A Vermont annuity as consideration for the transfer of securities is a financial arrangement in the state of Vermont where an individual or entity transfers their securities (such as stocks, bonds, or mutual funds) to an insurance company in exchange for an annuity contract. This type of annuity serves as a payment method or consideration for the transfer, providing the transferring party with a steady stream of income. Vermont offers various types of annuities as consideration for the transfer of securities, each with its unique features and benefits. Here are some of the commonly known types: 1. Fixed Annuity: This annuity type offers a guaranteed fixed interest rate for a specified period. It provides stable and predictable income, making it an attractive option for individuals seeking security and consistent returns. 2. Variable Annuity: With a variable annuity, the income is tied to the performance of investment options within the annuity. It provides the opportunity for potential growth, as the returns are based on market performance. However, there is also a level of investment risk involved with this type of annuity. 3. Indexed Annuity: An indexed annuity offers a return that is linked to a specific market index, such as the S&P 500. It combines elements of both fixed and variable annuities, providing the potential for growth based on market performance while also offering downside protection. 4. Immediate Annuity: An immediate annuity starts providing income payments shortly after the initial transfer, usually within a year. It can offer a steady stream of income for a specified period or the remainder of the individual's life. 5. Deferred Annuity: Unlike an immediate annuity, a deferred annuity starts paying out income at a later date, allowing the funds to grow tax-deferred until the payments begin. This type of annuity is often used as a retirement planning tool to provide a future income stream. Vermont's annuities as consideration for the transfer of securities provide individuals with flexibility, tax advantages, and the potential for steady income. It's advisable to consult with a financial advisor or insurance professional to determine which type of annuity aligns best with personal financial goals and risk tolerance.

Vermont Annuity as Consideration for Transfer of Securities

Description

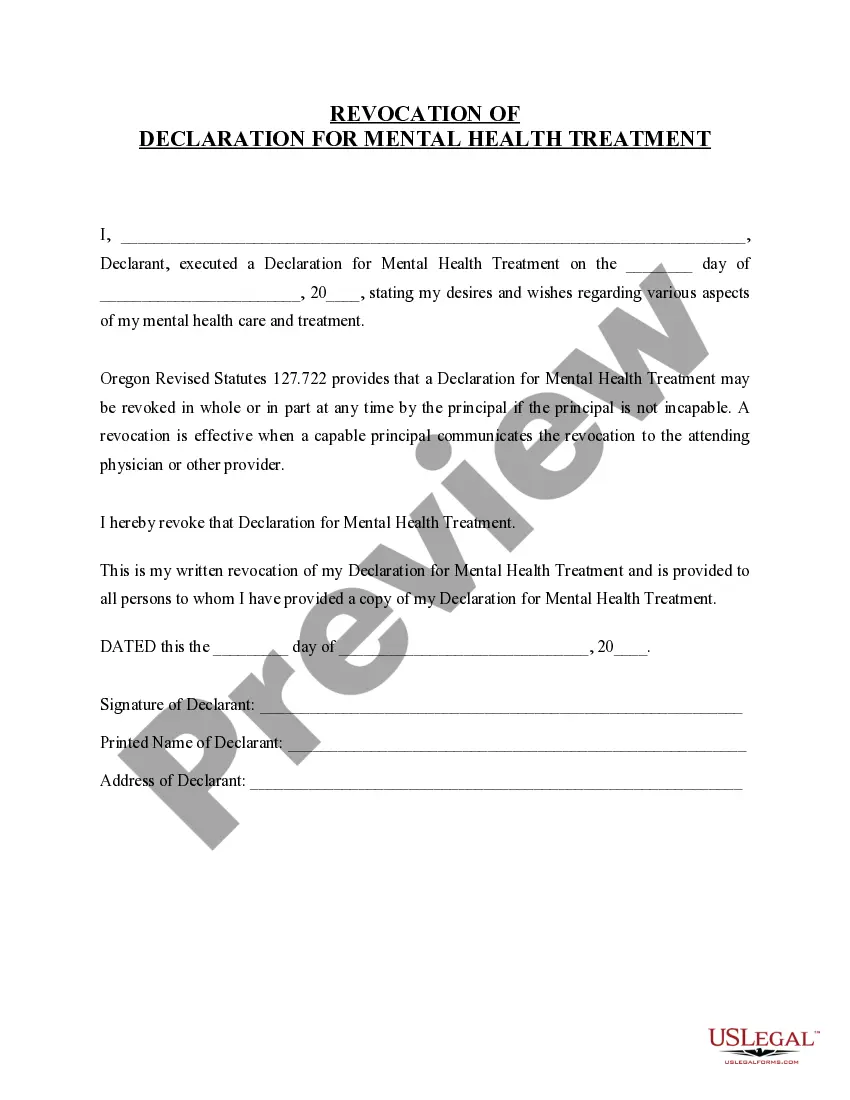

How to fill out Vermont Annuity As Consideration For Transfer Of Securities?

US Legal Forms - one of the greatest libraries of lawful varieties in the USA - provides an array of lawful file web templates it is possible to acquire or printing. Using the web site, you can find thousands of varieties for company and personal uses, sorted by types, says, or search phrases.You can find the latest variations of varieties such as the Vermont Annuity as Consideration for Transfer of Securities in seconds.

If you have a subscription, log in and acquire Vermont Annuity as Consideration for Transfer of Securities from your US Legal Forms local library. The Acquire option can look on every single develop you see. You have accessibility to all in the past saved varieties inside the My Forms tab of your own profile.

If you want to use US Legal Forms for the first time, listed below are simple recommendations to obtain started out:

- Be sure you have chosen the best develop to your area/county. Go through the Review option to examine the form`s content. Browse the develop outline to actually have chosen the right develop.

- In case the develop doesn`t satisfy your needs, make use of the Look for industry towards the top of the display to find the the one that does.

- Should you be happy with the form, confirm your choice by simply clicking the Get now option. Then, select the rates prepare you favor and offer your qualifications to register to have an profile.

- Method the purchase. Make use of your bank card or PayPal profile to perform the purchase.

- Select the formatting and acquire the form on your system.

- Make alterations. Load, edit and printing and indicator the saved Vermont Annuity as Consideration for Transfer of Securities.

Every template you put into your account does not have an expiration time which is your own property forever. So, if you want to acquire or printing yet another version, just proceed to the My Forms area and click on about the develop you need.

Gain access to the Vermont Annuity as Consideration for Transfer of Securities with US Legal Forms, the most extensive local library of lawful file web templates. Use thousands of professional and condition-distinct web templates that meet your small business or personal requires and needs.