Vermont Sample Letter for Revised Promissory Note

Description

How to fill out Sample Letter For Revised Promissory Note?

Are you currently in a situation where you need documents for either business or personal reasons on a regular basis.

There are numerous legal document templates accessible online, but finding reliable versions is not easy.

US Legal Forms offers a vast collection of templates, such as the Vermont Sample Letter for Revised Promissory Note, designed to meet state and federal requirements.

Once you locate the correct form, click Buy now.

Choose the pricing plan you wish, complete the necessary information to create your account, and pay for your order using PayPal or Visa or Mastercard. Select a convenient document format and download your copy. Access all the document templates you have purchased in the My documents section. You can obtain an additional copy of Vermont Sample Letter for Revised Promissory Note anytime if needed. Just choose the required form to download or print the document template. Utilize US Legal Forms, one of the largest collections of legal documents, to save time and avoid mistakes. The service provides appropriately crafted legal document templates that can be utilized for various purposes. Create a free account on US Legal Forms and start simplifying your life.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the Vermont Sample Letter for Revised Promissory Note template.

- If you do not have an account and want to start using US Legal Forms, follow these steps.

- Find the form you need and ensure it corresponds to the correct city/state.

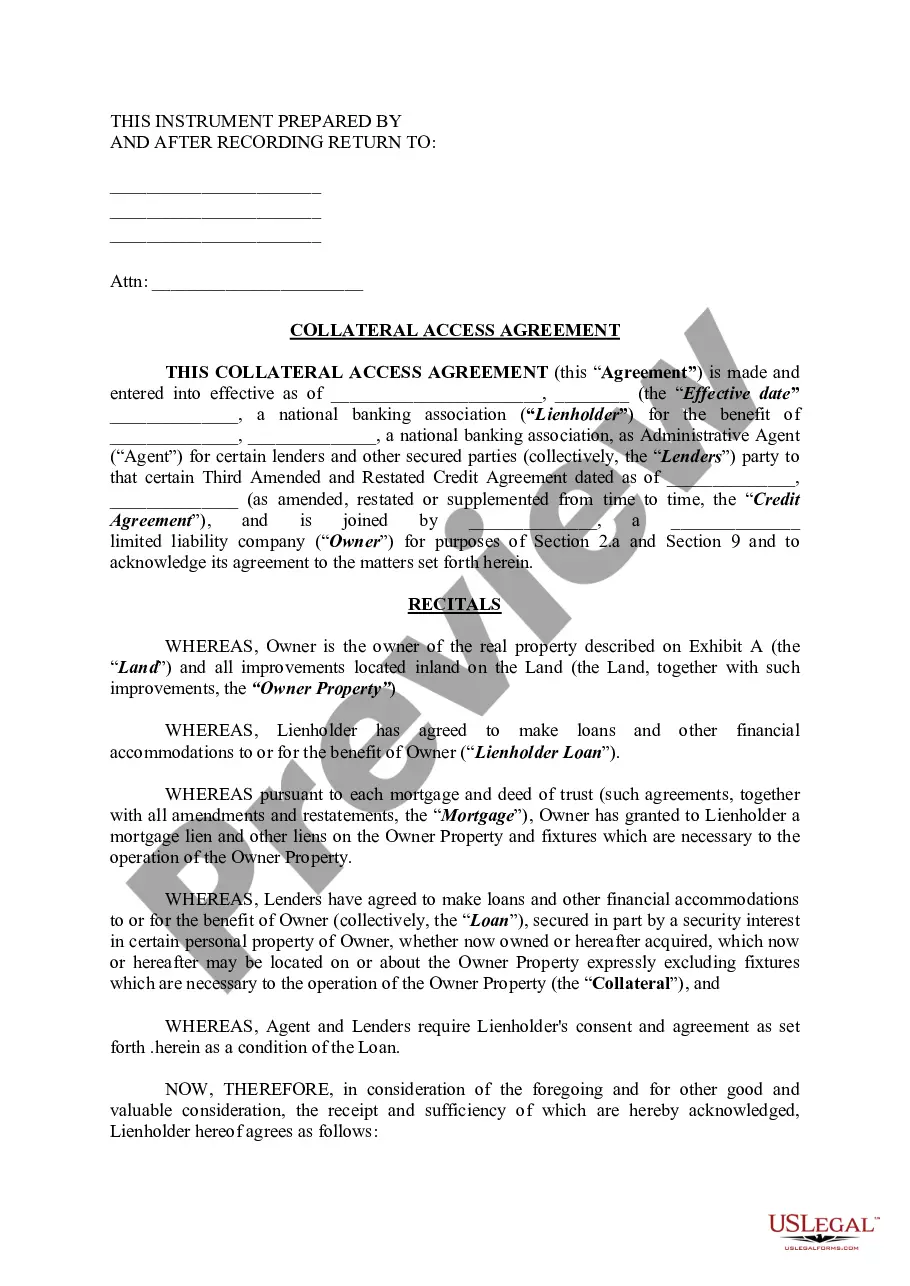

- Use the Preview button to review the document.

- Read the description to confirm that you have selected the right form.

- If the form doesn’t meet your needs, use the Search field to find the appropriate document.

Form popularity

FAQ

How to Modify a Promissory NoteIdentify the terms of the note that are creating difficulty in repayment.Communicate your need to modify the terms of the note to the note holder.Have the holder of the note draft modifications to the original note.Sign and notarize the modified promissory note.

An amended promissory note is a legal document that changes the terms of the original promissory note. These amendments should be made with consent from the lender and, once in place, will be considered binding by all parties involved. Canceling a promissory note is a completely different process from amending it.

An amended promissory note is a legal document that changes the terms of the original promissory note. These amendments should be made with consent from the lender and, once in place, will be considered binding by all parties involved.

An amended and restated promissory note is a legally binding addition to a promissory note that notes any significant changes and replaces the original agreement. Amended and restated promissory notes are seen as the most recent and up-to-date versions of the promise to pay between a borrower and a lender.

Refinancing a hard money note is exactly like refinancing a bank mortgage. Find the refinancing lender and loan, go through a qualifications process, have the property appraised, and give contact information for the original note holder to your new lender so it can make arrangements to pay off the privately held note.

Amending a promissory note is a legal process by which parties can denote changes to the original contract and continue with the terms of the agreement as set forth. Canceling a promissory note is a process that will lead the note to become null and void.

A promissory note can become invalid if it excludes A) the total sum of money the borrower owes the lender (aka the amount of the note) or B) the number of payments due and the date each increment is due.

If there is a breach of the terms of a promissory note by the maker, the bearer can seek to enforce the note by filing a claim in Court.