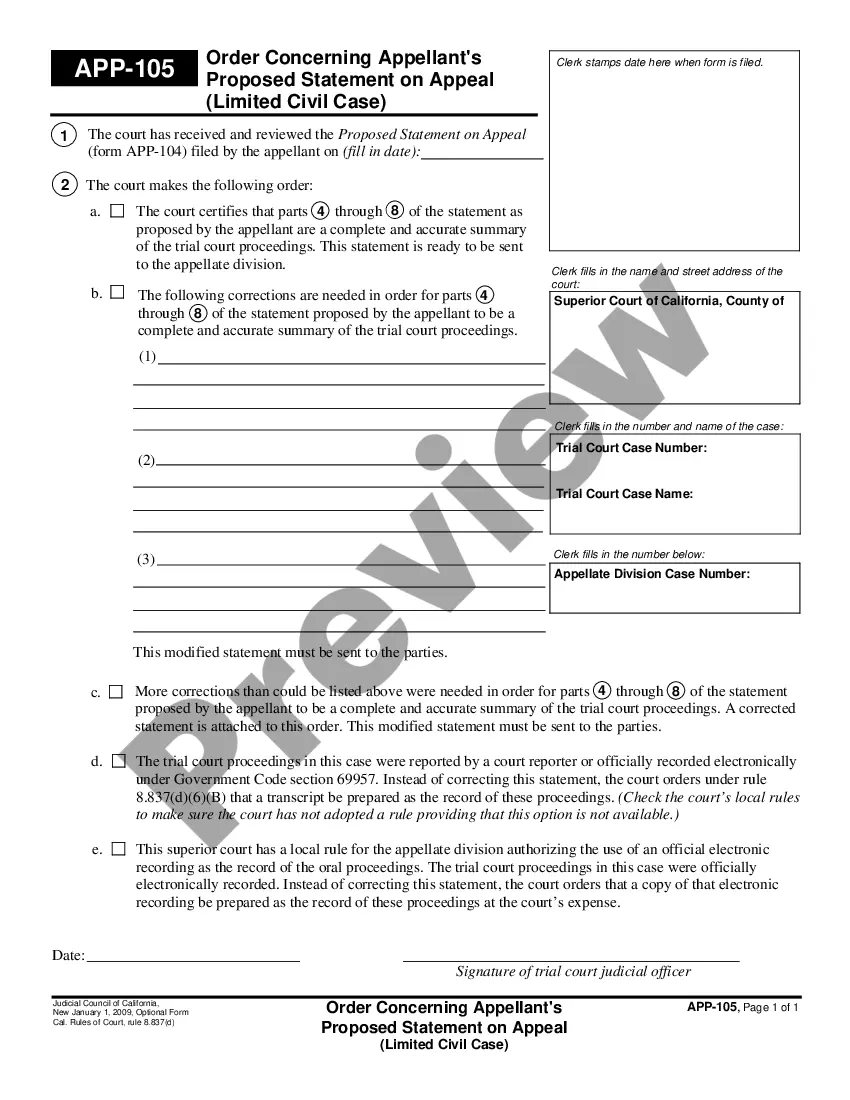

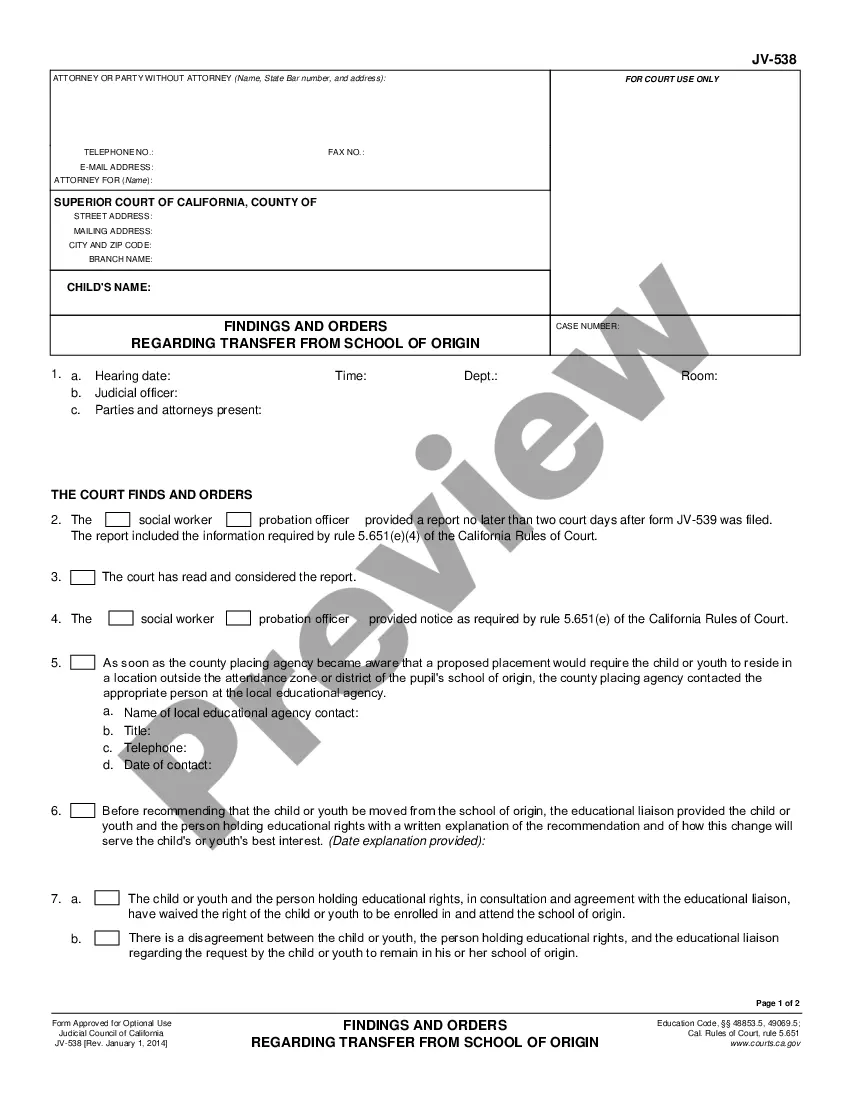

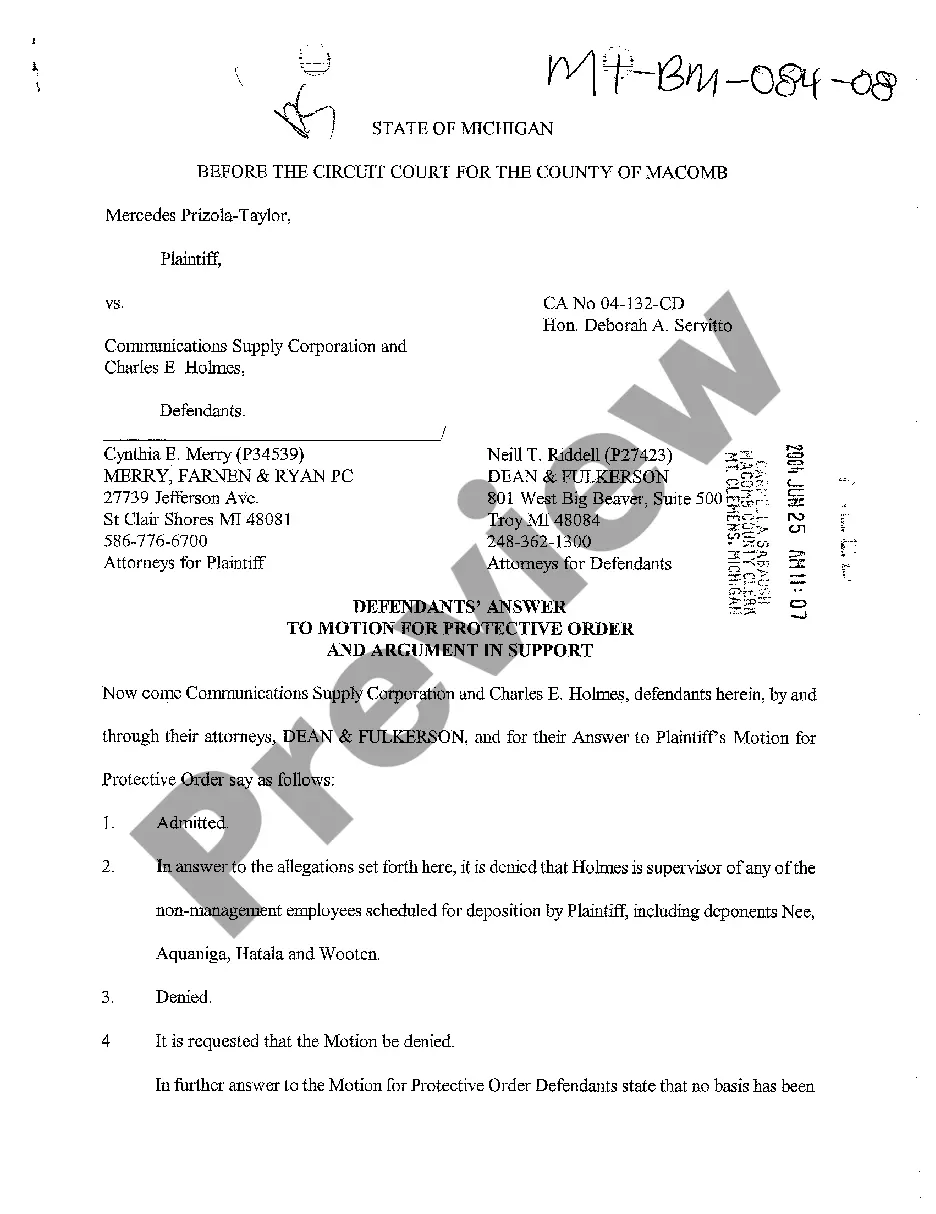

Vermont Notice of Assignment of Accounts is an important legal document used to notify debtors about the transfer of their accounts to a third party. This notice serves as a formal notification that an assignment of accounts, meaning the transfer of the right to collect debts, has taken place. When a creditor decides to assign their accounts to another entity, they are required to issue a Vermont Notice of Assignment of Accounts to inform debtors of this change. This document ensures transparency and protects the rights of both the debtor and the assignee. The Vermont Notice of Assignment of Accounts includes crucial information such as the original creditor's name, the new assignee's information, and the specific details of the assigned accounts. It also specifies that any future payments or settlements related to the assigned accounts must be made to the assignee. There are a few different types of Vermont Notice of Assignment of Accounts that may vary based on the specific circumstances of the assignment. Some common variations include: 1. General Assignment of Accounts: This type of notice is used when a creditor transfers their entire accounts receivable portfolio to a new assignee. 2. Partial Assignment of Accounts: In certain cases, a creditor may choose to assign only a portion of their accounts to a new entity. In such situations, a Partial Assignment of Accounts notice is issued to inform debtors about the assignment of specific accounts. 3. Specific Account Assignment: In this type of notice, a creditor assigns a particular account or a set of accounts to a new assignee. This notice includes the specific details of the account(s) being assigned. 4. Revocable Assignment: This notice indicates that the assignment of accounts can be canceled or revoked under certain circumstances, such as non-compliance with terms or conditions. Overall, the Vermont Notice of Assignment of Accounts is a crucial legal document used to establish and communicate the transfer of debt collection rights from one entity to another. It protects the rights of both parties involved and ensures transparency in the debt collection process.

Vermont Notice of Assignment of Accounts

Description

How to fill out Vermont Notice Of Assignment Of Accounts?

Choosing the right lawful document format can be quite a struggle. Of course, there are a variety of layouts available on the net, but how can you find the lawful kind you need? Take advantage of the US Legal Forms internet site. The assistance gives a huge number of layouts, for example the Vermont Notice of Assignment of Accounts, that can be used for enterprise and private requires. Each of the varieties are inspected by professionals and meet up with federal and state needs.

Should you be previously authorized, log in to your profile and then click the Download key to obtain the Vermont Notice of Assignment of Accounts. Make use of profile to look throughout the lawful varieties you have purchased earlier. Check out the My Forms tab of your own profile and obtain another version of your document you need.

Should you be a whole new customer of US Legal Forms, here are easy instructions that you can adhere to:

- Initial, make certain you have selected the proper kind for your town/state. You can look over the form while using Review key and look at the form outline to ensure it is the right one for you.

- When the kind does not meet up with your needs, make use of the Seach discipline to obtain the right kind.

- When you are certain that the form is suitable, select the Get now key to obtain the kind.

- Select the costs program you want and enter in the essential information. Make your profile and purchase the order with your PayPal profile or charge card.

- Pick the submit file format and down load the lawful document format to your gadget.

- Total, edit and print out and sign the received Vermont Notice of Assignment of Accounts.

US Legal Forms will be the largest collection of lawful varieties for which you can find different document layouts. Take advantage of the service to down load appropriately-produced paperwork that adhere to state needs.