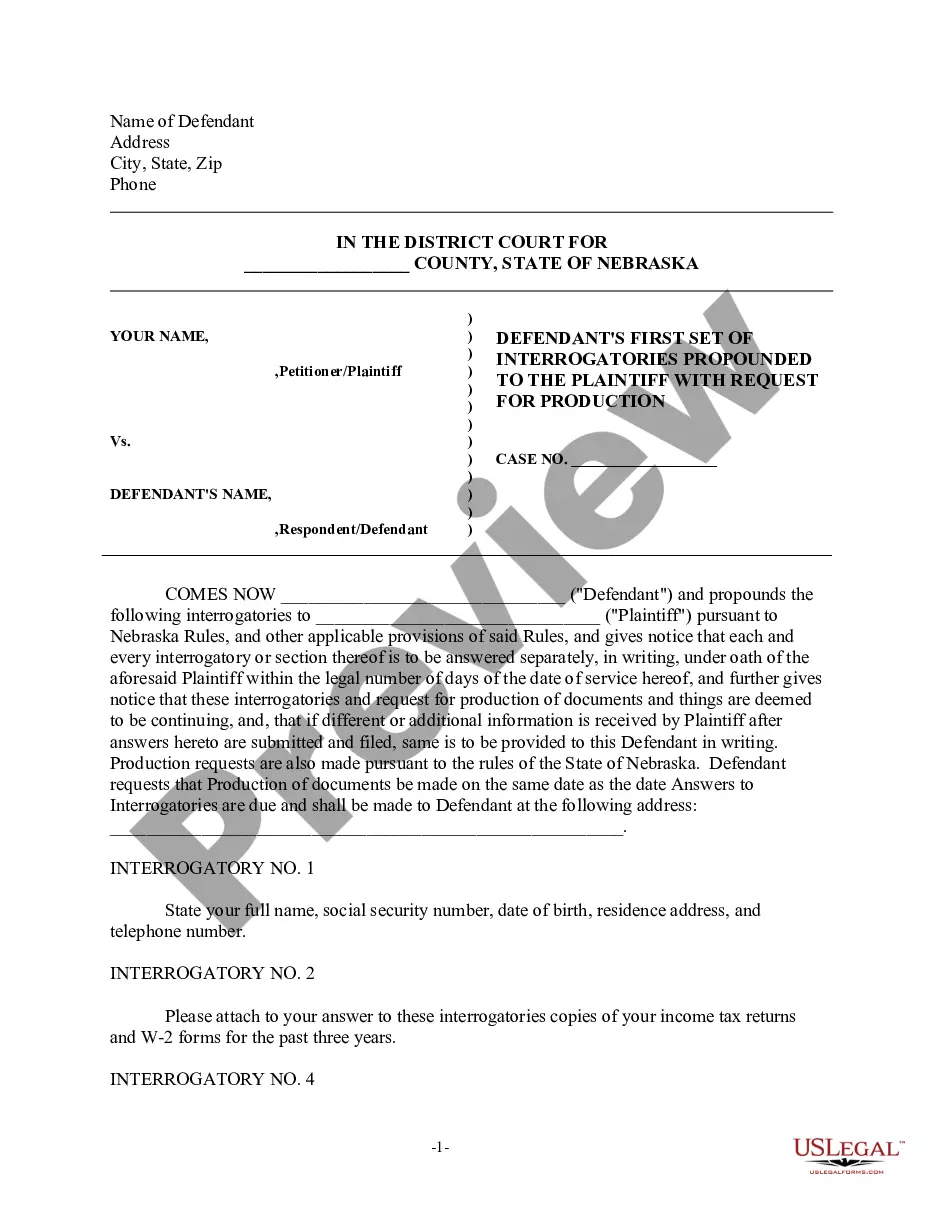

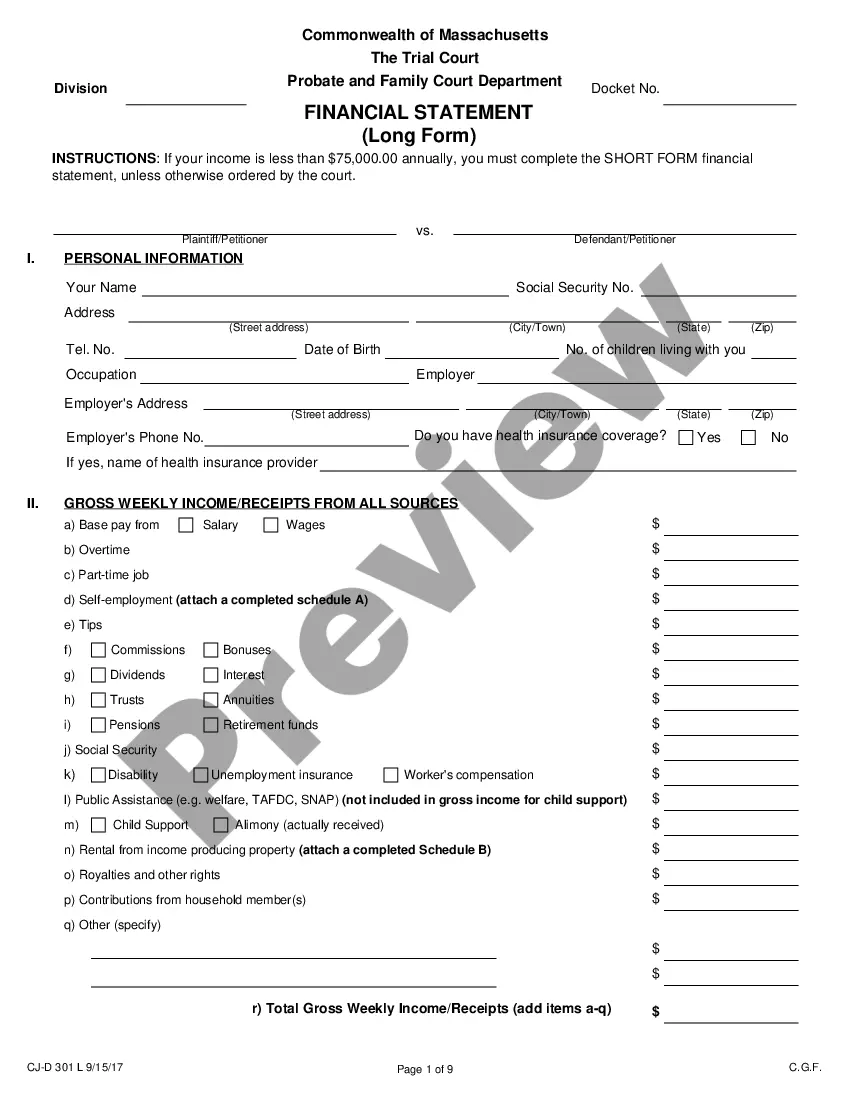

- Step 2. Use the Preview option to review the content of the form. Make sure to read the overview.

- Step 3. If you are not satisfied with the form, use the Search box at the top of the screen to find other variations of the official form template.

- Step 4. Once you have found the form you want, select the Buy Now option. Choose the pricing plan you prefer and enter your details to register for an account.

- Step 5. Complete the transaction. You can use your credit card or PayPal account to finalize the purchase.

- Step 6. Choose the format of the official form and download it to your device.

- Step 7. Fill out, edit, and print or sign the Vermont Check Disbursements Journal.

Form popularity

FAQ

To check the status of your Vermont refund, visit the Vermont Department of Taxes website and access their refund status tool. You will need to input specific information about your tax return, which will provide you with real-time updates. Additionally, maintaining a Vermont Check Disbursements Journal can help you track your financial activities, making this process smoother.

VT Form 113 is known as the Vermont Non-Resident Income Tax Return. Non-residents use this form to report income earned within Vermont. Utilizing the Vermont Check Disbursements Journal helps ensure that all relevant income is accurately reflected when preparing this return, making your tax filings more streamlined.

The non-resident tax form for Vermont is Form PR-141. This form is specifically designed for individuals who earn income in Vermont but do not reside there. If you maintain a Vermont Check Disbursements Journal, you can easily reference your earnings while filling out this important tax document.

To check your refund status on back taxes in Vermont, you can visit the Vermont Department of Taxes website and use their online refund status tool. Simply enter the required information, and you will receive updates on your refund. Utilizing the Vermont Check Disbursements Journal can provide you with a better overview of your past tax returns and refunds.

Form 111 is the Vermont Individual Income Tax Return. This form is used by residents to report their income and calculate their state tax liability. If you are using the Vermont Check Disbursements Journal, ensuring that your reported income aligns with documented disbursements will simplify your filing process.

Yes, you can file Vermont taxes online. The Vermont Department of Taxes offers an electronic filing option that allows you to submit your tax forms conveniently from your home. Additionally, the Vermont Check Disbursements Journal can help you track your payments and refunds accurately, ensuring that you stay organized.

You invoice a company for work it hired you to do; it disburses funds as payment. You purchase a home with a mortgage; your lender disburses funds to the seller at closing. You retire and receive regular disbursements from your retirement account.

Disbursement means paying out money. The term disbursement may be used to describe money paid into a business' operating budget, the delivery of a loan amount to a borrower, or the payment of a dividend to shareholders.

A cash disbursement journal is a record kept by a company's internal accountants that itemizes all financial expenditures a business makes before those payments are posted to the general ledger.

The cash payment journal is used to record the cash disbursements made by check, including payments on account, payments for cash merchandise purchase, payments for various expenses, and other loan payments. A typical cash payment journal is shown in the example below.