Vermont Consultant Agreement for Services Relating to Finances and Financial Reporting of Company with Confidentiality Provisions

Description

How to fill out Consultant Agreement For Services Relating To Finances And Financial Reporting Of Company With Confidentiality Provisions?

US Legal Forms - one of the foremost collections of legal documents in the United States - provides a wide selection of legal form templates you can download or print.

Through the website, you can access thousands of forms for business and personal purposes, organized by categories, states, or keywords. You can find the latest versions of forms such as the Vermont Consultant Agreement for Services Related to Finances and Financial Reporting of Company with Confidentiality Provisions within moments.

If you have a membership, Log In and download the Vermont Consultant Agreement for Services Related to Finances and Financial Reporting of Company with Confidentiality Provisions from the US Legal Forms library. The Download button will be available on every form you view. You can access all previously downloaded forms in the My documents section of your profile.

Complete the transaction. Use a credit card or PayPal account to finalize the transaction.

Select the format and download the form onto your device. Edit. Fill out, modify, print, and sign the downloaded Vermont Consultant Agreement for Services Related to Finances and Financial Reporting of Company with Confidentiality Provisions. Every template you add to your account does not have an expiration date and is yours indefinitely. Hence, if you wish to download or print another version, just go to the My documents section and click on the form you need. Access the Vermont Consultant Agreement for Services Related to Finances and Financial Reporting of Company with Confidentiality Provisions using US Legal Forms, the most extensive collection of legal document templates. Utilize a multitude of professional and state-specific templates that meet your business or personal requirements.

- To use US Legal Forms for the first time, here are simple steps to get you started.

- Ensure you have chosen the appropriate form for your city/region.

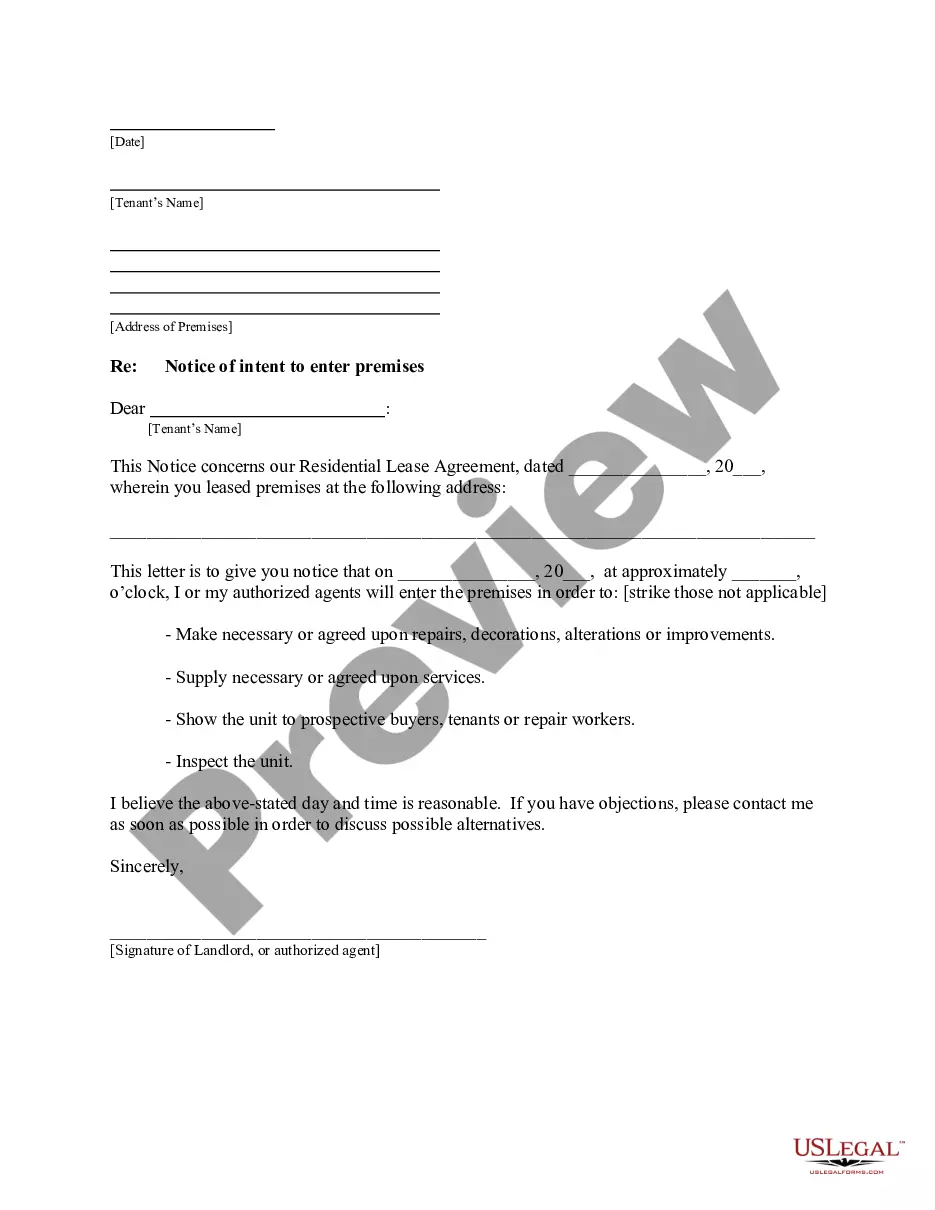

- Click the Preview button to review the form's content.

- Examine the form description to ensure you have selected the right form.

- If the form does not meet your requirements, use the Search box at the top of the screen to find one that does.

- Once you are content with the form, confirm your choice by clicking on the Buy Now button.

- Then, select the pricing plan you wish and provide your details to register for an account.

Form popularity

FAQ

What are 6 types of professional services contract agreements for consulting services?Time and materials contract.Fixed price services contract.Not to exceed (or time and materials with a cap) contract.Retainer-based services contract.Recurring service subscription.Managed services agreement.

The consultancy agreement is made between the company and consultant. It outlines the scope of work to be performed by them and other terms and conditions related to their appointment in the company. It is a kind of service agreement only.

Protect yourself: Put your guidelines in writing -- and stick by them. Have a very clear discussion laying out your professional boundaries and ask your client to do the same. Come to an understanding about working hours and response times and agree on how you will schedule calls, meetings, and Skype sessions.

What should you include in a consulting contract?Receitals and Background. The recital clause is the opening section of the consulting agreement.Scope of Services.Ownership of Intellectual Property.Compensation, Expenses, and Schedules.Dispute Resolution.Termination of Services.Methods of Communication.Confidentiality.More items...?

The consulting agreement is an agreement between a consultant and a client who wishes to retain certain specified services of the consultant for a specified time at a specified rate of compensation. As indicated previously, the terms of the agreement can be quite simple or very complex.

Here's a short list of what should be included in every consulting contract:Full names and titles of the people with whom you're doing business. Be sure they're all spelled correctly.Project objectives.Detailed description of the project.List of responsibilities.Fees.Timeline.Page numbers.

What should you include in a consulting contract?Receitals and Background. The recital clause is the opening section of the consulting agreement.Scope of Services.Ownership of Intellectual Property.Compensation, Expenses, and Schedules.Dispute Resolution.Termination of Services.Methods of Communication.Confidentiality.More items...?04-Jan-2021

Protect Yourself: How to Structure Your Consulting ContractsFull names and titles of the people with whom you're doing business. Be sure they're all spelled correctly.Project objectives.Detailed description of the project.List of responsibilities.Fees.Timeline.Page numbers.