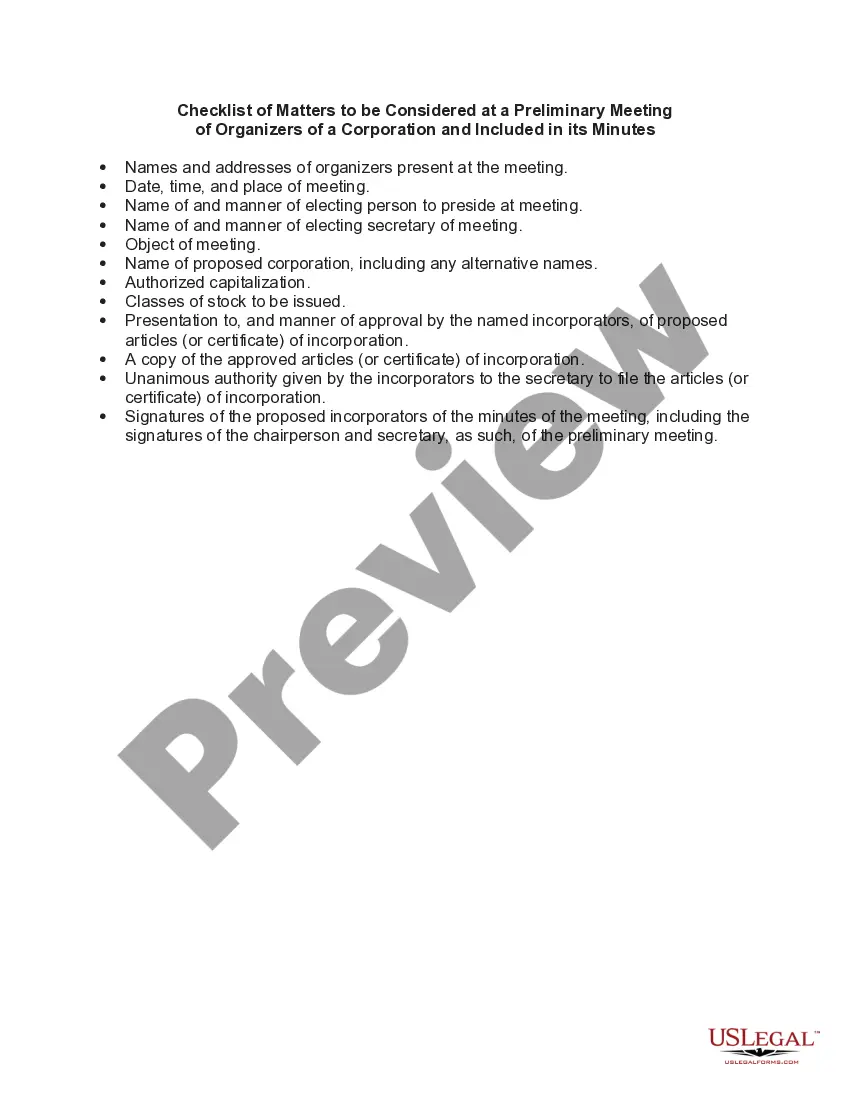

Vermont has specific requirements for organizing a corporation, and a preliminary meeting of organizers plays a crucial role in the formation process. To ensure all necessary matters are considered and documented, it is important to follow a checklist designed for such meetings. The following checklist outlines the key matters to be considered at a preliminary meeting of organizers of a corporation in Vermont and should be included in the meeting's minutes. 1. Roll call: Start the meeting by checking the attendance of all organizers and recording their names for the minutes. 2. Appointment of temporary chairperson: Designate a temporary chairperson to lead the meeting until a permanent chairperson is elected. 3. Adoption of bylaws: Discuss and adopt the bylaws, which serve as the corporation's governing document. Address important aspects such as purposes, procedures, and powers of the corporation. 4. Election of officers and directors: Conduct elections for officers and directors, including the president, vice president, secretary, and treasurer. Record the names, roles, and responsibilities of each elected individual. 5. Determining authorized shares: Determine the number of authorized shares the corporation can issue, including common and preferred shares. Specify the classes, par value, and voting rights associated with each type of share. 6. Subscription and issuance of shares: Discuss the initial subscription of shares and the terms and conditions for their issuance. Note any restrictions or special requirements related to share ownership or transfers. 7. Appointment of registered agent and office: Select a registered agent and registered office that will serve as the corporation's official point of contact and address for legal notifications. 8. Approval of fiscal year-end and accounting methods: Decide on the fiscal year-end date and the accounting methods the corporation will use for financial reporting, such as accrual or cash basis accounting. 9. Banking arrangements: Determine the authorized signatories for the corporation's bank accounts and establish banking arrangements to facilitate financial transactions. 10. Adoption of corporate seal: Discuss and approve the design and use of a corporate seal if desired. Note any specific requirements related to its usage. 11. Record keeping and internal governance: Establish guidelines for maintaining corporate records, including minutes, contracts, and other important documents. Discuss procedures for holding regular meetings and making important decisions. 12. Tax considerations and registrations: Review necessary tax filings and registrations with the Vermont Secretary of State and other relevant authorities. Ensure compliance with state and federal tax laws. Types of Vermont Checklists for Preliminary Meetings of Organizers may include variations based on the specific nature of the corporation. For example, additional matters may need to be considered for nonprofit corporations, benefit corporations, or professional corporations. It is important to consult the relevant Vermont statutes and regulations to identify any specific requirements applicable to these types of corporations. By diligently addressing these matters and recording them in the meeting's minutes, organizers can set a strong foundation for their Vermont corporation, ensuring compliance with legal requirements and facilitating smooth operations in the future.

Vermont Checklist of Matters to be Considered at a Preliminary Meeting of Organizers of a Corporation and Included in its Minutes

Description

How to fill out Vermont Checklist Of Matters To Be Considered At A Preliminary Meeting Of Organizers Of A Corporation And Included In Its Minutes?

If you have to full, down load, or produce authorized papers layouts, use US Legal Forms, the biggest collection of authorized forms, which can be found online. Make use of the site`s simple and hassle-free look for to get the papers you require. Various layouts for organization and specific uses are categorized by groups and says, or key phrases. Use US Legal Forms to get the Vermont Checklist of Matters to be Considered at a Preliminary Meeting of Organizers of a Corporation and Included in its Minutes in a number of click throughs.

If you are presently a US Legal Forms buyer, log in to the accounts and click on the Download option to have the Vermont Checklist of Matters to be Considered at a Preliminary Meeting of Organizers of a Corporation and Included in its Minutes. You can also accessibility forms you in the past delivered electronically from the My Forms tab of your respective accounts.

If you are using US Legal Forms the first time, follow the instructions below:

- Step 1. Be sure you have chosen the shape for that right town/nation.

- Step 2. Use the Preview solution to examine the form`s content material. Never forget to read the information.

- Step 3. If you are unhappy with all the kind, take advantage of the Lookup field on top of the display to discover other variations of the authorized kind format.

- Step 4. When you have identified the shape you require, select the Buy now option. Choose the costs plan you favor and add your qualifications to register on an accounts.

- Step 5. Procedure the financial transaction. You can utilize your credit card or PayPal accounts to accomplish the financial transaction.

- Step 6. Find the format of the authorized kind and down load it on your own device.

- Step 7. Comprehensive, modify and produce or indication the Vermont Checklist of Matters to be Considered at a Preliminary Meeting of Organizers of a Corporation and Included in its Minutes.

Each and every authorized papers format you purchase is your own eternally. You possess acces to each kind you delivered electronically within your acccount. Select the My Forms portion and pick a kind to produce or down load once more.

Be competitive and down load, and produce the Vermont Checklist of Matters to be Considered at a Preliminary Meeting of Organizers of a Corporation and Included in its Minutes with US Legal Forms. There are thousands of skilled and state-specific forms you may use for the organization or specific demands.