A lactation consultant is a healthcare provider recognized as having expertise in the fields of human lactation and breastfeeding

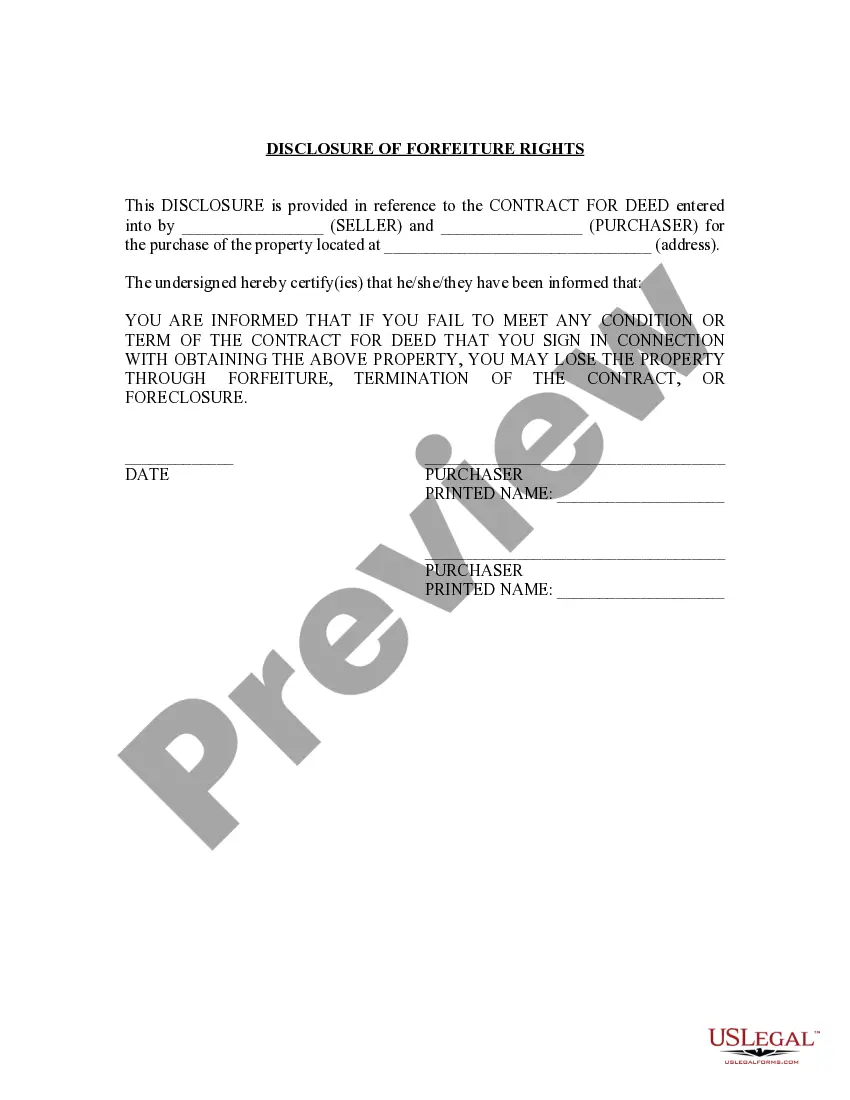

This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

The Vermont Irrevocable Trust Agreement for the Benefit of Spouse, Children, and Grandchildren is a legally binding contract that allows individuals to transfer their assets into a trust for the ultimate benefit of their loved ones. This type of trust is specifically designed to provide financial security and assets protection for beneficiaries, while giving the granter control over the distribution of their wealth. With the Vermont Irrevocable Trust Agreement for the Benefit of Spouse, Children, and Grandchildren, the trust creator, or granter, establishes the terms and conditions for the management and distribution of their assets. One of the key features of this trust is that it cannot be modified or revoked once it is established, ensuring that the granter's wishes are carried out. There are different types of Vermont Irrevocable Trust Agreements for the Benefit of Spouse, Children, and Grandchildren, including: 1. Spousal Trust: This type of trust arrangement allows the granter's assets to be held for the benefit of their surviving spouse. It ensures the spouse's financial security and may include provisions for their healthcare expenses and maintenance. 2. Children's Trust: This trust focuses on providing for the granter's children, ensuring their education, healthcare, and general welfare. The trust may also include provisions for distributing assets to the children at specific ages or milestones. 3. Grandchildren's Trust: The grandchildren's trust is set up to benefit the granter's grandchildren, offering financial security and support for their future. This trust may include provisions for educational expenses, healthcare needs, and other purposes as determined by the granter. 4. Generation-Skipping Trust: This type of trust enables the granter to pass on assets directly to their grandchildren, skipping their children as beneficiaries. It offers potential estate tax advantages and provides long-term asset protection for the grandchildren. When establishing the Vermont Irrevocable Trust Agreement for the Benefit of Spouse, Children, and Grandchildren, it is essential to include the necessary legal elements such as the name of the granter, trustee, and beneficiaries. The trust document should also outline the specific terms and conditions for asset management, distribution, and potential contingencies. Overall, the Vermont Irrevocable Trust Agreement for the Benefit of Spouse, Children, and Grandchildren is a powerful estate planning tool that ensures the preservation and orderly distribution of assets to loved ones. It allows the granter to provide for their family's well-being, protect assets from creditors, and potentially minimize estate taxes. Consulting with a knowledgeable attorney is vital to drafting a comprehensive and legally sound trust agreement that meets individual needs.