Vermont Receipt for Payment of Loss for Subrogation is a legal document that serves as proof of payment for a loss and transfers the rights of the claimant to the paying party. This document is commonly used in insurance claims cases, where an insurance company pays for a loss on behalf of their insured and then seeks reimbursement from the responsible party. Subrogation refers to the process where an insurance company recovers funds it paid for an insured's loss from a liable third party, typically the party at fault for the loss. The Vermont Receipt for Payment of Loss for Subrogation is a crucial tool in this process as it establishes the transfer of the claimant's rights to the insurance company once the payment has been made. The document generally includes the following key details: 1. Parties involved: The receipt specifies the names and contact information of the parties involved in the subrogation process, namely the claimant (the insured or policyholder), the insurance company, and the liable third party (if known at the time of payment). 2. Payment details: The receipt will state the specific amount paid by the insurance company to the claimant, including any deductibles or exclusions that may apply. 3. Loss description: A detailed description of the loss and the circumstances of it, including supporting documentation, is typically included in the receipt. This may encompass various types of losses such as property damage, personal injury, or automobile accidents. 4. Subrogation rights: The receipt clearly states that the claimant, by accepting the payment, transfers all rights to the insurance company for pursuing subrogation against the responsible party to recover the funds paid on their behalf. 5. Legal implications: The document may include a statement specifying that acceptance of the payment does not release the liable party from any legal obligations or rights held by the insurance company. Different types of Vermont Receipt for Payment of Loss for Subrogation may exist depending on the nature of the loss and the type of insurance coverage involved. For example, specific receipts may be used for property damage claims, bodily injury claims, or auto insurance claims. Using keywords in your content can improve its relevance for search engines. Here are some relevant keywords: Vermont subrogation, receipt of payment, loss reimbursement, insurance claims, legal document, claimant rights transfer, payment details, liable third party, property damage, personal injury, auto insurance, reimbursement process.

Vermont Receipt for Payment of Loss for Subrogation

Description

How to fill out Vermont Receipt For Payment Of Loss For Subrogation?

Choosing the best legitimate file template might be a battle. Naturally, there are a lot of layouts available on the net, but how do you obtain the legitimate develop you want? Utilize the US Legal Forms site. The service gives a large number of layouts, like the Vermont Receipt for Payment of Loss for Subrogation, which you can use for enterprise and private requirements. Every one of the forms are examined by professionals and fulfill state and federal needs.

If you are presently registered, log in to your account and then click the Download switch to have the Vermont Receipt for Payment of Loss for Subrogation. Make use of account to search through the legitimate forms you might have acquired formerly. Proceed to the My Forms tab of the account and get one more version from the file you want.

If you are a whole new consumer of US Legal Forms, listed here are basic guidelines that you can follow:

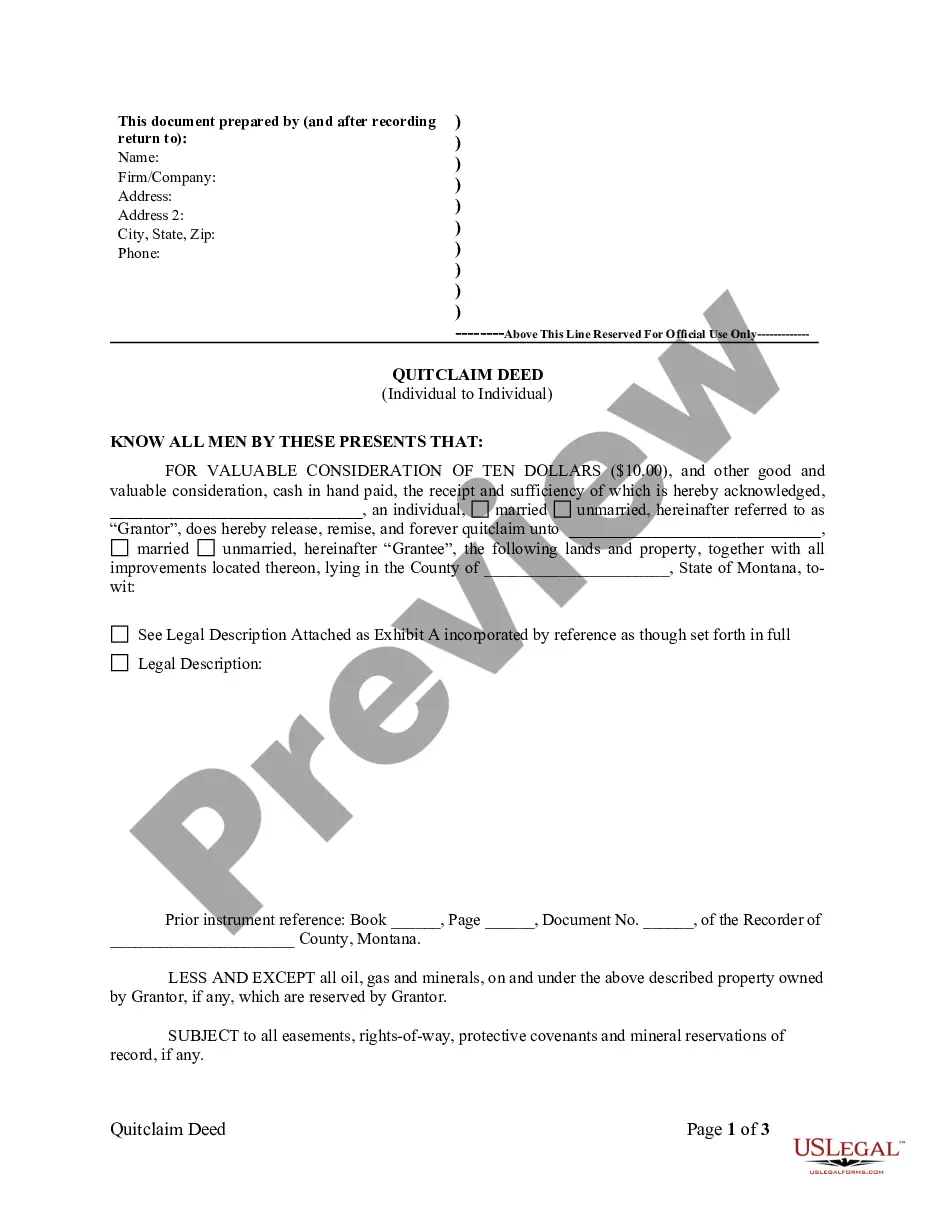

- First, be sure you have chosen the right develop for your personal area/county. You are able to examine the shape using the Preview switch and browse the shape description to make certain it will be the right one for you.

- When the develop fails to fulfill your preferences, utilize the Seach discipline to discover the proper develop.

- Once you are certain that the shape is acceptable, click on the Get now switch to have the develop.

- Select the costs strategy you want and enter the essential information. Create your account and buy your order utilizing your PayPal account or credit card.

- Pick the document file format and acquire the legitimate file template to your product.

- Total, edit and produce and indication the obtained Vermont Receipt for Payment of Loss for Subrogation.

US Legal Forms will be the greatest library of legitimate forms in which you can find different file layouts. Utilize the company to acquire expertly-made files that follow express needs.

Form popularity

FAQ

Vermont negligence laws follow the doctrine of modified comparative negligence.

In most cases, Vermont has a three-year statute of limitations for personal injury claims. To be clear, this means that the victim's case must be initiated within three years, not that it has to be completely resolved within that time frame.

The Vermont Tort Claims Act waives sovereign immunity for certain instances of negligence and makes Vermont liable for the negligence of employees. Municipal liability is largely a matter of common law.

(a) A person who knows that another is exposed to grave physical harm shall, to the extent that the same can be rendered without danger or peril to himself or herself or without interference with important duties owed to others, give reasonable assistance to the exposed person unless that assistance or care is being ...

Vermont Statute Of Limitations In Vermont, an injured person has three years from the date of the injury or accident to file a personal injury lawsuit in the state's civil court system.

(1) A person who operates a motor vehicle on a public highway in a negligent manner shall be guilty of negligent operation. (2) The standard for a conviction for negligent operation in violation of this subsection shall be ordinary negligence, examining whether the person breached a duty to exercise ordinary care.