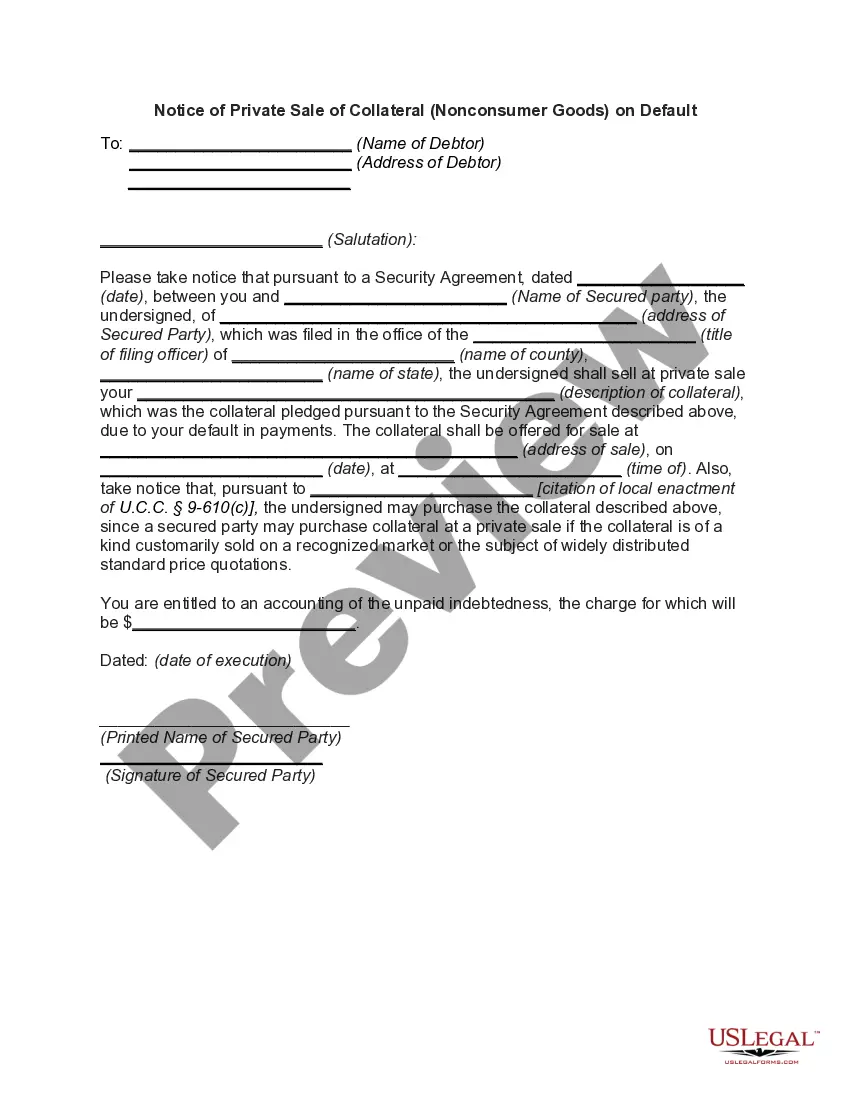

Vermont Notice of Private Sale of Collateral (Non-consumer Goods) on Default Keywords: Vermont, Notice of Private Sale, Collateral, Non-consumer Goods, Default 1. Introduction to Vermont Notice of Private Sale of Collateral (Non-consumer Goods) on Default: The Vermont Notice of Private Sale of Collateral serves as a formal document that lenders or secured parties use when an individual or entity defaults on a loan or credit agreement involving non-consumer goods. This notice allows the lender to inform the borrower of their intention to sell the collateral to recover the outstanding debt. Failure to address the default or negotiate alternative arrangements may lead to the lender conducting a private sale of the assets. 2. Purpose and Legal Requirements: The purpose of the Vermont Notice of Private Sale of Collateral is to provide proper notification to the borrower about the intended private sale of the collateral. This notice must comply with the requirements stated in the Vermont UCC (Uniform Commercial Code) provision, specifically Article 9. The lender must ensure that the notice is comprehensive, accurate, and sent within the timeframe specified by law. 3. Types of Vermont Notice of Private Sale of Collateral (Non-consumer Goods) on Default: a) Vermont Notice of Private Sale of Collateral — Standard Form: This type of notice follows the standard format and content requirements as per Vermont UCC provisions. It includes details such as borrower and lender information, description of collateral, amount owed, notice of intended private sale, and contact details of the lender. b) Vermont Notice of Private Sale of Collateral — Modified Form: In certain cases, lenders may require modifications to the standard form to suit specific circumstances. This form still adheres to the legal requirements but includes additional clauses or information as agreed upon between the parties. c) Vermont Notice of Private Sale of Collateral — Verified Form: If there is a need for legal verification or certification of the notice, lenders may opt for a verified form. This may involve obtaining an affidavit or supporting documentation to strengthen the credibility of the notice. 4. Essential Elements of the Notice: To ensure legal validity, the Vermont Notice of Private Sale of Collateral should include the following elements: — Identification of the parties involved (lender and borrower) — Description of the collateral being sold — Details of the default or breach of contract by the borrower — Amount owed by thborrowedwe— - Notification of the intent to sell the collateral through a private sale — Date, time, and locatiopalatalal— - Information on the borrower's right to redeem the collateral before the sale — Explanation of the borrower's deficiency liability (if applicable) — Contact details of the lender or its authorized representative Note: It is crucial to consult legal counsel or familiarize oneself with Vermont laws and regulations to ensure compliance with all requirements for a valid notice. In conclusion, the Vermont Notice of Private Sale of Collateral plays a critical role in informing borrowers about their lender's intention to privately sell non-consumer goods in the event of a default. By providing all necessary details and adhering to Vermont UCC provisions, lenders can protect their interests while ensuring transparency and fairness in the sale process.

Vermont Notice of Private Sale of Collateral (Non-consumer Goods) on Default

Description

How to fill out Vermont Notice Of Private Sale Of Collateral (Non-consumer Goods) On Default?

You can commit time on the Internet attempting to find the authorized document design that meets the state and federal requirements you need. US Legal Forms provides thousands of authorized types that are examined by professionals. You can easily down load or produce the Vermont Notice of Private Sale of Collateral (Non-consumer Goods) on Default from our services.

If you already possess a US Legal Forms profile, you are able to log in and click the Down load button. Afterward, you are able to total, revise, produce, or indication the Vermont Notice of Private Sale of Collateral (Non-consumer Goods) on Default. Each authorized document design you acquire is your own property for a long time. To have an additional version associated with a obtained type, proceed to the My Forms tab and click the corresponding button.

If you work with the US Legal Forms website initially, stick to the straightforward directions beneath:

- First, ensure that you have selected the correct document design for your area/metropolis that you pick. See the type outline to make sure you have picked the correct type. If offered, utilize the Preview button to check with the document design also.

- If you want to locate an additional model in the type, utilize the Search discipline to get the design that meets your requirements and requirements.

- Once you have found the design you desire, click Buy now to proceed.

- Pick the costs strategy you desire, type in your accreditations, and sign up for your account on US Legal Forms.

- Complete the purchase. You should use your charge card or PayPal profile to pay for the authorized type.

- Pick the file format in the document and down load it to your system.

- Make modifications to your document if necessary. You can total, revise and indication and produce Vermont Notice of Private Sale of Collateral (Non-consumer Goods) on Default.

Down load and produce thousands of document web templates utilizing the US Legal Forms site, which provides the biggest assortment of authorized types. Use professional and express-distinct web templates to take on your business or personal demands.