A Vermont Purchase Agreement by a Corporation of Assets of a Partnership refers to a legal contract wherein a corporation acquires the assets of a partnership located in the state of Vermont. This purchase agreement outlines the terms and conditions of the transfer, including the purchase price, payment details, rights, and responsibilities of each party involved. Keywords: Vermont, Purchase Agreement, Corporation, Assets, Partnership In Vermont, there are different types of Purchase Agreements by a Corporation of Assets of a Partnership, categorized based on the nature of the partnership assets being acquired. These types include: 1. Tangible Assets Purchase Agreement: This type of agreement involves the acquisition of physical assets owned by the partnership, such as equipment, inventory, real estate, vehicles, or any other tangible property. The agreement will specify the condition and valuation of these assets. 2. Intangible Assets Purchase Agreement: In cases where the partnership possesses intangible assets, like intellectual property, patents, trademarks, copyrights, or contractual rights, this type of agreement will outline the transfer and ownership rights associated with these assets. 3. Goodwill Purchase Agreement: When a corporation acquires a partnership, it may also acquire the intangible asset known as goodwill. Goodwill represents the reputation, customer base, brand recognition, and other intangible benefits associated with the partnership. This agreement will address the valuation and transfer of goodwill. 4. Stock Purchase Agreement: In some instances, a corporation may choose to purchase the partnership's stock instead of the assets directly. This type of agreement outlines the purchase of shares or ownership interests in the partnership held by its partners. The corporation becomes the majority or sole shareholder of the partnership, taking control of its assets and operations. Regardless of the specific type, a Vermont Purchase Agreement by a Corporation of Assets of a Partnership typically includes the following key provisions: — Identifying the parties involved, including the corporation and the partnership. — Description and valuation of the assets being acquired. — Purchase price and payment terms, including any installment payments or contingent payments based on certain conditions. — Representations and warranties made by both parties regarding the assets, liabilities, and legal compliance. — Indemnification provisions, detailing the responsibility of each party for any claims, liabilities, or debts associated with the assets. — Closing conditions and procedures, including the transfer of title, possession, and any necessary regulatory approvals. — Post-closing obligations, such as non-compete agreements, transition assistance, or employment arrangements. — Dispute resolution mechanisms, such as arbitration or mediation, in case of conflicts arising from the agreement. It is crucial to consult legal professionals experienced in Vermont corporate law and partnership transactions to draft a comprehensive Purchase Agreement that protects the interests and rights of both the corporation and the partnership involved in the asset acquisition process.

Vermont Purchase Agreement by a Corporation of Assets of a Partnership

Description

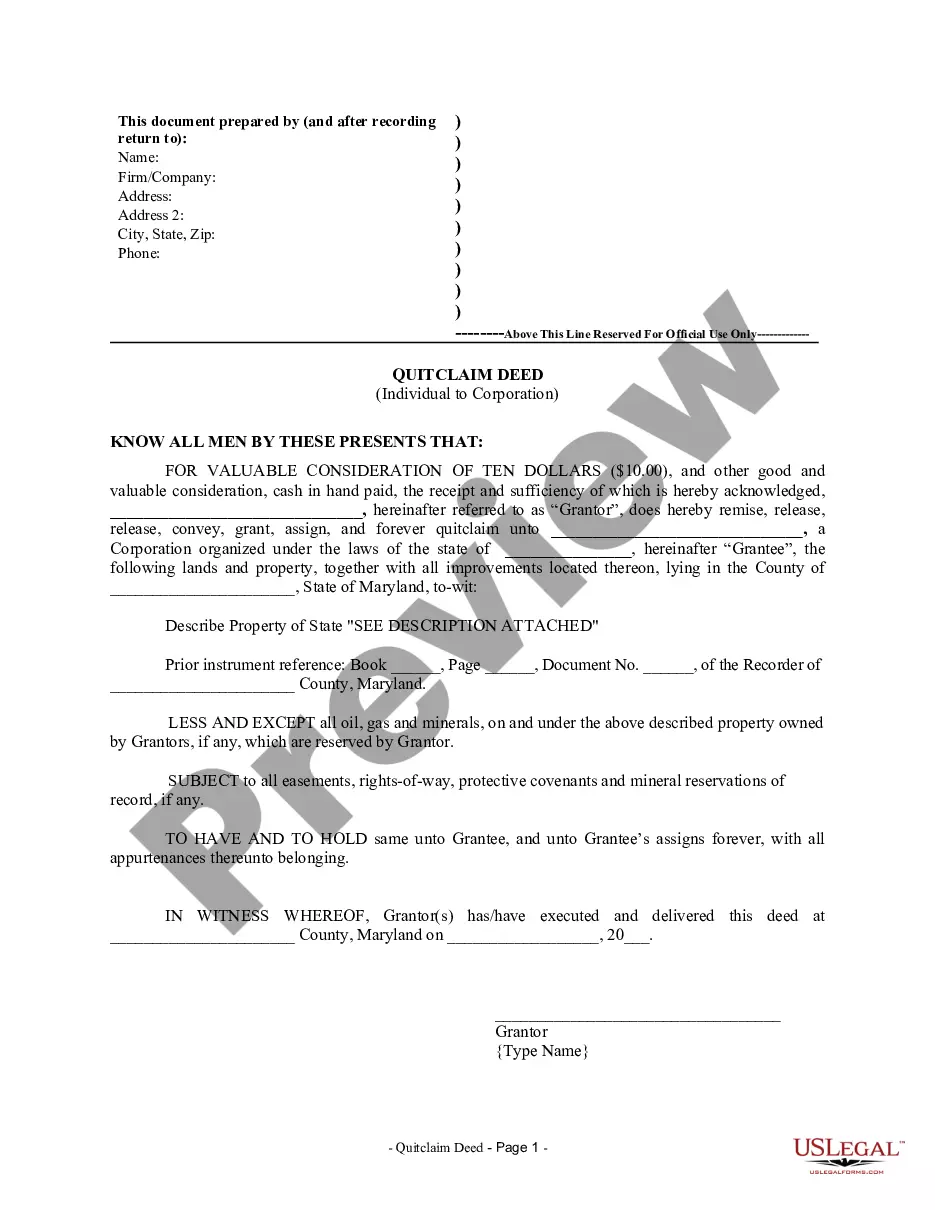

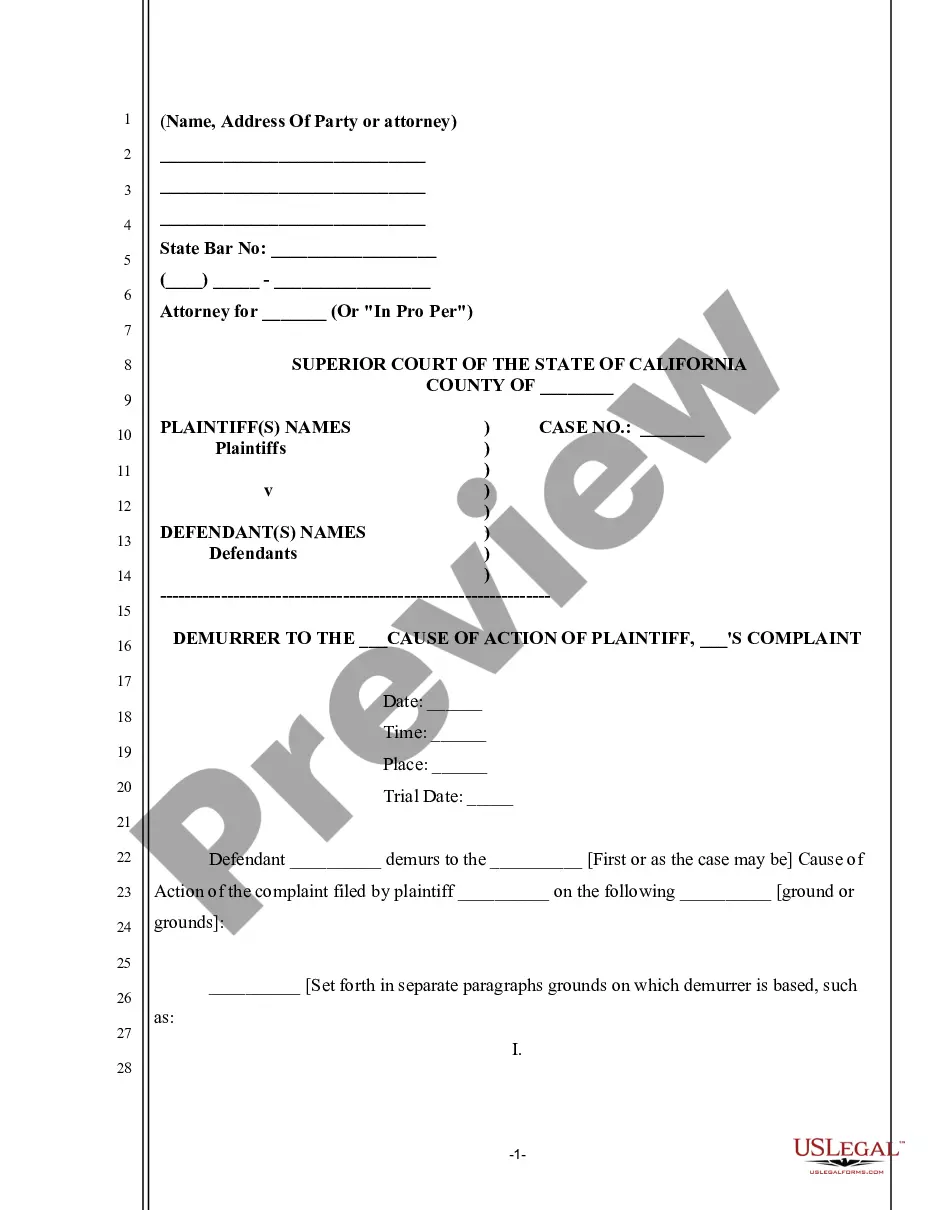

How to fill out Vermont Purchase Agreement By A Corporation Of Assets Of A Partnership?

You are able to invest several hours on the Internet trying to find the legal record template that suits the state and federal needs you want. US Legal Forms provides 1000s of legal types which can be reviewed by experts. You can actually acquire or print out the Vermont Purchase Agreement by a Corporation of Assets of a Partnership from my services.

If you currently have a US Legal Forms bank account, it is possible to log in and click the Download switch. Next, it is possible to comprehensive, modify, print out, or signal the Vermont Purchase Agreement by a Corporation of Assets of a Partnership. Each and every legal record template you buy is yours forever. To get an additional backup for any purchased kind, go to the My Forms tab and click the related switch.

If you use the US Legal Forms site initially, adhere to the simple recommendations beneath:

- First, make certain you have selected the best record template for the state/city that you pick. See the kind explanation to ensure you have selected the proper kind. If available, take advantage of the Review switch to appear from the record template at the same time.

- If you wish to locate an additional variation from the kind, take advantage of the Research industry to get the template that fits your needs and needs.

- After you have discovered the template you desire, simply click Acquire now to carry on.

- Choose the costs program you desire, key in your references, and register for a merchant account on US Legal Forms.

- Total the financial transaction. You should use your Visa or Mastercard or PayPal bank account to fund the legal kind.

- Choose the formatting from the record and acquire it in your product.

- Make changes in your record if required. You are able to comprehensive, modify and signal and print out Vermont Purchase Agreement by a Corporation of Assets of a Partnership.

Download and print out 1000s of record layouts while using US Legal Forms website, that provides the most important variety of legal types. Use expert and state-distinct layouts to take on your small business or person requirements.

Form popularity

FAQ

Partnership Assets means all assets, whether tangible or intangible and whether real, personal or mixed (including, without limitation, all partnership capital and interest in other partnerships), at any time owned or represented by any Partnership Interest.

There are four types of business partnerships:LLC partnership (also known as a multi-member LLC)Limited liability partnership (LLP)Limited partnership (LP)General partnership (GP)

Do Partners Own Partnership Assets? Partnerships are not taxable entities, but they are required to file their tax returns at the end of each accounting year. If they have agreed to share equally a partnership asset, it is owned by both partners.

These are the four types of partnerships.General partnership. A general partnership is the most basic form of partnership.Limited partnership. Limited partnerships (LPs) are formal business entities authorized by the state.Limited liability partnership.Limited liability limited partnership.

Yes, assets can be acquired by the partnership.

A limited partner's personal assets are protected against any debts or judgments that the partnership might incur.

General partnership In most cases, partners form their business by signing a partnership agreement. Ownership and profits are usually split evenly among the partners, although they may establish different terms in the partnership agreement.

Active/Managing Partner.Sleeping Partner.Nominal Partner.Partner by Estoppel.Partner in Profits only.Minor Partner.Secret Partner.Outgoing partner.More items...?

Types of Partnership 5 Types: General Partnership, Limited Partnership, Limited Liability Partnership, Partnership at Will and Particular PartnershipGeneral Partnership:Limited Partnership:Limited Liability Partnership (L.L.P):Partnership at Will:Particular Partnership:

Corporations can act as partners in a partnership because states allow corporations to perform many of the same activities as individuals, such as entering into contracts, owning property, and hiring employees.