Vermont Business Start-up Checklist

Description

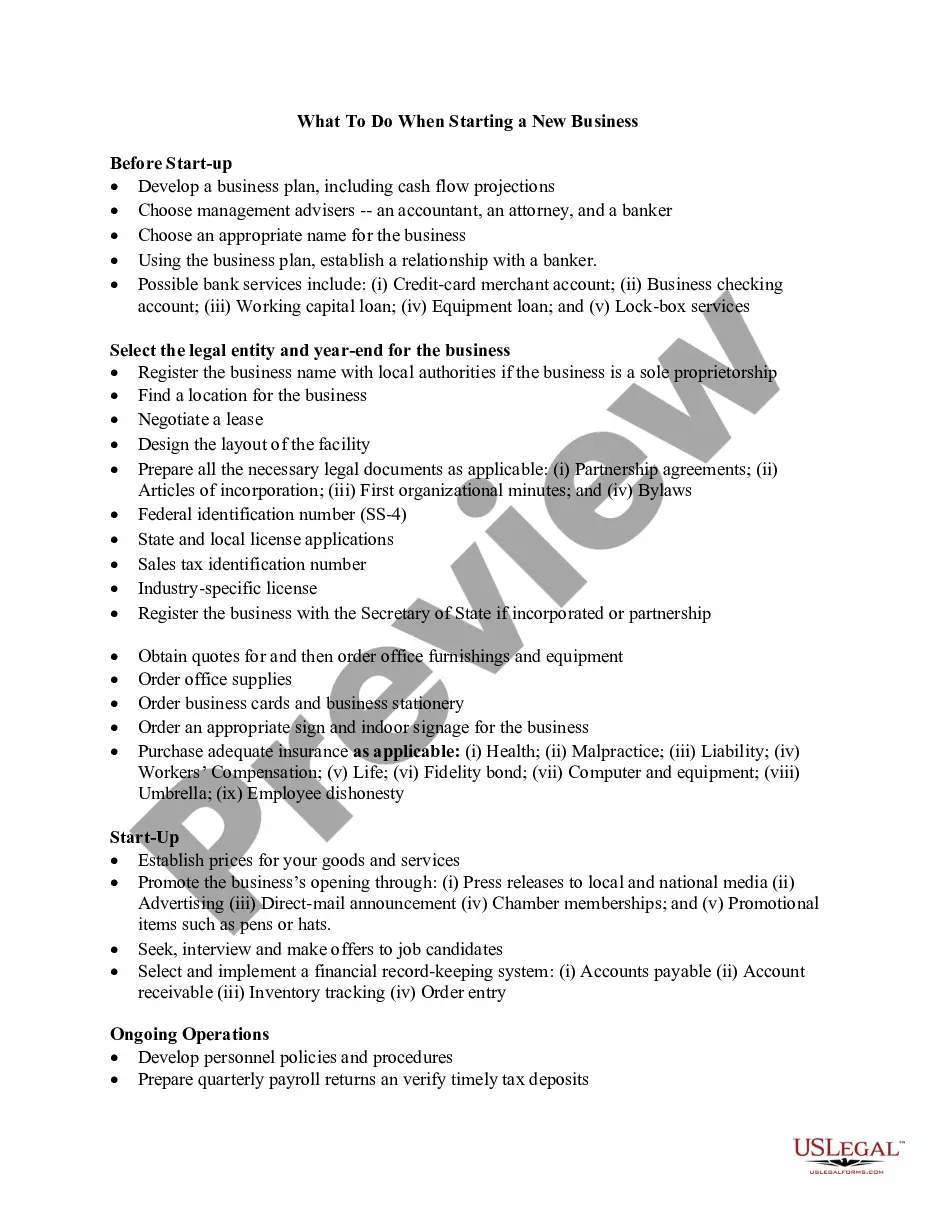

How to fill out Business Start-up Checklist?

US Legal Forms - among the largest collections of legal templates in the United States - offers a range of legal document formats that you can download or print.

While navigating the website, you can find countless templates for professional and personal use, categorized by types, states, or keywords. You will discover the latest versions of forms like the Vermont Business Start-up Checklist in just a few minutes.

If you have an account, Log In and download the Vermont Business Start-up Checklist from the US Legal Forms library. The Acquire button will appear on every template you view. You can access all previously downloaded forms from the My documents section of your account.

Process the payment. Use your credit card or PayPal account to complete the transaction.

Choose the format and download the template to your device. Make modifications. Fill out, edit, and print and sign the downloaded Vermont Business Start-up Checklist. Each template you add to your account has no expiration date and belongs to you indefinitely. Therefore, if you need to download or print another copy, simply go to the My documents section and click on the form you need. Access the Vermont Business Start-up Checklist with US Legal Forms, one of the most comprehensive collections of legal document formats. Utilize a wide array of professional and state-specific templates that meet your business or personal requirements.

- Ensure you have selected the correct template for your region/area.

- Click the Review button to examine the content of the template.

- Read the form details to confirm that you've chosen the right document.

- If the document does not fit your needs, use the Search box at the top of the screen to find one that does.

- Once satisfied with the form, confirm your choice by clicking the Get now button.

- Then, select your preferred pricing plan and provide your details to register for an account.

Form popularity

FAQ

While forming an LLC offers many advantages, there are some downsides to consider for your Vermont Business Start-up Checklist. One significant drawback is the ongoing administrative requirements, including annual reports and fees. Moreover, LLCs can lead to self-employment taxes that may be higher than those for a sole proprietorship. It's essential to weigh these factors against the benefits as you plan your business.

You can set up an LLC quite quickly, typically within one day if you file online through a reliable platform. Using a Vermont Business Start-up Checklist helps streamline the process and ensures you gather all necessary documents. By organizing your information in advance, you can minimize delays. Ultimately, with the right preparation, you can start your business without unnecessary wait time.

Vermont does not have a statewide basic business license. Businesses may need to register with the Vermont Secretary of State or the Department of Taxes for business taxes, sales tax, or payroll taxes. Many different agencies and boards oversee the professional and occupational state license requirements.

How much does it cost to register a business in Vermont? Registering a business in Vermont costs $125 to file Articles of Organization or Articles of Incorporation with the Secretary of State.

How to Start a Business in VermontDevelop an idea.Do the research.Draft a business plan.Secure funding.Decide on a legal business entity.Register your business.Acquire federal and state tax IDs.Open business banking and credit accounts.More items...

Start or Buy a BusinessStep 1: Obtain a Federal Employer Identification Number.Step 2: Register your business with the Vermont Secretary of State.Step 3: Register for a business tax account.Step 4: Determine which taxes you need to pay.

The 7 documents you need to create an LLCInternal Revenue Service (IRS) Form SS-4.Name reservation application.Articles of organization.Operating agreement.Initial and annual reports.Tax registrations.Business licenses.

Business Plan. Almost every business needs a little funding to get started.Partnership Agreement.LLC Operating Agreement.Buy/Sell Agreement.Employment Agreement.Employee Handbook.Non-Disclosure Agreement.Non-Compete Agreement.More items...

How to Start an LLC in VermontChoose a Name for Your LLC.Appoint a Registered Agent.File Articles of Organization.Prepare an Operating Agreement.Obtain an EIN.File Vermont Annual Reports.

The cost to start a Vermont limited liability company (LLC) online is $125. This fee is paid to the Vermont Secretary of State when filing the LLC's Articles of Organization.