Title: Understanding Vermont Receipt for Loan Funds: Types and Detailed Description Introduction: Vermont Receipt for Loan Funds is a document that serves as proof of receiving loan funds in the state of Vermont. It provides a record of the loan amount, borrower's information, lender details, loan terms, and conditions. This article aims to provide a detailed description of the Vermont Receipt for Loan Funds, highlighting its purpose and the various types available. Key Keywords: Vermont Receipt for Loan Funds, loan funds, types, detailed description I. Purpose of Vermont Receipt for Loan Funds: Upon disbursal of loan funds, lenders issue a Vermont Receipt for Loan Funds to borrowers as a legal acknowledgment of the loan amount received. This document is crucial for maintaining accurate financial records, ensuring transparency, and providing evidence in case of any future disputes or audits. II. Components of Vermont Receipt for Loan Funds: 1. Borrower Information: This section includes the borrower's name, address, contact details, and other relevant identification information. 2. Lender Details: It contains the lender's name, address, contact information, and any licensing credentials, if applicable. 3. Loan Amount: The exact loan amount disbursed to the borrower is clearly mentioned in the receipt, emphasizing the currency and payment method (cash, check, wire transfer, etc.). 4. Loan Terms and Conditions: This section outlines crucial information such as interest rate, repayment schedule, loan duration, any penalties or additional charges, and any specific terms agreed upon by both parties. 5. Signatures and Dates: The receipt requires the signatures of both the borrower and the lender, along with the date of receipt, confirming that both parties acknowledge the loan transaction. III. Types of Vermont Receipt for Loan Funds: 1. Personal Loan Receipt: A personal loan receipt is issued when an individual borrows funds for personal expenses such as education, medical bills, travel, or any other non-commercial purposes. 2. Business Loan Receipt: This type of receipt is used for loans taken by businesses to support their operations, expansion plans, inventory purchase, or other business-related activities. 3. Mortgage Loan Receipt: When a borrower receives loan funds for a mortgage to purchase or refinance a property, a mortgage loan receipt is generated. 4. Auto Loan Receipt: This receipt is applicable when an individual obtains a loan for purchasing a vehicle. Conclusion: Vermont Receipt for Loan Funds acts as a crucial document to validate the disbursal of loan funds to borrowers. By understanding its purpose and having a detailed description of its components, individuals can ensure their financial transactions are transparent, while maintaining accurate records. Whether it is a personal loan, business loan, mortgage loan, or auto loan, these receipts play a pivotal role in affirming the lending process's legality and authenticity.

Vermont Receipt for loan Funds

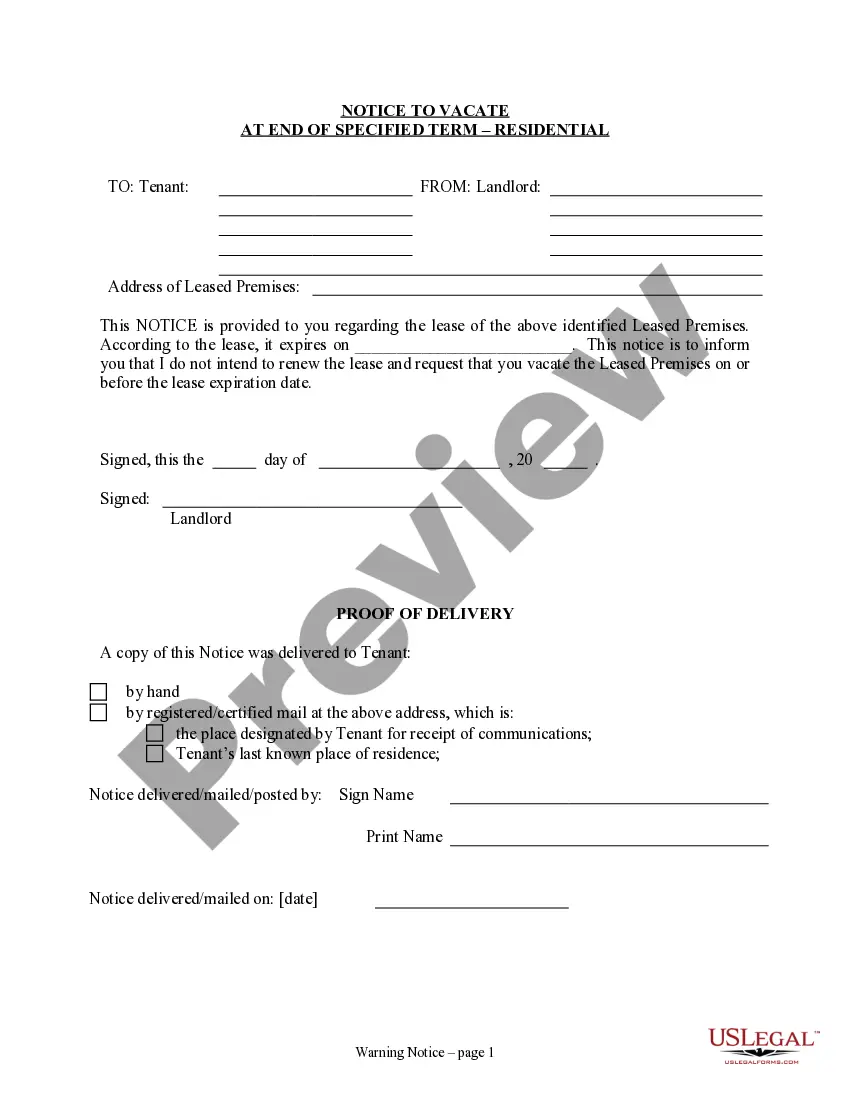

Description

How to fill out Vermont Receipt For Loan Funds?

If you want to complete, acquire, or produce legitimate papers templates, use US Legal Forms, the biggest variety of legitimate varieties, which can be found on-line. Utilize the site`s simple and hassle-free research to find the documents you will need. A variety of templates for organization and specific reasons are sorted by groups and suggests, or keywords. Use US Legal Forms to find the Vermont Receipt for loan Funds in just a number of clicks.

In case you are already a US Legal Forms buyer, log in for your account and click the Acquire option to find the Vermont Receipt for loan Funds. You may also gain access to varieties you earlier delivered electronically from the My Forms tab of your respective account.

If you use US Legal Forms the first time, follow the instructions below:

- Step 1. Be sure you have chosen the form to the appropriate city/country.

- Step 2. Make use of the Preview option to look through the form`s information. Never forget about to learn the information.

- Step 3. In case you are unhappy together with the develop, take advantage of the Look for field at the top of the monitor to find other variations from the legitimate develop template.

- Step 4. Once you have discovered the form you will need, click on the Get now option. Select the prices program you favor and add your qualifications to sign up for the account.

- Step 5. Approach the transaction. You can utilize your charge card or PayPal account to perform the transaction.

- Step 6. Find the structure from the legitimate develop and acquire it in your device.

- Step 7. Full, edit and produce or indication the Vermont Receipt for loan Funds.

Each legitimate papers template you get is your own for a long time. You have acces to each develop you delivered electronically inside your acccount. Click the My Forms section and choose a develop to produce or acquire once again.

Remain competitive and acquire, and produce the Vermont Receipt for loan Funds with US Legal Forms. There are millions of professional and express-distinct varieties you can use to your organization or specific requirements.