Vermont Partnership Buy-Sell Agreement with Purchase on Death, Retirement or Withdrawal of Partner with Life Insurance on Each Partner to Fund Purchase in Case of Death

Description

How to fill out Partnership Buy-Sell Agreement With Purchase On Death, Retirement Or Withdrawal Of Partner With Life Insurance On Each Partner To Fund Purchase In Case Of Death?

Have you been inside a position the place you require paperwork for sometimes enterprise or personal purposes almost every day? There are plenty of lawful papers layouts available on the net, but finding types you can rely isn`t easy. US Legal Forms delivers a huge number of type layouts, such as the Vermont Partnership Buy-Sell Agreement with Purchase on Death, Retirement or Withdrawal of Partner with Life Insurance on Each Partner to Fund Purchase in Case of Death, that are written to fulfill state and federal demands.

When you are presently familiar with US Legal Forms site and get a free account, just log in. Afterward, you are able to obtain the Vermont Partnership Buy-Sell Agreement with Purchase on Death, Retirement or Withdrawal of Partner with Life Insurance on Each Partner to Fund Purchase in Case of Death template.

Unless you have an bank account and wish to begin to use US Legal Forms, adopt these measures:

- Find the type you require and ensure it is for the right metropolis/county.

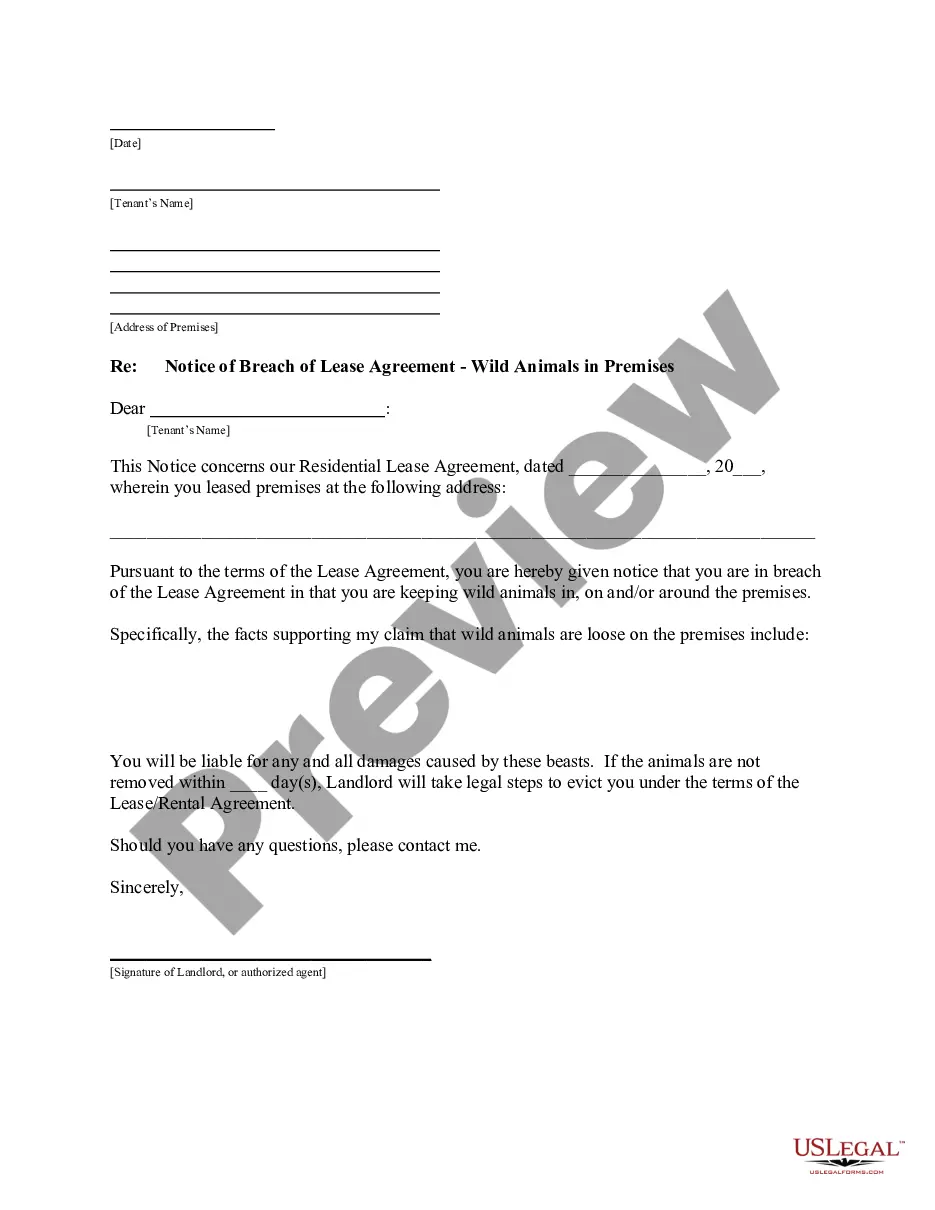

- Make use of the Review switch to review the form.

- Look at the explanation to actually have selected the appropriate type.

- When the type isn`t what you are seeking, make use of the Search discipline to obtain the type that suits you and demands.

- Once you find the right type, click on Get now.

- Opt for the prices plan you want, fill in the specified information and facts to create your account, and pay money for your order with your PayPal or charge card.

- Decide on a hassle-free data file structure and obtain your version.

Find every one of the papers layouts you might have purchased in the My Forms food selection. You can get a further version of Vermont Partnership Buy-Sell Agreement with Purchase on Death, Retirement or Withdrawal of Partner with Life Insurance on Each Partner to Fund Purchase in Case of Death at any time, if needed. Just click on the necessary type to obtain or print the papers template.

Use US Legal Forms, probably the most considerable selection of lawful kinds, to save time as well as stay away from faults. The services delivers skillfully produced lawful papers layouts which you can use for a range of purposes. Create a free account on US Legal Forms and start producing your lifestyle easier.

Form popularity

FAQ

Buy and sell agreements are designed to help partners manage potentially difficult situations in ways that protect the business and their own personal and family interests. For example, the agreement can restrict owners from selling their interests to outside investors without approval from the remaining owners.

sell agreement establishes the fair value of a person's share in the business, which comes in handy if a partner wants to remain in the company after another partner's exit. This helps forestall disagreements about whether a buyout offer is fair since the agreement establishes these figures ahead of time.

The business owners individually own the policies insuring each other's lives. When a business owner dies, the proceeds are paid to those surviving owners who hold one or more policies on the deceased owner, and these surviving owners buy the shares from the deceased owner's personal representative.

The smartest method for funding a buy-sell agreement is through life insurance. This ensures that funds are immediately available when a death occurs; plus, death benefit proceeds are generally income-tax free.

One common question we receive when discussing key person benefits is What is a buy/sell agreement? A buy/sell agreement, also known as a buyout agreement, is a contract funded by a life insurance policy that can help minimize the turmoil caused by the sudden departure, disability or death of a business owner or

Life insurance is an effective tool that business owners can use to implement the provisions of a buy-sell agreement by providing liquidity at the death of an owner to both his or her business and family.

Cross-purchase agreements allow remaining owners to buy the interests of a deceased or selling owner. Redemption agreements require the business entity to buy the interests of the selling owner.

One common question we receive when discussing key person benefits is What is a buy/sell agreement? A buy/sell agreement, also known as a buyout agreement, is a contract funded by a life insurance policy that can help minimize the turmoil caused by the sudden departure, disability or death of a business owner or

Why is life insurance important? Buying life insurance protects your spouse and children from the potentially devastating financial losses that could result if something happened to you. It provides financial security, helps to pay off debts, helps to pay living expenses, and helps to pay any medical or final expenses.

Each owner would pay the premiums and be the beneficiary of the policy. The face amount of the insurance would be calculated based on the other's ownership interest. Upon the death of one owner, the insurance proceeds would be used to purchase the ownership interests from the deceased owner's estate or family.