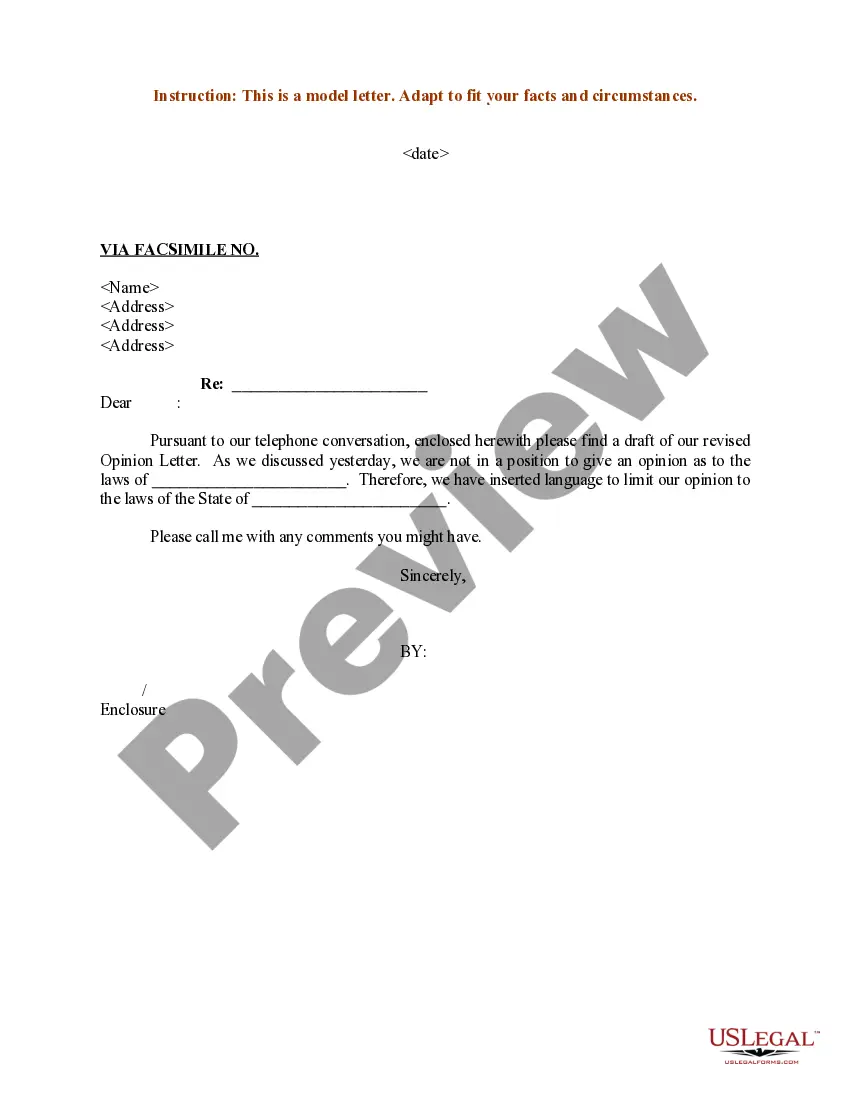

Vermont Sample Letter for Request of State Attorney's opinion concerning Taxes

Description

How to fill out Sample Letter For Request Of State Attorney's Opinion Concerning Taxes?

You are able to invest hours on-line searching for the legal file format that meets the state and federal needs you will need. US Legal Forms gives a large number of legal varieties which are examined by professionals. You can actually download or print the Vermont Sample Letter for Request of State Attorney's opinion concerning Taxes from the assistance.

If you already possess a US Legal Forms profile, you may log in and then click the Obtain switch. After that, you may total, edit, print, or indicator the Vermont Sample Letter for Request of State Attorney's opinion concerning Taxes. Each legal file format you acquire is your own eternally. To acquire an additional copy of the bought type, visit the My Forms tab and then click the corresponding switch.

If you work with the US Legal Forms internet site initially, adhere to the simple directions beneath:

- Initially, be sure that you have chosen the best file format for that state/city of your choosing. Browse the type outline to make sure you have picked out the appropriate type. If accessible, utilize the Preview switch to appear from the file format as well.

- If you wish to discover an additional edition of the type, utilize the Lookup field to find the format that meets your needs and needs.

- When you have identified the format you would like, simply click Acquire now to proceed.

- Choose the costs program you would like, enter your accreditations, and sign up for an account on US Legal Forms.

- Full the deal. You may use your Visa or Mastercard or PayPal profile to cover the legal type.

- Choose the format of the file and download it to the device.

- Make adjustments to the file if needed. You are able to total, edit and indicator and print Vermont Sample Letter for Request of State Attorney's opinion concerning Taxes.

Obtain and print a large number of file layouts making use of the US Legal Forms website, that provides the largest variety of legal varieties. Use expert and state-distinct layouts to take on your business or individual needs.

Form popularity

FAQ

Does a Power of Attorney need to be notarized, witnessed, or recorded in Vermont? The guidelines and restrictions will be different in each state; however, in Vermont, your document must be signed by one witness and a notary public.

This power of attorney authorizes another person (your agent) to make decisions concerning your property for you (the principal). Your agent will be able to make decisions and act with respect to your property (including your money) whether or not you are able to act for yourself.

An advance directive is what many people think of as a living will or a durable power of attorney for health care. It is a written document that outlines your wishes for medical treatment in the future, including if you are no longer able to make those decisions.

A taxpayer may designate another person, such as a tax professional, an attorney, a family member, or friend, as the taxpayer's agent through a power of attorney. This authorizes the agent to prepare and file a tax return on the taxpayer's behalf and represent the taxpayer before the Vermont Department of Taxes.

Steps for Making a Financial Power of Attorney in Vermont Create the POA Using a Form, Software or an Attorney. ... Sign the POA in the Presence of a Witness and Notary Public. ... Store the Original POA in a Safe Place. ... Give a Copy to Your Agent or Attorney-in-Fact. ... File a Copy With the Town or City Clerk's Office.

This power of attorney authorizes another person (your agent) to make decisions concerning your property for you (the principal). Your agent will be able to make decisions and act with respect to your property (including your money) whether or not you are able to act for yourself.

You may complete Form PVR-317, Vermont Property Tax Public, Pious, or Charitable Exemption application to present to the lister. The application will help you gather the necessary information the lister needs. It is important that you provide clear and detailed information about the property and its uses.

A tax opinion letter can help in reducing the likelihood of an audit and provide a strong rationale for a tax position or a strategy to minimize your tax exposure by referring to specific IRS codes and rulings.