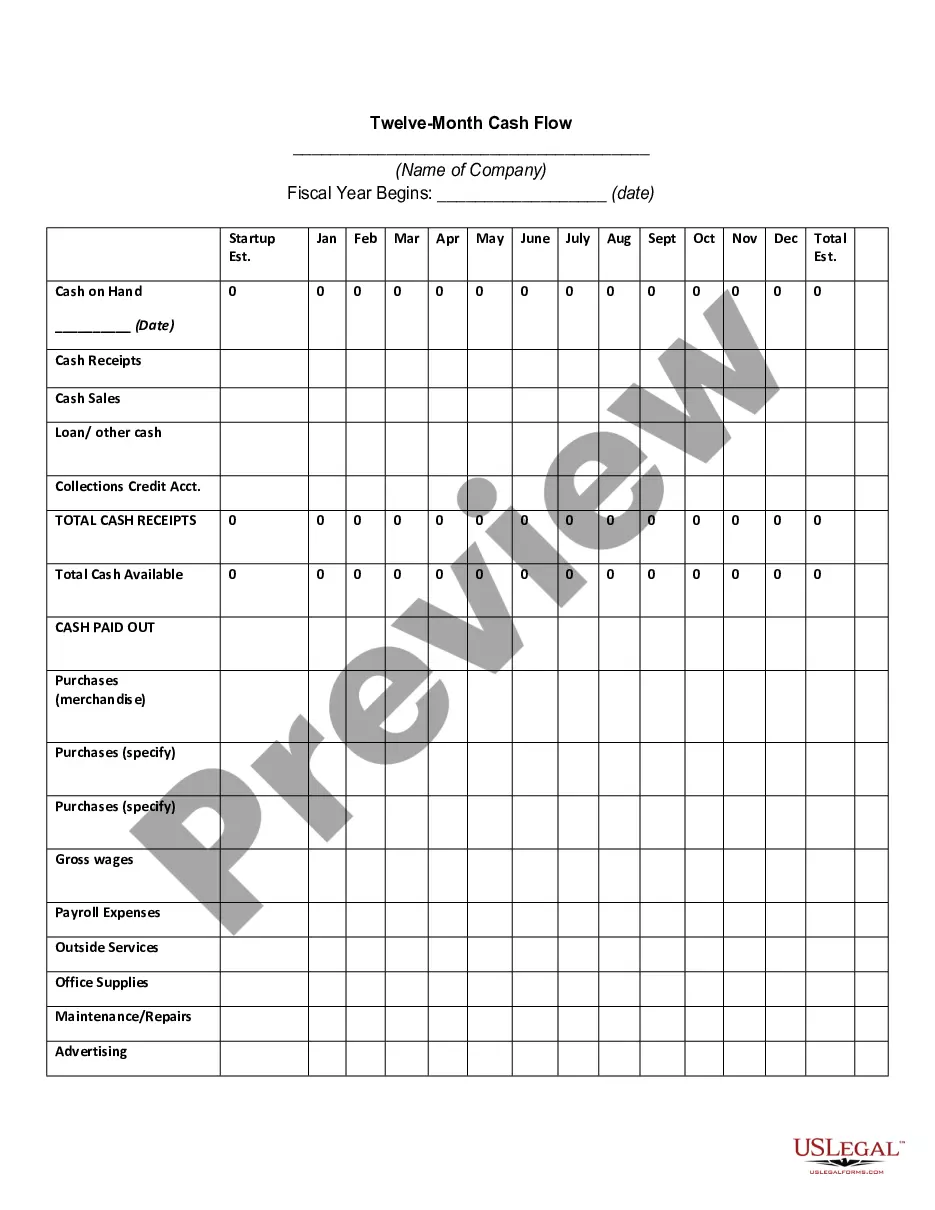

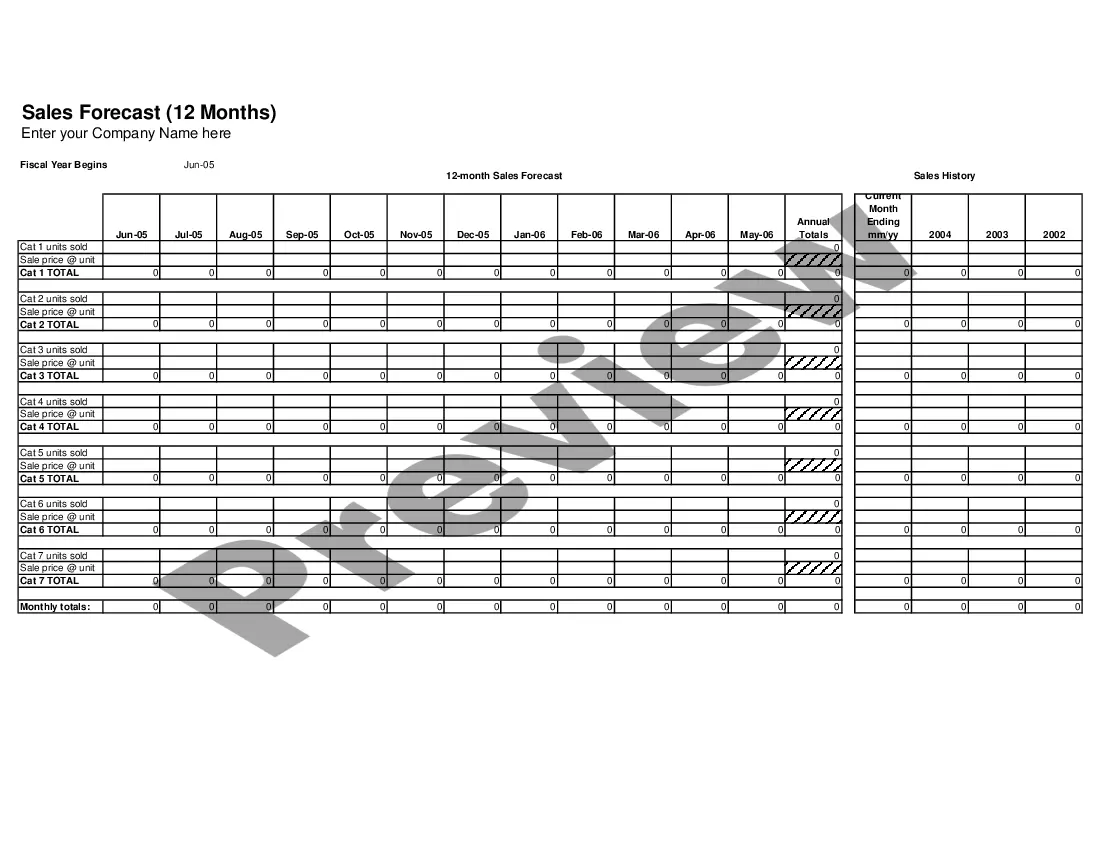

Cash flow is the movement of cash into or out of a business, project, or financial product. It is usually measured during a specified, finite period of time. Measurement of cash flow can be used for calculating other parameters that give information on a company's value and situation. Cash flow can e.g. be used for calculating parameters:

To determine a project's rate of return or value. The time of cash flows into and out of projects are used as inputs in financial models such as internal rate of return and net present value.

To determine problems with a business's liquidity. Being profitable does not necessarily mean being liquid. A company can fail because of a shortage of cash even while profitable.

As an alternative measure of a business's profits when it is believed that accrual accounting concepts do not represent economic realities. For example, a company may be notionally profitable but generating little operational cash (as may be the case for a company that barters its products rather than selling for cash). In such a case, the company may be deriving additional operating cash by issuing shares or raising additional debt finance.

Cash flow can be used to evaluate the 'quality' of income generated by accrual accounting. When net income is composed of large non-cash items it is considered low quality.

To evaluate the risks within a financial product, e.g. matching cash requirements, evaluating default risk, re-investment requirements, etc.