Vermont Jury Instruction — 10.10.6 Section 6672 Penalty The Vermont Jury Instruction — 10.10.6 Section 6672 Penalty is a legal guideline that pertains to the potential penalties associated with Section 6672 of the Internal Revenue Code. The instruction provides detailed information to the jury about the various consequences and outcomes that an individual or organization may face if found guilty of violating this section. Section 6672 of the Internal Revenue Code focuses on penalties related to the failure to collect, account for, or pay federal withholding taxes. This provision is primarily designed to hold individuals, such as corporate officers, bookkeepers, accountants, or other responsible parties, accountable for their involvement in not properly handling these taxes. Within this instruction, there may be different types of penalties that a defendant could potentially face. These penalties are imposed to ensure compliance with federal tax laws and to deter individuals from engaging in fraudulent activities. It is important for the jury to understand the severity of these penalties and make informed decisions based on the evidence presented during a trial. The specific penalties associated with Section 6672 may include: 1. Civil Penalties: Defendants found guilty under this section can be subjected to substantial civil penalties. These penalties aim to recover the unpaid withholding taxes which should have been properly remitted to the Internal Revenue Service (IRS). The amount of civil penalties may vary based on the extent of the tax liability and the defendant's level of involvement. 2. Criminal Penalties: In more severe cases, where an individual intentionally and willfully attempts to evade paying the withholding taxes, criminal penalties may be applicable. These penalties can result in fines and potential imprisonment. The jury must consider the evidence presented to determine if the defendant's actions meet the criteria for criminal prosecution. 3. Trust Fund Recovery Penalty (TARP): Under Section 6672, the IRS has the authority to assess the Trust Fund Recovery Penalty. This penalty holds responsible parties, such as officers, directors, or employees, personally liable for the unpaid withholding taxes of a company. The TARP can impose severe financial consequences on individuals who are deemed responsible for the non-payment or misappropriation of these taxes. It is crucial for the jury to carefully assess the evidence presented during the trial and weigh the severity of the defendant's actions. The jury is tasked with considering the level of the defendant's involvement, their knowledge of the tax obligations, their intent or willfulness, and any mitigating circumstances that may impact the penalty. By understanding the implications of the Vermont Jury Instruction — 10.10.6 Section 6672 Penalty, the jury can contribute to fair and just outcomes in cases involving violations of federal withholding tax laws.

Vermont Jury Instruction - 10.10.6 Section 6672 Penalty

Description

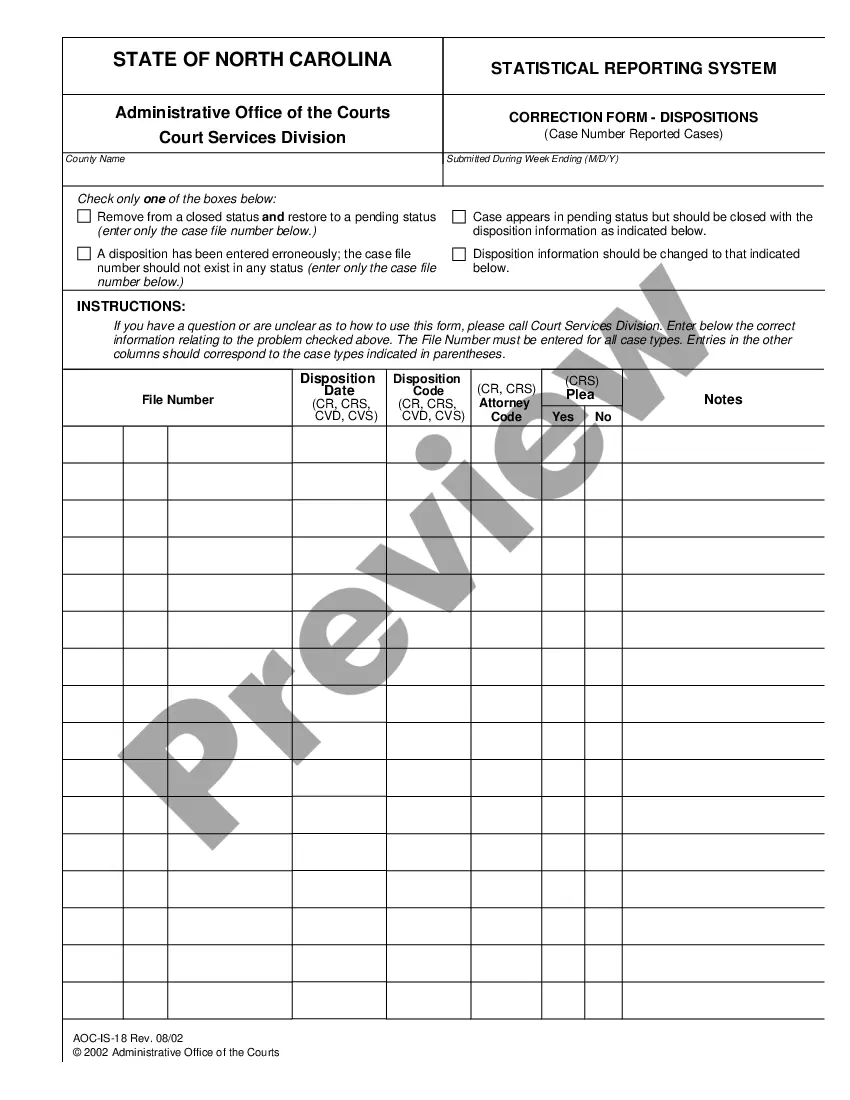

How to fill out Vermont Jury Instruction - 10.10.6 Section 6672 Penalty?

You may devote several hours on-line trying to find the legal document design that meets the federal and state requirements you will need. US Legal Forms offers 1000s of legal varieties which are analyzed by professionals. It is simple to acquire or produce the Vermont Jury Instruction - 10.10.6 Section 6672 Penalty from your support.

If you have a US Legal Forms account, it is possible to log in and click on the Acquire button. After that, it is possible to complete, modify, produce, or indicator the Vermont Jury Instruction - 10.10.6 Section 6672 Penalty. Each and every legal document design you buy is the one you have for a long time. To acquire one more duplicate of the acquired type, proceed to the My Forms tab and click on the related button.

Should you use the US Legal Forms website the first time, keep to the easy directions below:

- Very first, be sure that you have selected the right document design for your region/area that you pick. Read the type explanation to ensure you have chosen the correct type. If available, use the Review button to search from the document design too.

- If you want to get one more version in the type, use the Lookup discipline to obtain the design that meets your needs and requirements.

- When you have found the design you need, just click Buy now to proceed.

- Choose the pricing program you need, key in your accreditations, and sign up for an account on US Legal Forms.

- Full the deal. You may use your bank card or PayPal account to fund the legal type.

- Choose the structure in the document and acquire it for your device.

- Make adjustments for your document if possible. You may complete, modify and indicator and produce Vermont Jury Instruction - 10.10.6 Section 6672 Penalty.

Acquire and produce 1000s of document themes making use of the US Legal Forms Internet site, that offers the most important collection of legal varieties. Use professional and status-particular themes to handle your small business or individual requires.