Vermont Jury Instruction — 4.4.3 Rule 10(b— - 5(c) Fraudulent Practice or Course of Dealing Stockbroker Churning — Violation of Blue Sky Law and Breach of Fiduciary Duty In Vermont, Rule 10(b) — 5(c) of the Jury Instruction 4.4.3 is used to address the fraudulent practices or courses of dealing by stockbrokers. This instruction focuses on a specific type of misconduct known as "churning," which involves excessive trading by a broker to generate commissions, disregarding the best interests of the investor. Churning is a deceptive practice where a stockbroker engages in excessive trading in a customer's account solely to generate commissions for themselves. This behavior is deemed fraudulent as it prioritizes the broker's financial gain over the customer's investment goals and best interests. Churning violates both the Blue Sky Law and the stockbroker's fiduciary duty. Under the Vermont Jury Instruction 4.4.3 Rule 10(b) — 5(c), there are two primary elements that need to be established to prove churning: 1. Excessive Trading: The first element involves showing that the stockbroker executed a high volume of transactions in the customer's account, which resulted in excessive buying and selling of securities. This excessive trading can be determined by comparing the turnover rate or the cost-to-equity ratio of the account to industry averages or established standards. 2. Intent to Defraud: The second element requires demonstrating the stockbroker's intent to defraud or deceive the investor. This can be established by proving that the broker knowingly engaged in excessive trading, disregarding the customer's investment objectives, financial situation, or risk tolerance. The presence of exorbitant commissions earned by the broker can further support a claim of fraudulent intent. If a stockbroker is found guilty of churning, they can be held liable under the Blue Sky Law and face penalties imposed by regulatory authorities. Additionally, the broker may be deemed to have breached their fiduciary duty owed to the customer. Breach of fiduciary duty refers to the violation of the stockbroker's obligation to act in the best interests of the client, putting their own interests ahead of the client's financial well-being. It is important to note that while Vermont Jury Instruction 4.4.3 Rule 10(b) — 5(c) primarily focuses on churning as a fraudulent practice, there may be other types of fraudulent practices or courses of dealing by stockbrokers that can also be covered under this instruction. Other possible scenarios could involve misrepresentation of investment opportunities, insider trading, front-running, or other manipulative trade practices. Understanding these instructions is crucial for legal professionals, investors, and individuals who suspect fraudulent practices by their stockbrokers. Seeking legal advice and pursuing appropriate legal action can help investors protect their rights and seek recovery for any financial losses caused by the fraudulent conduct of a stockbroker.

Vermont Jury Instruction - 4.4.3 Rule 10(b) - 5(c) Fraudulent Practice or Course of Dealing Stockbroker Churning - Violation of Blue Sky Law and Breach of Fiduciary Duty

Description

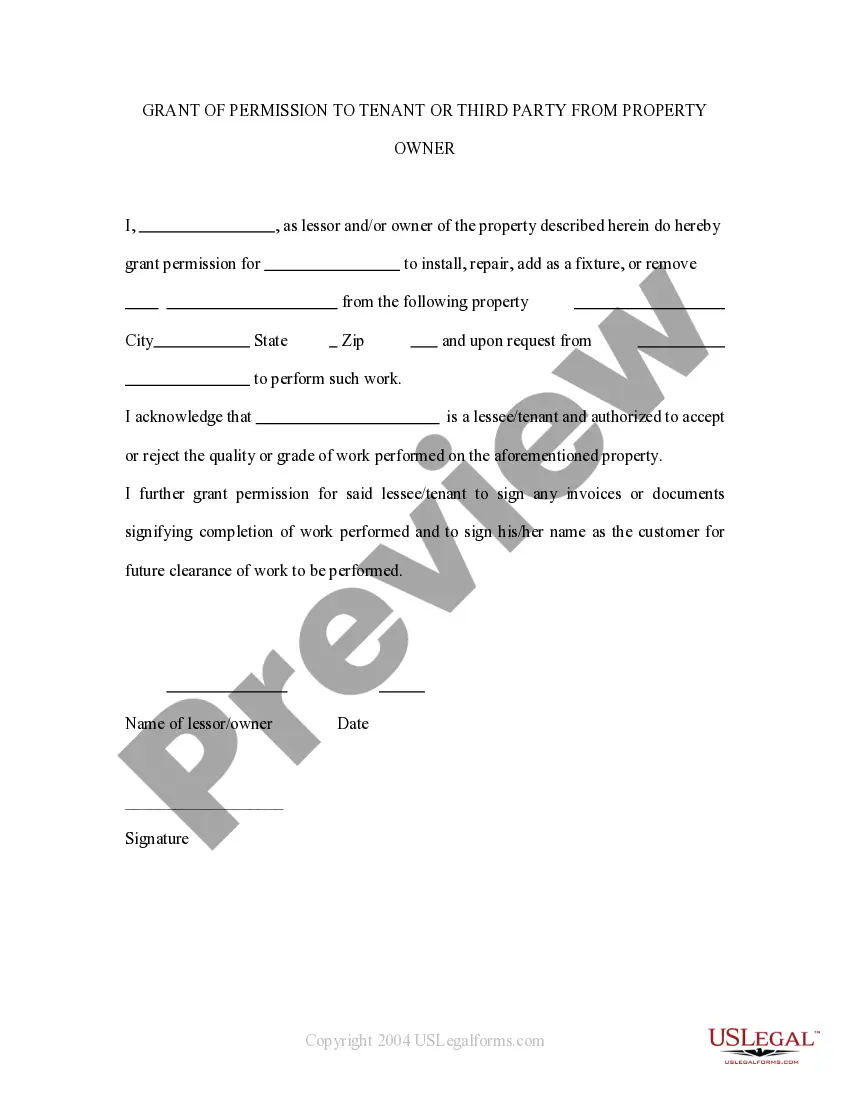

How to fill out Vermont Jury Instruction - 4.4.3 Rule 10(b) - 5(c) Fraudulent Practice Or Course Of Dealing Stockbroker Churning - Violation Of Blue Sky Law And Breach Of Fiduciary Duty?

Are you inside a position that you require paperwork for possibly enterprise or personal purposes nearly every day time? There are plenty of authorized papers templates accessible on the Internet, but getting kinds you can trust isn`t effortless. US Legal Forms provides 1000s of form templates, just like the Vermont Jury Instruction - 4.4.3 Rule 10(b) - 5(c) Fraudulent Practice or Course of Dealing Stockbroker Churning - Violation of Blue Sky Law and Breach of Fiduciary Duty, which can be created to meet federal and state demands.

In case you are presently familiar with US Legal Forms web site and get your account, merely log in. Next, you are able to download the Vermont Jury Instruction - 4.4.3 Rule 10(b) - 5(c) Fraudulent Practice or Course of Dealing Stockbroker Churning - Violation of Blue Sky Law and Breach of Fiduciary Duty design.

Unless you offer an account and would like to start using US Legal Forms, follow these steps:

- Get the form you require and make sure it is to the correct metropolis/region.

- Use the Preview switch to review the shape.

- Read the outline to ensure that you have selected the appropriate form.

- In case the form isn`t what you are seeking, utilize the Research discipline to obtain the form that suits you and demands.

- If you obtain the correct form, click on Purchase now.

- Opt for the rates strategy you want, fill in the necessary info to create your money, and pay money for the order using your PayPal or credit card.

- Select a convenient data file formatting and download your copy.

Find each of the papers templates you might have bought in the My Forms food list. You can obtain a additional copy of Vermont Jury Instruction - 4.4.3 Rule 10(b) - 5(c) Fraudulent Practice or Course of Dealing Stockbroker Churning - Violation of Blue Sky Law and Breach of Fiduciary Duty anytime, if possible. Just click on the essential form to download or print the papers design.

Use US Legal Forms, the most considerable variety of authorized types, to conserve time as well as prevent mistakes. The service provides skillfully produced authorized papers templates that you can use for a range of purposes. Produce your account on US Legal Forms and commence producing your lifestyle easier.