A Vermont Commission Buyout Agreement Insurance Agent is a professional who specializes in assisting individuals, businesses, or organizations in purchasing insurance policies that include commission buyout agreements. This type of insurance policy is designed to financially protect insurance agents or brokers when they are ready to sell their books of business. Commission buyout agreements are commonly used in the insurance industry to provide agents or brokers with a lump sum payment when they sell their business. Instead of receiving ongoing commissions from the policies they have sold, agents can choose to sell their future commissions to a third party, such as an insurance company or investment firm. Vermont Commission Buyout Agreement Insurance Agents serve as intermediaries between insurance agents or brokers looking to sell their commission rights and the potential buyers. They possess a deep understanding of the insurance market in Vermont and have knowledge of the specific legal and regulatory landscape related to commission buyout agreements. These agents provide advisory services to insurance agents or brokers who wish to sell their commission rights, guiding them through the buyout process, and helping them find suitable buyers. They play a crucial role in evaluating the value of the commission rights being sold, negotiating on behalf of their clients, and ensuring a fair and profitable transaction. The different types of Vermont Commission Buyout Agreement Insurance Agents include: 1. Independent Insurance Agents: These agents work independently and represent multiple insurance companies. They have the flexibility to offer a variety of commission buyout options from different insurers, tailoring the solution to meet the unique needs of their clients. 2. Captive Insurance Agents: These agents work exclusively for one insurance company. They can still provide commission buyout agreement services but may be limited to the options offered by their parent company. 3. Insurance Brokers: Insurance brokers act as intermediaries between insurance buyers and insurance providers. They can assist insurance agents or brokers in finding the best commission buyout agreement options available in the market by leveraging their network and knowledge. 4. Insurance Consultants: These professionals specialize in providing expert advice and guidance on various insurance-related matters. Insurance consultants may offer their services to insurance agents or brokers seeking assistance with commission buyout agreements, helping them understand the implications, risks, and benefits associated with such transactions. In conclusion, a Vermont Commission Buyout Agreement Insurance Agent is an expert in facilitating the sale of commission rights for insurance agents or brokers looking to exit the industry or transition their business. These agents provide valuable guidance, negotiation support, and access to suitable buyers, ensuring a smooth and profitable transaction.

Vermont Commission Buyout Agreement Insurance Agent

Description

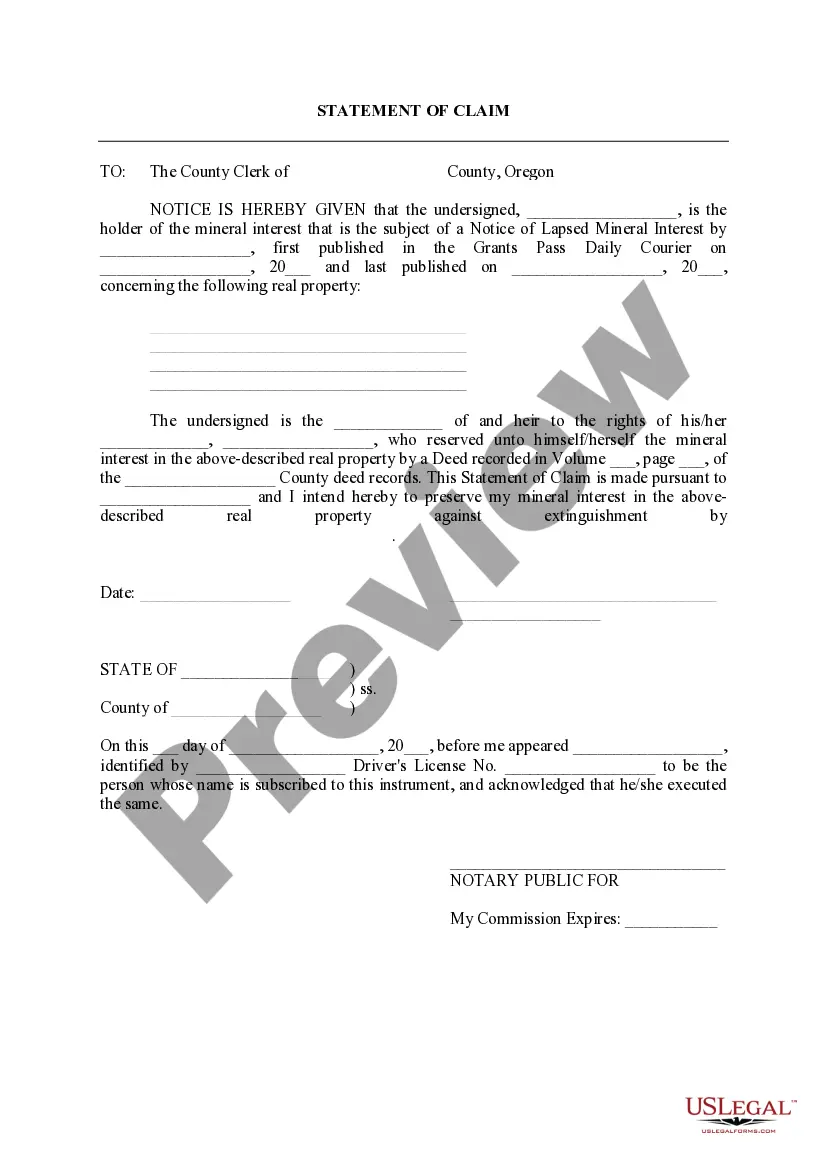

How to fill out Vermont Commission Buyout Agreement Insurance Agent?

You can spend hours online looking for the legitimate file template that suits the federal and state needs you require. US Legal Forms offers thousands of legitimate varieties which are evaluated by specialists. It is simple to acquire or produce the Vermont Commission Buyout Agreement Insurance Agent from our service.

If you already possess a US Legal Forms profile, you may log in and click the Down load option. Afterward, you may total, revise, produce, or sign the Vermont Commission Buyout Agreement Insurance Agent. Every legitimate file template you acquire is yours permanently. To obtain another version of any bought type, check out the My Forms tab and click the related option.

If you use the US Legal Forms internet site for the first time, stick to the basic instructions beneath:

- First, ensure that you have selected the correct file template for that county/area that you pick. Read the type information to make sure you have selected the appropriate type. If offered, use the Review option to check through the file template also.

- If you want to discover another version of your type, use the Research area to discover the template that meets your requirements and needs.

- After you have located the template you need, click on Get now to continue.

- Select the pricing strategy you need, key in your credentials, and sign up for a free account on US Legal Forms.

- Comprehensive the deal. You can use your charge card or PayPal profile to purchase the legitimate type.

- Select the format of your file and acquire it for your system.

- Make adjustments for your file if required. You can total, revise and sign and produce Vermont Commission Buyout Agreement Insurance Agent.

Down load and produce thousands of file templates making use of the US Legal Forms site, which provides the biggest assortment of legitimate varieties. Use professional and condition-distinct templates to deal with your company or personal requires.