Vermont Sample Letter for Explanation of Bankruptcy

Description

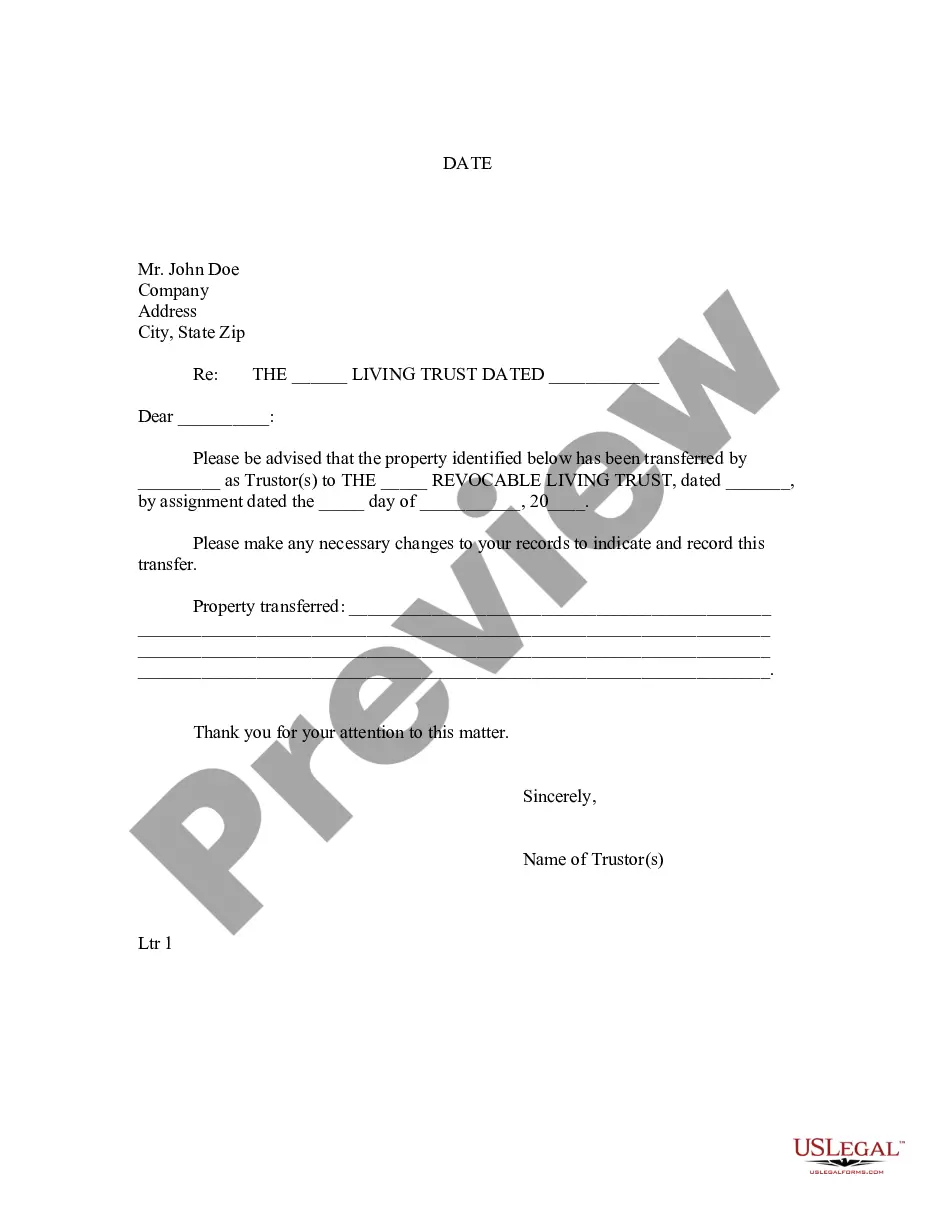

How to fill out Sample Letter For Explanation Of Bankruptcy?

Locating the appropriate legal document template can be challenging.

Naturally, there are numerous templates available online, but how do you locate the legal form you need.

Utilize the US Legal Forms website. The service provides thousands of templates, such as the Vermont Sample Letter for Explanation of Bankruptcy, suitable for both business and personal needs.

You can preview the form using the Preview option and read the form description to confirm it is indeed the right one for you.

- All forms are reviewed by professionals and comply with federal and state regulations.

- If you are already registered, Log In to your account and click the Download button to access the Vermont Sample Letter for Explanation of Bankruptcy.

- Use your account to search for the legal forms you have previously obtained.

- Navigate to the My documents tab in your account to download an additional copy of the document you need.

- If you are a new user of US Legal Forms, follow these simple steps.

- First, ensure you have selected the correct form for your region.

Form popularity

FAQ

If you claim the mortgage interest deduction on your property, you can still claim it during bankruptcy even though the trustee actually sends the money to your lender. If you're paying off back property taxes as part of the payment plan, you can deduct them too.

A 341 notice is the notice sent by the bankruptcy clerk to the debtor, the creditors, and all other interested parties, notifying them of the date, time, and place in which the 341 meeting (creditors meeting) will be held.

A fundamental goal of the federal bankruptcy laws enacted by Congress is to give debtors a financial "fresh start" from burdensome debts.

The Six Steps in a Bankruptcy ProcessStep 1: Pre-Bankruptcy Counseling.Step 2: Filing the Bankruptcy Petition.Step 3: Automatic Stay.Step 4:Creditor's Meeting.Step 5:Debtor Education Course.Step 6: Notice of Discharge.

Legal Definition of Statement of Intention : a written statement filed by a debtor prior to the meeting of creditors in a chapter 7 bankruptcy case that indicates what property the debtor intends to surrender and retain.

Proof of Claim or Proof of Interest means the proof of claim or proof of interest, respectively, that must be filed by a Holder of a Claim or Interest by the date(s) designated by the Bankruptcy Court as the last date(s) for filing proofs of claim or interests against the Debtors, or as is otherwise permitted to be

Another one of the myriad documents that you must complete when you file for bankruptcy is Official Form 108, called the "Statement of Intention." This document tells the bankruptcy trustee, the judge, and your creditors what you intend to do with certain property and certain leases.

The statement of financial affairs is a required form when filing for bankruptcy. This form dives into all of your personal matters so that the court can fully grasp the financial situation that is causing you to file. You'll fill out the SOFA if you file for a Chapter 7, Chapter 11 or Chapter 13 bankruptcy.

Proof of Claim or Proof of Interest means the proof of claim or proof of interest, respectively, that must be filed by a Holder of a Claim or Interest by the date(s) designated by the Bankruptcy Court as the last date(s) for filing proofs of claim or interests against the Debtors, or as is otherwise permitted to be

Redemption is a tool available only in a Chapter 7 Bankruptcy. It allows you to pay off a loan by paying an amount equal to the value of the loan collateral. However, redemption may not be an option for all Chapter 7 debtors because it requires you to pay off the loan in a lump sum.