Title: Vermont Independent Sales Representative Agreement with Developer of Computer Software — Complying with the IRS's 20 Part Test for Independent Contractor Status Keywords: Vermont, Independent Sales Representative Agreement, Developer of Computer Software, Provisions, Internal Revenue Service, 20 Part Test, Independent Contractor Status Introduction: In Vermont, an Independent Sales Representative Agreement is a crucial contract between a Developer of Computer Software and their appointed sales representative. This agreement outlines the terms and conditions of their working relationship, while specifically incorporating provisions designed to satisfy the Internal Revenue Service's comprehensive 20 Part Test for determining independent contractor status. Types of Vermont Independent Sales Representative Agreement: 1. Standard Vermont Independent Sales Representative Agreement with Developer of Computer Software: This agreement includes all essential provisions establishing the relationship between the Developer of Computer Software and the independent sales representative, while also ensuring compliance with the IRS's 20 Part Test for determining independent contractor status. 2. Vermont Independent Sales Representative Agreement (Software Sales): Tailored specifically for the software industry, this agreement focuses on the promotion, sale, and licensing of computer software products. It integrates provisions addressing licensing terms, sales targets, and related industry-specific obligations, all adhering to the IRS's 20 Part Test. Key Provisions: 1. Scope of Engagement: Clearly defines the responsibilities, obligations, and limitations of the independent sales representative in representing the developer's computer software products in a specified territory. 2. Compensation: Outlines the commission-based compensation structure for the sales representative, specifying the percentage or amount they will earn for successful sales and any additional bonuses or incentives. 3. Independent Contractor Relationship: Articulates the relationship between the developer and the sales representative as an independent contractor arrangement, explicitly stating that the representative is not an employee and assumes responsibility for their taxes and benefits. 4. Exclusive or Non-Exclusive Representations: Specifies whether the sales representative will have the exclusive right to promote and sell the developer's computer software products within the designated territory or if multiple representatives may be appointed. 5. Termination: Addresses the conditions under which either party can terminate the agreement, including violation of terms, inconsistent sales performance, or changes in business circumstances. 6. Intellectual Property Rights: Clarifies the ownership and use of intellectual property associated with the computer software; includes provisions to protect the developer's copyrights, trademarks, and patents. 7. Confidentiality and Non-Disclosure: Imposes obligations on the sales representative to maintain the confidentiality of proprietary information, trade secrets, and customer lists obtained during the course of their representation. 8. Indemnification: Establishes the parties' responsibilities for any damages, liabilities, or legal actions resulting from the sales representative's actions or the use of the developer's software products. Conclusion: Drafting a Vermont Independent Sales Representative Agreement with Provisions Intended to Satisfy the Internal Revenue Service's 20 Part Test for Determining Independent Contractor Status ensures compliance with the applicable regulations and helps define a clear relationship between the developer of computer software and their independent sales representative.

Vermont Independent Sales Representative Agreement with Developer of Computer Software with Provisions Intended to Satisfy the Internal Revenue Service's 20 Part Test for Determining Independent Contractor Status

Description

How to fill out Vermont Independent Sales Representative Agreement With Developer Of Computer Software With Provisions Intended To Satisfy The Internal Revenue Service's 20 Part Test For Determining Independent Contractor Status?

If you wish to total, down load, or printing legal record layouts, use US Legal Forms, the most important selection of legal forms, that can be found on the web. Take advantage of the site`s simple and practical look for to get the paperwork you want. Various layouts for business and specific functions are sorted by categories and says, or keywords and phrases. Use US Legal Forms to get the Vermont Independent Sales Representative Agreement with Developer of Computer Software with Provisions Intended to Satisfy the Internal Revenue Service's 20 Part Test for Determining Independent Contractor Status in just a handful of click throughs.

Should you be previously a US Legal Forms client, log in to your account and click on the Down load option to have the Vermont Independent Sales Representative Agreement with Developer of Computer Software with Provisions Intended to Satisfy the Internal Revenue Service's 20 Part Test for Determining Independent Contractor Status. Also you can entry forms you formerly downloaded within the My Forms tab of the account.

If you work with US Legal Forms initially, refer to the instructions under:

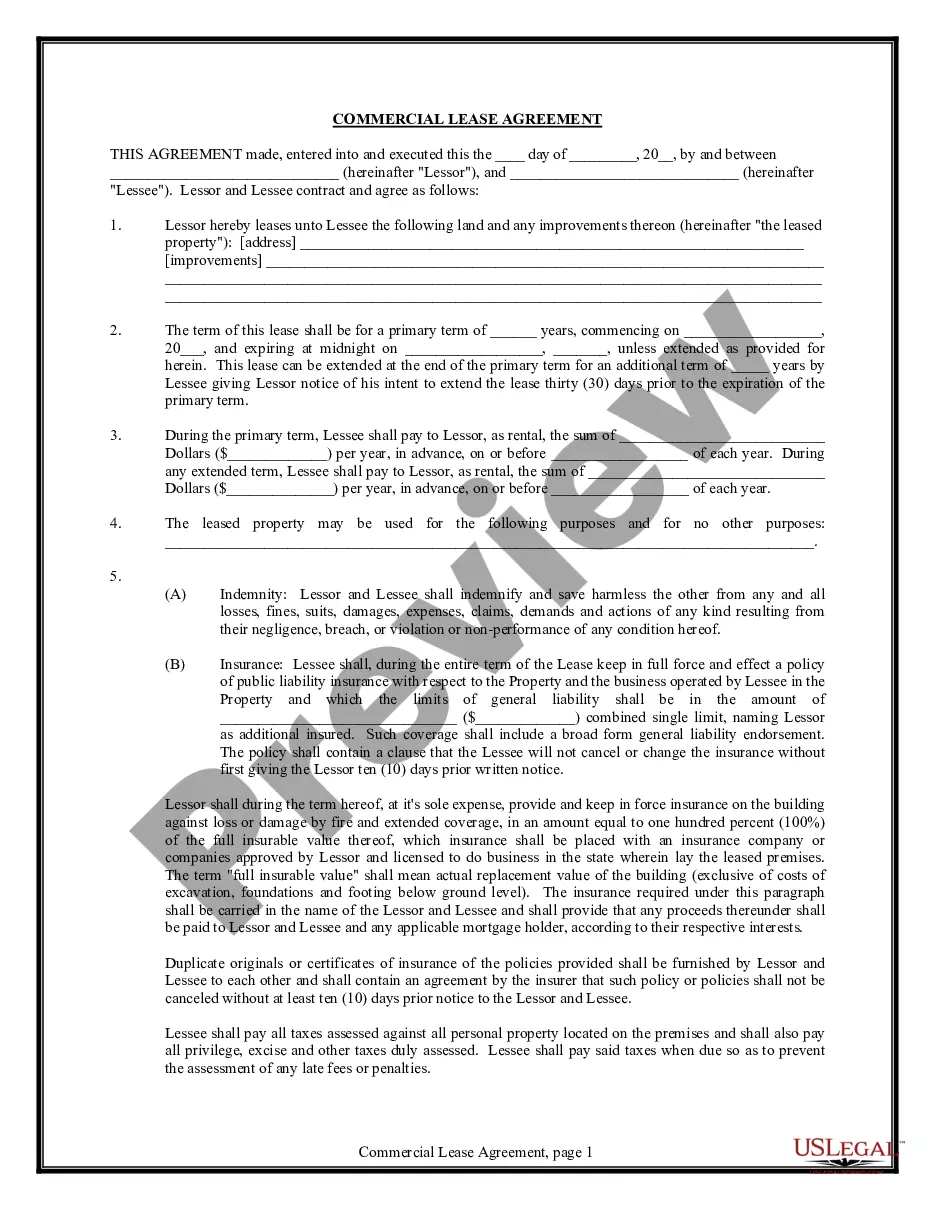

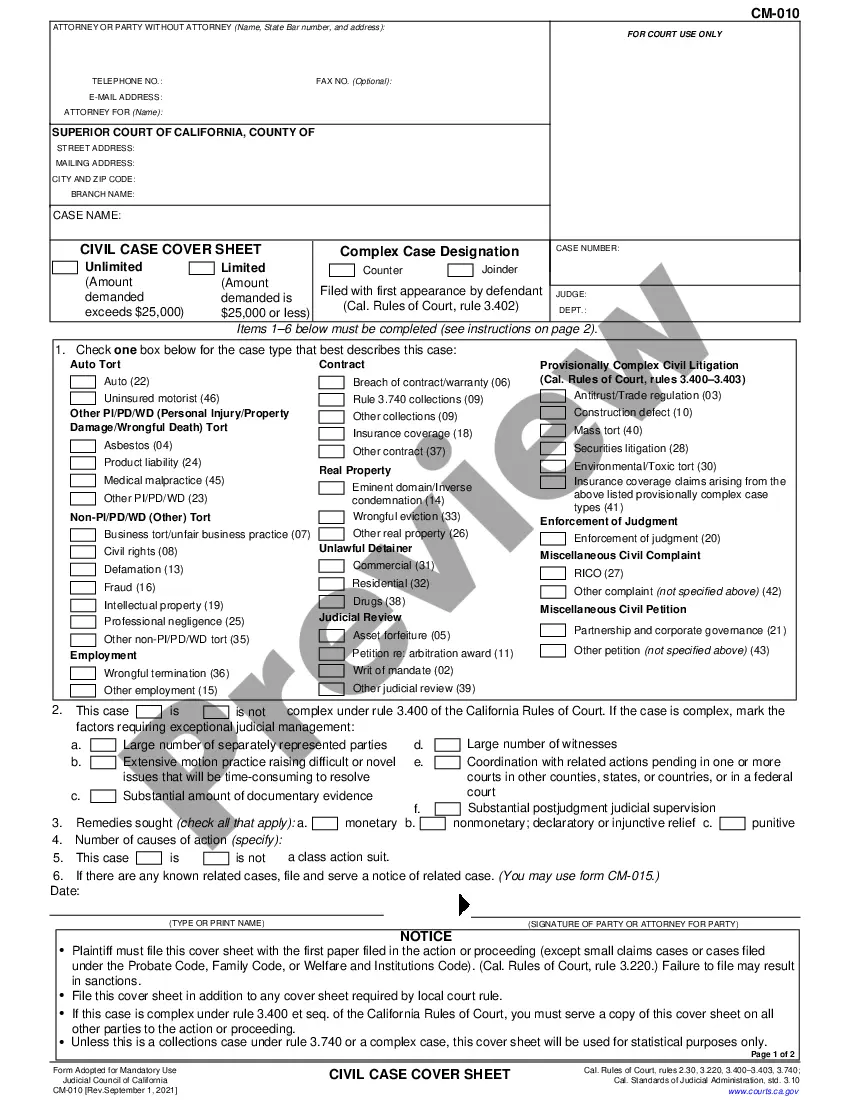

- Step 1. Make sure you have chosen the form for that right area/nation.

- Step 2. Make use of the Review choice to look through the form`s information. Do not forget about to read the description.

- Step 3. Should you be unhappy using the kind, utilize the Research area at the top of the display to get other models from the legal kind template.

- Step 4. Once you have found the form you want, click the Acquire now option. Select the rates plan you favor and include your credentials to sign up to have an account.

- Step 5. Method the purchase. You should use your credit card or PayPal account to finish the purchase.

- Step 6. Select the structure from the legal kind and down load it on your own product.

- Step 7. Full, revise and printing or signal the Vermont Independent Sales Representative Agreement with Developer of Computer Software with Provisions Intended to Satisfy the Internal Revenue Service's 20 Part Test for Determining Independent Contractor Status.

Each and every legal record template you purchase is the one you have for a long time. You have acces to each kind you downloaded with your acccount. Click the My Forms portion and pick a kind to printing or down load once more.

Contend and down load, and printing the Vermont Independent Sales Representative Agreement with Developer of Computer Software with Provisions Intended to Satisfy the Internal Revenue Service's 20 Part Test for Determining Independent Contractor Status with US Legal Forms. There are many expert and express-distinct forms you can use for the business or specific demands.