A Vermont Gift of Stock to Spouse for Life with Remainder to Children is a type of estate planning strategy that allows individuals to transfer their assets, specifically stocks, to their spouse during their lifetime while ensuring that their children will ultimately receive the remaining assets upon the spouse's death. This technique involves carefully structuring the ownership and transfer of stocks to maximize tax benefits and ensure a smooth transfer of assets. In this arrangement, the individual (referred to as the "donor") initially gifts stocks to their spouse, often to provide financial security and support during their lifetime. The spouse then holds and manages the stocks, benefiting from any income generated by the investments. This can be especially useful in cases where the spouse may not have substantial assets or income of their own. Upon the spouse's death, the remainder of the stocks, or the original investment, transfers to the children or other beneficiaries as specified in the estate plan. This allows for the preservation and transfer of wealth to the next generation while minimizing potential estate taxes. Different variations of this strategy include the Vermont Gift of Stock to Spouse for Life with Remainder to Children in Trust, which involves placing the gifted stocks into a trust rather than directly transferring ownership to the spouse. This trust arrangement can provide additional control, asset protection, and flexibility in managing and distributing the assets. Other similar estate planning techniques in Vermont may include the Vermont Gift of Stock to Spouse for Life with Remainder to Charitable Organizations, where the remainder of the stocks is directed towards charitable causes upon the spouse's passing, effectively providing a dual benefit of supporting philanthropic endeavors while ensuring financial security for the spouse during their lifetime. Overall, a Vermont Gift of Stock to Spouse for Life with Remainder to Children is an effective tool for individuals looking to strategically transfer their wealth, particularly stocks, to their loved ones while ensuring the financial well-being of their spouse. It is crucial to consult with an experienced estate planning attorney or financial advisor to consider the specific circumstances and goals, as well as to navigate the legal and tax implications associated with such arrangements.

Vermont Gift of Stock to Spouse for Life with Remainder to Children

Description

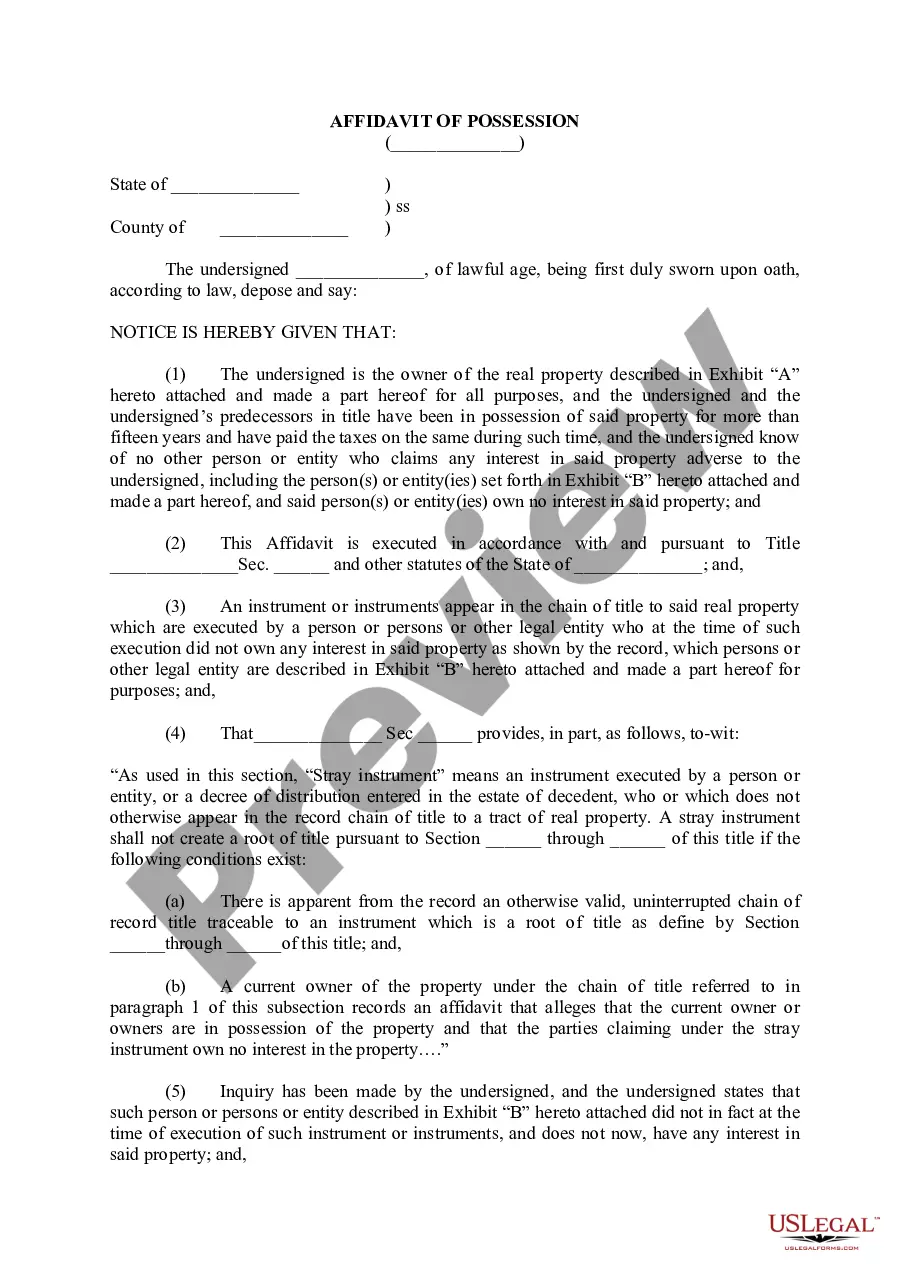

How to fill out Vermont Gift Of Stock To Spouse For Life With Remainder To Children?

US Legal Forms - among the largest libraries of legal types in the USA - gives a wide array of legal document templates it is possible to download or print out. Utilizing the internet site, you will get a huge number of types for organization and person uses, categorized by categories, claims, or key phrases.You can get the most up-to-date types of types like the Vermont Gift of Stock to Spouse for Life with Remainder to Children within minutes.

If you currently have a membership, log in and download Vermont Gift of Stock to Spouse for Life with Remainder to Children from your US Legal Forms catalogue. The Down load button can look on each kind you view. You get access to all formerly delivered electronically types from the My Forms tab of your own accounts.

If you want to use US Legal Forms the first time, allow me to share straightforward instructions to get you started:

- Make sure you have selected the proper kind to your city/region. Select the Review button to examine the form`s content material. Look at the kind information to actually have chosen the correct kind.

- If the kind doesn`t satisfy your requirements, take advantage of the Search discipline near the top of the monitor to obtain the one who does.

- When you are pleased with the shape, affirm your decision by simply clicking the Acquire now button. Then, pick the pricing plan you like and supply your credentials to sign up for an accounts.

- Method the deal. Make use of credit card or PayPal accounts to perform the deal.

- Pick the file format and download the shape on your own device.

- Make adjustments. Load, edit and print out and signal the delivered electronically Vermont Gift of Stock to Spouse for Life with Remainder to Children.

Every format you included in your money does not have an expiration time and it is the one you have for a long time. So, if you would like download or print out an additional duplicate, just proceed to the My Forms area and click on the kind you need.

Obtain access to the Vermont Gift of Stock to Spouse for Life with Remainder to Children with US Legal Forms, one of the most substantial catalogue of legal document templates. Use a huge number of professional and status-particular templates that satisfy your business or person requirements and requirements.