Vermont is a scenic state located in the northeastern region of the United States, known for its picturesque landscapes, charming small towns, and outdoor recreational opportunities. When starting a new business in Vermont, it is essential to be well-prepared and knowledgeable about the state's regulations, resources, and local market. Here is a detailed description of what to do when starting a new business in Vermont, along with some important keywords to consider: 1. Research: Conduct thorough research on the industry and market you plan to enter in Vermont. Understand the local demand, competition, and potential target audience. Keywords: Vermont business market, industry research, local demand analysis. 2. Business Plan: Develop a comprehensive business plan that outlines your mission, vision, products/services, target market, marketing strategy, financial projections, and growth plans. This plan will serve as a roadmap for your business. Keywords: business plan development, mission statement, financial projections, growth strategy. 3. Business Structure and Registration: Choose an appropriate legal structure for your business (sole proprietorship, partnership, LLC, or corporation) and register it with the Vermont Secretary of State's office. Keywords: legal structure, business registration, Vermont Secretary of State. 4. Secure Financing: Identify potential sources of funding for your business, such as personal savings, loans, grants, or investment. Create a detailed budget and financial plan to ensure sustainable operations. Keywords: business financing, funding options, small business loans, grants in Vermont. 5. Licenses and Permits: Determine the specific licenses and permits required to legally operate your business in Vermont. Consult the Vermont Department of Taxes, Agency of Commerce and Community Development, or other relevant authorities for guidance. Keywords: business licenses, permits, Vermont Department of Taxes, Agency of Commerce and Community Development. 6. Location and Facilities: Choose a suitable location for your business, considering factors like accessibility, target market proximity, rental costs, and infrastructure support. Keywords: business location, commercial property, facilities in Vermont. 7. Taxation and Regulations: Familiarize yourself with Vermont's tax obligations, local regulations, zoning laws, employment laws, and other legal requirements related to your industry. Consult with an attorney or tax professional if necessary. Keywords: Vermont taxation, business regulations, zoning laws, employment laws. 8. Marketing and Branding: Develop a strong brand identity and create a marketing strategy to promote your business. Utilize various marketing channels, including digital marketing, social media, local advertising, and networking. Keywords: marketing strategy, branding, digital marketing, social media, advertising in Vermont. 9. Hiring and Workforce: If your business requires employees, understand the hiring process, labor laws, and regulations in Vermont. Familiarize yourself with the local workforce, talent pool, and potential staffing resources. Keywords: hiring employees, Vermont labor laws, staffing resources. 10. Networking and Support: Connect with local business organizations, chambers of commerce, and entrepreneurial communities to gain support, advice, and potential business opportunities. Attend relevant workshops, seminars, and conferences to expand your network. Keywords: Vermont business organizations, chambers of commerce, entrepreneurial communities, networking opportunities. Different types of Vermont What To Do When Starting a New Business may include specific guides and resources tailored to different industries, such as Vermont retail business startup guide, Vermont food industry startup guide, Vermont tech startup guide, etc. Each type may highlight industry-specific tips, regulations, and resources relevant to that particular sector in Vermont.

Vermont What To Do When Starting a New Business

Description

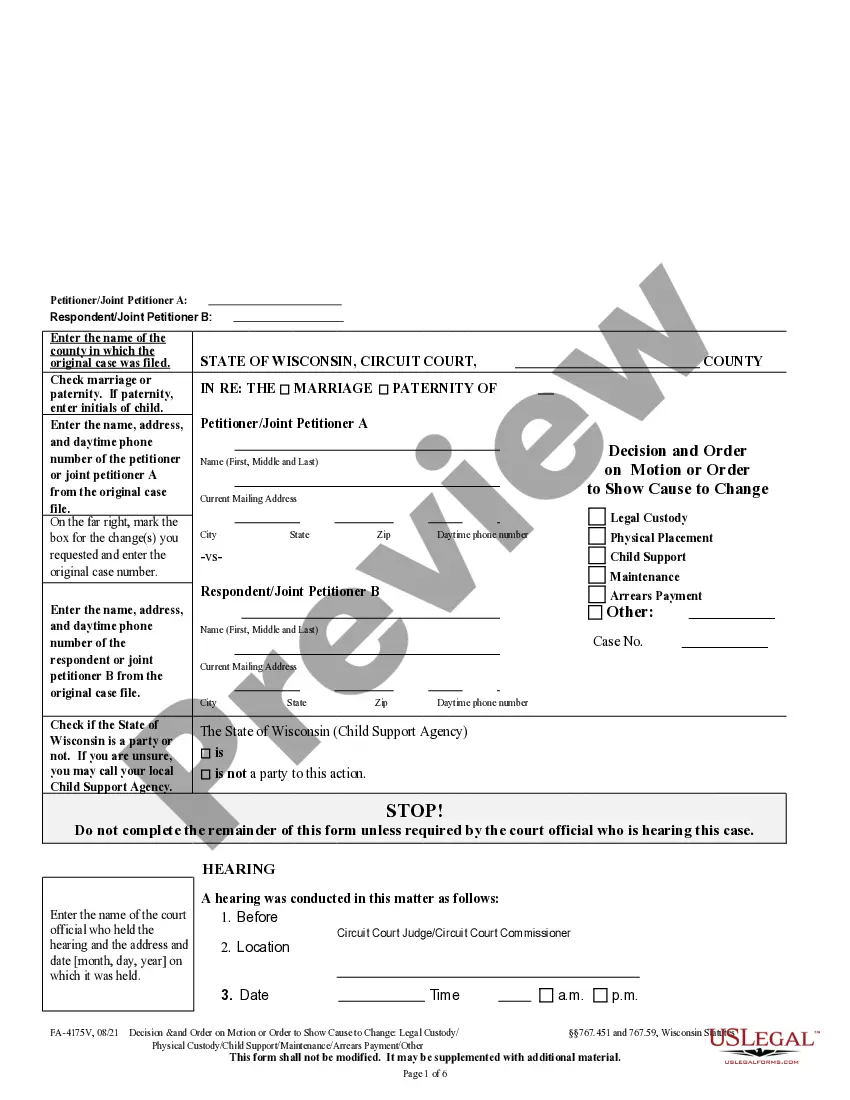

How to fill out Vermont What To Do When Starting A New Business?

You can invest time online searching for the legal file design that suits the federal and state requirements you require. US Legal Forms supplies a large number of legal forms which are reviewed by pros. It is possible to acquire or print out the Vermont What To Do When Starting a New Business from the service.

If you already possess a US Legal Forms bank account, you may log in and then click the Down load button. Following that, you may full, modify, print out, or sign the Vermont What To Do When Starting a New Business. Each and every legal file design you buy is yours forever. To get yet another duplicate of the bought type, go to the My Forms tab and then click the corresponding button.

If you are using the US Legal Forms website for the first time, follow the basic directions under:

- First, ensure that you have selected the right file design for your county/town that you pick. See the type outline to ensure you have picked out the proper type. If accessible, make use of the Preview button to check through the file design at the same time.

- In order to get yet another edition of your type, make use of the Search area to get the design that fits your needs and requirements.

- After you have discovered the design you would like, simply click Get now to proceed.

- Select the prices plan you would like, key in your credentials, and sign up for a merchant account on US Legal Forms.

- Comprehensive the financial transaction. You may use your bank card or PayPal bank account to fund the legal type.

- Select the structure of your file and acquire it in your system.

- Make modifications in your file if required. You can full, modify and sign and print out Vermont What To Do When Starting a New Business.

Down load and print out a large number of file web templates utilizing the US Legal Forms Internet site, that provides the most important variety of legal forms. Use expert and condition-distinct web templates to handle your company or personal requirements.

Form popularity

FAQ

Conduct market research. Market research will tell you if there's an opportunity to turn your idea into a successful business.Write your business plan.Fund your business.Pick your business location.Choose a business structure.Choose your business name.Register your business.Get federal and state tax IDs.More items...

If you are a sole proprietor in Vermont seeking to do business as a name other than your own personal name, regardless of the goods or services provided, you must register that business name as an assumed business name with the Secretary of State first.

Vermont does not have a statewide basic business license. Businesses may need to register with the Vermont Secretary of State or the Department of Taxes for business taxes, sales tax, or payroll taxes. Many different agencies and boards oversee the professional and occupational state license requirements.

How to Start a Business in VermontDevelop an idea.Do the research.Draft a business plan.Secure funding.Decide on a legal business entity.Register your business.Acquire federal and state tax IDs.Open business banking and credit accounts.More items...

It's the country's second worst state to start a business, largely due to it's expensive environment. It has both high tax rates, high business startup costs, and a high cost of living. Where it isn't lacking, it's simply average; the state's business survivability rate and economic growth rate are middle of the road.

Most businesses operating in Vermont must first register with the Vermont Department of Taxes. For Sales and Use, Meals and Rooms, or Withholding you will need a separate business tax account for each of these respective taxes.

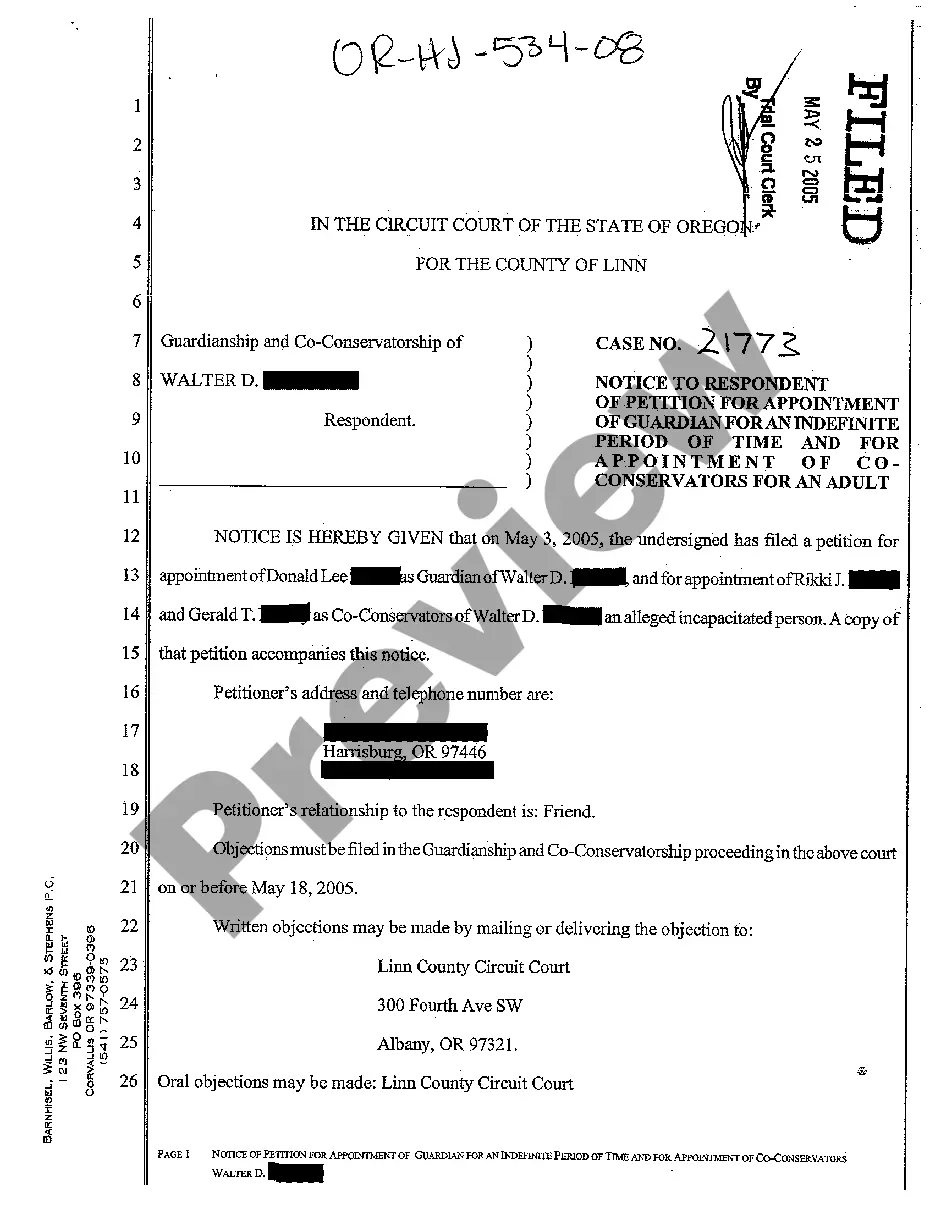

Start or Buy a BusinessStep 1: Obtain a Federal Employer Identification Number.Step 2: Register your business with the Vermont Secretary of State.Step 3: Register for a business tax account.Step 4: Determine which taxes you need to pay.

Vermont does not have a statewide basic business license. Businesses may need to register with the Vermont Secretary of State or the Department of Taxes for business taxes, sales tax, or payroll taxes. Many different agencies and boards oversee the professional and occupational state license requirements.