Title: Vermont Notice of Special Stockholders' Meeting to Consider Recapitalization — A Comprehensive Guide Introduction: The Vermont Notice of Special Stockholders' Meeting to Consider Recapitalization is a crucial document that outlines the details of an upcoming meeting held by a Vermont-based corporation with its stockholders. This notice seeks to inform stockholders about the special meeting, its purpose, and encourages their participation to discuss potential recapitalization strategies. This detailed description will shed light on the various aspects of these notices and their importance. 1. Purpose of the Notice: The notice serves as an official communication tool to inform stockholders about the intent to consider recapitalization. It explains the reasons behind the company's desire to revise its capital structure and highlights the potential benefits the company can reap from such a change. 2. Types of Vermont Notice of Special Stockholders' Meeting to Consider Recapitalization: a. Voluntary Recapitalization Notice: This type of notice is issued when the corporation willingly decides to seek stockholder approval for recapitalization to address specific business needs or growth opportunities. The motives can include debt reduction, increasing shareholder value, restructuring ownership, or amending the dividend policy. b. Legal Obligation Imposed Recapitalization Notice: This type of notice is issued when the company is legally obligated to seek stockholder approval due to various reasons, such as statutory provisions, corporate bylaws, or court orders. These obligations could stem from mergers, acquisitions, or regulatory requirements. 3. Key Components of the Notice: a. Meeting Details: The notice clearly mentions the place, date, and time of the special stockholders' meeting, ensuring that stakeholders can plan their participation accordingly. b. Recapitalization Explanation: The notice provides a clear and concise explanation of the recapitalization concept. It may cover aspects like changes to the corporate structure, impact on share value, voting rights, dividend policies, or any other modifications that will potentially occur as a result of recapitalization. c. Purpose and Benefits: The notice describes the main objectives behind pursuing recapitalization strategies, such as improving financial flexibility, enhancing the company's competitive position, better aligning with market trends, or overcoming specific obstacles. d. Voting Information: The notice outlines the voting procedures, including eligibility criteria, deadlines for proxy submissions, and the importance of stockholders' involvement in the decision-making process. It encourages stockholders to exercise their votes to gain a comprehensive mandate for the proposed recapitalization. e. Additional Materials & Questions: The notice may specify any accompanying materials, such as proxy statements, financial reports, or any other documentation for stockholders' reference. It also provides contact details or channels through which stockholders can seek additional information or clarification. Conclusion: The Vermont Notice of Special Stockholders' Meeting to Consider Recapitalization is a vital communication tool that ensures transparency and invites stockholders to participate actively in the decision-making process regarding recapitalization efforts. By understanding the different types of notices and their components, stockholders can make informed decisions that align with their interests and contribute to the long-term success of the corporation.

Vermont Notice of Special Stockholders' Meeting to Consider Recapitalization

Description

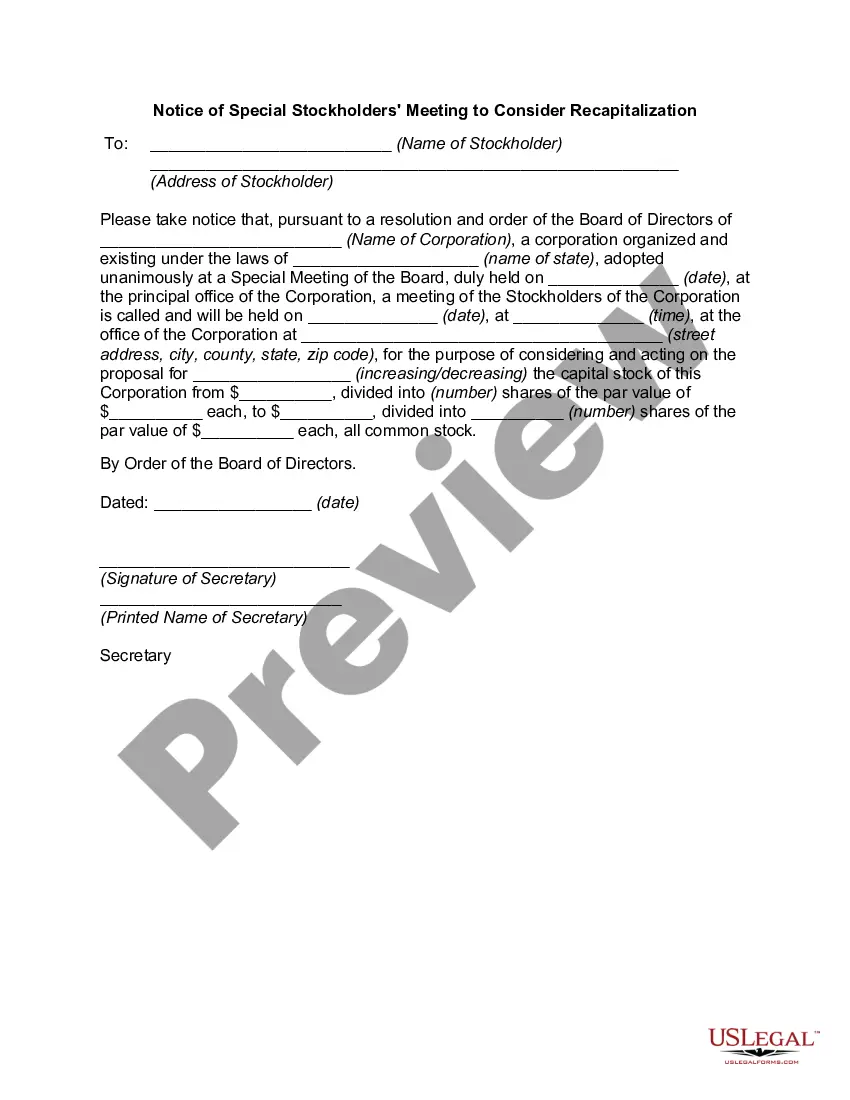

How to fill out Vermont Notice Of Special Stockholders' Meeting To Consider Recapitalization?

Finding the right authorized papers format can be a have a problem. Of course, there are a lot of web templates available online, but how would you get the authorized kind you need? Use the US Legal Forms web site. The service offers 1000s of web templates, such as the Vermont Notice of Special Stockholders' Meeting to Consider Recapitalization, which can be used for company and personal needs. Every one of the varieties are checked by experts and meet up with federal and state needs.

In case you are presently registered, log in for your accounts and click the Acquire button to find the Vermont Notice of Special Stockholders' Meeting to Consider Recapitalization. Utilize your accounts to search with the authorized varieties you may have purchased earlier. Proceed to the My Forms tab of your respective accounts and have an additional version of the papers you need.

In case you are a whole new customer of US Legal Forms, listed below are straightforward recommendations for you to adhere to:

- Initially, make sure you have selected the appropriate kind to your metropolis/state. You are able to examine the form while using Review button and read the form outline to make sure this is basically the right one for you.

- When the kind fails to meet up with your preferences, take advantage of the Seach discipline to obtain the right kind.

- When you are certain that the form is acceptable, select the Acquire now button to find the kind.

- Select the costs program you need and enter in the required details. Create your accounts and purchase your order with your PayPal accounts or credit card.

- Select the document structure and down load the authorized papers format for your system.

- Total, modify and print and indication the obtained Vermont Notice of Special Stockholders' Meeting to Consider Recapitalization.

US Legal Forms is definitely the largest catalogue of authorized varieties where you will find various papers web templates. Use the service to down load skillfully-created paperwork that adhere to express needs.

Form popularity

FAQ

Generally, a corporation's directors will call a special meeting of the shareholders when they would like to undertake a particular activity or a special issue that requires shareholder approval. It is often convenient to combine special meetings with annual meetings.

Your notice must follow state and company guidelines, but it should have your company name , the date and time of the meeting, the location of the meeting, an agenda , and notes . For more information about how to prepare a notice of meeting, read this article.

Special meetings of the shareholders may be called for any purpose or purposes, at any time, by the Chief Executive Officer; by the Chief Financial Officer; by the Board or any two or more members thereof; or by one or more shareholders holding not less than 10% of the voting power of all shares of the corporation

The corporation can allow others to call a special meeting, such as the BoD Chair, CEO, or yes, shareholders.

Therefore, all shareholders should be invited to the meeting, at which point they will discuss official business items that need to be addressed. Such items might include electing of new board members, financial issues, and other future short-term and long-term goals and objectives.

Legal Definition of special meeting : a meeting held for a special and limited purpose specifically : a corporate meeting held occasionally in addition to the annual meeting to conduct only business described in a notice to the shareholders.

Notice to Shareholders Most states require notice of any shareholder meeting be mailed to all shareholders at least 10 days prior to the meeting. The notice should contain the date, time and location of the meeting as well as an agenda or explanation of the topics to be discussed.

When should I hold a shareholder meeting? An annual shareholder meeting is typically scheduled just after the end of the fiscal year. This allows for the previous year's financial performance to be fully assessed and discussed.

Special meeting is a meeting called by shareholders to discuss specific matters stated in the notice of the meeting. It is a meeting of shareholders outside the usual annual general meeting.

Special meetings of directors or members shall be held at any time deemed necessary or as provided in the bylaws: Provided, however, That at least one (1) week written notice shall be sent to all stockholders or members, unless a different period is provided in the bylaws, law or regulation.