Vermont Sample Letter for Notice of Change of Address - Awaiting Refund

Description

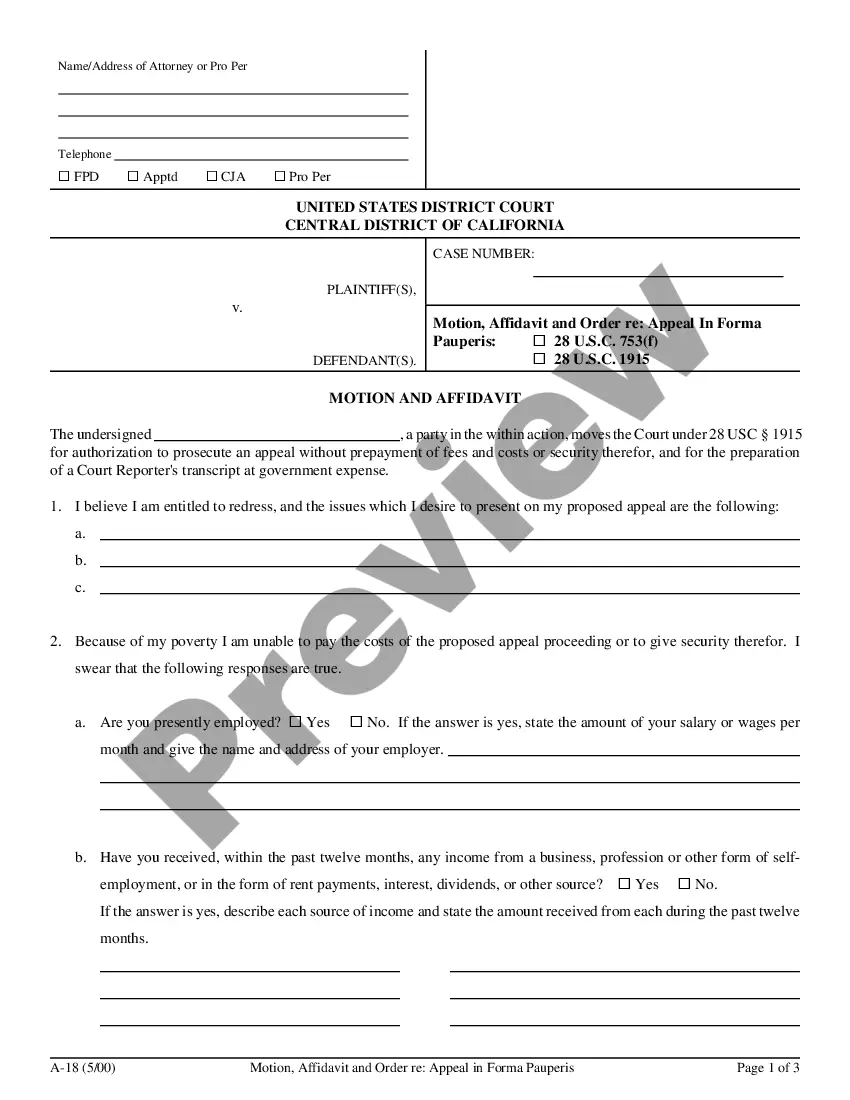

How to fill out Sample Letter For Notice Of Change Of Address - Awaiting Refund?

You might spend hours online trying to locate the correct legal document template that complies with the local and national standards you require.

US Legal Forms offers a vast array of legal forms that are reviewed by experts.

You can quickly download or print the Vermont Sample Letter for Notice of Change of Address - Awaiting Refund from the platform.

If available, use the Review button to further examine the document template as well.

- If you already have a US Legal Forms account, you can Log In and click the Acquire button.

- After that, you can complete, modify, print, or sign the Vermont Sample Letter for Notice of Change of Address - Awaiting Refund.

- Each legal document template you purchase is yours permanently.

- To obtain an additional copy of any purchased document, visit the My documents tab and click the respective button.

- If you are using the US Legal Forms website for the first time, follow the straightforward instructions below.

- First, ensure you have selected the correct document template for the state/city of your preference.

- Check the form description to confirm you have chosen the right form.

Form popularity

FAQ

If you are a non-resident earning income in Vermont, you need to complete Form VT-1040NR. This form allows you to report your income and calculate the taxes owed to the state. Using a Vermont Sample Letter for Notice of Change of Address - Awaiting Refund can assist you in notifying the state if your address changes while your tax refund is pending. Remember to file this form accurately to avoid any delays in your refund.

REASONS TAX RETURN MAY TAKE LONGER TO PROCESS:Includes a claim filed for an Earned Income Tax Credit or an Additional Child Tax Credit using 2019 income. Includes a Form 8379, Injured Spouse Allocation, which could take up to 14 weeks to process. Needs further review in general.

The process time for e-filed returns have an expected time frame of six to eight weeks, while paper returns typically take at least eight to 12 weeks. Tax identity fraud prevention techniques may result in refund wait times in excess of 10 weeks.

There are a few reasons why you may be getting the following message at Where's My Refund: We cannot provide any information about your refund. You must wait at least 24 hours after you get the acknowledgment e-mail that your tax return was received by the IRS.

The process time for e-filed returns have an expected time frame of six to eight weeks, while paper returns typically take at least eight to 12 weeks. Tax identity fraud prevention techniques may result in refund wait times in excess of 10 weeks.

If the information on your return does not match the information available to the Department, your refund may be delayed. The Department may be waiting for information from your employer or the IRS for data verification.

Your return could have been flagged as fraudulent because of identity theft or fraud. Some returns are taking longer because of corrections needed that are related to the earned-income tax credit and the pandemic-related stimulus payments (officially termed a Recovery Rebate Credit).

If you haven't received your tax refund after at least 21 days of filing online or six weeks of mailing your paper return, go to a local IRS office or call the federal agency (check out our list of IRS phone numbers that could get you help faster).

A convenient way to check the status of your refund online is through the Department's website at myVTax.vermont.gov (see A and B). Please wait at least 72 hours for e-filed returns and 8-10 weeks for paper-filed returns before checking the status of your refund.

Generally, you can expect to receive your state tax refund within 30 days if you filed your tax return electronically. If you filed a paper tax return, it may take as many as 12 weeks for your refund to arrive.