Vermont Deed Conveying Condominium Unit to Charity with Reservation of Life Tenancy in Donor and Donor's Spouse A Vermont Deed Conveying Condominium Unit to Charity with Reservation of Life Tenancy in Donor and Donor's Spouse is a legal document that transfers ownership of a condominium unit to a charitable organization while allowing the donor and their spouse to retain a life tenancy in the property. This type of deed is commonly used by individuals who wish to make a significant charitable contribution while still maintaining the right to live in their property for the remainder of their lives. With this deed, the donor transfers their condominium unit to a chosen charitable organization, thereby enabling the charity to benefit from the property's value. However, the donor and their spouse reserve the right to live in the unit throughout their lifetime, also known as a life tenancy. The key purpose of this arrangement is to allow the donor and their spouse to continue living in the property while also making a generous charitable contribution. By utilizing this type of deed, donors can enjoy the peace of mind that comes from knowing they have supported a worthy cause while retaining the security and comfort of their home. There are various subtypes of this particular deed, including: 1. Vermont Deed Conveying Condominium Unit to Charity with Reservation of Life Estate in Donor: In this variation, the donor retains a life estate in the property, meaning they have the right to occupy and use the condominium unit for the duration of their life. This type of deed guarantees the donor's continued residency until their passing. 2. Vermont Deed Conveying Condominium Unit to Charity with Reservation of Life Estate in Donor and Donor's Spouse: This subtype extends the life estate reservation to both the donor and their spouse. It ensures that both individuals have the right to live in the condominium unit for as long as they both live. 3. Vermont Deed Conveying Condominium Unit to Charity with Reservation of Life Use in Donor: With this variation, the donor retains the right to use the condominium unit for their lifetime, but the ownership is transferred to the charity immediately. Unlike a life estate, a life use does not include the right to rent, sell, or transfer the property. Regardless of the specific subtype, the primary objective behind a Vermont Deed Conveying Condominium Unit to Charity with Reservation of Life Tenancy in Donor and Donor's Spouse is to establish a long-term charitable arrangement while allowing the donor and spouse to continue enjoying their home. This type of deed can provide financial benefits, tax advantages, and ultimately create a meaningful legacy through philanthropic contribution.

Vermont Deed Conveying Condominium Unit to Charity with Reservation of Life Tenancy in Donor and Donor's Spouse

Description

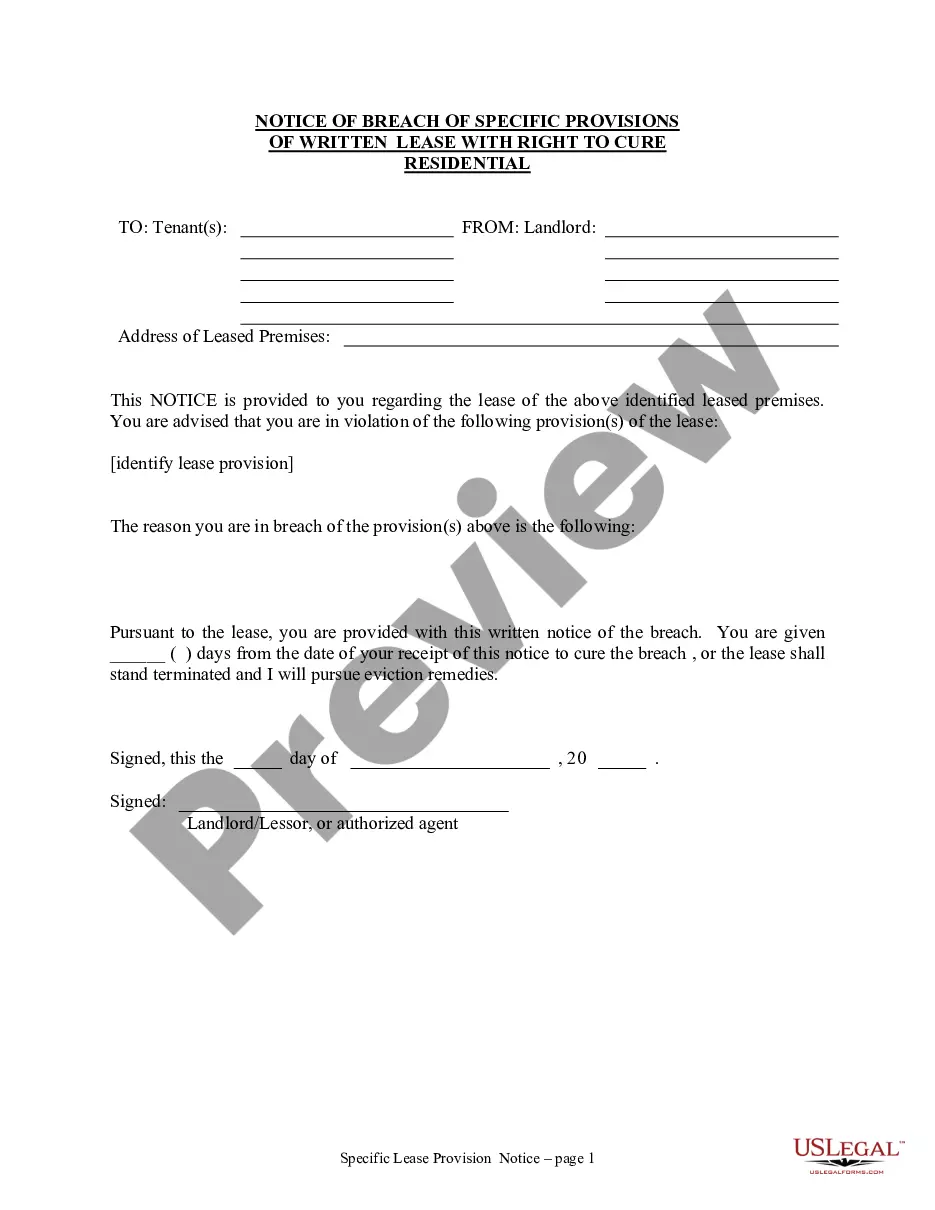

How to fill out Vermont Deed Conveying Condominium Unit To Charity With Reservation Of Life Tenancy In Donor And Donor's Spouse?

You are able to spend hours online trying to find the lawful document web template that suits the federal and state needs you require. US Legal Forms supplies a huge number of lawful forms that are evaluated by professionals. You can actually obtain or print out the Vermont Deed Conveying Condominium Unit to Charity with Reservation of Life Tenancy in Donor and Donor's Spouse from our support.

If you already have a US Legal Forms profile, you may log in and click on the Acquire button. Following that, you may comprehensive, revise, print out, or indicator the Vermont Deed Conveying Condominium Unit to Charity with Reservation of Life Tenancy in Donor and Donor's Spouse. Each lawful document web template you buy is yours for a long time. To acquire another copy of any bought kind, proceed to the My Forms tab and click on the corresponding button.

If you use the US Legal Forms web site the first time, keep to the basic guidelines below:

- Initial, ensure that you have selected the proper document web template for the region/town of your choosing. Read the kind description to ensure you have selected the proper kind. If offered, use the Review button to search through the document web template at the same time.

- If you want to find another model of your kind, use the Look for field to obtain the web template that suits you and needs.

- When you have discovered the web template you want, simply click Buy now to continue.

- Select the prices prepare you want, key in your credentials, and register for a merchant account on US Legal Forms.

- Comprehensive the financial transaction. You should use your credit card or PayPal profile to fund the lawful kind.

- Select the format of your document and obtain it in your gadget.

- Make alterations in your document if necessary. You are able to comprehensive, revise and indicator and print out Vermont Deed Conveying Condominium Unit to Charity with Reservation of Life Tenancy in Donor and Donor's Spouse.

Acquire and print out a huge number of document templates utilizing the US Legal Forms web site, which provides the largest assortment of lawful forms. Use professional and status-specific templates to take on your organization or person requirements.

Form popularity

FAQ

A life estate helps avoid the probate process upon the life tenant's death. The property will automatically transfer to the remainderman, making the process simple and easy ? a will isn't needed for the transfer to happen.

Joint Tenancy With The Right Of Survivorship ? This method of ownership provides that in the event of the death of any one of the titleholders, the title automatically and without the need for probate, passes to the surviving owners.

An interest in land that is inheritable by and transferable to only lineal descendants of the original grantee.

Cons of a Life Estate Deed Lack of control for the owner. ... Property taxes, which remain for the life tenant until their death. ... It's tough to reverse. ... The owner is still vulnerable to any debt actions that may be brought against the future beneficiary or remainderman.

A lady bird deed is a type of life estate deed that lets the owner maintain control of a property until their death, when the property automatically transfers to a beneficiary without going through probate.

While a fee simple estate generally means that the land may be used by the grantee for an unlimited duration, a life estate only grants the ownership of the (interests of the) property for as long as the grantee lives.

Fee Tail vs Life Estate The ownership is meant to be passed down through a specific line of descendants indefinitely, potentially leading to perpetuity. Life estate provides ownership rights to an individual only for the duration of their life.

The Vermont Condominium Ownership Act requires the association to file a declaration, floor plans, lot plans, and apartment deeds with the county where the property is located. The association cannot have a lien on the property after the declaration is filed. However, apartment owners can have mortgages.