Vermont Sample Letter to Pension Plan Administrator regarding Division of Plan Proceeds per Court Order

Description

How to fill out Vermont Sample Letter To Pension Plan Administrator Regarding Division Of Plan Proceeds Per Court Order?

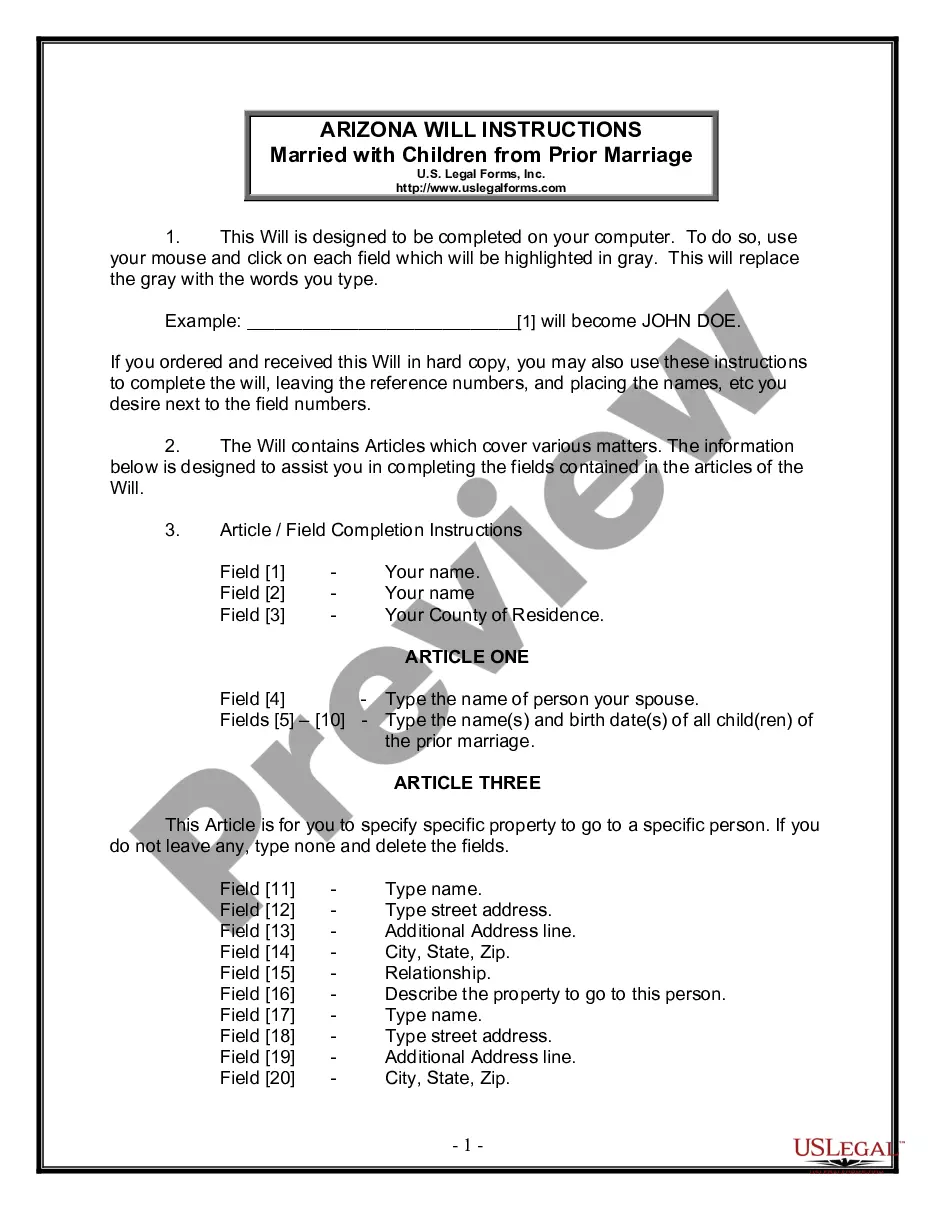

Discovering the right legitimate file template might be a have a problem. Of course, there are plenty of themes accessible on the Internet, but how do you obtain the legitimate type you want? Use the US Legal Forms web site. The assistance gives 1000s of themes, like the Vermont Sample Letter to Pension Plan Administrator regarding Division of Plan Proceeds per Court Order, that can be used for enterprise and private requires. All of the forms are inspected by specialists and meet federal and state specifications.

If you are currently registered, log in to the bank account and click on the Acquire button to find the Vermont Sample Letter to Pension Plan Administrator regarding Division of Plan Proceeds per Court Order. Use your bank account to appear throughout the legitimate forms you have acquired formerly. Proceed to the My Forms tab of your own bank account and obtain one more backup of the file you want.

If you are a new customer of US Legal Forms, allow me to share easy directions that you should stick to:

- First, ensure you have selected the appropriate type for the city/area. It is possible to check out the shape utilizing the Preview button and look at the shape outline to make sure it will be the right one for you.

- In the event the type is not going to meet your needs, make use of the Seach area to get the right type.

- Once you are certain that the shape is suitable, click the Buy now button to find the type.

- Pick the pricing strategy you desire and enter the essential info. Build your bank account and pay money for your order using your PayPal bank account or credit card.

- Choose the submit format and down load the legitimate file template to the device.

- Full, edit and print and sign the attained Vermont Sample Letter to Pension Plan Administrator regarding Division of Plan Proceeds per Court Order.

US Legal Forms is definitely the biggest collection of legitimate forms for which you can see different file themes. Use the company to down load skillfully-manufactured documents that stick to express specifications.

Form popularity

FAQ

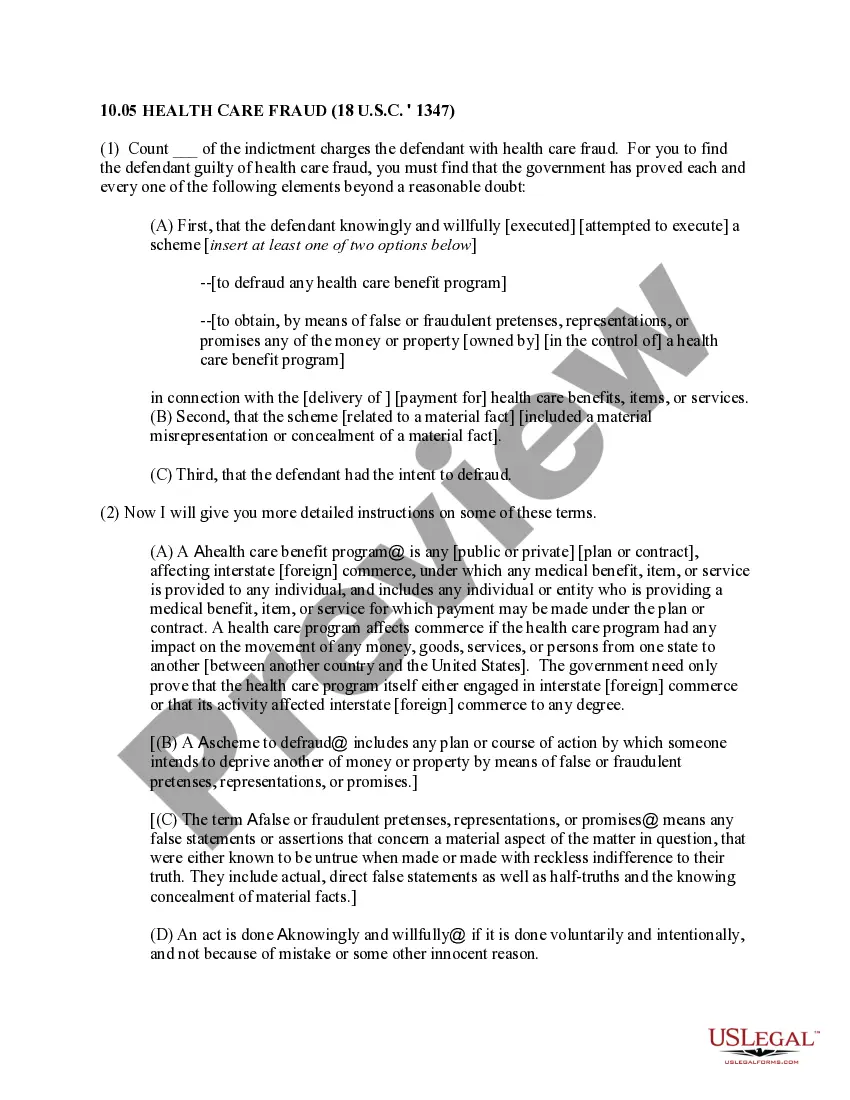

The ?earliest retirement age? for a QDRO under this plan is the earlier of: ? When the participant actually terminates employment or reaches age 59½ , or ? The later of the date the participant reaches age 50 or the date the participant could receive the account balance if the participant terminated employment.

If your jurisdiction follows a system of "equitable distribution" or "community property," then the pension earned during the marriage may be considered a joint asset, and your ex-wife could be entitled to a portion of it.

A QDRO recognizes that a spouse, former spouse, child, or other dependent is entitled to receive some of the account owner's retirement plan assets. A court order cannot force a retirement plan to disburse any benefit not provided through the plan or require increased benefits from the retirement plan.

If your spousal relationship ends, your former spouse may be entitled to an equal share of the pension you earned while in the relationship. Dividing financial assets is complicated, and there are many complex decisions to make.

One of the methods used to calculate your former spouse's community property interest is the "time rule formula." Your pension benefit. Divide the service credit from date of marriage until date of separation by your total service credit. Multiply by your pension benefit.

Generally, an alternate payee is entitled to a distribution from the plan at the same time the participant is eligible for a distribution. However, the QDRO may allow for an immediate payment from the plan. Distribution Request Form is used by an alternate payee to request a payment from the plan.

A spouse or former spouse who receives QDRO benefits from a retirement plan reports the payments received as if he or she were a plan participant. The spouse or former spouse is allocated a share of the participant's cost (investment in the contract) equal to the cost times a fraction.