Vermont Scriptwriter Agreement

Description

How to fill out Scriptwriter Agreement?

If you wish to acquire, download, or print authentic document templates, utilize US Legal Forms, the premier collection of lawful forms, accessible online.

Use the site’s straightforward and user-friendly search function to find the documents you require.

Various templates for business and personal purposes are organized by categories and states, or keywords.

Step 4. Once you have found the form you need, click the Purchase now button. Choose the pricing plan you prefer and enter your information to create an account.

Step 5. Complete the transaction. You can use your Visa or Mastercard or PayPal account to finalize the payment. Step 6. Choose the format of the legal form and download it to your device. Step 7. Fill out, edit, and print or sign the Vermont Scriptwriter Agreement.

Every legal document format you purchase is yours to keep permanently. You have access to every form you downloaded in your account. Check the My documents section and select a form to print or download again. Complete and download, and print the Vermont Scriptwriter Agreement with US Legal Forms. There are thousands of professional and state-specific forms you can utilize for your business or personal needs.

- Utilize US Legal Forms to locate the Vermont Scriptwriter Agreement with just a few clicks.

- If you are currently a US Legal Forms user, Log In to your account and click the Download button to access the Vermont Scriptwriter Agreement.

- You can also find forms you have previously downloaded in the My documents tab of your account.

- If you are using US Legal Forms for the first time, follow the steps below.

- Step 1. Ensure you have selected the form for your correct city/state.

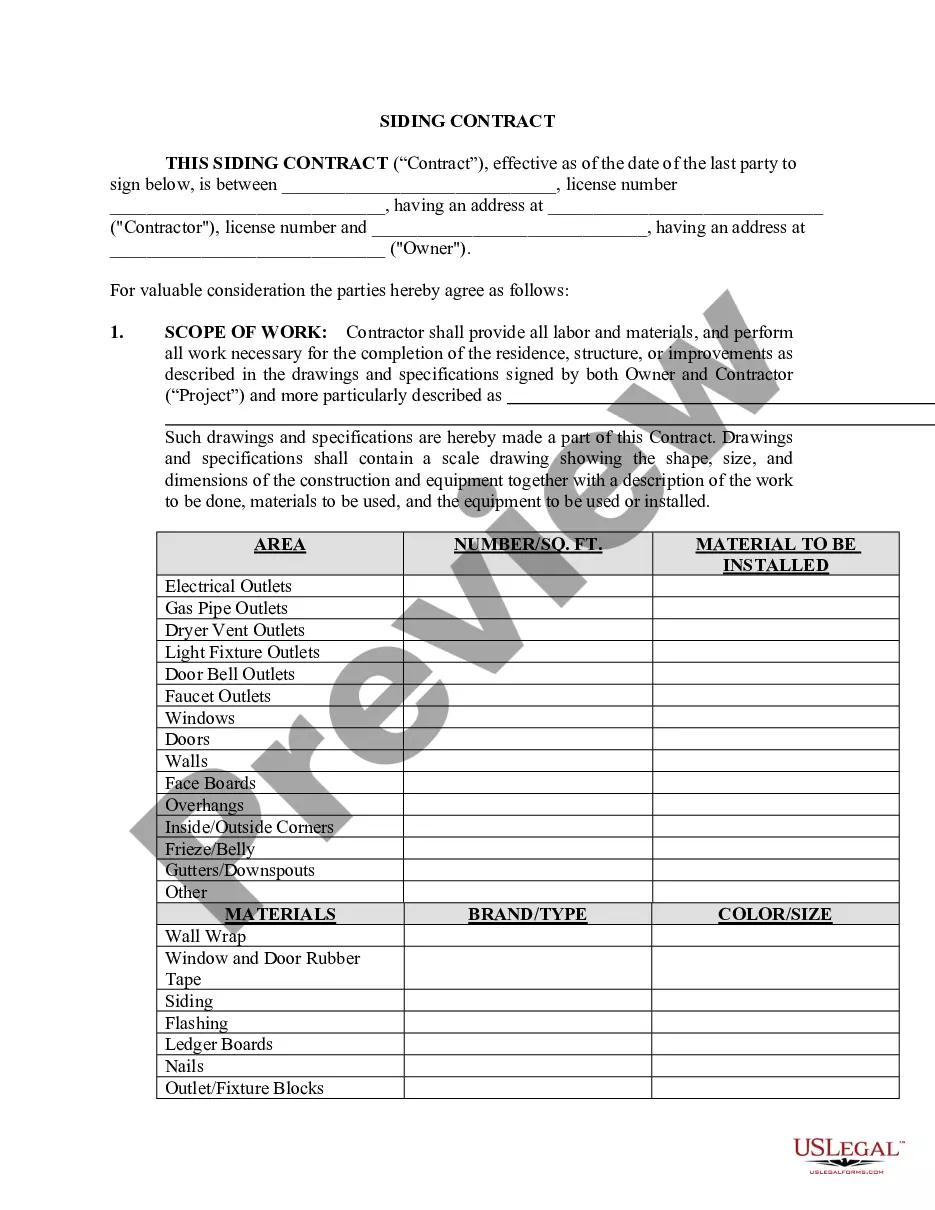

- Step 2. Use the Preview function to review the form’s content. Remember to read the instructions.

- Step 3. If you are not satisfied with the form, use the Search area at the top of the screen to find other forms in the legal form format.

Form popularity

FAQ

You can obtain Vermont tax forms directly from the Vermont Department of Taxes website. They offer a comprehensive array of forms, including those needed for property transfers and other tax filings. For added convenience, consider checking whether your Vermont Scriptwriter Agreement includes necessary information about tax forms to help streamline your tax preparation.

In Vermont, the seller generally pays the property transfer tax at the time of sale. However, this can be negotiated between the buyer and seller, allowing flexibility in the transaction agreements. Recognizing the responsibilities tied to property transfer can be clearer with a well-drafted Vermont Scriptwriter Agreement, ensuring all parties understand their obligations.

Property tax in Vermont is based on the assessed value of real estate, which is established by local municipalities. Homeowners receive a tax bill that typically contributes to public services like schools and roads. Payment is usually made annually, and rates may vary by town. Keeping paperwork organized with a Vermont Scriptwriter Agreement can simplify understanding your property tax obligations.

To avoid Vermont estate tax, individuals can consider estate planning strategies, such as gifting assets during their lifetime. Trusts may also protect your estate from this tax. Furthermore, ensuring your estate is structured properly can help in minimizing tax liabilities. Understanding how a Vermont Scriptwriter Agreement can integrate with estate planning can provide effective strategies.

Yes, selling a house in Vermont may involve taxes, specifically the capital gains tax. This tax applies to the profit made from the sale. Additionally, if a home is sold for over a certain amount, the Vermont property transfer tax may also apply. It's wise to consult with a tax professional familiar with the Vermont Scriptwriter Agreement to navigate any potential tax implications.