Vermont Certification of Seller is a legal document that serves as proof of seller's compliance with certain requirements and regulations in the state of Vermont. It ensures that the seller is authorized to conduct business and has met specific criteria to ensure consumer protection and fair trade practices. The certification is often required in various industries to maintain transparency and trust between sellers and buyers. Keywords: Vermont, Certification of Seller, compliance, requirements, regulations, legal document, business, consumer protection, fair trade practices, transparency, trust. There are different types of Vermont Certification of Seller, including: 1. Vermont Business Certification: This type of certification is issued to businesses operating in Vermont to demonstrate their compliance with state laws and regulations. It verifies that the business has obtained all the necessary licenses, permits, and registrations required to operate legally. 2. Vermont Product Certification: This certification is specific to manufacturers and sellers who produce and distribute goods in Vermont. It ensures that the products offered meet the required health, safety, and quality standards set by the state. This certification is especially crucial for industries dealing with food, pharmaceuticals, and other consumer goods. 3. Vermont Real Estate Certification: Real estate agents and property sellers in Vermont are required to obtain this certification. It ensures that the seller has a thorough understanding of the state's real estate laws, regulations, and ethical practices. This certification is essential for maintaining integrity and protecting consumers involved in real estate transactions. 4. Vermont Professional Certification: Certain professions in Vermont require individuals to obtain a certification of seller to ensure that they are qualified and competent to offer their services. Examples could include certifications for medical professionals, legal practitioners, financial advisors, or any other regulated profession. Overall, the Vermont Certification of Seller is an essential document that verifies the compliance of businesses and sellers with state laws and regulations. It promotes consumer protection, transparency, and trust in various industries.

Vermont Certification of Seller

Description

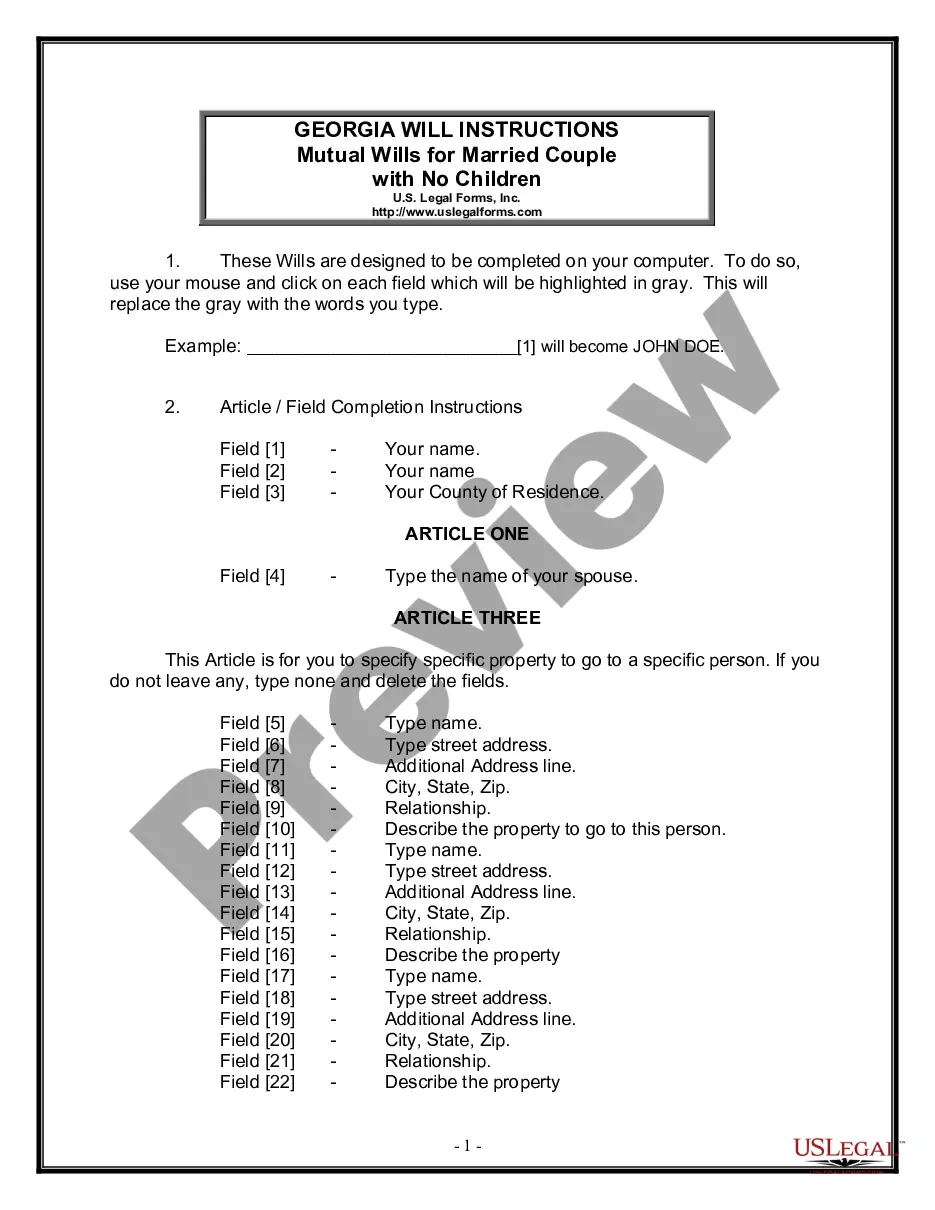

How to fill out Certification Of Seller?

It is possible to invest several hours on the Internet trying to find the legal record design that fits the federal and state demands you need. US Legal Forms supplies a huge number of legal forms which can be analyzed by pros. You can easily obtain or produce the Vermont Certification of Seller from our services.

If you already possess a US Legal Forms accounts, it is possible to log in and click the Obtain option. Afterward, it is possible to full, change, produce, or indicator the Vermont Certification of Seller. Each and every legal record design you get is the one you have for a long time. To acquire an additional backup of the obtained kind, go to the My Forms tab and click the corresponding option.

If you are using the US Legal Forms internet site for the first time, adhere to the straightforward instructions under:

- First, make sure that you have selected the proper record design for the region/city of your choice. Read the kind information to ensure you have picked out the appropriate kind. If offered, make use of the Review option to check throughout the record design too.

- If you would like discover an additional edition in the kind, make use of the Research area to get the design that fits your needs and demands.

- After you have located the design you desire, click Purchase now to continue.

- Select the pricing prepare you desire, enter your references, and sign up for an account on US Legal Forms.

- Complete the transaction. You should use your Visa or Mastercard or PayPal accounts to fund the legal kind.

- Select the structure in the record and obtain it for your system.

- Make alterations for your record if needed. It is possible to full, change and indicator and produce Vermont Certification of Seller.

Obtain and produce a huge number of record web templates utilizing the US Legal Forms site, that offers the biggest assortment of legal forms. Use specialist and express-particular web templates to handle your small business or individual requires.

Form popularity

FAQ

FOOD, FOOD PRODUCTS, AND BEVERAGES - TAXABLE Food, food products, and beverages are exempt from Vermont Sales and Use Tax under Vermont law 32 V.S.A. § 9741(13) with the exception of soft drinks.

Vermont Sales Tax is charged on the retail sales of tangible personal property unless exempted by law. The sales tax rate is 6%. Vermont Use Tax is imposed on the buyer at the same rate as the sales tax.

Vermont Capital Gains TaxMost capital gains in Vermont are subject to the personal income tax rates of 3.35% - 8.75%. This includes all short-term gains, but long term-gains may be eligible for an exclusion.

Tax sales. A Vermont city or town may take a person's home and sell it in order to pay back property taxes that are owed. Before a town can sell your house at a tax sale, they must send you written notice of the time and place of the sale by registered mail at least 10 days before the sale.

The resale certificate is kept on file by the seller for three years from the date of the last sale and is not filed with the Vermont Department of Taxes.

You must then charge sales tax on items subject to tax that you resell at retail to customers. To take the exemption, you must provide a Form S-3, Vermont Sales Tax Exemption Certificate for Purchases for Resale and by Exempt Organizations. You also must have a Vermont Sales and Use Tax account with the Department.

When a home purchase closes, the home buyer is required to pay, among other closing costs, the Vermont Property Transfer Tax. The buyer is taxed is at a rate of 0.5% of the first $100,000 of the home's value and 1.45% of the remaining portion of the value.

Vermont is a decent tax lien state because the interest rate of 12% per year is reasonable. Are you looking for detailed information for every state that sells tax lien certificates and/or conducts tax deed sales?