Vermont Sample Letter of Intent - Franchise Purchase via Stock Purchase

Description

How to fill out Sample Letter Of Intent - Franchise Purchase Via Stock Purchase?

Choosing the right legitimate file design can be quite a struggle. Needless to say, there are a variety of templates accessible on the Internet, but how can you discover the legitimate kind you require? Utilize the US Legal Forms site. The support gives thousands of templates, like the Vermont Sample Letter of Intent - Franchise Purchase via Stock Purchase, that you can use for enterprise and private requirements. Every one of the varieties are checked by professionals and meet federal and state requirements.

In case you are currently registered, log in for your account and click on the Down load key to have the Vermont Sample Letter of Intent - Franchise Purchase via Stock Purchase. Use your account to appear from the legitimate varieties you possess purchased formerly. Visit the My Forms tab of your account and acquire one more duplicate of your file you require.

In case you are a new end user of US Legal Forms, here are simple recommendations that you can comply with:

- First, be sure you have selected the right kind for your metropolis/area. You may look through the form utilizing the Preview key and read the form outline to make sure it is the best for you.

- In the event the kind fails to meet your needs, use the Seach field to obtain the appropriate kind.

- Once you are certain the form would work, click the Acquire now key to have the kind.

- Pick the pricing plan you desire and type in the necessary information and facts. Create your account and pay money for the order utilizing your PayPal account or Visa or Mastercard.

- Select the data file format and download the legitimate file design for your device.

- Total, revise and print out and sign the obtained Vermont Sample Letter of Intent - Franchise Purchase via Stock Purchase.

US Legal Forms may be the biggest library of legitimate varieties for which you can discover various file templates. Utilize the company to download expertly-manufactured files that comply with express requirements.

Form popularity

FAQ

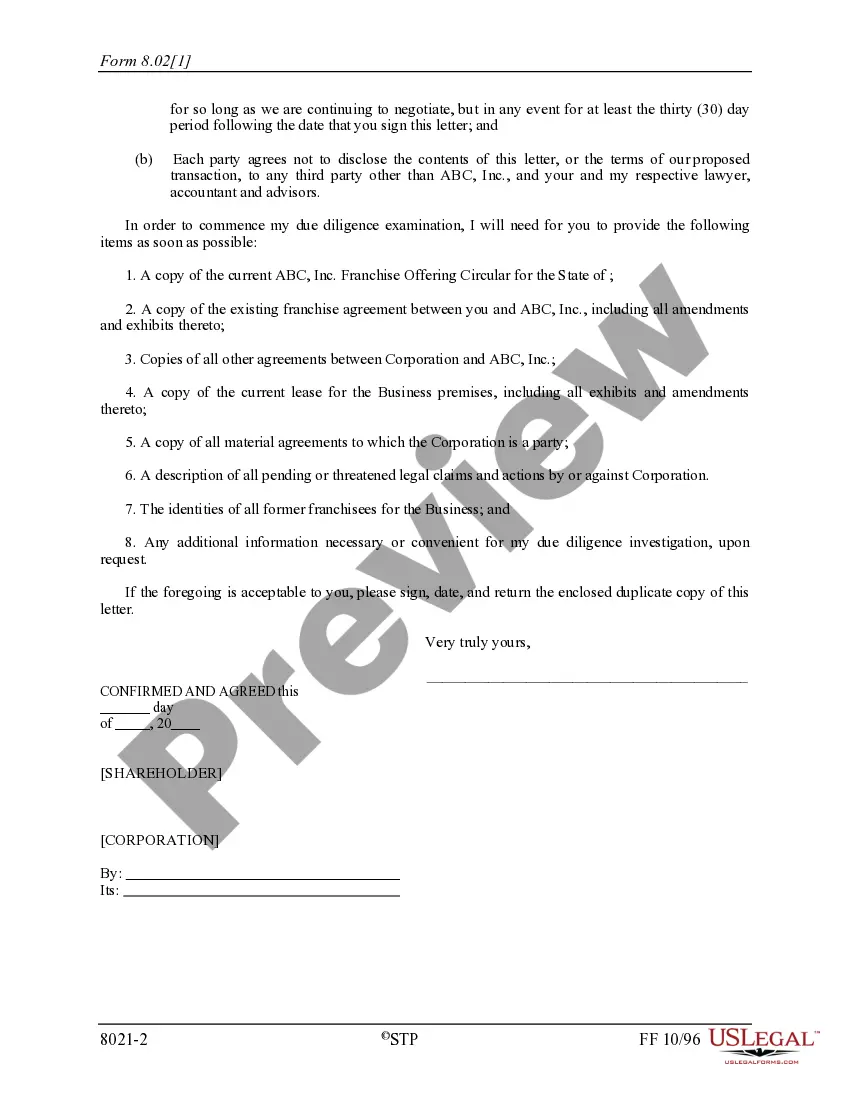

A letter of intent to purchase is a written document detailing a buyer's intent to purchase a seller's product, assets, or services. It's used to establish and indicate an understanding between two or more parties which provides the basis for a future or proposed agreement.

How to Structure the Letter Name the Parties. Provide the full names and mailing addresses of the buyer and seller. ... Identify the Business. The parties must identify the name of the business being considered for purchase. Establish the Payment Terms. ... Detail the Terms and Conditions. ... Sign the Letter.

The LOI memorializes the terms of a real estate transaction before it is finalized. It is an agreement that states the desire to enter into a real estate transaction, such as a sale or lease. It outlines the crucial terms before the purchase contract or lease is signed.

A stock purchase letter of intent is used for the purchase of a limited number of stocks in a company or corporation from an individual or entity that owns the desired shares. A letter of intent is often non-binding and is instead a preliminary offer prior to the signing of a purchase agreement.

Identify your letter as a letter of intent to sell shares. Define the company and who is meant by "seller" and "buyer." Include contact information for all the parties. Include the postal and registered address of the company, if they're different. Name every shareholder involved in the sale.

A letter of intent (LOI) is a document declaring the preliminary commitment of one party to do business with another. The letter outlines the chief terms of a prospective deal. Commonly used in major business transactions, LOIs are similar in content to term sheets.

A letter of intent (LOI) is a document written in business letter format that declares your intent to do a specific thing. It's usually, but not always, nonbinding, and it states a preliminary commitment by one party to do business with another party.

The Letter of Intent is a written, non- binding document which outlines an agreement in principle for the buyer to purchase the seller's business, stating the proposed price and terms. The mutually signed LOI is required before the buyer proceeds with the ?due diligence? phase of acquisition.